PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940674

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940674

Asia-Pacific Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

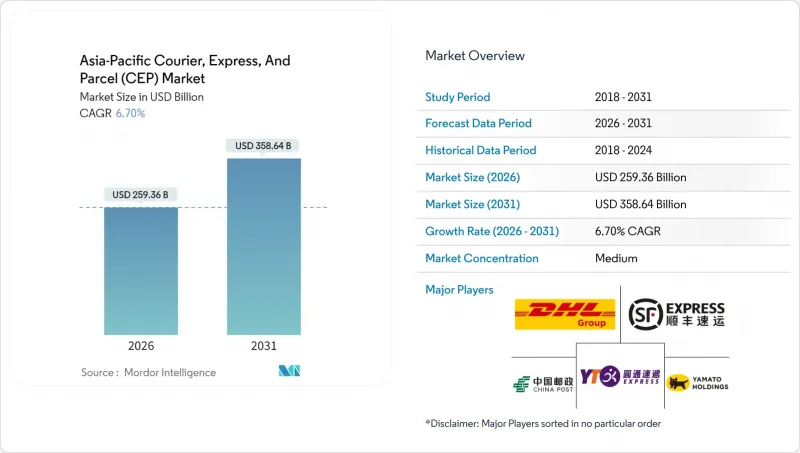

Asia-Pacific courier, express, and parcel market size in 2026 is estimated at USD 259.36 billion, growing from 2025 value of USD 243.08 billion with 2031 projections showing USD 358.64 billion, growing at 6.70% CAGR over 2026-2031.

This expansion reflects the region's sustained e-commerce momentum, wider digital payments adoption, and supportive trade frameworks such as RCEP and CPTPP. Same-day fulfillment expectations have shifted from premium add-ons to baseline service levels, prompting heavy investment in urban micro-fulfillment assets. Operators that integrate real-time tracking, predictive routing, and temperature-controlled capacity are positioned to secure higher-margin volumes. Meanwhile, labor constraints and fuel price swings temper operating margins and incentivize automation.

Asia-Pacific Courier, Express, And Parcel (CEP) Market Trends and Insights

E-commerce Boom and Same-Day Culture

Rising urban incomes and mobile internet access have entrenched next-day and same-day delivery as the new normal across leading Asian cities. Regional e-commerce value surpassed USD 2 trillion in 2024, and shoppers now abandon carts if express options are unavailable. Logistics firms respond by positioning inventory inside city-edge micro-fulfillment sites and using predictive analytics to consolidate orders by postcode. Same-day density boosts stop efficiency yet raise wages and real estate costs, prompting wider deployment of electric two-wheelers and automated lockers. Rapid-commerce grocery models compress fulfillment windows to under 30 minutes, forcing a redesign of traditional hub-and-spoke networks into nodal mesh layouts that prioritize proximity. These shifts underpin premium yield opportunities for operators able to keep unit costs in check.

Cross-Border E-Tailer Alliances (RCEP, CPTPP)

Tariff elimination on 90% of goods traded under RCEP and streamlined customs protocols under CPTPP have shortened average clearance times by one-third within member states. Mid-sized logistics providers now harness digital certificates of origin to offer two-day door-to-door delivery between Bangkok and Tokyo. Smaller sellers in the Philippines and Vietnam gain export access through marketplace tie-ups with regional integrators that bundle freight, duty pre-payment, and returns management. As import ceilings rise, parcel volumes shift from postal channels to premium express lanes, supporting rate integrity despite softening commodity prices. Enhanced interoperability across single-window platforms further shrinks paperwork and boosts service reliability.

Urban Driver-Hour Caps and Labor Shortages

Singapore's 44-hour weekly limit and Tokyo's downtown truck curfews constrain peak-hour capacity. Aging demographics in Japan and South Korea shrink the available workforce even as parcel counts climb. Chinese tier-one cities saw logistics wages climb during 2024, with operators offering sign-on bonuses to secure riders. To mitigate exposure, carriers extend alternative collection points and test sidewalk robots. Yet autonomous options remain at pilot scale, keeping tight labor supply a near-term constraint.

Other drivers and restraints analyzed in the detailed report include:

- Government Smart-Logistics Corridors

- Cold-Chain Surge for Biologics and Fresh Food

- Volatile Bunker and Jet-Fuel Surcharges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce contributed 34.42% of parcel demand in 2025, reflecting entrenched online shopping behavior. Healthcare deliveries advance at a 7.03% CAGR between 2026-2031, driven by biologics, clinical trial samples, and home-care devices. The Asia-Pacific courier, express, and parcel market supports regulatory-compliant cold-chain lanes featuring passive packaging and real-time sensors.

Manufacturing maintains a stable baseline through just-in-time raw-material flows, while financial services require secure, tracked movement of confidential documents. Grocery quick commerce stretches network capacity with high-frequency, low-ticket orders demanding near-instant dispatch.

International parcel flows expanded at a 6.86% CAGR between 2026-2031, even as domestic consignments retained a commanding 64.02% hold on the Asia-Pacific courier, express, and parcel market in 2025. Customs digitalization under RCEP cuts border dwell time, enabling 2- to 3-day delivery between key metropolitan pairs. The Asia-Pacific courier, express, and parcel market size linked to cross-border e-commerce is forecast to grow steadily through 2030. Domestic density advantages support low unit costs, but same-day guarantees pressure margins in megacities.

Cross-border demand is strongest among mid-market exporters pursuing supply-chain diversification. Quick commerce marketplaces now promise 72-hour delivery for niche Korean beauty products into Southeast Asia, with buyers paying double the standard tariff for premium tracking. Addressing gaps and language barriers persists, yet is gradually mitigated through shared data interfaces between customs, carriers, and marketplaces.

The Asia-Pacific Courier, Express, and Parcel (CEP) Market Report is Segmented by Destination (Domestic and International), Speed of Delivery (Express and Non-Express), Model (Business-To-Business (B2B), and More), Shipment Weight (Heavy Weight, and More), Mode of Transport (Air, Road, and Others), End User Industry (E-Commerce, and More), and Country (China, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Blue Dart Express Limited

- China Post

- CJ Logistics Corporation

- DHL Group

- DTDC Express Limited

- FedEx

- Japan Post Holdings Co., Ltd. (including Toll Group)

- JWD Group

- SF Express (KEX-SF)

- SG Holdings Co., Ltd.

- Shanghai YTO Express (Logistics) Co., Ltd.

- United Parcel Service (UPS)

- Yamato Holdings Co., Ltd.

- ZTO Express

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.13.1 Australia

- 4.13.2 China

- 4.13.3 India

- 4.13.4 Indonesia

- 4.13.5 Japan

- 4.13.6 Malaysia

- 4.13.7 Pakistan

- 4.13.8 Philippines

- 4.13.9 Thailand

- 4.13.10 Vietnam

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 E-Commerce Boom and Same-Day Culture

- 4.15.2 Cross-Border E-Tailer Alliances (RCEP, CPTPP)

- 4.15.3 Government Smart-Logistics Corridors (China, India, ASEAN)

- 4.15.4 Cold-Chain Surge for Biologics and Fresh Food

- 4.15.5 AI-Driven Route-Optimization and Autonomous Hubs

- 4.15.6 Micro-Fulfilment and Dark-Store Proliferation

- 4.16 Market Restraints

- 4.16.1 Urban Driver-Hour Caps and Labor Shortages

- 4.16.2 Volatile Bunker and Jet-Fuel Surcharges

- 4.16.3 Addressing-System Gaps in Tier-2/3 Cities

- 4.16.4 Geopolitical Trade-Lane Disruptions (Straits, SCS)

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

- 5.7 Country

- 5.7.1 Australia

- 5.7.2 China

- 5.7.3 India

- 5.7.4 Indonesia

- 5.7.5 Japan

- 5.7.6 Malaysia

- 5.7.7 Pakistan

- 5.7.8 Philippines

- 5.7.9 Thailand

- 5.7.10 Vietnam

- 5.7.11 Rest of Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Blue Dart Express Limited

- 6.4.2 China Post

- 6.4.3 CJ Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 DTDC Express Limited

- 6.4.6 FedEx

- 6.4.7 Japan Post Holdings Co., Ltd. (including Toll Group)

- 6.4.8 JWD Group

- 6.4.9 SF Express (KEX-SF)

- 6.4.10 SG Holdings Co., Ltd.

- 6.4.11 Shanghai YTO Express (Logistics) Co., Ltd.

- 6.4.12 United Parcel Service (UPS)

- 6.4.13 Yamato Holdings Co., Ltd.

- 6.4.14 ZTO Express

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment