PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885814

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885814

Protein Hydrolysates for Inflammatory Bowel Disease Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

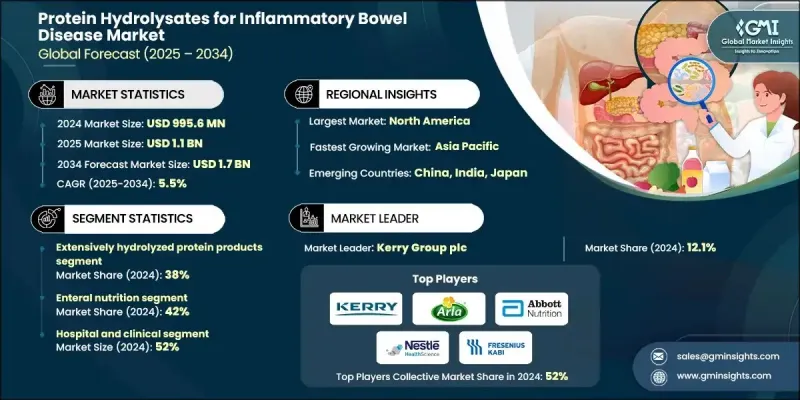

The Global Protein Hydrolysates for Inflammatory Bowel Disease Market was valued at USD 995.6 million in 2024 and is estimated to grow at a CAGR of 5.5% to reach USD 1.7 billion by 2034.

Industry expansion continues to benefit from strong scientific support, as recent clinical findings reinforce their therapeutic value. These products are gaining traction across regions with established diagnostic systems and advanced healthcare capabilities, particularly in markets where IBD detection rates are high. Areas experiencing rapid growth, such as Asia Pacific, are accelerating due to rising awareness and increasing incidence trends, especially in East Asia. Another major force reshaping the market is the growing global shift toward plant-based nutrition. As vegan and vegetarian lifestyles expand, demand for plant-derived protein hydrolysates is rising sharply, supported by research that highlights their potential in managing inflammation and supporting gut health. Market interest is also driven by the broader trend toward specialized medical nutrition, where protein hydrolysates are becoming an important part of therapeutic dietary strategies for individuals managing chronic digestive conditions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $995.6 Million |

| Forecast Value | $1.7 Billion |

| CAGR | 5.5% |

The extensively hydrolyzed protein formulations segment held a 38% share in 2024, driven by their suitability for severe inflammatory bowel disease and the need for highly digestible, low-antigen solutions. These products are processed into smaller nutritional components, helping reduce immune triggers while still supplying key nutrients essential for maintaining intestinal function and promoting recovery. Their clinical acceptance continues to rise due to their effectiveness in supporting patients requiring precise nutritional interventions.

The enteral nutrition segment held a 42% share in 2024. This category is widely used for individuals with inflammatory bowel disease who require nutritional support through feeding systems or liquid-based dietary management. Clinical evidence consistently highlights the benefits of enteral nutrition, particularly in cases where conventional therapies are insufficient, and its strong performance reflects continued reliance on specialized nutritional regimens for managing disease flares.

U.S. Protein Hydrolysates for Inflammatory Bowel Disease Market generated USD 330.4 million in 2024, supported by a significant IBD patient pool, with about 0.72% of the population affected. The region's robust healthcare systems, active clinical research landscape, supportive regulations for medical nutrition, and insurance coverage contribute to strong adoption. Ongoing studies led by major research institutions underscore the region's commitment to improving therapeutic nutrition and maintaining its leadership position.

Key companies participating in the Protein Hydrolysates for Inflammatory Bowel Disease Market industry include Kerry Group plc, Arla Foods Ingredients, Abbott Nutrition, Nestle Health Science, Fresenius Kabi, Nutricia, Reckitt, Ajinomoto, and DSM Nutritional Products. Companies in the Protein Hydrolysates for Inflammatory Bowel Disease Market are widening their market footprint by investing heavily in clinical research to validate therapeutic advantages and secure stronger medical acceptance. Many manufacturers are refining production technologies to enhance protein digestibility and reduce antigenicity, helping them meet the needs of patients with severe gastrointestinal challenges. Firms are also diversifying their portfolios with plant-based hydrolysates to align with rising consumer preference for vegan and vegetarian medical nutrition. Strategic collaborations with healthcare institutions, product innovation geared toward advanced enteral formulations, and expansion into high-growth regions are central to their competitive approach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Product type

- 2.2.2 Source material

- 2.2.3 Application

- 2.2.4 End Use

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Product Type, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Extensively hydrolyzed protein products

- 5.3 Partially hydrolyzed protein products

- 5.4 Amino acid-based formulations

- 5.5 Others

Chapter 6 Market Size and Forecast, By Source Material, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Dairy-derived hydrolysates

- 6.2.1 Whey protein hydrolysates

- 6.2.2 Casein hydrolysates

- 6.2.3 Alpha-lactalbumin concentrates

- 6.2.4 Others

- 6.3 Plant-based hydrolysates

- 6.3.1 Rice protein hydrolysates

- 6.3.2 Pea protein hydrolysates

- 6.3.3 Soy protein hydrolysates

- 6.3.4 Others

- 6.4 Marine-derived hydrolysates

- 6.5 Others

Chapter 7 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Enteral nutrition

- 7.3 Oral nutritional supplements

- 7.4 Medical foods

- 7.5 Others

Chapter 8 Market Size and Forecast, By End Use, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Hospitals & clinical settings

- 8.3 Home healthcare

- 8.4 Specialized nutrition centers

- 8.5 Others

Chapter 9 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East & Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

- 9.6.4 Rest of Middle East & Africa

Chapter 10 Company Profiles

- 10.1 Kerry Group

- 10.2 Arla Foods Ingredients

- 10.3 Abbott Nutrition

- 10.4 Nestle Health Science

- 10.5 Fresenius Kabi

- 10.6 Nutricia

- 10.7 Reckitt

- 10.8 Ajinomoto

- 10.9 DSM Nutritional Products