PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822557

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1822557

Germany Apoptosis Assay Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

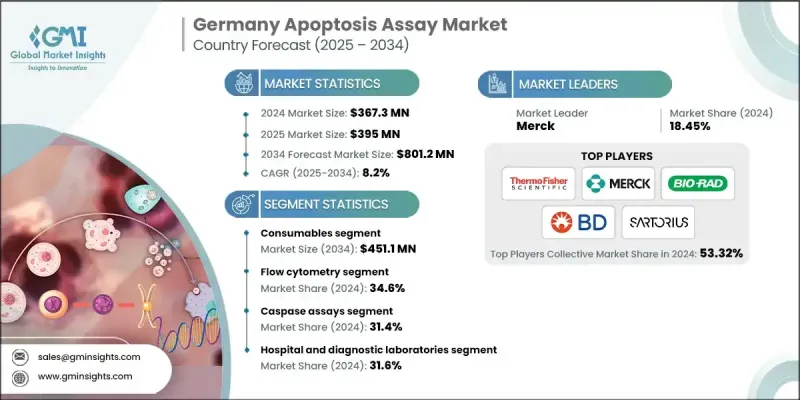

Germany apoptosis assay market was valued at USD 367.3 million in 2024 and is projected to grow from USD 395 million in 2025 to USD 801.2 million by 2034, expanding at a CAGR of 8.2%, according to the latest report published by Global Market Insights, Inc.

Germany's robust biomedical research infrastructure, growing prevalence of chronic illness, and enhanced investment in life sciences are major drivers of apoptosis assay demand. The assays are useful across a number of applications in pharmaceutical R&D, toxicology, and clinical diagnostics in the understanding of programmed cell death processes and therapeutic response.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $367.3 Million |

| Forecast Value | $801.2 Million |

| CAGR | 8.2% |

Key Drivers:

1. Increased cancer research and targeted drug development: The increased emphasis on apoptosis pathways in cancer treatment is driving the application of high-throughput apoptosis assays.

2. Public funding of research projects: New German investments into life sciences in the colonies and other initiatives, such as "High-Tech Strategy 2025," are improving access to the latest technology and sophisticated lab equipment.

3. Increased need and interest in fast diagnostic equipment: The speed at which flow cytometry apoptosis detection takes place is being increasingly popularised by hospitals and research institutions, who enjoy the benefits of speed and reliability.

4. University-industry partnerships: Germany's research community supports partnerships between universities, biotech companies, and diagnostic laboratories, fueling assay innovation.

Key Players:

In Germany, the market for apoptosis assay is dominated by industry giants such as Thermo Fisher Scientific, Merck, Bio Rad Laboratories, Becton, Dickinson and Company (BD), and Sartorius. These five together held 53.32% of the market share in 2024.

Key Challenges:

- Very high cost of operation of advanced platforms: The cost of flow cytometry and fluorescence microscopy systems is still high for smaller research laboratories.

- More specialized and sophisticated data analysis use cases need: Advanced apoptosis detection often requires bioinformatics skills and training (which is not widely available or accessible).

- Regulation and standardization: Maintaining consistent assay performance across different labs is still an issue in clinical use.

1. By Product Type - Consumables Hold the Largest Market Share

Consumables include assay kits, reagents, buffers, and detection probes, and for 2024, consumables had the largest market share. As consumables are used so frequently in diagnostic and academic settings, future demand is supported through frequency of usage.

2.By Technology -Flow Cytometry Leads the Way

Flow cytometry was the lead in the technology space, and its market growth was due in part to its high throughput profile and enhanced multiparametric profile. It is most commonly used in academic research, as well as hospital labs.

3. By Assay Type - Caspase Assays Lead

Caspase assays recorded the largest market share in 2024 because they are more accurate for the identification of apoptosis that occurs at an early stage. These assays are critical in analyzing cell death during oncology and pharmacology research.

4. By End Use - Hospitals and Diagnostic Labs Lead

Hospitals and diagnostic labs were the largest end use segment in 2024. Increasing use in clinical research as well as in diagnostic tests continues to drive their extensive use.

Key players in the Germany apoptosis assay market are Agilent Technologies, BD Becton, Dickinson and Company, Bio-Rad Laboratories, Bio-Techne, Carl Roth GmbH + Co. KG, Enzo Life Sciences, Merck, Miltenyi Biotec, PerkinElmer, Promega, Sartorius, Tecan Group, and Thermo Fisher Scientific.

Key players in the Germany apoptosis assay market are investing heavily in product development, collaborations with academic research organizations, and laboratory automation. Merck and Sartorius are enhancing their bioscience portfolios through premium caspase and annexin V assay kits that are specific to German and EU laboratories. Miltenyi Biotec is increasing its capabilities in flow cytometry and Carl Roth GmbH + Co. KG is focusing on low-cost reagent kits for university and hospital laboratories. Companies are also optimizing internal processes by bundling assay kits with hardware to offer Total Laboratory Solutions and expedite cellular analysis.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product trends

- 2.2.2 Technology trends

- 2.2.3 Assay type trends

- 2.2.4 End use trends

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Growing need for personalized medicine

- 3.2.1.3 Technological advancements in flow cytometry

- 3.2.1.4 Rising application in toxicology and drug safety assessment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced technologies

- 3.2.2.2 Regulatory and ethical challenges

- 3.2.3 Market opportunities

- 3.2.3.1 Rising focus on cancer and neurodegenerative research

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological advancements

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Supply chain analysis

- 3.7 Pricing analysis, 2024

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers and acquisitions

- 4.6.2 Partnerships and collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

- 5.3.1 Kits and reagents

- 5.3.2 Microplate

- 5.3.3 Other consumables

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Flow cytometry

- 6.3 Cell imaging and analysis system

- 6.4 Spectrophotometry

- 6.5 Other detection technologies

Chapter 7 Market Estimates and Forecast, By Assay Type, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Caspase assays

- 7.3 DNA fragmentation assays

- 7.4 Mitochondrial assays

- 7.5 Annexin V

- 7.6 Cell permeability assays

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Hospital and diagnostic laboratories

- 8.4 Academic and research institutes

Chapter 9 Company Profiles

- 9.1 Agilent Technologies

- 9.2 BD Becton, Dickinson and Company

- 9.3 Bio-Rad Laboratories

- 9.4 Bio-Techne

- 9.5 Carl Roth GmbH + Co. KG

- 9.6 Enzo Life Sciences

- 9.7 Merck

- 9.8 Miltenyi Biotec

- 9.9 PerkinElmer

- 9.10 Promega

- 9.11 Sartorius

- 9.12 Tecan Group

- 9.13 Thermo Fisher Scientific