PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801863

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1801863

Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

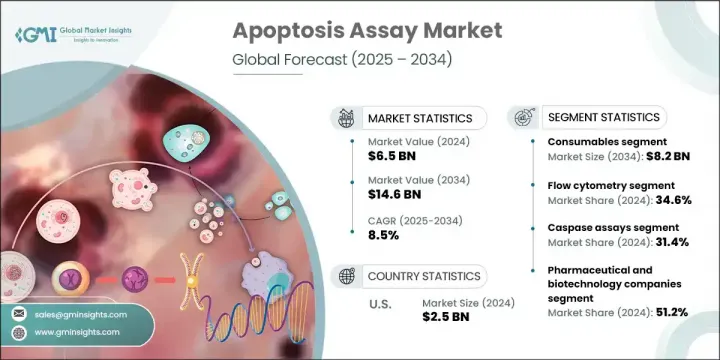

The Global Apoptosis Assay Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 8.5% to reach USD 14.6 billion by 2034. The steady expansion of this market is being driven by the rising prevalence of chronic conditions and the growing demand for personalized therapeutic solutions. Innovations in cell analysis tools, including advanced imaging-based assays and high-throughput flow cytometry, are significantly enhancing the accuracy and efficiency of research processes. Additionally, increased funding for life sciences and broader use of apoptosis assays in drug development are fueling global adoption across both developed and developing regions. Apoptosis assays are essential for identifying and measuring programmed cell death and play a key role in advancing disease research and pharmaceutical innovations. As healthcare systems prioritize targeted treatment and early diagnostics, the relevance of apoptosis assays continues to grow across multiple medical fields.

The increasing focus on personalized medicine is acting as a powerful growth engine for the apoptosis assay market. Tailoring medical treatments to an individual's genetic makeup and specific disease characteristics demands advanced tools capable of precise cellular-level analysis. Apoptosis assays enable researchers to evaluate how cells respond to therapies, particularly in fields like neurodegenerative disease, cancer, and autoimmune disorders. This type of cellular response tracking is essential for determining the effectiveness of treatments, optimizing dosing strategies, and minimizing adverse effects. By allowing clinicians to monitor therapy-induced apoptosis, these assays help refine treatment protocols for better outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $14.6 Billion |

| CAGR | 8.5% |

In 2024, the flow cytometry segment held a 34.6% share. Flow cytometry is favored for its speed, accuracy, and capacity to perform multi-parameter analysis at the single-cell level. It offers high-throughput functionality and excels in identifying various apoptotic indicators simultaneously. Its integration into modern laboratories is supported by cutting-edge features such as laser-based detection, automated gating mechanisms, and live data monitoring, making it ideal for large-scale clinical and research settings.

The caspase assays segment held a 31.4% share in 2024. These assays are instrumental in tracking programmed cell death by measuring the activity of caspase enzymes, which play a central role in apoptosis. They are extensively used in areas like immunology, oncology, and drug screening to assess how therapeutic agents affect cell viability. Designed for use in high-volume screening environments, caspase assays feature compatibility with automated systems and support luminescent and fluorescent detection for flexible, sensitive performance.

United States Apoptosis Assay Market USD 2.5 billion in 2024. This growth reflects the country's strong investment in R&D, favorable regulatory framework, and high level of awareness around advanced diagnostic tools. The U.S. market benefits from increasing demand for scalable, automated solutions in biomedical research, especially in fields like immunotherapy and oncology. Ongoing public health efforts and private innovation continue to strengthen the market's momentum, ensuring long-term adoption of apoptosis assay technologies.

Key companies in the Global Apoptosis Assay Market include Thermo Fisher Scientific, Promega, PerkinElmer, Becton, Dickinson and Company, GeneCopoeia, Takara Bio, Agilent Technologies, Danaher, Sartorius, Abcam, G Biosciences, Merck, Biotium, Bio-Rad Laboratories, and Bio-Techne. These firms are actively shaping the global market landscape. To reinforce their market position, leading players in the apoptosis assay industry are emphasizing innovation in assay sensitivity, speed, and multi-parameter capabilities. Companies are enhancing product portfolios with automation-ready platforms and integrating AI-driven analytics for more precise results. Strategic collaborations with pharmaceutical firms and academic institutions support new applications in personalized medicine and drug discovery. In parallel, firms are expanding their geographic reach through regional partnerships, localized manufacturing, and tailored product offerings for emerging markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Assay type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Bio-Rad Laboratories

- 10.5 Bio-Techne

- 10.6 Biotium

- 10.7 Danaher

- 10.8 G Biosciences

- 10.9 GeneCopoeia

- 10.10 Merck

- 10.11 PerkinElmer

- 10.12 Promega

- 10.13 Sartorius

- 10.14 Takara Bio

- 10.15 Thermo Fisher Scientific