PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939721

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939721

United Kingdom Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

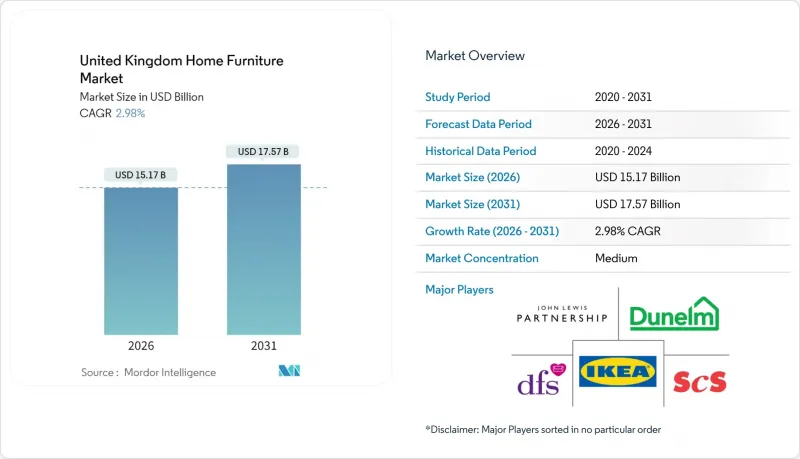

The United Kingdom Home Furniture Market size in 2026 is estimated at USD 15.17 billion, growing from 2025 value of USD 14.73 billion with 2031 projections showing USD 17.57 billion, growing at 2.98% CAGR over 2026-2031.

The growth signals steady expansion despite raw-material inflation and heightened regulatory burdens. The trajectory rests on accelerated digitization of retail, a marked consumer preference for sustainable products, and the structural shift toward hybrid working that sustains elevated demand for home-office pieces. Build-to-Rent (BTR) developments reinforce underlying demand, as record 2024 capital inflows of USD 5.1 billion and government targets for 60,000 new rental homes annually to 2030 translate into higher institutional furniture orders. Intensifying competition comes from omnichannel incumbents and rising second-hand platforms, while compliance with the 2025 fire-safety amendments imposes additional testing and labeling costs on upholstered ranges. Volatile timber and steel prices press margins; however, domestic sourcing initiatives such as Ercol's Grown in Britain partnership illustrate how local supply chains can bolster resilience.

United Kingdom Home Furniture Market Trends and Insights

Growth of E-commerce Furniture Sales

Online channels are projected to account for nearly 40% of all UK furniture market transactions in 2025, driven by AR-enabled visualization tools that cut return rates and raise conversion. Retailers extend click-and-collect networks-exemplified by IKEA's 100 Tesco collection points that enjoy 91% customer approval-to shrink last-mile costs and boost convenience. Mobile commerce shapes discovery behavior, with a majority of shoppers initiating searches on smartphones before finalizing in store or online checkout. Omnichannel integration becomes mandatory, requiring real-time inventory visibility and uniform pricing to safeguard shopper confidence. The logistics burden grows in tandem, prompting investments in automated warehouses and specialized two-man delivery fleets that can handle bulky items without damage.

Sustainability & Eco-friendly Material Demand

Seventy-eight percent of UK consumers label sustainable living a priority and 76% accept price premiums for eco-friendly furniture, magnifying the strategic imperative for certified materials. Two-thirds of manufacturers rank sustainability among their top three management issues, yet many cite implementation costs and knowledge gaps as barriers. Circular programs led by WRAP's Circular Change Council aim to divert part of the 22 million furniture items discarded annually toward reuse or recycling, thereby easing landfill pressure. Retailers increasingly specify FSC-certified timber and recycled metal, embedding environmental credentials directly in product marketing. Modular, repairable designs gain traction as extended-warranty offers reinforce product longevity narratives that resonate with value-conscious buyers.

Timber, Steel & Foam Price Volatility Squeezing Retailer Margins

Building-material prices have climbed 38% since 2020, with kitchen furniture inputs up 36%, tightening already slim retailer gross margins. The UK imports 81% of its timber, exposing manufacturers to currency swings and geopolitical supply shocks that ripple through finished goods pricing. Government consultation on a USD 2.5 billion plan to stabilize domestic steel provides future relief, yet immediate implementation timelines leave producers vulnerable to spot-market spikes. Foam costs stay elevated because petrochemical feedstock volatility persists, particularly affecting high-density upholstery applications. Firms counter risk through multi-sourcing, local procurement partnerships, and material substitution, though each strategy demands capital outlays and may challenge established design aesthetics.

Other drivers and restraints analyzed in the detailed report include:

- Build-to-Rent Boom Raises Demand for Durable Fixtures

- Remote-working Tax Incentives Boost Home-office Demand

- Second-hand Resale Platforms Cannibalizing New-furniture Demand

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living-Room & Dining-Room furniture retained a 31.78% share of the UK furniture market in 2025 as open-plan layouts and social-space enhancements persisted. Home-Office pieces, while smaller in absolute terms, post a category-leading 3.24% CAGR, reflecting continuous hybrid working adoption and employer-funded ergonomic upgrades. Bedroom furnishings remain stable, underpinned by storage innovations that cater to urban dwellers with limited square footage. Kitchen furniture benefits from renovation cycles that treat the kitchen as a multi-use social hub, boosting demand for integrated seating and storage modules. Outdoor ranges saw pandemic-era uplift, yet sales moderate as weather-related seasonality returns, reinforcing the dominance of indoor core categories.

Demand patterns now prioritize multifunctionality, driving modular sofas and extendable tables that adapt to evolving household needs while guarding against premature obsolescence. Vintage-inspired designs have resurged, with retro silhouettes signaling perceived durability and design permanence that consumers equate with value. Updated fire-safety regulations add engineering complexity to upholstered products, compelling producers to source low-flame fabrics without sacrificing comfort. Premium smart furniture-with wireless charging and concealed lighting, is carving a niche, especially among urban professionals seeking seamless tech integration. Customization engines enable shoppers to tweak finishes online, shrinking the gap between bespoke craftsmanship and mass-market affordability.

Wood accounted for 55.92% of the UK furniture market share in 2025, illustrating enduring consumer affinity for natural aesthetics and renewable sourcing narratives. Metal components grow fastest at 4.18% CAGR as industrial loft themes permeate residential settings and commercial buyers prize durability. Plastic and polymer lines retain utility in outdoor environments where low maintenance outweighs premium design aspirations. Emerging composites leverage recycled fibers and bio-resins, giving sustainability-minded shoppers new alternatives without compromising performance. The dominance of imported timber remains a structural risk, but domestic initiatives like Grown in Britain showcase the feasibility of shorter, traceable supply chains that improve carbon metrics.

Advanced kiln drying and CNC processing now yield tighter tolerances and reduced wastage, elevating consistency across mid-range price points. Hybrid constructions that fuse wood tops with metal frames deliver visual warmth and structural strength, aligning with contemporary design cues. Recycled-content mandates from large retailers encourage smelters to expand closed-loop aluminum supplies that feed into dining furniture and shelving systems. Material traceability apps let consumers scan QR codes for provenance data, reinforcing trust and reinforcing brand credentials around responsible sourcing. As domestic timber capacity scales, producers anticipate greater buffer against future currency fluctuations that have historically distorted input costs.

The United Kingdom Home Furniture Market Report is Segmented by Product (Living Room & Dining Room Furniture, Bedroom Furniture, Kitchen Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, Online, Other Distribution Channels), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- IKEA

- DFS Furniture Plc

- John Lewis Partnership

- SCS Group

- Dunelm Group

- Bensons for Beds

- Dreams Ltd

- Oak Furnitureland

- Wren Kitchens

- Magnet Kitchens

- Sharps Bedrooms

- Habitat

- Made.com

- Wayfair

- The Range

- Furniture Village

- Harveys Furniture

- Barker & Stonehouse

- Heal's

- Loaf

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Home-Improvement Expenditure

- 4.2.2 Growth of E-Commerce Furniture Sales

- 4.2.3 Sustainability & Eco-Friendly Material Demand

- 4.2.4 Remote-Working Tax Incentives Boost Home-Office Demand

- 4.2.5 Build-To-Rent Boom Raises Demand For Durable Fixtures

- 4.2.6 Circular-Economy "Right-To-Repair" Legislation

- 4.3 Market Restraints

- 4.3.1 Timber, Steel And Foam Price Volatility Squeezing Retailer Margins

- 4.3.2 Geopolitical Shipping Disruptions Increasing Lead Times

- 4.3.3 Stricter UK Fire-Safety And Flammability Compliance Costs For Upholstery

- 4.3.4 Second-Hand Resale Platforms Cannibalising New-Furniture Demand

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Living Room & Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets and local stores from the unorganized sector)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 England

- 5.5.2 Scotland

- 5.5.3 Wales

- 5.5.4 Northern Ireland

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA

- 6.4.2 DFS Furniture Plc

- 6.4.3 John Lewis Partnership

- 6.4.4 SCS Group

- 6.4.5 Dunelm Group

- 6.4.6 Bensons for Beds

- 6.4.7 Dreams Ltd

- 6.4.8 Oak Furnitureland

- 6.4.9 Wren Kitchens

- 6.4.10 Magnet Kitchens

- 6.4.11 Sharps Bedrooms

- 6.4.12 Habitat

- 6.4.13 Made.com

- 6.4.14 Wayfair

- 6.4.15 The Range

- 6.4.16 Furniture Village

- 6.4.17 Harveys Furniture

- 6.4.18 Barker & Stonehouse

- 6.4.19 Heal's

- 6.4.20 Loaf

7 Market Opportunities & Future Outlook

- 7.1 Rising Focus on Locally Sourced and British-Made Furniture

- 7.2 Heritage and Vintage Revival Driving UK Home Interiors