PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940797

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940797

United States (US) IT Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

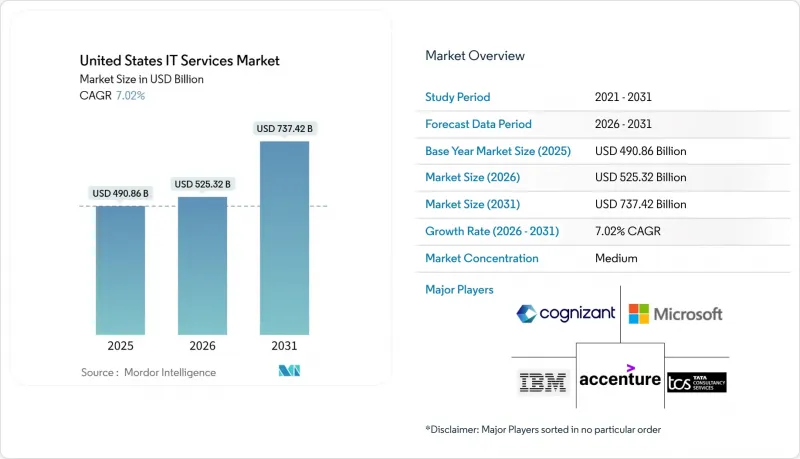

United States IT Services Market size in 2026 is estimated at USD 525.32 billion, growing from 2025 value of USD 490.86 billion with 2031 projections showing USD 737.42 billion, growing at 7.02% CAGR over 2026-2031.

Generative AI ranks as the single largest driver of enterprise technology budgets, while federal incentives for secure cloud migration, 5G-edge roll-outs, and zero-trust mandates supply additional tailwinds. The United States IT services market also benefits from resilient corporate cash flows and the rapid shift of both public and private organizations toward consumption-based operating models. Competition remains intense, yet vendor consolidation continues as global systems integrators acquire niche specialists to secure talent and proprietary AI platforms. Regional dynamics add another layer of complexity: the West retains leadership, but the South is scaling fastest as new data-center corridors emerge to meet surging AI workload demand.

United States (US) IT Services Market Trends and Insights

Federal Incentives Accelerating Cloud Migration in US Public Sector

Federal agencies announced USD 13 billion in new IT services contracts during H1 2024, and the civilian-agency budget for 2025 allocates USD 75.13 billion toward technology, 16.4% of which is earmarked for cybersecurity. A bipartisan proposal seeks an additional USD 32 billion for AI initiatives, widening opportunities for providers with FedRAMP-authorized cloud and security practices.Executive Order 14028 acts as the compliance backbone, mandating secure cloud adoption across agencies. Service partners positioned around Washington, DC, Virginia, and Maryland have begun expanding delivery centers to capture the rapidly growing public-sector pipeline.

Large-Scale Adoption of Generative AI among Fortune 1000

By mid-2025, nearly half of Fortune 1000 enterprises had embedded generative AI into core workflows, and the share is projected to climb sharply as CEOs prioritize enterprise-wide rollouts. Average annual AI budgets are set to rise 14% in 2025, concentrating spend on data-engineering foundations, governance models, and responsible AI controls.The United States IT services market is therefore witnessing record demand for cloud re-platforming, LLM tuning, and model-ops managed services, especially in financial centers along the Northeast corridor and innovation clusters on the West Coast.

Scarcity of Senior Cloud & Security Talent

Employers across the United States report persistent shortages of cloud architects and senior security engineers, a gap that limits project throughput and increases wage inflation. The pressure is fiercest in technology clusters such as Seattle, Austin, and Northern Virginia, where hyperscalers and consultancies compete for the same high-end talent pools. Agencies implementing zero-trust frameworks struggle to match private-sector compensation, encouraging heavier use of staff-augmentation firms that combine domestic leadership with nearshore delivery capacity. Several service providers now deploy AI-based sourcing tools to accelerate candidate screening and reduce vacancy gaps.

Other drivers and restraints analyzed in the detailed report include:

- 5G & Edge Roll-out Driving Network Integration Demand

- Zero-Trust Cybersecurity Mandates Boosting Security Services

- Margin Pressure from Outcome-Based Pricing Models

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Managed Services held 27.85% of the United States IT services market in 2025, driven by enterprises outsourcing run-and-operate functions to focus scarce talent on differentiating innovation. Hybrid-infrastructure complexity and relentless cyberthreats reinforce demand for fully managed observability, patching, and compliance services. Providers position bundled managed offerings as stepping stones to higher-value transformation engagements, ensuring annuity revenue streams and sticky client relationships.

Cloud & Platform Services, expanding at a 9.02% CAGR from 2026-2031, represents the growth engine of the United States IT services market. Clients accelerate large-scale generative-AI pilots directly onto public-cloud foundations, and consumption-based economics move more workloads off private data centers. Service partners, therefore, scale certified cloud squads and FinOps capabilities to control spend. Application Development & Maintenance services still secure sizable deal flow as legacy estates shift toward microservices and serverless paradigms. Meanwhile, cybersecurity and digital-transformation advisory maintain strong pipelines, given regulatory scrutiny and board-level prioritization of modernization road maps.

Onshore Delivery accounted for 62.65% of the United States IT services market size in 2025, reflecting client preference for regulatory compliance, timezone alignment, and domain knowledge. Domestic bill rates in the USD 115-175 per hour band reward deeply specialized consultants, especially in regulated industries. Providers sustain margin by concentrating high-touch architecture and governance roles in metropolitan hubs while dispersing execution to lower-cost U.S. cities.

Nearshore Delivery, forecast to grow 10.05% CAGR to 2031, meets rising demand for Spanish- and Portuguese-speaking agile pods that bridge U.S. business teams and Latin American engineering talent. Firms adopting a "Nearshore Plus" model base solution architects in the U.S. and scale development in Mexico, Colombia, and Costa Rica at blended rates near USD 85 per hour. Offshore delivery continues to supply cost leverage, but wage inflation in traditional hubs such as Bengaluru and Manila triggers selective reshoring of sensitive workloads.

The United States (US) IT Services is Segmented by Type (IT Consulting and Implementation, ADM, and More), Deployment Model (Onshore Delivery, Nearshore Delivery, and More), Engagement Model (Project-Based / Fixed Price, and More), Organization Size (Large Enterprises, Smes), End-User (BFSI, Manufacturing, Government, and More), and by Geography. The Market Forecasts are Provided in Terms of Value in USD.

List of Companies Covered in this Report:

- Accenture plc

- IBM Corporation

- Cognizant Technology Solutions Corp.

- Tata Consultancy Services Ltd.

- Microsoft Corporation

- Infosys Ltd.

- Wipro Ltd.

- Deloitte Consulting LLP

- Capgemini SE

- HCL Technologies Ltd.

- CGI Inc.

- DXC Technology Co.

- Booz Allen Hamilton Inc.

- Leidos Holdings Inc.

- Atos SE

- EPAM Systems Inc.

- NTT DATA Services

- Kyndryl Holdings Inc.

- LTI Mindtree Ltd.

- Tech Mahindra Ltd.

- Slalom LLC

- Perficient Inc.

- ThoughtWorks Inc.

- Persistent Systems Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Federal Incentives Accelerating Cloud Migration in US Public Sector

- 4.2.2 Large-scale Adoption of Generative AI among Fortune 1000

- 4.2.3 5G and Edge Roll-out Driving Network Integration Demand

- 4.2.4 Zero-Trust Cybersecurity Mandates Boosting Security Services

- 4.2.5 Healthcare Interoperability Rules Fueling EHR Integration Services

- 4.2.6 PE-Backed ERP Modernization Wave in Mid-Market Firms

- 4.3 Market Restraints

- 4.3.1 Scarcity of Senior Cloud and Security Talent

- 4.3.2 Margin Pressure from Outcome-Based Pricing Models

- 4.3.3 Compliance Complexity under CCPA/CPRA Litigation

- 4.3.4 Offshore Wage Inflation Eroding Cost Advantages

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Degree of Competition

- 4.7.5 Threat of Substitutes

- 4.8 Comparative Insights: Tier 1 vs Tier 2 Vendors

- 4.9 In-housing vs Outsourcing Analysis

- 4.10 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 IT Consulting and Implementation

- 5.1.2 Application Development and Maintenance (ADM)

- 5.1.3 Infrastructure Services

- 5.1.4 Managed Services

- 5.1.5 IT Outsourcing (ITO)

- 5.1.6 Business Process Outsourcing (BPO)

- 5.1.7 Cloud and Platform Services

- 5.1.8 Cybersecurity Services

- 5.1.9 Digital Transformation and Emerging Tech (AI, IoT, Blockchain)

- 5.2 By Deployment Model

- 5.2.1 Onshore Delivery

- 5.2.2 Nearshore Delivery

- 5.2.3 Offshore Delivery

- 5.3 By Engagement Model

- 5.3.1 Project-based / Fixed Price

- 5.3.2 Staff Augmentation / Time-and-Material

- 5.3.3 Managed Services / Outcome-based

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises (SMEs)

- 5.5 By End-User Industry

- 5.5.1 Banking, Financial Services and Insurance (BFSI)

- 5.5.2 Manufacturing

- 5.5.3 Government and Public Sector

- 5.5.4 Healthcare and Life Sciences

- 5.5.5 Retail and Consumer Goods

- 5.5.6 Telecom and Media

- 5.5.7 Transportation and Logistics

- 5.5.8 Energy and Utilities

- 5.5.9 Others

- 5.6 By Geography

- 5.6.1 Northeast

- 5.6.2 Midwest

- 5.6.3 South

- 5.6.4 West

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accenture plc

- 6.4.2 IBM Corporation

- 6.4.3 Cognizant Technology Solutions Corp.

- 6.4.4 Tata Consultancy Services Ltd.

- 6.4.5 Microsoft Corporation

- 6.4.6 Infosys Ltd.

- 6.4.7 Wipro Ltd.

- 6.4.8 Deloitte Consulting LLP

- 6.4.9 Capgemini SE

- 6.4.10 HCL Technologies Ltd.

- 6.4.11 CGI Inc.

- 6.4.12 DXC Technology Co.

- 6.4.13 Booz Allen Hamilton Inc.

- 6.4.14 Leidos Holdings Inc.

- 6.4.15 Atos SE

- 6.4.16 EPAM Systems Inc.

- 6.4.17 NTT DATA Services

- 6.4.18 Kyndryl Holdings Inc.

- 6.4.19 LTI Mindtree Ltd.

- 6.4.20 Tech Mahindra Ltd.

- 6.4.21 Slalom LLC

- 6.4.22 Perficient Inc.

- 6.4.23 ThoughtWorks Inc.

- 6.4.24 Persistent Systems Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment