PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822598

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822598

China Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

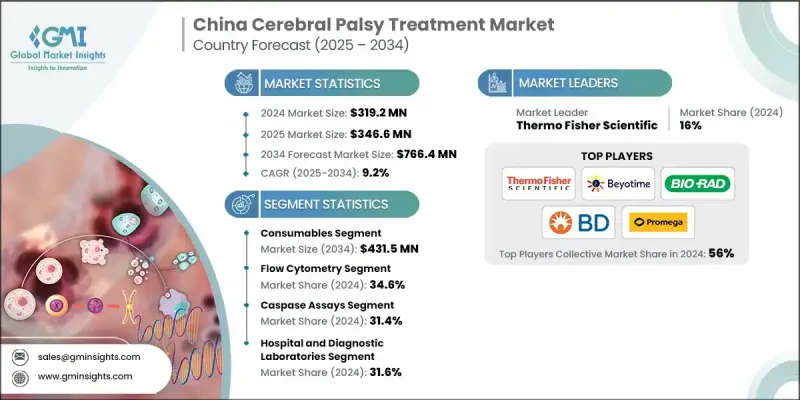

China apoptosis assay market was valued at USD 319.2 million in 2024 and is projected to grow from USD 346.6 million in 2025 to USD 766.4 million by 2034, expanding at a CAGR of 9.2%, according to the latest report published by Global Market Insights, Inc.

Market growth is fueled by the accelerating growth of China's biomedical research industry, augmented interest in cancer diagnostics and drug development, and expanding investment in molecular biology tools. Since apoptosis assays play a prime role in interpreting mechanisms of cell death and in assessing therapeutic responses, their application is widening among hospitals, diagnostic laboratories, and academia.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $319.2 Million |

| Forecast Value | $766.4 Million |

| CAGR | 9.2% |

Key Drivers:

1. Burden of cancer and chronic diseases: The Growing prevalence of cancers and autoimmune diseases is generating demand for precise cell death assays to assist in research and clinical decision-making.

2. Public investment in R&D infrastructure: Initiatives such as "Healthy China 2030" are enhancing public-private research partnerships, driving demand for cellular and molecular biology tools.

3. Expansion of local biotech companies: Firms such as Beyotime Biotechnology and NeoBioscience are expanding regional assay manufacture and tailoring for the Chinese research environment.

4. Increased use of advanced technologies like flow cytometry: More advanced high-throughput, multiparameter analysis platforms are used in research institutions and hospitals, factoring in scale and standardization of assays.

Key Players:

Market leaders in the China apoptosis assay market are Thermo Fisher Scientific, Beyotime Biotechnology, Bio-Rad Laboratories, Becton, Dickinson and Company (BD), and Promega. These five players combined held a market share of 56% in 2024.

Key Challenges:

- Variability in assay performance and interpretation: The assay outputs can vary depending on the quality of the reagent and handling; hence need for standardization and staff training.

- Cost of an imported assay kit and equipment: Even while demand is increasing, the cost is still a limiting factor for certain labs and hospitals in smaller provinces.

- Demand for experienced personnel: The sophistication of apoptotic assay technologies, such as flow cytometry and ELISA, creates a demand for experienced laboratory technicians and analysts.

1. By Product Type - Consumables Rule the Market

Consumables like assay kits, reagents, buffers, and dyes represented the largest market share in 2024. Recurring use of these products in academic or clinical settings ensures demand for caspase and DNA fragmentation assays.

2. By Technology - Flow Cytometry Dominates

Flow cytometry was the most common technology in 2024 because it is fast, sensitive, and able to perform multiparametric analysis. The technique is also most favored in hospital research departments and high-volume laboratories for quantitative apoptosis measurement.

3. By Assay Type - Special Mention for Caspase Assays

Caspase assays were the most frequently offered assay in 2024 because of their high specificity for determining early apoptosis. Caspase assays are often used in cancer biology research, drug screening, and toxicology.

4. By End Use - Hospitals and Diagnostic Labs Continue to Dominate

The diagnostic labs and hospitals represented the highest revenue by end user in 2024. Clinical applications of apoptosis in disease pathology and response to treatment are fueling the use of these assays in immunology and oncology departments.

Major players in the China apoptosis assay market are Agilent Technologies, BD Becton, Dickinson and Company, Beyotime Biotechnology, Bio-Rad Laboratories, Bio-Techne, Creative Diagnostics, Danaher, NeoBioscience Technology Co., Ltd, PerkinElmer, Promega, Sartorius, Takara Bio, Thermo Fisher Scientific, and Wuhan Servicebio Technology Co., Ltd.

Players are undertaking R&D partnerships, local production development, and strategic acquisitions to excel in China. Beyotime Biotechnology is broadening its reagent lines for caspase and TUNEL assays and expanding its footprint in tier 2 and 3 cities. Thermo Fisher and BD Biosciences are locally enhancing the product offerings as well as distribution capabilities. Local players like NeoBioscience and Wuhan Servicebio are also working on low-cost, customized assay kits designed for Chinese research labs. Moreover, numerous companies are selling bundled diagnostic packages with flow cytometers to enhance their market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Technology trends

- 2.2.3 Assay type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Company Profiles

- 9.1 Agilent Technologies

- 9.2 BD Becton, Dickinson and Company

- 9.3 Beyotime Biotechnology

- 9.4 Bio-Rad Laboratories

- 9.5 Bio-Techne

- 9.6 Creative Diagnostics

- 9.7 Danaher

- 9.8 NeoBioscience Technology Co., Ltd

- 9.9 PerkinElmer

- 9.10 Promega

- 9.11 Sartorius

- 9.12 Takara Bio

- 9.13 Thermo Fisher Scientific

- 9.14 Wuhan Servicebio Technology Co., Ltd