Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687265

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687265

Thailand Freight and Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 335 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

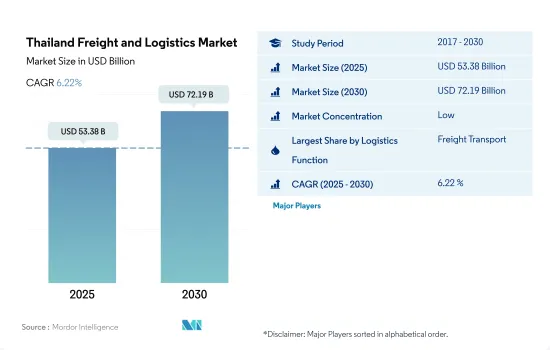

The Thailand Freight and Logistics Market size is estimated at 53.38 billion USD in 2025, and is expected to reach 72.19 billion USD by 2030, growing at a CAGR of 6.22% during the forecast period (2025-2030).

Rising GDP contribution of the transport sector increases investment opportunities in the freight market

- In 2023, the Thai government initiated the Eastern Aviation City project worth THB 290 billion (USD 8.8 billion). This involves the transformation of U-Tapao Airport, a facility dating back to the Vietnam War in Rayong, into a global aviation hub. The upgraded airport will be linked to Don Muang Airport and Suvarnabhumi Airport. Spanning 1,040 hectares, the project encompasses the construction of a new terminal and the establishment of a cargo-free trade zone.

- Thailand aims to convert about 30% of its annual production of 2.5 million vehicles into EVs by 2030 and is preparing incentives to encourage more investment and conversion into EV manufacturing. Thailand plans to provide incentives and tax breaks for manufacturers setting up electric vehicle R&D centers as it seeks to build on early success as a regional EV frontrunner. Various Chinese automobile manufacturers have committed to invest USD 1.44 billion in new production facilities in Thailand, with BYD investing nearly USD 500 million to produce 150,000 EVs a year.

Thailand Freight and Logistics Market Trends

Thailand's transport and storage sector experienced growth in 2022 driven by international trade and e-commerce

- Despite a decline in economic growth in 2023, the government boosted FDI and tourism to act as economic stimulus and contribute towards Thailand becoming a manufacturing hub especially for electric trucks. Furthermore, the recently finalized "EV 3.5 package" in 2023 offers a reduced purchase subsidy of USD 2,889.23 per vehicle, further supporting GDP contribution from the sector.

- In February 2024, the Transport Ministry announced plans to invest USD 18.83 billion in around 150 transport projects by the end of 2025 to enhance the country's infrastructure. In 2024, 64 projects will commence, with an additional 31 projects valued at USD 11.23 billion in the pipeline. For 2025, there are 57 new projects planned, totaling USD 7.59 billion. These initiatives include 18 motorway projects, 9 railway projects, and plans for regional port development, all aimed at bolstering the transport and storage sector's contribution to GDP in the future.

USD 2.35 billion was approved by Thailand's cabinet for the 2023 state fund to subsidize fuel costs

- The Thai government decided to waive the diesel excise tax from February 2022 to relieve the impact of the global oil price surge, but this led the government to lose USD 4.56 billion in revenue. The tax exemption and the diesel price subsidy under the fund played a key role in keeping the domestic diesel price at around USD 1.01 a liter since Feb 2022 till March 2024. The diesel price has gradually fallen since February 2023 to USD 0.92 a liter in response to declining global oil prices. Thailand's cabinet approved another USD 2.35 billion of new borrowing in 2023 for a state fund to subsidize fuel costs as the government battles high inflation.

- Despite an anticipated sluggish economic growth, demand for refined oil in Thailand, particularly jet fuel, is predicted to rise in 2024. Jet fuel consumption is forecasted to grow by 24.2% to an average of 16.8 million litres per day (MLD), up from 13.5 MLD in 2023. Diesel, gasoline, and gasohol are currently part of a state price subsidy program. Additionally, LNG prices are expected to decrease in 2024, leading power plant operators to rely less on fuel oil.

Thailand Freight and Logistics Industry Overview

The Thailand Freight and Logistics Market is fragmented, with the major five players in this market being Deutsche Bahn AG (including DB Schenker), DHL Group, FedEx, JWD Group and United Parcel Service of America, Inc. (UPS) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 58019

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Demographics

- 4.2 GDP Distribution By Economic Activity

- 4.3 GDP Growth By Economic Activity

- 4.4 Inflation

- 4.5 Economic Performance And Profile

- 4.5.1 Trends in E-Commerce Industry

- 4.5.2 Trends in Manufacturing Industry

- 4.6 Transport And Storage Sector GDP

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Price

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Logistics Performance

- 4.13 Major Truck Suppliers

- 4.14 Modal Share

- 4.15 Maritime Fleet Load Carrying Capacity

- 4.16 Liner Shipping Connectivity

- 4.17 Port Calls And Performance

- 4.18 Freight Pricing Trends

- 4.19 Freight Tonnage Trends

- 4.20 Infrastructure

- 4.21 Regulatory Framework (Road and Rail)

- 4.21.1 Thailand

- 4.22 Regulatory Framework (Sea and Air)

- 4.22.1 Thailand

- 4.23 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes 1. Market value in USD for all segments 2. Market volume for select segments viz. freight transport, CEP (courier, express, and parcel) and warehousing & storage 3. Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode Of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode Of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Deutsche Bahn AG (including DB Schenker)

- 6.4.2 DHL Group

- 6.4.3 DSV A/S (De Sammensluttede Vognmaend af Air and Sea)

- 6.4.4 FedEx

- 6.4.5 JWD Group

- 6.4.6 Kuehne+Nagel

- 6.4.7 ProFreight Group

- 6.4.8 Sub Sri Thai Public Company Ltd.

- 6.4.9 Toyota Tsusho Corporation (including Toyota Tsusho Thai Holdings Co., Ltd.)

- 6.4.10 Triple I Logistics Public Company Ltd.

- 6.4.11 United Parcel Service of America, Inc. (UPS)

- 6.4.12 WICE Logistics Public Company Ltd.

7 KEY STRATEGIC QUESTIONS FOR FREIGHT AND LOGISTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.1.5 Technological Advancements

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.