PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940854

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940854

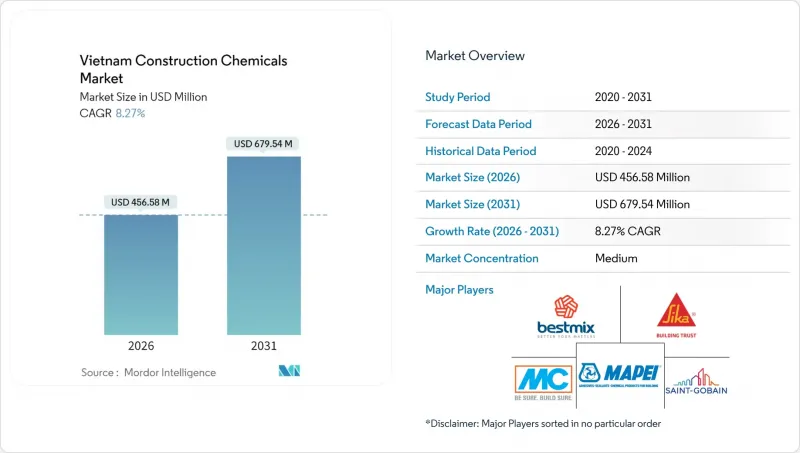

Vietnam Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam Construction Chemicals Market size in 2026 is estimated at USD 456.58 million, growing from 2025 value of USD 421.71 million with 2031 projections showing USD 679.54 million, growing at 8.27% CAGR over 2026-2031.

Robust infrastructure spending under the government's VND 791 trillion public investment plan, coupled with USD 23.15 billion of foreign direct investment (FDI) inflows in 2024, underpins sustained demand for high-performance chemical formulations. Developers are pursuing waterproofing and durability solutions to address Vietnam's monsoon climate, while low-carbon concrete admixtures are gaining traction as the country advances toward achieving net-zero status by 2050. Contractors are adopting digitalized dosing equipment that cuts material waste by up to 20%, widening the performance gap between premium and commodity offerings. Meanwhile, Circular 10/2024/TT-BXD tightens quality standards, elevating entry barriers for non-compliant suppliers.

Vietnam Construction Chemicals Market Trends and Insights

Infrastructure-led Public-Sector Spending Surge

Public investment officially approved at USD 67 billion for 2025 is redirecting cash toward airports, seaports, metros, and expressways. Large concrete volumes, rigid project-delivery schedules, and tighter quality control standards under TCVN and QCVN codes are incentivizing contractors to specify high-range water reducers, rapid-set repair mortars, and corrosion-inhibiting coatings. Suppliers with a track record of on-time logistics and job-site technical support already report double-digit order backlogs for 2026. The Vietnam construction chemicals market, therefore, links directly to state capital expenditure plans that favor global-standard materials.

Rapid Expansion of Foreign-Invested Industrial

Realized FDI hit USD 21.68 billion in 2024, and 221 additional industrial parks are scheduled before 2030. Singaporean, Chinese, and Korean manufacturers building electronics, batteries, and semiconductors require antistatic floors, chemical-resistant linings, and moisture-tolerant grouts that preserve GMP certifications. Each new VSIP phase consumes 15,000-20,000 tons of admixtures, sealers, and floor toppings. Product managers that align formulations with ISO 14644 clean-room norms are converting inquiries into multi-year supply contracts, reinforcing upside for the Vietnam construction chemicals market through 2030.

Volatile Cement and Petro-Chemical Feedstock Prices

PVC resin spiked 15-20% within three months when crude oil rose in 2024. Cement utilization dipped from 58% in 2022 to 55% in 2023. Clinker export taxes trimmed producer margins, forcing admixture formulators to renegotiate quarterly prices. Smaller brands in the Vietnam construction chemicals market with low inventory buffers absorb the greatest shocks, often delaying innovation spending until cost curves stabilize.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Low-Carbon Concrete Admixtures

- Digitalized Job-Site Dosing and QA Systems

- Fragmented Contractor Purchasing Practices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Waterproofing solutions held 45.02% of the Vietnam construction chemicals market share in 2025, with high-elasticity membranes specified for basements built three meters below sea level in Ho Chi Minh City. Surface-treatment chemicals, helped by automated sprayers and QA sensors, are set to outpace the broader Vietnam construction chemicals market at an 8.41% CAGR.

Contractors increasingly pair silane-siloxane repellents with nano-silica sealers to achieve double-digit reductions in water absorption. Concrete admixtures remain indispensable for expressway girders; super-plasticizers ensure slump retention under 35°C site temperatures common along the central coast. Repair formulations grow as aging bridges along National Route 1 require chloride-resistant mortars. Flooring resins, especially ESD-safe epoxies, move into electronics clusters north of Hanoi, signaling diversification beyond legacy cement-centric products.

The Vietnam Construction Chemicals Market Report is Segmented by Product (Adhesives, Anchors and Grouts, Concrete Admixtures, Concrete Protective Coatings, Flooring Resins, Repair and Rehabilitation Chemicals, Sealants, Surface-Treatment Chemicals, Waterproofing Solutions) and End-User Sector (Commercial, Industrial and Institutional, Infrastructure, Residential). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Adchem Construction Chemical (Berry Global Inc.)

- BESTMIX

- GPS Vietnam

- MAPEI S.p.A

- MC-Bauchemie

- Saint-Gobain

- Schomburg

- Sika AG

- Thermax Limited

- Arkema (Bostik)

- Henkel AG & Co. KGaA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Infrastructure-led public-sector spending surge

- 4.2.2 Rapid expansion of foreign-invested industrial parks

- 4.2.3 Adoption of low-carbon concrete admixtures

- 4.2.4 Digitalised job-site dosing and QA systems

- 4.2.5 Circular-economy demand for rice-husk-ash nano-silica

- 4.3 Market Restraints

- 4.3.1 Volatile cement and petro-chemical feedstock prices

- 4.3.2 Fragmented contractor purchasing practices

- 4.3.3 Slow harmonisation of national product standards

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power - Suppliers

- 4.6.4 Bargaining Power - Buyers

- 4.6.5 Threat of Substitutes

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Adhesives

- 5.1.1.1 Hot-Melt

- 5.1.1.2 Reactive

- 5.1.1.3 Solvent-borne

- 5.1.1.4 Water-borne

- 5.1.2 Anchors and Grouts

- 5.1.2.1 Cementitious Fixing

- 5.1.2.2 Resin Fixing

- 5.1.3 Concrete Admixtures

- 5.1.3.1 Accelerator

- 5.1.3.2 Air-Entraining

- 5.1.3.3 Super-plasticizer

- 5.1.3.4 Retarder

- 5.1.3.5 Shrinkage-Reducer

- 5.1.3.6 Viscosity-Modifier

- 5.1.3.7 Plasticizer

- 5.1.3.8 Other Types

- 5.1.4 Concrete Protective Coatings

- 5.1.4.1 Acrylic

- 5.1.4.2 Alkyd

- 5.1.4.3 Epoxy

- 5.1.4.4 Polyurethane

- 5.1.4.5 Other Resins

- 5.1.5 Flooring Resins

- 5.1.5.1 Acrylic

- 5.1.5.2 Epoxy

- 5.1.5.3 Polyaspartic

- 5.1.5.4 Polyurethane

- 5.1.5.5 Other Resins

- 5.1.6 Repair and Rehabilitation Chemicals

- 5.1.6.1 Fiber-Wrapping Systems

- 5.1.6.2 Injection Grouting

- 5.1.6.3 Micro-concrete Mortars

- 5.1.6.4 Modified Mortars

- 5.1.6.5 Rebar Protectors

- 5.1.7 Sealants

- 5.1.7.1 Acrylic

- 5.1.7.2 Epoxy

- 5.1.7.3 Polyurethane

- 5.1.7.4 Silicone

- 5.1.7.5 Other Resins

- 5.1.8 Surface-Treatment Chemicals

- 5.1.8.1 Curing Compounds

- 5.1.8.2 Mold-Release Agents

- 5.1.8.3 Other Types

- 5.1.9 Waterproofing Solutions

- 5.1.9.1 Chemicals

- 5.1.9.2 Membranes

- 5.1.1 Adhesives

- 5.2 By End-User Sector

- 5.2.1 Commercial

- 5.2.2 Industrial and Institutional

- 5.2.3 Infrastructure

- 5.2.4 Residential

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share**(%)/Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Adchem Construction Chemical (Berry Global Inc.)

- 6.4.2 BESTMIX

- 6.4.3 GPS Vietnam

- 6.4.4 MAPEI S.p.A

- 6.4.5 MC-Bauchemie

- 6.4.6 Saint-Gobain

- 6.4.7 Schomburg

- 6.4.8 Sika AG

- 6.4.9 Thermax Limited

- 6.4.10 Arkema (Bostik)

- 6.4.11 Henkel AG & Co. KGaA

7 Market Opportunities Future Outlook

- 7.1 White-space and Unmet-need Assessment

8 Key Strategic Questions for CEOs