PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822587

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822587

U.S. Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

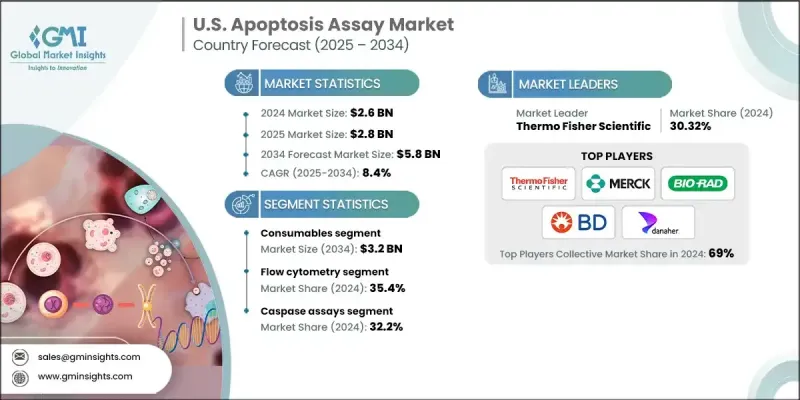

U.S. apoptosis assay market was valued at USD 2.6 billion in 2024 and is projected to grow from USD 2.8 billion in 2025 to USD 5.8 billion by 2034, at a CAGR of 8.4%, according to the latest report published by Global Market Insights, Inc.

The driving force of this trend is the increase in research and development innovation in immunology & cancer, demand for high-throughput screening technologies, and expanding pipelines from pharmaceutical and biotech companies. Apoptosis assays are indispensable in drug discovery and in cell-based research to correctly assess the effects of an intervention on programmed cell death.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 8.4% |

The United States has an unparalleled share of the worldwide apoptosis assay market, given the established life sciences infrastructure (laboratory space and equipment), world-class biotech and pharma industries, and both public and private research funding in the life sciences sector. Moreover, as cancer personalized medicine and immunotherapy increase in importance, there remains a significant requirement for reliable probes in assessing cell viability and apoptosis assays.

Key Drivers:

1. Increasing R&D of oncology agents: Apoptosis assays will be critical for anti-cancer agents and will be included in the preclinical and clinical phases.

2. Increasing demand for high-throughput technologies: Multiplexed analyses and automation will favor the adoption of these technologies in screening platforms.

3. Growth of biotechnology and CRO industries: Anticipation of more biotech start-ups and contracting with contract research organizations (CROs) will lead to more assay usage.

4. Advancements in assay sensitivity and specificity technologies: Newer fluorometric and luminescent detection advances will continue to improve assay reproducibility.

Key Players:

- Some of the major players in the U.S. apoptosis assay market are Thermo Fisher Scientific, BD Becton Dickinson and Company, Agilent Technologies, Bio-Rad Laboratories, Promega, Merck, Sartorius, Takara Bio, Biotium, Abcam, GeneCopoeia, Danaher, PerkinElmer, and G Biosciences.

- Leading firms like Thermo Fisher Scientific, Danaher, Merck, Bio-Rad Laboratories, and BD (Becton, Dickinson and Company) combined represent 69% of the U.S. market.

Key Challenges:

- Assay protocol complexity and interpretation: Multiparametric assays require careful handling and analysis tools.

- High cost of equipment: There is a large capital requirement for technologies such as flow cytometry and live-cell imaging platforms.

- Variability in assays and standardization: Some variability in the laboratory can come from using different cell lines, assay conditions, or quality of reagents that have affected reproducibility.

By Product - Consumables were the largest segment

In the U.S. market in 2024, consumables, which include kits, reagents, and probes, accounted were the largest segment. They are always in demand because of their single usage and periodic requirement in academic, clinical, and industrial research settings.

By Technology - Flow Cytometry Leads

Flow cytometry was the leading technology segment in 2024. Its quantitative, multiparameter real-time cell analysis capability makes it the standard for apoptosis detection in basic and translational research.

By Assay Type - Caspase Assays in Focus

Caspase assays accounted for the greatest proportion by assay type. Given their roles as prime enzymes of the apoptosis cascade, detection of caspases is most fundamental to mechanisms of action in cancer drugs and toxicity.

Pharmaceutical and biotechnology firms were the major end users in 2024, utilizing apoptosis assays for backing drug screening, preclinical validation, and therapeutic profiling. Their continuous investment in R&D ensures they are the major growth drivers for this segment.

Major players in the U.S. apoptosis assay market are Thermo Fisher Scientific, BD Becton, Dickinson and Company, Agilent Technologies, Bio-Rad Laboratories, Promega, Merck, Sartorius, Takara Bio, Biotium, Abcam, GeneCopoeia, Danaher, PerkinElmer, and G Biosciences.

To strengthen their market position, key players are investing in the development of assay portfolios, collaborative research, and automation integration. Thermo Fisher Scientific introduced advanced caspase detection kits with enhanced fluorescence intensity recently. Promega and Agilent Technologies have both broadened their apoptosis platforms with the addition of real-time, live-cell imaging capabilities. Bio-Rad and BD are also focusing on the U.S. academic and pharma market with easy-to-use flow cytometry kits. The increased collaborations of assay developers and biopharma companies are paving pathways to biomarker discovery and precision diagnostics for oncology.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Technology trends

- 2.2.3 Assay type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Company Profiles

- 9.1 Abcam

- 9.2 Agilent Technologies

- 9.3 BD Becton, Dickinson and Company

- 9.4 Bio-Rad Laboratories

- 9.5 Biotium

- 9.6 Danaher

- 9.7 G Biosciences

- 9.8 GeneCopoeia

- 9.9 Merck

- 9.10 PerkinElmer

- 9.11 Promega

- 9.12 Sartorius

- 9.13 Takara Bio

- 9.14 Thermo Fisher Scientific