PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833450

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1833450

North America Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

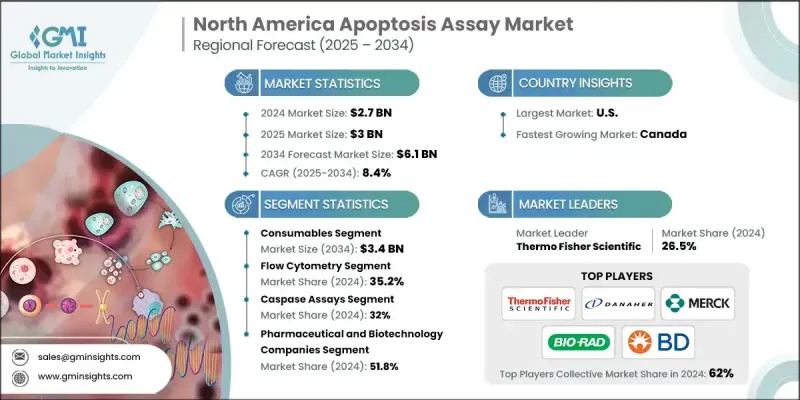

North America Apoptosis Assay Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 6.1 billion by 2034.

Market growth is being propelled by the rising prevalence of chronic illnesses and the accelerating need for tailored medicine. Technological advancements in cell analysis, particularly high-throughput flow cytometry and imaging-based platforms, are enhancing accuracy and efficiency in research. Strong investments in life sciences and the broader adoption of apoptosis assays in drug discovery are also fueling demand across both developed and emerging markets. These assays are essential tools for detecting and quantifying programmed cell death, offering critical insights into disease biology and the drug development process. The shift toward personalized treatment strategies has made precise cellular analysis indispensable. By enabling a deeper understanding of how therapies interact with cells, apoptosis assays are becoming vital in cancer research as well as studies of autoimmune and neurodegenerative disorders. With the healthcare industry placing a strong emphasis on targeted and individualized therapies, apoptosis assays are playing a key role in advancing precision medicine and supporting early-stage research that improves treatment outcomes.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8.4% |

The consumables segment was valued at USD 1.5 billion in 2024 and is expected to reach USD 3.4 billion by 2034. Consumables, including reagents, kits, buffers, and microplates, remain in constant demand as they are fundamental to cell death detection across pharmaceutical laboratories, academic centers, and clinical facilities in both the U.S. and Canada. Their role in ensuring reproducible and reliable outcomes across a variety of experimental scales keeps this category at the forefront of the market.

The flow cytometry segment accounted for a 35.2% share in 2024, maintaining its lead in the technology segment due to its ability to deliver high-speed, multiparameter analysis at the single-cell level. Its accuracy in identifying multiple markers and different stages of apoptosis has made it the preferred technique for researchers, who rely on its sensitivity and reproducibility for both early and advanced cell death studies.

U.S. Apoptosis Assay Market was valued at USD 2.6 billion in 2024. With a stronghold on the global market, the U.S. continues to dominate due to its advanced healthcare infrastructure, rapid uptake of new medical technologies, and high cancer incidence. Robust R&D funding, regulatory clarity, and growing awareness are further strengthening the adoption of apoptosis assays across clinical and research domains.

Key players active in the North America Apoptosis Assay Market include Agilent Technologies, PerkinElmer, Bio Rad Laboratories, Becton, Dickinson and Company, Abcam, Danaher, Takara Bio, Thermo Fisher Scientific, Merck, and Bio Techne. Companies in the North America apoptosis assay market are implementing targeted strategies to expand their footprint and strengthen competitiveness. Heavy R&D investments are directed toward developing advanced kits, reagents, and high-throughput platforms to improve assay accuracy and efficiency. Strategic partnerships with research institutes and pharmaceutical companies are being formed to accelerate innovation and broaden product adoption. Firms are also expanding their distribution networks across the U.S. and Canada to enhance accessibility and strengthen customer reach. Product diversification, including the launch of multiplex assays and automated systems, is another priority.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional trends

- 2.2.2 Product trends

- 2.2.3 Technology trends

- 2.2.4 Assay type trends

- 2.2.5 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.3.2 Growing use in evaluating individual cellular responses to therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 U.S.

- 9.3 Canada

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Agilent Technologies

- 10.3 Becton, Dickinson and Company

- 10.4 Bio-Rad Laboratories

- 10.5 Bio-Techne

- 10.6 Danaher

- 10.7 Merck

- 10.8 PerkinElmer

- 10.9 Takara Bio

- 10.10 Thermo Fisher Scientific