PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885825

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885825

Fermented Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

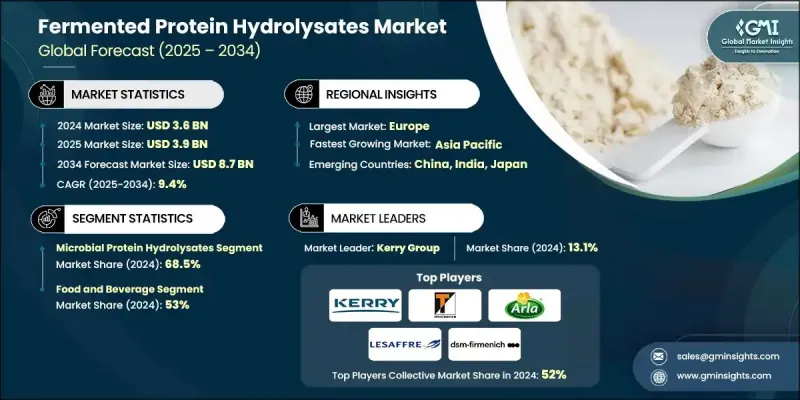

The Global Fermented Protein Hydrolysates Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 9.4% to reach USD 8.7 billion by 2034.

Growing attention to wellness and preventive nutrition has created an estimated USD 12-15 billion worldwide demand for functional foods and supplements that rely on bioactive protein hydrolysates. These ingredients are linked to various biological activities, including antioxidant, antimicrobial, antihypertensive, anti-inflammatory, and immune-supportive effects. Clinical evidence and aggregated research show that daily intake of 3-5 grams of bioactive peptides can contribute to blood pressure management. International food-safety bodies recognize protein hydrolysates within additive frameworks, and ongoing assessments by global committees are expected to establish acceptable intake limits, which may stimulate further commercialization. Circular-economy principles are also reshaping production by converting agricultural and seafood processing residues into high-value nutritional materials. Global agricultural agencies continue promoting affordable fermentation and by-product processing methods that convert waste into usable protein ingredients, helping both reduce environmental impact and improve economic returns.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9.4% |

The microbial protein hydrolysates segment held 68.5% share in 2024, driven by established fermentation infrastructure, favorable regulations, and cost-efficient scale-up potential. Proteins derived from organisms such as yeasts, microalgae, filamentous fungi, and bacteria typically contain 30% to 80% protein on a dry-weight basis, depending on the strain and process used.

The food & beverage segment held 53% share in 2024. These ingredients improve solubility, emulsifying ability, foaming capacity, and gelation compared with intact proteins, enabling their use in a wide range of beverages, bakery items, dairy-alternative formulations, and plant-based products. Their bioactive peptides offer added benefits, supporting blood pressure control through enzyme-inhibitory activity, reducing oxidative stress via antioxidant action, and helping extend product shelf life through antimicrobial properties.

United States Fermented Protein Hydrolysates Market generated USD 713.4 million in 2024 and is estimated to reach USD 1.1 billion by 2034, supported by robust biotech expertise, increasing investment in precision fermentation, and rising consumption of functional nutrition. The US regulatory framework evaluates fermentation-based proteins through the Generally Recognized as Safe pathway, with multiple determinations covering a range of precision-fermented protein ingredients issued through 2025.

Major companies active in the Global Fermented Protein Hydrolysates Market include Kerry Group, Angel Yeast, Novozymes, Hebei Shuntian Biotechnology, Sensient Technologies Corporation, Arla Foods Ingredients Group, DSM-Firmenich, Fonterra, Lesaffre Group, and Tate & Lyle. Key strategies adopted by companies in the Fermented Protein Hydrolysates Market focus on boosting competitiveness and expanding global presence. Many players are investing in advanced fermentation technologies to improve yield, enhance peptide functionality, and lower production costs. Firms are also forming partnerships across biotechnology, food processing, and ingredient development to accelerate innovation and strengthen supply reliability. Several companies are prioritizing the use of agricultural and marine by-products to support circular-economy models and meet sustainability expectations. Regulatory alignment and proactive engagement with safety authorities help streamline market entry and build customer confidence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Source

- 2.2.2 Application

- 2.2.3 Form

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Size and Forecast, By Source, 2021-2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Animal-based protein hydrolysates

- 5.2.1 Fish protein hydrolysates

- 5.2.2 Poultry protein hydrolysates

- 5.2.3 Livestock protein hydrolysates (non-dairy)

- 5.2.4 Dairy protein hydrolysates

- 5.2.5 Others

- 5.3 Plant-based protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Wheat protein hydrolysates

- 5.3.4 Rice protein hydrolysates

- 5.3.5 Others

- 5.4 Microbial protein hydrolysates

- 5.4.1 Yeast extract & autolysates

- 5.4.2 Bacterial fermentation products

- 5.5 Insect protein hydrolysates

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021-2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Food & beverage applications

- 6.2.1 Flavor enhancers & seasonings

- 6.2.2 Protein fortification

- 6.2.3 Infant formula & clinical nutrition

- 6.2.4 Functional foods & beverages

- 6.3 Animal feed applications

- 6.3.1 Aquaculture feed

- 6.3.2 Livestock feed

- 6.3.3 Poultry feed

- 6.3.4 Pet food

- 6.4 Nutraceuticals & pharmaceuticals

- 6.4.1 Bioactive peptides

- 6.4.2 Dietary supplements

- 6.5 Cosmetics & personal care

- 6.6 Agriculture & horticulture

- 6.7 Others

Chapter 7 Market Size and Forecast, By Form, 2021-2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Fine powder

- 7.3 Granular/agglomerated

- 7.4 Liquid concentrate

- 7.5 Paste/semi-solid

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021-2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East & Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

- 8.6.4 Rest of Middle East & Africa

Chapter 9 Company Profiles

- 9.1 Kerry Group

- 9.2 Angel Yeast

- 9.3 Arla Foods Ingredients Group

- 9.4 Novozymes

- 9.5 DSM-firmenich

- 9.6 Fonterra

- 9.7 Lesaffre Group

- 9.8 Hebei Shuntian Biotechnology

- 9.9 Sensient Technologies Corporation

- 9.10 Tate & Lyle

- 9.11 Ynsect

- 9.12 Entomo Farms

- 9.13 Gelita

- 9.14 Rousselot

- 9.15 Specialty Enzymes & Probiotics

- 9.16 Azelis Group