PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885846

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885846

Pharmaceutical-Grade Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

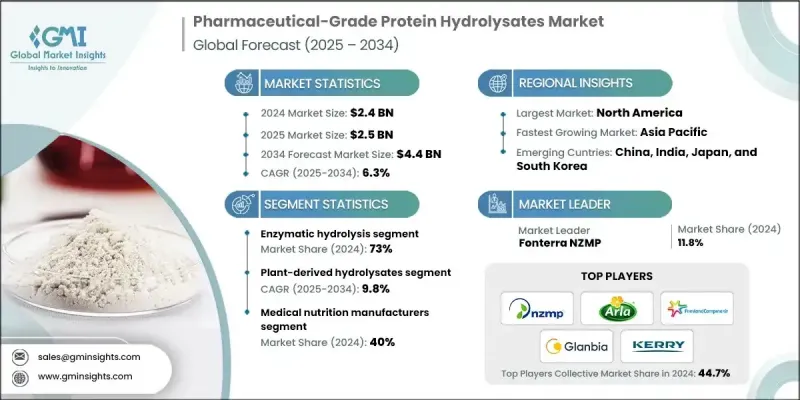

The Global Pharmaceutical-Grade Protein Hydrolysates Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 6.3% to reach USD 4.4 billion by 2034.

The market's expansion is fueled by rising demand for specialized nutritional and therapeutic products that target specific health needs. Protein hydrolysates are proteins broken down into smaller peptides or amino acids through enzymatic or acid-based processes, improving digestibility and bioavailability. In the pharmaceutical sector, these hydrolysates are critical for medical nutrition, functional foods, and dietary supplements that address malnutrition, gastrointestinal disorders, and immune deficiencies. Their high purity, safety, and efficacy make them suitable for vulnerable populations such as infants, elderly patients, and those with compromised health. Furthermore, they support muscle development, wound recovery, and immune function, reinforcing their therapeutic importance. Increasing adoption in medical nutrition, drug delivery systems, and sports nutrition is driving steady demand.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.4 Billion |

| CAGR | 6.3% |

The plant-derived protein hydrolysates segment will grow at a CAGR of 9.8% through 2034. Sustainability concerns and clean-label preferences, along with the need to avoid lactose-related issues, are pushing demand for plant-based sources such as soy and pea proteins. Enzymatic hydrolysis improves the functional properties of plant proteins, including solubility at acidic pH, enabling their use in fortified beverages and clinical nutrition formulations.

The enzymatic hydrolysis dominates the manufacturing processes segment, holding a 73% share in 2024, owing to its precision, safety, and ability to produce high-purity products with minimal by-products. Pharmaceutical manufacturers favor this method for its compliance with stringent regulatory standards and suitability for sensitive patient populations.

North America Pharmaceutical-Grade Protein Hydrolysates Market accounted for a 36.9% share in 2024. Growth in the region is driven by an aging population, rising chronic disease prevalence, and increasing adoption of personalized medicine. High demand for medical nutrition and clinical foods, combined with stringent quality regulations and advanced processing technologies, supports the production of high-quality hydrolysates. A strong pharmaceutical and nutraceutical sector, coupled with substantial healthcare expenditure, further underpins the market's development.

Major players in the Global Pharmaceutical-Grade Protein Hydrolysates Market include Abbott Laboratories, AMCO Proteins, Arla Foods Ingredients Group, Fonterra NZMP, FrieslandCampina Ingredients, Glanbia plc, Hilmar Cheese Company, Inc., Hofseth BioCare ASA, Ingredia SA, Kerry Group plc, and NINGBO INNO PHARMCHEM CO., LTD. Companies are focusing on expanding their product portfolios through innovation in hydrolysis techniques, enhanced bioavailability, and plant-based protein offerings to meet growing consumer and therapeutic demands. Strategic collaborations with pharmaceutical, nutraceutical, and clinical nutrition companies help improve market reach and application development. Investments in R&D enable the development of premium-grade hydrolysates tailored for sensitive populations, including infants and the elderly. Geographic expansion into emerging markets and localized production facilities ensures regulatory compliance and faster distribution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Protein sources

- 2.2.3 Manufacturing process

- 2.2.4 Application

- 2.2.5 End Use industry

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By protein source

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Protein Source, 2021-2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Milk-derived protein hydrolysates

- 5.2.1 Whey protein hydrolysates

- 5.2.2 Casein hydrolysates

- 5.3 Plant-derived protein hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Others

- 5.4 Animal-derived protein hydrolysates

- 5.4.1 Egg protein hydrolysates

- 5.4.2 Collagen/gelatin hydrolysates

- 5.5 Fish/marine protein hydrolysates

- 5.6 Other sources hydrolysates

Chapter 6 Market Estimates and Forecast, By Manufacturing Process, 2021-2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.4 Microbial fermentation

- 6.5 Hybrid/sequential processes

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Million & Kilo Tons)

- 7.1 Key trend

- 7.2 Clinical/enteral nutrition

- 7.2.1 Polymeric formulations

- 7.2.2 Oligomeric/peptide-based formulations

- 7.2.3 Tube feeding applications

- 7.2.4 Oral nutritional supplements

- 7.2.5 Critical care & ICU nutrition

- 7.3 Medical foods/FSMP

- 7.3.1 PKU & metabolic disorder formulations

- 7.3.2 Renal disease formulations

- 7.3.3 Hepatic disease formulations

- 7.3.4 Cystic fibrosis nutrition

- 7.4 Therapeutic/pharmaceutical applications

- 7.4.1 Ace inhibition peptides

- 7.4.2 Antioxidant bioactive peptides

- 7.4.3 Immunomodulatory applications

- 7.4.4 Wound healing formulations

- 7.4.5 Drug delivery systems

- 7.5 Infant formula

- 7.5.1 Partially hydrolyzed formulas (DH 10-30%)

- 7.5.2 Extensively hydrolyzed formulas (DH30-60%)

- 7.5.3 Amino acid-based formulas (DH >80%)

- 7.5.4 Hypoallergenic formulations

- 7.6 Parenteral nutrition

- 7.6.1 Amino acid solutions

- 7.6.2 Dipeptide formulations (alanyl-glutamine)

- 7.6.3 Total parenteral nutrition (TPN)

- 7.6.4 Peripheral parenteral nutrition (PPN)

- 7.7 Sports nutrition

- 7.7.1 Rapid absorption formulations

- 7.7.2 Muscle recovery applications

- 7.7.3 Performance enhancement products

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Medical nutrition manufacturers

- 8.3 Pharmaceutical companies

- 8.4 Infant formula manufacturers

- 8.5 Nutraceutical companies

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Abbott Laboratories

- 10.2 AMCO Proteins

- 10.3 Arla Foods Ingredients Group

- 10.4 Fonterra NZMP

- 10.5 FrieslandCampina Ingredients

- 10.6 Glanbia plc

- 10.7 Hilmar Cheese Company, Inc.

- 10.8 Hofseth BioCare ASA

- 10.9 Ingredia SA

- 10.10 Kerry Group plc

- 10.11 NINGBO INNO PHARMCHEM CO., LTD