PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940886

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940886

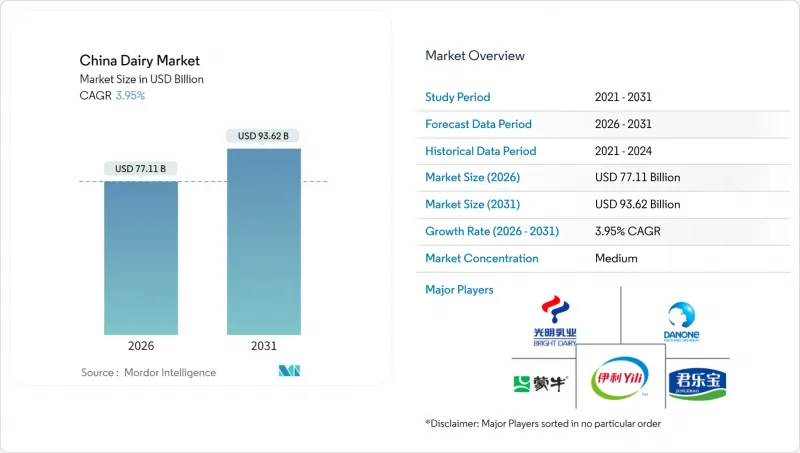

China Dairy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China dairy market size in 2026 is estimated at USD 77.11 billion, growing from 2025 value of USD 74.18 billion with 2031 projections showing USD 93.62 billion, growing at 3.95% CAGR over 2026-2031.

Urban income growth, increasing health awareness, and consumer preference for premium products are reshaping the China dairy market, shifting focus from volume expansion to value-driven innovation. The implementation of stricter national standards, including GB 19644-2024 for milk powder and GB 19302-2025 for fermented milk, along with an improved cold-chain ecosystem, has elevated product quality standards and consolidated market share among compliant manufacturers. The demand for protein-rich, probiotic, and organic products has increased, with tier-1 consumers accepting 15-25% price premiums while tier-3/4 households continue to drive volume growth. E-commerce penetration has expanded market reach into inland regions, contributing to market growth. While competition from plant-based alternatives and increasing compliance costs present challenges, they have not impacted the market's growth trajectory.

China Dairy Market Trends and Insights

Rising Demand for High-Protein, Fortified, and Functional Dairy Products

Protein fortification has emerged as a fundamental growth driver in China's dairy market, with high-protein products commanding substantial price premiums compared to conventional products. Consumer acceptance of premium pricing for functional benefits continues to increase, particularly among fitness-focused millennials and health-conscious seniors who prioritize nutritional value over cost considerations. The integration of whey protein isolate in yogurt formulations has enabled manufacturers to develop products with higher protein content per serving, effectively positioning them as complete meal replacements rather than conventional snacks. The diversification of probiotic strains beyond Lactobacillus now encompasses specialized cultures targeting digestive health, immune system support, and mental wellness benefits. Expedited regulatory approvals for new functional ingredients have accelerated the innovation pipeline, enabling manufacturers to introduce products with scientifically-supported health claims that resonate with consumers seeking evidence-based nutrition solutions.

Growth in Health Consciousness and Focus on Nutrition Among Chinese Consumers

The transformation of health consciousness in China demonstrates a fundamental shift in dietary preferences across generations. Urban consumers are increasingly engaged in reading and understanding nutrition labels, showing substantial growth in this behavior compared to previous years . The post-pandemic environment has permanently altered consumer purchasing patterns, with heightened interest in dairy products fortified with immune-supporting nutrients such as vitamin D, zinc, and omega-3 fatty acids. Healthcare professionals' educational initiatives have enhanced consumer understanding of critical nutritional factors like calcium absorption, protein quality scores, and glycemic impact, enabling more sophisticated product selection among middle-class families. The proliferation of digital health platforms and social media has amplified nutrition education reach, repositioning dairy products from optional items to essential dietary components. Furthermore, government nutrition guidelines emphasizing dairy consumption for bone health and child development have established a robust regulatory framework that supports continued market expansion.

Rising Competition from Plant-Based and Nut-Based "Milk" Products

Plant-based dairy alternatives have established a robust market presence by positioning themselves as environmentally sustainable and health-conscious options. The market for almond milk and oat milk variants continues to experience substantial growth across major metropolitan areas. The younger generation increasingly perceives plant-based alternatives not merely as dietary requirements but as an integral part of their lifestyle choices, which has expanded the consumer base beyond those with lactose intolerance to include mainstream consumers. Domestic plant-based brands have achieved competitive pricing compared to conventional dairy products while offering enhanced benefits such as extended shelf life and reduced cold storage requirements. Marketing messages highlighting reduced environmental impact and improved animal welfare practices have successfully connected with environmentally conscious consumers who prioritize sustainability over conventional taste preferences. The widespread availability through modern retail channels and e-commerce platforms has enhanced accessibility and normalized plant-based consumption patterns across diverse consumer segments.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Assortment of Lactose-Free and Plant-Based Dairy Alternatives

- Expansion of Premium Dairy Segments, Including Specialty Cheeses and Yogurts

- Stringent Regulatory Standards Leading to Frequent Product Recalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Milk accounted for a significant market share of 50.22% in 2025, driven by the availability of premium fresh milk and Ultra-High Temperature (UHT) products tailored to urban consumer preferences. The demand for organic milk has grown considerably, as health-conscious consumers increasingly opt for pesticide-free and hormone-free choices in their diets. Despite these products being priced 40-50% higher than conventional milk alternatives, their popularity continues to rise due to the perceived health benefits and growing awareness of sustainable farming practices.

The flavored milk segment has expanded its appeal beyond traditional breakfast consumption, with the introduction of chocolate, strawberry, and seasonal fruit varieties that cater to children and teenagers. Additionally, the market has observed increased usage of condensed milk, fueled by the growing popularity of home baking activities. Powdered milk, also known as dried milk, continues to play a critical role in infant nutrition due to its long shelf life and nutritional value. It also serves as a reliable option for emergency supply needs, ensuring availability during unforeseen circumstances.

The China Dairy Market is Segmented by Category (Butter, Cheese, Cream, Dairy Desserts, Milk, Sour Milk Drinks, and Yogurt) and by Distribution Channel (Off-Trade, On-Trade). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Tonnes).

List of Companies Covered in this Report:

- Yili Group

- Mengniu Dairy

- Bright Dairy & Food

- Junlebao Dairy Group

- Danone SA

- Nestle SA

- Feihe Limited

- New Hope Group

- Fonterra Co-operative Group Limited

- MiaoKe Lando

- Want Want Holdings Limited

- Panda Dairy Group Co. Ltd

- VV Group Co. Ltd

- Blue Diamond Growers

- Modern Dairy Holdings Ltd

- Shengmu Dairy

- Beijing Sanyuan Foods

- Yantang Dairy Co. Ltd

- Xinjiang Tianrun Dairy

- Adopt-a-Cow Dairy Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for high-protein, fortified, and functional dairy products

- 4.2.2 Growth in health consciousness and focus on nutrition among Chinese consumers

- 4.2.3 Expanding assortment of lactose-free and plant-based dairy alternatives

- 4.2.4 Expansion of premium dairy segments, including specialty cheeses and yogurts

- 4.2.5 Strong research and development investments in product shelf-life, taste, and packaging improvement

- 4.2.6 Enhanced marketing: celebrity influence, social media campaigns, and nutrition education

- 4.3 Market Restraints

- 4.3.1 Rising competition from plant-based and nut-based "milk" products

- 4.3.2 Stringent regulatory standards leading to frequent product recalls

- 4.3.3 Health concerns over added sugar, fats, and additives in flavored dairy

- 4.3.4 Traceability challenges in multi-tiered distribution networks

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Butter

- 5.1.1.1 Salted Butter

- 5.1.1.2 Unsalted Butter

- 5.1.2 Cheese

- 5.1.2.1 Natural Cheese

- 5.1.2.1.1 Cheddar

- 5.1.2.1.2 Cottage

- 5.1.2.1.3 Ricotta

- 5.1.2.1.4 Parmesan

- 5.1.2.1.5 Others

- 5.1.2.2 Processed Cheese

- 5.1.2.1 Natural Cheese

- 5.1.3 Cream

- 5.1.3.1 Fresh Cream

- 5.1.3.2 Cooking Cream

- 5.1.3.3 Whippng Cream

- 5.1.3.4 Others

- 5.1.4 Dairy Desserts

- 5.1.4.1 Ice Cream

- 5.1.4.2 Cheesecakes

- 5.1.4.3 Frozen Desserts

- 5.1.4.4 Others

- 5.1.5 Milk

- 5.1.5.1 Condensed milk

- 5.1.5.2 Flavored Milk

- 5.1.5.3 Fresh Milk

- 5.1.5.4 UHT Milk

- 5.1.5.5 Powdered Milk

- 5.1.6 Yogurt

- 5.1.6.1 Drinkable

- 5.1.6.2 Spoonable

- 5.1.7 Sour Milk Drinks

- 5.1.1 Butter

- 5.2 By Distribution Channel

- 5.2.1 On-trade

- 5.2.2 Off-trade

- 5.2.2.1 Convenience Stores

- 5.2.2.2 Specialist Retailers

- 5.2.2.3 Supermarkets and Hypermarkets

- 5.2.2.4 Online Retail

- 5.2.2.5 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Yili Group

- 6.4.2 Mengniu Dairy

- 6.4.3 Bright Dairy & Food

- 6.4.4 Junlebao Dairy Group

- 6.4.5 Danone SA

- 6.4.6 Nestle SA

- 6.4.7 Feihe Limited

- 6.4.8 New Hope Group

- 6.4.9 Fonterra Co-operative Group Limited

- 6.4.10 MiaoKe Lando

- 6.4.11 Want Want Holdings Limited

- 6.4.12 Panda Dairy Group Co. Ltd

- 6.4.13 VV Group Co. Ltd

- 6.4.14 Blue Diamond Growers

- 6.4.15 Modern Dairy Holdings Ltd

- 6.4.16 Shengmu Dairy

- 6.4.17 Beijing Sanyuan Foods

- 6.4.18 Yantang Dairy Co. Ltd

- 6.4.19 Xinjiang Tianrun Dairy

- 6.4.20 Adopt-a-Cow Dairy Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK