Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687137

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687137

Vietnam Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 430 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

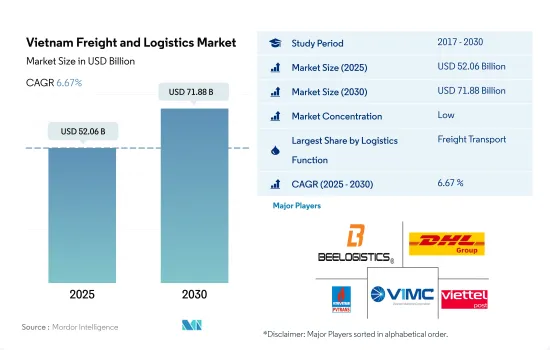

The Vietnam Freight and Logistics Market size is estimated at 52.06 billion USD in 2025, and is expected to reach 71.88 billion USD by 2030, growing at a CAGR of 6.67% during the forecast period (2025-2030).

Rising GDP contribution, along with trade flows, leading freight and logistics market demand

- In December 2023, Vietnam announced a USD 70 billion investment to establish a comprehensive high-speed railway network across the country. This move is crucial as Vietnam's current railway infrastructure lags behind its Southeast Asian counterparts. The proposed national network will feature a double-track system capable of speeds up to 350 kilometers per hour. It will adhere to a standard gauge of 1,435 millimeters and support an axle load of 22.5 metric tons.

- Vietnam is channeling substantial funds into airport renovations and constructions, with the aim of establishing itself as a leading regional hub for international travelers in Southeast Asia. As per the 2023 plan by the Ministry of Transport (MoT), Vietnam is on track to have 30 airports by 2030, and that number is projected to rise to 33 by 2050. Hanoi and Ho Chi Minh City are poised to become the country's major aviation hubs. The government is expected to allocate over USD 4 billion to expand Hanoi's Noi Bai International Airport, enabling it to handle 60 million passengers by 2030, a 2.5-fold increase from its current capacity.

Vietnam Freight and Logistics Market Trends

The government aims to increase the total length of expressways to 3,000 km by end of 2025

- In 2023, the Government prioritized investment in modern transport infrastructure, including roads, railways, marine and inland waterways, and airports. In 2023, construction began on 12 North-South expressway projects, with nine new traffic projects inaugurated and four completed. Around 475 km of expressways were added that year. Other key transport projects initiated in 2023 included three east-west expressways, the Long Thanh International Airport, Phu Bai Airport, Dien Bien Airport, Mỹ Thuận 2 Bridge, and Vĩnh Tuy 2 Bridge. As major transport infrastructure is completed in 2023, the GDP growth of the transport sector is estimated to increase in 2024 and 2025.

- Vietnam's Ministry of Transport plans to break ground on 14 infrastructure projects and complete 50 more by 2025, including key parts of the North-South Expressway. This is part of the goal to expand the country's expressways to 3,000 km by 2025, up from the current 2,021 km. Additionally, the Long Thanh International Airport, a USD 14.12 billion project in Dong Nai province, is on track to finish in 2025. Once completed, it will be the country's largest airport, easing congestion at Tan Son Nhat in Ho Chi Minh City.

Vietnam aims to expand its national fuel storage capacity by 2030, with an investment of up to USD 11.4 billion

- In December 2023, Vietnam reduced retail prices of gasoline and other oil products for the fourth consecutive time. The price of E5 RON 92 per liter was decreased by VND 509 (USD 0.021) to VND 21,290 (USD 0.9), and RON95-III petrol price was lowered to VND 22,322 (USD 0.944) per liter. The ministries of finance, industry, and trade responsible for these adjustments opted not to utilize the petrol and oil price stabilization fund. Since the start of the year, Vietnam has adjusted petrol prices 35 times.

- In 2022, the retail price of RON 95 gasoline in Vietnam reached its highest point in eight years, reaching VND 26,287 (USD 1.14) per liter. The increase in fuel prices in Vietnam was exacerbated by domestic gasoline shortages caused by the Nghi Son Oil Refinery, the country's largest refinery, reducing production by 20% from January 2022 due to financial challenges. Although the refinery has obtained temporary investment, it might be forced to cease operations if it fails to secure sufficient liquidity or loans to procure Kuwaiti crude oil. Moreover, Vietnam has approved a plan to expand its national fuel storage capacity by 2030, with an investment of up to USD 11.4 billion. The investment would raise the country's crude oil and refined fuel storage capacity to 75 to 80 days of net imports, from 65 days currently.

Vietnam Freight and Logistics Industry Overview

The Vietnam Freight and Logistics Market is fragmented, with the major five players in this market being Bee Logistics Corporation, DHL Group, PetroVietnam Transportation Corporation (PVTrans), Vietnam Maritime Corporation (Vinalines) and ViettelPost (including Viettel Logistics) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 55540

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Vietnam

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Vietnam

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Aviation Logistics Corporation

- 6.4.3 Bee Logistics Corporation

- 6.4.4 Deutsche Bahn AG (including DB Schenker)

- 6.4.5 DHL Group

- 6.4.6 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.7 Expeditors International of Washington, Inc.

- 6.4.8 FedEx

- 6.4.9 Gemadept

- 6.4.10 Giao Hang Nhanh

- 6.4.11 Hai Minh Corporation

- 6.4.12 Hop Nhat International Joint Stock Company

- 6.4.13 Indo Trans Logistics Corporation

- 6.4.14 Kuehne+Nagel

- 6.4.15 MACS Maritime Joint Stock Company

- 6.4.16 Noi Bai Express and Trading Joint Stock Company

- 6.4.17 NYK (Nippon Yusen Kaisha) Line

- 6.4.18 PetroVietnam Transportation Corporation (PVTrans)

- 6.4.19 Phuong Trang Bus Joint Stock Company - FUTA Bus Lines

- 6.4.20 Saigon Cargo Service Corporation (SCSC)

- 6.4.21 Samsung SDS

- 6.4.22 Sojitz Corporation

- 6.4.23 Transimex

- 6.4.24 U&I Logistics Corporation

- 6.4.25 United Parcel Service of America, Inc. (UPS)

- 6.4.26 Vietfracht HoChiMinh

- 6.4.27 Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- 6.4.28 Vietnam Maritime Corporation (Vinalines)

- 6.4.29 ViettelPost (including Viettel Logistics)

- 6.4.30 Voltrans Logistics

- 6.4.31 ZIM Integrated Shipping Services Ltd.

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.