PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940819

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940819

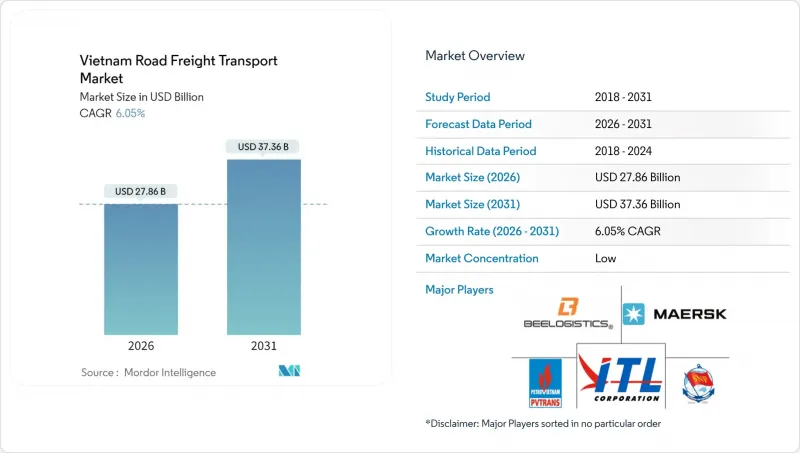

Vietnam Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam road freight transport market was valued at USD 26.27 billion in 2025 and estimated to grow from USD 27.86 billion in 2026 to reach USD 37.36 billion by 2031, at a CAGR of 6.05% during the forecast period (2026-2031).

This expansion reflects sustained infrastructure spending, expanding industrial clusters, and accelerating digital adoption that collectively improve freight productivity and make shipment visibility the new industry baseline. Continued expressway build-out under the 5,000 km national target compresses north-south transit times, supports predictable lead times for exporters, and underpins competitive routing strategies. Digital freight platforms gain ground as shippers demand instantaneous rate discovery, real-time tracking, and dynamic route optimization, while electric truck pilots in major metro areas signal a gradual shift toward low-emission haulage. Competition remains fragmented even after the April 2025 DSV-DB Schenker merger because local specialists retain intimate route knowledge and strong relationships with Vietnamese manufacturers. Cross-border reforms at smart gate projects further widen the country's gateway role between China and ASEAN trade lanes.

Vietnam Road Freight Transport Market Trends and Insights

Rapid Expressway Expansion to 5,000 Km by 2030

Vietnam aims to complete 5,000 km of expressways by 2030, including the USD 25 billion, 1,811 km North-South backbone that will slash travel time between Hanoi and Ho Chi Minh City by up to 40%. Dedicated freight lanes alleviate congestion on national highways where 90% of trucks currently operate, allowing carriers to boost payload utilization and cut fuel costs. Manufacturers along the corridor gain flexibility to synchronize inbound component flows with production timetables, thereby reducing buffer inventories. New spur links to border checkpoints unlock trade potential with China and Laos, positioning Vietnam as a preferred overland bridge for ASEAN-China cargo. The improved physical network, when paired with tolling interoperability and 4G/5G coverage, supports real-time vehicle diagnostics and route optimization.

Booming E-Commerce and Retail Logistics

Online retail sales are projected to reach USD 57 billion in 2025, a figure that pushes carriers toward hub-and-spoke models and urban micro-fulfillment centers. Average shipment sizes fall even as delivery frequency rises, prompting fleet diversification into smaller vans and refrigerated last-mile vehicles for fresh grocery orders. ViettelPost expanded its cross-border parcel service and embedded API-driven tracking that automates customs clearance at major crossings. Investors fund warehouse robotics and AI-based route planners that reduce failed delivery attempts. Rural outreach strategies add second- and third-tier city spokes to networks, broadening addressable demand while challenging operators to maintain cost efficiency.

Persistently High Logistics-to-GDP Cost Ratio

Vietnam's 16.8% logistics cost-to-GDP ratio in 2024 significantly exceeds the 10-11% levels seen in developed economies. Fragmented transport modes, limited backhaul matching, and cumbersome customs processes inflate delivered-goods pricing and limit road freight adoption among SMEs. Compliance with ISO 22000 and HACCP adds paperwork and cold-chain hardware expenses without matching infrastructure support, especially in rural districts. Exporters incur additional buffer inventories to hedge against uncertain lead times, inflating working capital requirements and weakening competitiveness on price-sensitive agricultural goods.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Near-Shoring FDI for Electronics Supply Chains

- Manufacturing Output Surge and Industrial-Park Build-Out

- Aging Truck Fleet Exceeding Five Years for 90% of Vehicles

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing represented 35.12% of 2025 shipments, underscoring how the Vietnam road freight transport market mirrors the nation's pivot into electronics and machinery assembly clusters. Vietnam road freight transport market size for manufacturing-driven consignments is forecast to scale consistently as plant utilization rises and component sourcing deepens domestically. Wholesale and retail trade, propelled by e-commerce, is set to expand faster at a 6.55% CAGR between 2026-2031, stimulating high-frequency replenishment demand that stretches carrier networks into suburban fulfillment nodes. The segment dynamics reward operators that offer SKU-level visibility and temperature-controlled capacity to meet fresh grocery deliveries. Construction cargoes remain stable, anchored by road and port developments, whereas oil and gas projects mandate specialized tubular and rig-component transport that only a handful of heavy-haul carriers can furnish. As traceability mandates tighten in seafood and fruit exports, agriculture shippers invest in IoT-enabled pallets and insulated curtainsider trailers to pass stringent EU and Japanese inspections.

The Vietnam road freight transport market benefits from public-private partnerships that bundle warehouse property with trucking services, giving manufacturers a one-stop logistics solution. High-value electronics consignments rely on real-time geofencing and panic-button technology, elevating security costs but reducing pilferage rates. Multiple freight exchanges arise to match backhaul loads from central provinces, helping reduce empty-run kilometers and slightly easing the sector's cost-to-GDP ratio. At the same time, manufacturers that previously leaned on sea freight for intra-ASEAN moves now deploy road to bridge port congestion or reach regional hubs faster, expanding addressable tonnage for domestic carriers.

Domestic traffic retained a 63.45% share in 2025 as north-south linear geography and two mega-cities anchor consumer demand clusters. Yet international consignments posting a 7.10% CAGR between 2026-2031 point to rising appetite for door-to-door road solutions that circumvent multiple port hand-offs. Customs digitalization at Hữu Nghị is designed to automate up to 50% of paperwork by 2030, cutting clearance time benchmarks and encouraging Vietnamese shippers to book cross-dock truck runs instead of multimodal routings. Vietnam road freight transport market size for cross-border loads is now tied to synchronized regulatory upgrades between Vietnamese and Chinese authorities who trial blockchain-based certificates of origin.

Domestically, the expressway roll-out compresses lead times, enabling retailers to consolidate inventory into fewer regional DCs while still honoring same-day delivery promises. For international moves, GEODIS stitched Vietnam into its Asia Road Network, offering bonded trucking to Singapore with hard transit commitments that challenge airfreight's price premium. SMEs exporting fruit or furniture to Bangkok and Phnom Penh increasingly book temperature-regulated or blanket-wrapped truck services as rates undercut comparable ocean box-rates on short-haul corridors.

Full-truck-load (FTL) commands 80.98% share in 2025 thanks to bulk commodity flows and manufacturing contract carriage. However, fragmented order sizes inherent in online retail lift the LTL growth trajectory to 6.82% CAGR between 2026-2031. Vietnam road freight transport market share for FTL remains high but tech-enabled LTL pooling gains trust among shippers seeking cost savings without sacrificing delivery windows. Route-optimization algorithms cluster pickups around Hanoi and Ho Chi Minh City belts before dispatching consolidated line-haul trailers south- and northbound overnight.

FTL operators enjoy predictable volumes from electronics and apparel exporters that secure annual truck quotas, enabling asset-specific pricing that protects margins. LTL specialists differentiate via automated sortation hubs and configurable delivery slots that satisfy consumer-side expectations. As carriers adopt digital freight matching, previously under-utilized truck deck space is monetized, gradually improving industry load factors and CO2 per-ton-kilometer metrics.

The Vietnam Road Freight Transport Market Report is Segmented by End User Industry (Manufacturing, and More), Destination (Domestic and International), Truckload Specification (FTL and LTL), Distance (Long Haul and Short Haul), Goods Configuration (Fluid Goods and Solid Goods), Temperature Control (Non-Temperature and Temperature Controlled), and by Containerization. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller-Maersk

- ASG Corporation

- Aviation Logistics Corporation

- Bee Logistics Corporation

- CMA CGM Group (Including CEVA Logistics)

- DHL Group

- Expeditors International of Washington, Inc.

- Gemadept

- GEODIS

- Hop Nhat International Joint Stock Company

- Indo Trans Logistics Corporation

- Kintetsu Group Holdings Co., Ltd.

- Linfox Pty Ltd.

- MACS Maritime Joint Stock Company

- MP Logistics

- Nguyen Ngoc Logistics Corporation

- Nippon Express Holdings

- NYK (Nippon Yusen Kaisha) Line

- PetroVietnam Transportation Corporation (PVTrans)

- Royal Cargo, Inc.

- Saigon Newport Corporation

- Transimex

- U&I Logistics Corporation

- VNT Logistics

- Viet Total Logistics Co., Ltd.

- Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- ViettelPost (including Viettel Logistics)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 GDP Distribution by Economic Activity

- 4.3 GDP Growth by Economic Activity

- 4.4 Economic Performance and Profile

- 4.4.1 Trends in E-Commerce Industry

- 4.4.2 Trends in Manufacturing Industry

- 4.5 Transport and Storage Sector GDP

- 4.6 Logistics Performance

- 4.7 Length of Roads

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Pricing Trends

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Road Freight Tonnage Trends

- 4.15 Road Freight Pricing Trends

- 4.16 Modal Share

- 4.17 Inflation

- 4.18 Regulatory Framework

- 4.19 Value Chain and Distribution Channel Analysis

- 4.20 Market Drivers

- 4.20.1 Rapid Expressway Expansion to 5,000 Km by 2030

- 4.20.2 Booming E-Commerce and Retail Logistics

- 4.20.3 Surge in Near-Shoring FDI for Electronics Supply Chains

- 4.20.4 Manufacturing Output Surge and industrial-Park Build-Out

- 4.20.5 IFC-Backed USD 2 Billion Fund for SME Logistics Digitalization

- 4.20.6 Adoption of Electric/Alt-Fuel Trucks in Municipal Contracts

- 4.21 Market Restraints

- 4.21.1 Persistently High Logistics-to-GDP Cost Ratio

- 4.21.2 Aging Truck Fleet >5 Yrs for 90 % of Vehicles

- 4.21.3 Border-Crossing Dwell-Time Bottlenecks with China and Laos

- 4.21.4 Volatile Fuel Prices and Refinery Disruptions Raise Haulage Rates

- 4.22 Technology Innovations in the Market

- 4.23 Porter's Five Forces Analysis

- 4.23.1 Threat of New Entrants

- 4.23.2 Bargaining Power of Buyers

- 4.23.3 Bargaining Power of Suppliers

- 4.23.4 Threat of Substitutes

- 4.23.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A.P. Moller-Maersk

- 6.4.2 ASG Corporation

- 6.4.3 Aviation Logistics Corporation

- 6.4.4 Bee Logistics Corporation

- 6.4.5 CMA CGM Group (Including CEVA Logistics)

- 6.4.6 DHL Group

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 Gemadept

- 6.4.9 GEODIS

- 6.4.10 Hop Nhat International Joint Stock Company

- 6.4.11 Indo Trans Logistics Corporation

- 6.4.12 Kintetsu Group Holdings Co., Ltd.

- 6.4.13 Linfox Pty Ltd.

- 6.4.14 MACS Maritime Joint Stock Company

- 6.4.15 MP Logistics

- 6.4.16 Nguyen Ngoc Logistics Corporation

- 6.4.17 Nippon Express Holdings

- 6.4.18 NYK (Nippon Yusen Kaisha) Line

- 6.4.19 PetroVietnam Transportation Corporation (PVTrans)

- 6.4.20 Royal Cargo, Inc.

- 6.4.21 Saigon Newport Corporation

- 6.4.22 Transimex

- 6.4.23 U&I Logistics Corporation

- 6.4.24 VNT Logistics

- 6.4.25 Viet Total Logistics Co., Ltd.

- 6.4.26 Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- 6.4.27 ViettelPost (including Viettel Logistics)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment