PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940785

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940785

United Kingdom IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

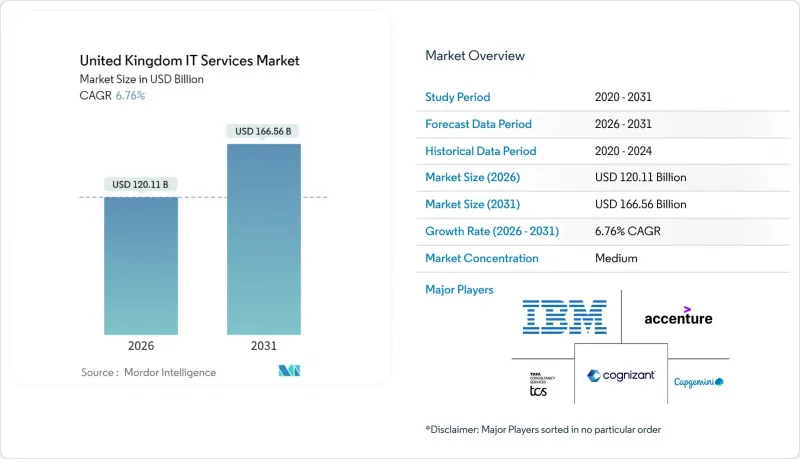

The UK IT services market was valued at USD 112.5 billion in 2025 and estimated to grow from USD 120.11 billion in 2026 to reach USD 166.56 billion by 2031, at a CAGR of 6.76% during the forecast period (2026-2031).

This trajectory underscores the resilience of the UK IT services market, powered by accelerating digital transformation in both public and private sectors, sustained public investment in AI infrastructure, and expanding compliance mandates in cybersecurity. Public-sector cloud frameworks, record generative-AI contract bookings, and growing regional tech hubs continue to stimulate demand, while wage inflation and macro-economic caution remain moderating influences. Global consulting firms are reinforcing their AI credentials to secure large multi-year deals, whereas mid-tier providers are targeting specialized niches such as managed security and Industry 4.0 integration. Nearshore delivery adoption is rising in response to tight local talent supply, yet the UK IT services market still favors on-premises proximity for high-regulation verticals such as finance and government.

United Kingdom IT Services Market Trends and Insights

AI-led Digital Transformation Wave

The United Kingdom now ranks as the world's third-largest AI economy and is targeting annual productivity gains of 1.5% through AI deployment. Despite enthusiasm, only 16% of manufacturers report adequate AI knowledge, opening consultative opportunities for service providers. Public investment of USD 4 billion and USD 14 billion in private commitments form a durable pipeline for AI-centric engagements. Accenture alone secured USD 1.4 billion in generative-AI bookings during Q2 FY25, signaling robust enterprise appetite. Government-designated AI Growth Zones-beginning with Culham, Oxfordshire-will require extensive systems integration and cloud capacity. Together, these factors generate a sustained uplift in the UK IT services market.

Cloud-first Government Procurement Policies

The cloud-first mandate, highlighted by G-Cloud 14's catalog of 46,000 services from 4,000 suppliers, is reshaping public-sector procurement. Framework savings of USD 2.3 billion since 2012 validate economic benefits and stimulate SME participation. The forthcoming USD 16 billion Technology Services 4 competition represents the largest single opportunity for vendors. Cloud uptake extends into strategic partnerships under the Digital and Technologies Sector Plan, blurring lines between procurement and innovation. Private-sector spillovers are visible as regulated industries replicate public-sector standards, reinforcing double-digit growth in platform services across the UK IT services market.

High Wage Inflation in Tech Talent Pool

Tech salaries escalated 7-10% in 2024, with 76% of employers citing acute skill shortages. The April 2025 National Insurance hike from 13.8% to 15% inflate employer costs. Post-Brexit workforce attrition of 300,000 EU professionals leaves 600,000 vacancies that cost the economy USD 63 billion annually. Firms offset gaps by expanding nearshore and automation strategies, yet elevated labor costs compress margins and temper growth in the UK IT services market.

Other drivers and restraints analyzed in the detailed report include:

- Acute Cyber-threat Environment

- Convergence of OT-IT in UK Manufacturing

- Near-term Macroeconomic Slowdown

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud and platform services represented 28.15% of the UK IT services market share in 2025, a leadership position supported by G-Cloud 14's widened catalog and ongoing migration of legacy estates to the public cloud. The UK IT services market size for this segment is projected to compound steadily on the back of the USD 16 billion Technology Services 4 framework. Simultaneously, managed security services are forecast to post a 9.38% CAGR to 2031, reflecting mandatory compliance under the Cyber Security and Resilience Bill. IT consulting remains resilient thanks to enterprise AI programs, while IT outsourcing and BPO experience balanced growth amid automation.

Cross-pollination between cloud migration and security hardening underpins provider revenue expansion. As agencies replace on-premise systems, bundled managed-security contracts accompany platform deals, magnifying wallet share. NHS tenders worth USD 1.4 billion illustrate how sector-specific frameworks pull along ecosystem suppliers. The UK IT services market, therefore, rewards vendors that combine hyperscale know-how with zero-trust architectures.

Large enterprises controlled 64.25% of the UK IT services market size in 2025, leveraging substantial budgets for multi-cloud rollouts, generative-AI pilots, and regulatory modernization. Despite dominance, their growth rate moderates as transformation roadmaps mature. In contrast, the SME cohort is projected to expand at a 8.98% CAGR to 2031, propelled by the SME Digital Adoption Taskforce's 10-step action plan. UK IT services market share among SMEs remains modest, yet the economic value potential-USD 78.1 billion in AI-enabled productivity gains-creates a fertile addressable base.

Service models must adjust to shorter sales cycles and outcome-based pricing preferred by smaller firms. Regional AI innovation hubs, tax credits, and cloud marketplaces lower entry barriers, allowing providers to develop repeatable packages. Accordingly, the UK IT services market is witnessing a rise in subscription-oriented solutions tailored to micro-enterprises outside London.

The UK IT Services Market Report is Segmented by Service Type (IT Consulting and Implementation, IT Outsourcing, Business Process Outsourcing, and More), End-User Enterprise Size (Small and Medium Enterprises, and Large Enterprises), Deployment Model (Onshore Delivery, Nearshore Delivery, and More), and End-User Vertical (BFSI, Government and Public Sector, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Accenture plc

- IBM UK Ltd.

- Capgemini SE

- Tata Consultancy Services (TCS) UK

- Infosys Ltd. UK

- Cognizant Technology Solutions UK

- HCL Technologies UK

- Wipro Ltd. UK

- Fujitsu Services Ltd.

- DXC Technology UK

- CGI IT UK Ltd.

- Sopra Steria Ltd.

- Computacenter plc

- Softcat plc

- Kainos Group plc

- BJSS Ltd.

- Endava plc

- Version 1 Software UK Ltd.

- FDM Group plc

- PA Consulting Group

- Civica Ltd.

- NTT DATA UK Ltd.

- Capita IT Services

- Rackspace Technology UK

- Mastek (UK) Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-led Digital Transformation Wave

- 4.2.2 Cloud-first Government Procurement Policies

- 4.2.3 Acute Cyber-threat Environment

- 4.2.4 Convergence of OT-IT in UK Manufacturing

- 4.2.5 Rise of Green-IT Mandates (Sustainability Targets)

- 4.2.6 Brexit-Driven Regulatory Complexity

- 4.3 Market Restraints

- 4.3.1 High Wage Inflation in Tech Talent Pool

- 4.3.2 Near-term Macroeconomic Slowdown

- 4.3.3 Data-Sovereignty Concerns with Offshore Delivery

- 4.3.4 Fragmented SME Adoption Outside London

- 4.4 Industry Value Chain Analysis

- 4.5 Impact of Macroeconomic Factors

- 4.6 Evaluation of Critical Regulatory Framework

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Competitive Rivalry

- 4.8.2 Threat of New Entrants

- 4.8.3 Bargaining Power of Suppliers

- 4.8.4 Bargaining Power of Buyers

- 4.8.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 IT Outsourcing (ITO)

- 5.1.3 Business Process Outsourcing (BPO)

- 5.1.4 Managed Security Services

- 5.1.5 Cloud and Platform Services

- 5.2 By End-User Enterprise Size

- 5.2.1 Small and Medium Enterprises (SMEs)

- 5.2.2 Large Enterprises

- 5.3 By Deployment Model

- 5.3.1 Onshore Delivery

- 5.3.2 Nearshore Delivery

- 5.3.3 Offshore Delivery

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Government and Public Sector

- 5.4.4 Healthcare and Life-Sciences

- 5.4.5 Retail and Consumer Goods

- 5.4.6 Telecom and Media

- 5.4.7 Logistics and Transport

- 5.4.8 Energy and Utilities

- 5.4.9 Other End-user Verticals

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 IBM UK Ltd.

- 6.4.3 Capgemini SE

- 6.4.4 Tata Consultancy Services (TCS) UK

- 6.4.5 Infosys Ltd. UK

- 6.4.6 Cognizant Technology Solutions UK

- 6.4.7 HCL Technologies UK

- 6.4.8 Wipro Ltd. UK

- 6.4.9 Fujitsu Services Ltd.

- 6.4.10 DXC Technology UK

- 6.4.11 CGI IT UK Ltd.

- 6.4.12 Sopra Steria Ltd.

- 6.4.13 Computacenter plc

- 6.4.14 Softcat plc

- 6.4.15 Kainos Group plc

- 6.4.16 BJSS Ltd.

- 6.4.17 Endava plc

- 6.4.18 Version 1 Software UK Ltd.

- 6.4.19 FDM Group plc

- 6.4.20 PA Consulting Group

- 6.4.21 Civica Ltd.

- 6.4.22 NTT DATA UK Ltd.

- 6.4.23 Capita IT Services

- 6.4.24 Rackspace Technology UK

- 6.4.25 Mastek (UK) Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment