PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940714

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940714

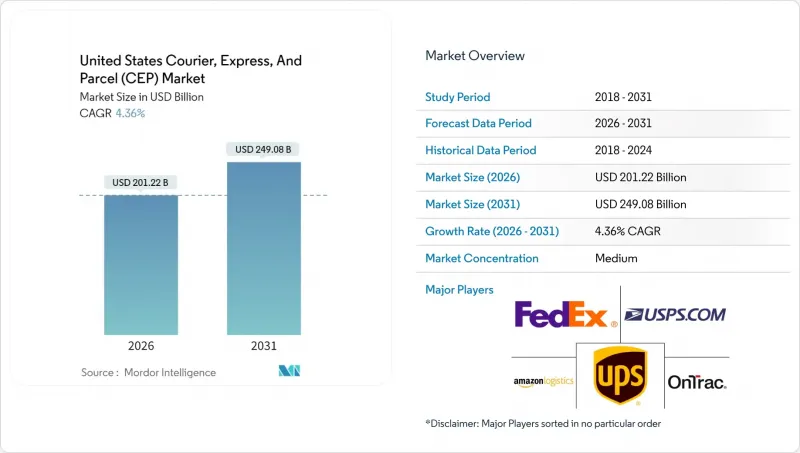

United States Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

United States courier, express, and parcel market size in 2026 is estimated at USD 201.22 billion, growing from 2025 value of USD 192.82 billion with 2031 projections showing USD 249.08 billion, growing at 4.36% CAGR over 2026-2031.

Recent volume gains stem from a resilient e-commerce base, normalization of omnichannel inventories, and the return of corporate mailers that paused discretionary spending in 2024. Consolidation among regional carriers, the U.S. Postal Service's re-priced Ground Advantage product, and disciplined capacity additions by integrators have tempered competitive pricing during peak seasons. Technology upgrades-ranging from API-driven visibility tools to AI-assisted sortation-continue to improve network velocity, especially in high-density corridors. At the same time, headwinds such as union wage settlements, road congestion, and shifting de-minimis thresholds keep operating costs elevated, nudging carriers toward greener fleets and contract renegotiations that better align pricing with service guarantees.

United States Courier, Express, And Parcel (CEP) Market Trends and Insights

Explosive E-commerce Order Volumes Post-Pandemic

A sustained shift toward online buying keeps the order book elevated well beyond the 2024 holiday peak, when U.S. retailers logged 255% more Black Friday transactions than average October Fridays. High-volume corridors now stretch beyond coastal megapolises, with 52% of national e-commerce parcels originating in only nine states, enabling carriers to raise daily stop density and lower last-mile unit costs. Consumers increasingly expect full shipment visibility; as a result, retailers integrate carrier APIs that push proactive alerts, minimizing "where-is-my-package" inquiries and smoothing courier workloads. Elevated demand pressures sortation hubs, prompting integrators to deploy machine-vision scanners that reduce mis-sorts and support flexible labor models during volume surges. These structural gains sustain the 1.2-point uplift to the United States courier, express, and parcel market CAGR over the medium term.

Growth of Same-Day / On-Demand Delivery Ecosystems

Same-day fulfillment has moved from optional to essential, with 26% of merchants targeting 2-day delivery and 12% pursuing next-day as their standard promise. Autonomous sidewalk robots, delivery drones, and micro-fulfillment nodes now cluster within five miles of dense consumer pockets, cutting average transit to below two hours for enrolled merchants. Suburban adoption accelerates as cost-per-delivery drops and consumers display parity in urgency preferences compared with urban peers. In response, 45% of retailers plan to embed AI-driven shipping software that optimizes carrier mix and automates exception handling, while 51% budget predictive analytics for returns to shrink reverse-logistics overhead. Fragmented municipal regulations, however, necessitate costly jurisdiction-specific compliance, nudging multi-city carriers to pilot modular hardware that meets varying curb-space mandates. The ecosystem's 0.8-point boost to CAGR is front-loaded into the next two years.

Escalating Union Wage and Benefit Costs for Drivers

The driver pool tightens as the shortage persists at 80,000 positions in 2025, and demographic shifts could more than double the gap by 2030. Large integrators confront turnover above 90%, forcing wage escalators and retention bonuses that ripple through regional peers. Collective-bargaining rounds reset industry baselines, compelling non-union fleets to match headline figures or risk capacity attrition during peak periods. Classification reforms threaten the owner-operator model that underpins smaller parcel contractors, potentially raising compliance outlays and narrowing net margins. Over the long term, escalating wages shave 0.7 points from the market CAGR as carriers pass along costs through general rate increases that may curb discretionary shipment growth.

Other drivers and restraints analyzed in the detailed report include:

- Retailers' Shift to Omnichannel and Store-Based Fulfillment

- USPS Ground Advantage Relaunch Expanding Low-Cost Capacity

- Aging Road and Bridge Infrastructure Causing Delays

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce contributed 42.10% of 2025 shipments and remains the lodestar for parcel demand, driven by marketplace promotions, buy-now-pay-later penetration, and social-commerce crossover events. High order frequency keeps fulfillment centers pulsing, while returns programs extend parcel counts into the reverse pipeline. Healthcare rises at a 4.58% CAGR between 2026-2031, fueled by controlled-temperature pharmaceuticals, at-home diagnostic kits, and telehealth devices subject to strict chain-of-custody regulations.

Carriers with Verified-Accredited Wholesale Distributor status win share in temperature-controlled lanes, leveraging sensor-equipped packaging that records lane-level compliance for FDA audits. The manufacturing sector leans on just-in-time parts replenishment, while wholesale and retail trade entities optimize replenishment frequency using predictive shelf-stock analytics. Together, these verticals fortify the United States courier, express, and parcel market share, cushioning it against sector-specific downturns and broadening the service blueprint.

Domestic shipments own a 76.15% slice of the United States courier, express, and parcel market in 2025, buoyed by unified regulations, standardized addressing, and dense last-mile coverage that reaches virtually every ZIP code. Stable household consumption, robust small-business formation, and USPS universal-service guarantees keep origin-and-destination pairs overwhelmingly domestic. The international leg, while smaller, expands at a 4.64% CAGR between 2026-2031 as U.S. sellers list on global marketplaces and Canadian and Mexican consumers tap U.S. assortment breadth.

International growth leans on simplified electronic customs declarations and improved hand-off protocols with foreign posts, but looming de-minimis revisions threaten to add paperwork and brokerage fees. Carriers hedge by investing in section-321 compliance engines that parse product classifications in real time. Network planners also deploy hybrid truck-air models across the US-Mexico border to sidestep congestion at Laredo and Otay Mesa, protecting service commitments during peak periods. The evolving cross-border mix ensures that the United States courier, express, and parcel market size linked to global flows grows in both absolute and relative terms over the decade.

The United States Courier, Express, and Parcel (CEP) Market Report is Segmented by Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Model (Business-To-Business (B2B) and More), Shipment Weight (Heavy Weight Shipment, Light Weight Shipment, and More), Mode of Transport (Air, Road, and Others), and End User Industry (E-Commerce and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon

- Aramex

- DHL Group

- Dropoff Inc.

- FedEx

- International Distributions Services (including GLS)

- OnTrac

- Spee-Dee Delivery Service, Inc.

- United Parcel Service (UPS)

- USA Couriers

- USPS

- WeDo Logistics Limited (including Lone Star Overnight Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Explosive E-Commerce Order Volumes Post-Pandemic

- 4.15.2 Growth of Same-Day / On-demand Delivery Ecosystems

- 4.15.3 Retailers' Shift To Omnichannel and Store-Based Fulfilment

- 4.15.4 USPS "Ground Advantage" Relaunch Expanding Low-Cost Capacity

- 4.15.5 Surge in C2C Recommerce Parcels from Second-Hand Platforms

- 4.15.6 Ev-Fleet Purchase Incentives Lowering Long-Term Last-Mile OPEX

- 4.16 Market Restraints

- 4.16.1 Escalating Union Wage and Benefit Costs for Drivers

- 4.16.2 Ageing Road and Bridge Infrastructure Causing Delays

- 4.16.3 Urban Curb-Space Regulations Limiting Van Access

- 4.16.4 Stricter De-Minimis Rules Raising Cross-Border Costs

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon

- 6.4.2 Aramex

- 6.4.3 DHL Group

- 6.4.4 Dropoff Inc.

- 6.4.5 FedEx

- 6.4.6 International Distributions Services (including GLS)

- 6.4.7 OnTrac

- 6.4.8 Spee-Dee Delivery Service, Inc.

- 6.4.9 United Parcel Service (UPS)

- 6.4.10 USA Couriers

- 6.4.11 USPS

- 6.4.12 WeDo Logistics Limited (including Lone Star Overnight Inc.)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment