PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842619

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1842619

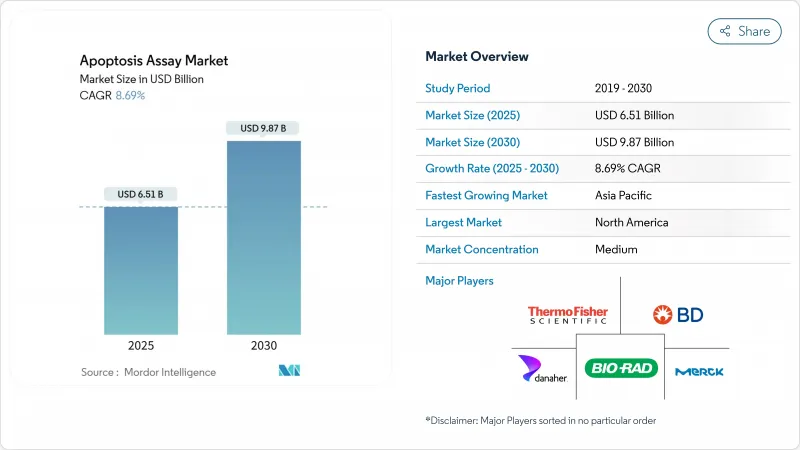

Apoptosis Assay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Apoptosis Assay Market size is estimated at USD 6.51 billion in 2025, and is expected to reach USD 9.87 billion by 2030, at a CAGR of 8.69% during the forecast period (2025-2030).

This wide growth arc underlines the central role of quantitative cell-death analytics in precision oncology, immunology and regenerative medicine. Uptake accelerates as 3D organoid models gain traction, artificial-intelligence platforms raise screening throughput and regulators harmonize laboratory-developed-test requirements. Demand also benefits from rising chronic-disease prevalence and sustained federal funding for cell-based R&D. Leading suppliers respond with integrated workflow solutions that combine high-content imaging, single-cell multi-omics and cloud analytics, creating higher switching costs and reinforcing the intellectual-property moat around next-generation detection methods.

Global Apoptosis Assay Market Trends and Insights

Rising Incidence of Chronic & Autoimmune Diseases

Chronic-disease prevalence reshapes demand curves for apoptosis quantification. National Cancer Institute grants such as the USD 4.9 million RNA Modifications Driving Oncogenesis initiative prioritize apoptosis pathway mapping to decode translational reprogramming in tumors. Autoimmune disorders add further momentum because dysregulated cell death sustains inflammatory cascades. Research into apoptotic extracellular vesicles shows potential for immune modulation across cancer, ischemic injury and inflammatory diseases. With aging populations, laboratories now deploy multiplex panels that read caspase activity, mitochondrial depolarization and phosphatidylserine exposure in parallel, aligning assay workflows with the multifactorial biology of chronic illness.

Advancements in Apoptosis-Modulating Therapeutics

Clinical pipelines that target BCL-2, IAP and MDM2-p53 regulators require precise, pathway-specific analytics. Ascentage Pharma runs active trials across all three classes, illustrating the commercial stake in accurate apoptosis measurement. Beyond oncology, navitoclax demonstrates host-directed action in tuberculosis by accelerating infected-cell clearance when paired with antibiotics. Drug developers therefore seek assays that capture early-stage mitochondrial events, caspase cascades and late DNA fragmentation within a single workflow, driving purchases of high-content imaging platforms and machine-learning analytics.

Stringent Multi-Jurisdictional Regulatory Requirements

The FDA's final rule for laboratory-developed tests applies a five-stage phased-enforcement plan, adding compliance costs between USD 566 million and USD 3.56 billion each year. European ATMP guidelines impose parallel GMP obligations for cell-therapy analytics. Vendors must therefore design validation packages that meet divergent documentary standards, slowing product launches and nudging smaller developers toward licensing rather than direct commercialization.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Funding for Cell-Based R&D & Precision Medicine

- Mainstream Adoption of High-Throughput Screening Platforms

- High Capital & Operating Cost of Advanced Detection Instruments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Assay kits generated 53.09% of apoptosis assay market revenue in 2024, underscoring the appeal of turnkey protocols that bundle buffers, conjugates and controls. Reagents and consumables, though smaller, are on track for a 9.84% CAGR because high-throughput platforms consume large reagent volumes and allow laboratories to tailor protocols. Instruments post moderate growth as capital cycles align with AI upgrades and optical-resolution gains.

Spending shifts toward individual dyes, fluorogenic substrates and customized buffer sets indicate process maturity. Annexin V-FITC and APC conjugates remain mainstays, while second-generation caspase-3/7 substrates gain drug-screening traction.

Flow cytometry captured 39.67% apoptosis assay market share in 2024 through its single-cell clarity and multi-parameter capability. Spectrophotometry, valued for plate-level speed, is advancing at a 10.23% CAGR. High-content imaging and 3D holotomography occupy the premium end, serving organoid research and AI analytics.

Flow cytometers apply dual-stain Annexin V/propidium-iodide protocols to resolve early versus late apoptosis. Spectrophotometric caspase assays can screen 384-well plates within 90 minutes. Advanced imaging systems are incorporating artificial intelligence algorithms to automate apoptosis quantification in 3D organoid models, addressing the complexity of analyzing cell death in physiologically relevant systems. The integration of holotomography with organoid culture systems enables real-time observation of apoptotic processes without fluorescent staining, representing a significant technological advancement.

The Apoptosis Assay Market Report is Segmented by Product (Assay Kits, Reagents and Consumables, and Instruments), Detection Technology (Flow Cytometry, Spectrophotometry and More), Application (Drug Discovery and Development, and More), End User (Pharmaceutical and Biotechnology Companies, and More) and Geography (North America, Europe and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 48.06% of 2024 revenue as NIH grants and robust venture capital support continuous adoption of advanced platforms. The FDA's laboratory-developed-test rule, offering USD 3.51 billion in annualized benefits, fosters uniform quality expectations that incentivize investment. Canada's biotech corridor and Mexico's contract-manufacturing hubs add incremental growth.

Asia Pacific is the fastest growing region at 10.16% CAGR through 2030. Japan scales its biotech revival strategy with direct funding for drug discovery programs that require apoptosis monitoring. South Korea and Australia expand clinical-trial infrastructure, while India leverages contract research depth to supply reagents and data services.

Europe maintains balanced growth, driven by pharmaceutical heavyweights and pan-EU research networks. The EMA's approval of Fruzaqla for metastatic colorectal cancer underscores the region's focus on advanced therapeutics that demand robust biomarker surveillance. The European Commission's biotechnology strategy further supports local production and translational research.

- Thermo Fisher Scientific

- Merck KGaA (MilliporeSigma)

- Beckton Dickinson

- Danaher Corp. (Beckman Coulter, Molecular Devices)

- Bio-Rad Laboratories

- PerkinElmer

- Sartorius AG (Essen BioScience)

- Bio-Techne Corp. (R&D Systems)

- Promega

- Agilent Technologies

- Enzo Life Sciences

- Abcam

- Tecan Group

- Miltenyi Biotec

- BioTek Instruments (Agilent)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising incidence of chronic & autoimmune diseases

- 4.2.2 Advancements in apoptosis-modulating therapeutics

- 4.2.3 Expanding funding for cell-based R&D & precision medicine

- 4.2.4 Mainstream adoption of high-throughput screening platforms

- 4.2.5 Emergence of single-cell multi-omics workflows needing apoptosis quantification

- 4.2.6 Shift to 3-D organoid models requiring imaging-compatible assays

- 4.3 Market Restraints

- 4.3.1 Stringent multi-jurisdictional regulatory requirements

- 4.3.2 High capital & operating cost of advanced detection instruments

- 4.3.3 Reproducibility & standardisation challenges across assay kits

- 4.3.4 Phototoxicity artefacts in live-cell imaging limiting data reliability

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Product

- 5.1.1 Assay Kits

- 5.1.1.1 Annexin V-based Assays

- 5.1.1.2 Caspase activity Assays

- 5.1.1.3 Mitochondrial membrane potential Assays

- 5.1.1.4 DNA fragmentation Assays

- 5.1.2 Reagents and Consumables

- 5.1.3 Instruments

- 5.1.1 Assay Kits

- 5.2 By Detection Technology

- 5.2.1 Flow Cytometry

- 5.2.2 Spectrophotometry

- 5.2.3 High-Content / 3-D Cell Imaging Systems

- 5.2.4 Other Technologies

- 5.3 By Application

- 5.3.1 Drug Discovery and Development

- 5.3.2 Clinical and Diagnostic Use

- 5.3.3 Stem-cell and Regenerative Medicine Research

- 5.3.4 Other Applications

- 5.4 By End User

- 5.4.1 Pharmaceutical and Biotechnology Companies

- 5.4.2 Academic and Research Institutes

- 5.4.3 Hospitals and Clinical Laboratories

- 5.4.4 Other End Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia & New Zealand

- 5.5.3.6 Rest of Asia Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 GCC

- 5.5.4.2 South Africa

- 5.5.4.3 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Thermo Fisher Scientific

- 6.3.2 Merck KGaA (MilliporeSigma)

- 6.3.3 Becton, Dickinson & Co.

- 6.3.4 Danaher Corp. (Beckman Coulter, Molecular Devices)

- 6.3.5 Bio-Rad Laboratories

- 6.3.6 PerkinElmer Inc.

- 6.3.7 Sartorius AG (Essen BioScience)

- 6.3.8 Bio-Techne Corp. (R&D Systems)

- 6.3.9 Promega Corporation

- 6.3.10 Agilent Technologies

- 6.3.11 Enzo Life Sciences

- 6.3.12 Abcam plc

- 6.3.13 Tecan Group AG

- 6.3.14 Miltenyi Biotec

- 6.3.15 BioTek Instruments (Agilent)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment