PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939723

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939723

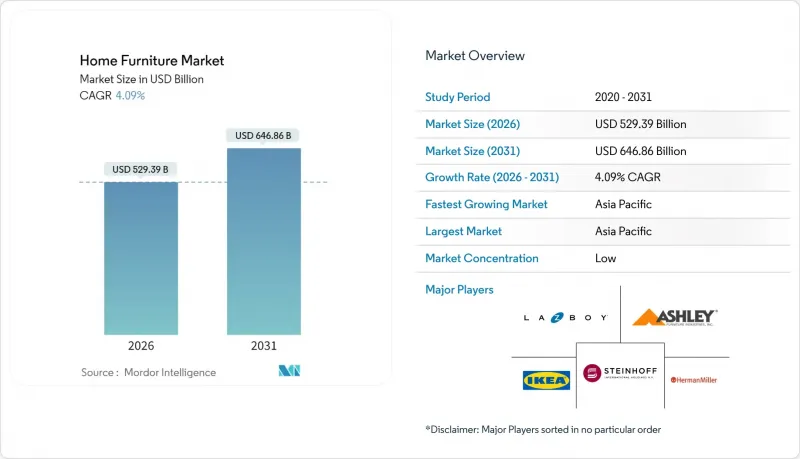

Home Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Home Furniture Market is expected to grow from USD 508.59 billion in 2025 to USD 529.39 billion in 2026 and is forecast to reach USD 646.86 billion by 2031 at 4.09% CAGR over 2026-2031.

Demand momentum is strongest in the home-office category as hybrid work models normalize, with consumers favoring multifunctional pieces that blend professional ergonomics with residential aesthetics. Digital manufacturing and artificial-intelligence-driven design shorten product cycles, enabling brands to introduce personalized collections that capture premium margins while controlling costs. Sustainability imperatives push companies toward circular production and certified timber sourcing, turning compliance into a competitive differentiator. Supply-chain optimization remains pivotal because ocean-freight volatility and currency swings directly influence pricing strategies and gross margins.

Global Home Furniture Market Trends and Insights

Hybrid work lifts home-office demand

Hybrid work schedules have sustained elevated spending on home office furniture. Employers are allocating a portion of their capital expenditures (CAPEX) to subsidize ergonomic desks and chairs, aiming to enhance employee retention. Manufacturers are addressing this demand by introducing compact sit-stand desks, hidden cable systems, and mobile storage solutions that integrate seamlessly into home spaces. Regulatory overlaps between workplace safety and home ergonomics could lead to stricter product specifications, creating higher entry barriers for new players. This shift ensures durable revenue streams for manufacturers. Additionally, the trend persists even as commercial real estate occupancy rates stabilize.

Millennial & Gen-Z home-ownership growth

Millennial and Gen-Z consumers are driving demand for starter furniture suites as they increasingly become first-time homeowners in emerging economies. These groups prioritize sustainably sourced, modular furniture that accommodates frequent moves and conduct thorough online research before purchasing. Flexible payment options like Buy-Now-Pay-Later and subscription models appeal to their financial preferences, encouraging higher-value purchases. Social media plays a significant role, influencing 70% of their buying decisions, which pushes brands to optimize their influencer marketing strategies. This demographic shift is expected to sustain steady growth in furniture volumes, extending beyond urban centers in the long term.

Volatile ocean-freight rates

Between 2023 and 2024, container costs surged by 120%, significantly impacting margins for exporters dependent on long-haul shipping lanes. While some manufacturers mitigate this by securing annual freight contracts, smaller firms often lack the bargaining power to obtain favorable terms. Nearshoring efforts in regions like Mexico and Eastern Europe help avoid congested ports, though initial relocation costs limit immediate savings. To counter rising shipping rates, companies are re-engineering packaging to optimize cube utilization, fitting more units per container. Diversifying shipping routes and expanding regional warehouse networks will be critical for future margin recovery.

Other drivers and restraints analyzed in the detailed report include:

- Organized retail expansion in Tier-2/3 cities

- Industry 4.0 mass-customization

- Growing rental popularity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Living Room & Dining Room sets held a 32.74% slice of 2025 revenue, underscoring their centrality to social interaction and entertainment trends within the furniture market. Home Office furniture posted the quickest 4.10% CAGR as employers reimbursed ergonomic setups, boosting a niche that bridges residential comfort with professional utility. Bedroom and kitchen lines enjoy steady baseline demand because replacements follow life-stage events such as marriage or relocation, offering predictable cycles for inventory planning. Outdoor pieces attract renewed interest in suburban and rural zones where consumers extend living spaces, creating opportunities for weather-resistant composites. Multifunctionality now permeates every category, with storage ottomans and modular sofas illustrating how product innovation solves space constraints.

Designers increasingly embed USB-C chargers and IoT sensors into premium desks and nightstands, elevating perceived value while prompting higher price points in the furniture market. Industry 4.0 production supports custom size and fabric choices, stimulating direct-to-consumer startups that bypass wholesale margins. Sustainability overlays every product brief, prompting FSC-certified wood and recycled-plastic inserts to satisfy eco-conscious buyers. Regional taste nuances-such as minimalism in Japan and ornate finishes in the Middle East-require localized SKU matrices that balance volume with design authenticity. Supply-chain data analytics guide demand forecasting, reducing markdown risks and protecting gross margin.

Wood remained the material of choice with a 41.88% hold on 2025 revenue, supported by certified forestry programs that assure buyers of responsible sourcing. Plastic & polymer pieces grow fastest at 4.85% CAGR because bio-based resins and recycled PET blends improve environmental footprints without sacrificing durability. Metal frames dominate institutional and garden segments, favored for longevity and sleek aesthetics that match modern architecture. Alternative materials, from bamboo composites to mushroom-based panels, inch into mainstream catalogs as experimentation scales up. Innovation in surface finishing replicates oak grain on polymer boards, helping price-sensitive customers access upscale looks.

Supply traceability platforms log chain-of-custody data, giving brands audit evidence and a marketing narrative around ethical sourcing within the furniture market. Material diversity mitigates risk-loss of Russian birch veneer pushed European producers to Indonesian rubberwood and Brazilian eucalyptus substitutions. Composite technology blends sawdust with recycled plastics, cutting landfill input while delivering moisture resistance. Consumer education via QR codes explains life-cycle impacts, boosting trust and premium willingness. Over time, competitive advantage will hinge on mastering circular-ready materials that ease dismantling and component reuse.

The Global Home Furniture Market Report is Segmented by Product (Living Room & Dining Room Furniture, and More), Material (Wood, Metal, Plastic & Polymer, Others), Price Range (Economy, Mid-Range, Premium), Distribution Channel (Home Centers, Specialty Furniture Stores, and More), and Geography (North America, South America, Europe, Asia-Pacific, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific accounted for 38.02% of global revenue in 2025, reflecting cost-competitive production clusters and burgeoning urban middle-class demand that anchor the furniture market. Rapid e-commerce adoption and growing home-ownership in Tier-2 Chinese and Indian cities extend market reach beyond coastal megacities. Government incentives for smart-factory upgrades accelerate technology penetration, raising local suppliers' quality to global benchmarks. Regional design language blends minimalist Scandinavian influences with indigenous motifs, sparking product differentiation. Freight proximity to raw-material sources like Malaysian rubberwood supports margin resilience against currency swings.

North America displays mature penetration yet retains innovation leadership in circular-ready products, reclaimed lumber usage, and ergonomic research, providing a blueprint for premium differentiation. The United States benefits from nearshoring in Mexico, which trims lead times and insulates brands from trans-Pacific freight shocks. Canadian demand rebounds as housing starts stabilize, especially in suburban single-family developments that require full-suite furnishing. Sustainability regulations, including California's extended producer responsibility rules, shape supplier selection and packaging design. Digital marketplace consolidation favors larger players that can absorb rising fulfillment costs.

Europe experiences moderate growth but commands influence through stringent environmental directives like the Right-to-Repair mandate, giving local makers first-mover advantage in circular solutions. Germany and the Nordics showcase high per-capita spending and preference for certified wood lines, while Southern Europe leans toward artisanal craftsmanship and solid-wood dining sets. Currency volatility due to macroeconomic shifts prompts hedging and localized production for euro-zone sales. Middle East and Africa represent long-range opportunities, with Gulf states investing in hospitality projects that demand bespoke luxury collections. Latin America gains traction as retailers invest USD 600 million in new outlets across five countries, signaling market formalization.

- Inter IKEA Systems B.V.

- Ashley Furniture Industries, Inc.

- Steinhoff International Holdings N.V.

- La-Z-Boy Incorporated

- Herman Miller, Inc.

- Steelcase Inc.

- Wayfair Inc.

- Kimball International, Inc.

- Williams-Sonoma, Inc.

- Haworth Inc.

- Okamura Corporation

- Godrej & Boyce Manufacturing Co. Ltd.

- HNI Corporation

- Ethan Allen Interiors Inc.

- Sauder Woodworking Co.

- Man Wah Holdings Ltd.

- Natuzzi S.p.A.

- Ikea Industry (manufacturing arm)

- Teknion Corporation

- IKEA Group Retail (for omnichannel angle)

- Flexsteel Industries, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Post-pandemic hybrid-working lifts home-office furniture demand

- 4.2.2 Growing millennial & Gen-Z home-ownership in emerging markets

- 4.2.3 Expansion of organized retail chains in Tier-2/3 cities

- 4.2.4 Mass-customization enabled by Industry 4.0 manufacturing

- 4.2.5 Shift toward certified sustainable timber sourcing

- 4.2.6 AI-driven design platforms shortening concept-to-launch cycles

- 4.3 Market Restraints

- 4.3.1 Volatile ocean-freight rates squeezing margins

- 4.3.2 Soaring lumber prices due to climate-driven supply shocks

- 4.3.3 EU "Right-to-Repair" and circular-economy mandates raising compliance costs

- 4.3.4 Rising popularity of furniture rental curbing replacement cycles

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Industry Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Living Room & Dining Room Furniture

- 5.1.2 Bedroom Furniture

- 5.1.3 Kitchen Furniture

- 5.1.4 Home Office Furniture

- 5.1.5 Bathroom Furniture

- 5.1.6 Outdoor Furniture

- 5.1.7 Other Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Others

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 Home Centers

- 5.4.2 Specialty Furniture Stores (including exclusive brand outlets and local stores from the unorganized sector)

- 5.4.3 Online

- 5.4.4 Other Distribution Channels (includes hypermarkets, supermarkets, teleshopping, departmental stores, etc.)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX

- 5.5.3.7 NORDICS

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Inter IKEA Systems B.V.

- 6.4.2 Ashley Furniture Industries, Inc.

- 6.4.3 Steinhoff International Holdings N.V.

- 6.4.4 La-Z-Boy Incorporated

- 6.4.5 Herman Miller, Inc.

- 6.4.6 Steelcase Inc.

- 6.4.7 Wayfair Inc.

- 6.4.8 Kimball International, Inc.

- 6.4.9 Williams-Sonoma, Inc.

- 6.4.10 Haworth Inc.

- 6.4.11 Okamura Corporation

- 6.4.12 Godrej & Boyce Manufacturing Co. Ltd.

- 6.4.13 HNI Corporation

- 6.4.14 Ethan Allen Interiors Inc.

- 6.4.15 Sauder Woodworking Co.

- 6.4.16 Man Wah Holdings Ltd.

- 6.4.17 Natuzzi S.p.A.

- 6.4.18 Ikea Industry (manufacturing arm)

- 6.4.19 Teknion Corporation

- 6.4.20 IKEA Group Retail (for omnichannel angle)

- 6.4.21 Flexsteel Industries, Inc.

7 Market Opportunities & Future Outlook

- 7.1 Growth of Circular Economy and Furniture Rental Models

- 7.2 Increased Demand for Compact Furniture in Smaller Urban Homes