PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885849

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1885849

Spray-Dried Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

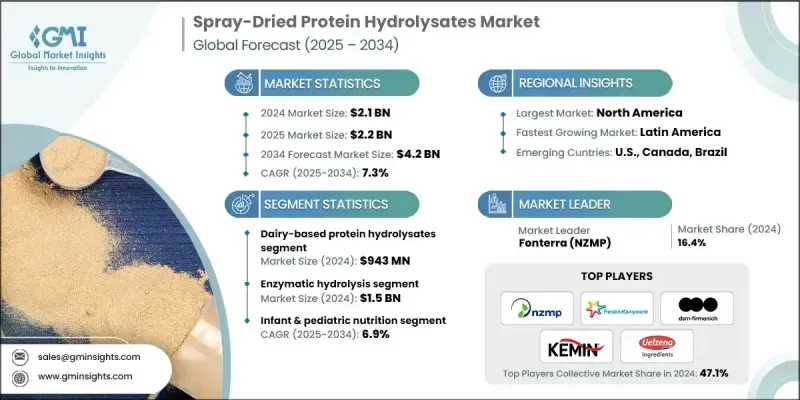

The Global Spray-Dried Protein Hydrolysates Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 7.3% to reach USD 4.2 billion by 2034.

Rising worldwide interest in higher protein intake is broadening the consumer base for spray-dried hydrolysates, especially as long-term dietary trends highlight greater demand for easily digestible and high-quality protein sources. Growing adoption of enhanced protein formats among individuals following vegetarian diets has added momentum, prompting manufacturers to enrich everyday food and beverage products with hydrolyzed proteins to meet evolving nutrition expectations. Expanding participation in fitness, recreational activities, and endurance sports, supported by public health data, continues to accelerate the need for fast-absorbing protein products. Spray-dried hydrolysates are appealing in these areas because their rapid uptake and high bioavailability help support faster muscle recovery. Demand from clinical and medical nutrition is also rising as the global population ages, driving consistent consumption of hydrolyzed protein ingredients.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 7.3% |

The dairy-based protein hydrolysates segment generated USD 943 million in 2024, maintaining a strong position due to their favorable functional traits, mild flavor, and compatibility with sports, pediatric, and medical nutrition formulations. Whey- and casein-derived hydrolysates benefit from efficient absorption, balanced amino acid profiles, and long-standing regulatory acceptance. Their prominence is reinforced by mature dairy-processing systems in regions such as North America and Europe, where reliable whey streams, refined enzymatic hydrolysis capabilities, and advanced spray-drying technologies contribute to consistent quality and dependable output.

The infant and pediatric nutrition will grow at a CAGR of 6.9% through 2034. This segment commands a major share of the spray-dried protein hydrolysates market because of stringent regulatory oversight and sustained demand for formulations tailored to sensitive digestion. Hydrolyzed casein and whey continue to play an essential role in meeting the needs of infants with lactose intolerance, cow's milk protein sensitivity, or digestive discomfort.

North America Spray-Dried Protein Hydrolysates Market held a 32% share in 2024. The region benefits from a strong sports nutrition category, a solid clinical nutrition sector, and a concentration of advanced dairy-processing operations specializing in enzymatic hydrolysis and spray-drying. Market growth is supported by rising consumption of performance-focused protein ingredients, broader adoption of easy-to-digest hydrolysates in clinical settings, and active investment in expanded production capacity. Regional processing capabilities continue to scale, improving supply reliability and supporting innovation in peptide-rich products.

Key companies involved in the Global Spray-Dried Protein Hydrolysates Market include Aumgene Biosciences, DSM-Firmenich, CRESCENT BIOTECH, Kemin Industries, FrieslandCampina Ingredients, Buchi, Uelzena Ingredients, Eklavya Biotech Private Limited, Fonterra (NZMP), and Fonterra. Companies competing in the Spray-Dried Protein Hydrolysates Market are pursuing several strategies to strengthen their competitive position. Many are upgrading enzymatic hydrolysis systems and spray-drying operations to improve yield, enhance peptide profiles, and deliver higher consistency across large production runs. Firms are expanding their product portfolios to serve rapidly growing areas such as pediatric nutrition, clinical nutrition, and performance-oriented formulations. Strategic partnerships with dairy processors, biotechnology firms, and specialized ingredient developers help accelerate innovation and ensure reliable sourcing of high-quality protein streams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Protein Source

- 2.2.3 Hydrolysis Method

- 2.2.4 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global protein consumption & protein fortification trends

- 3.2.1.2 Growing sports nutrition & active lifestyle market

- 3.2.1.3 Aging population & clinical nutrition demand

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High production costs & capital intensity of spray-drying equipment

- 3.2.2.2 Enzyme cost & availability for food-grade proteases

- 3.2.2.3 Regulatory fragmentation across regions

- 3.2.3 Market opportunities

- 3.2.3.1 Growing demand for convenient, shelf-stable protein ingredients in sports and clinical nutrition products

- 3.2.3.2 Expansion of functional food and beverage applications requiring easy-to-mix, high-solubility protein powders

- 3.2.3.3 Rising interest in infant and pediatric nutrition formulations with hypoallergenic properties

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 Product

- 3.8 Future market trends

- 3.9 Technology and Innovation Landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Protein Source, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Dairy-based protein hydrolysates

- 5.2.1 Whey protein hydrolysates (WPH)

- 5.2.2 Casein hydrolysates

- 5.2.3 Milk protein hydrolysates

- 5.3 Plant-based Protein Hydrolysates

- 5.3.1 Soy protein hydrolysates

- 5.3.2 Pea protein hydrolysates

- 5.3.3 Rice protein hydrolysates

- 5.3.4 Wheat protein hydrolysates

- 5.3.5 Other Plant Sources (lentil, chickpea, faba bean, etc.)

- 5.4 Animal-based Protein hydrolysates (Non-dairy)

- 5.4.1 Collagen/gelatin hydrolysates

- 5.4.2 Meat (beef/poultry/pork) hydrolysates

- 5.4.3 Egg protein hydrolysates

- 5.5 Marine-based protein hydrolysates

- 5.5.1 Fish protein hydrolysates

- 5.5.2 Shellfish/crustacean protein hydrolysates

Chapter 6 Market Estimates and Forecast, By Hydrolysis Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Acid hydrolysis

- 6.4 Microbial/fermentation

- 6.5 Autolysis

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Infant & pediatric nutrition

- 7.2.1 Hypoallergenic formulas

- 7.2.2 Lactose-free formulations

- 7.2.3 Premature infant nutrition

- 7.3 Clinical & medical nutrition

- 7.3.1 Geriatric nutrition

- 7.3.2 Enteral & tube-feeding formulas

- 7.3.3 Recovery & therapeutic diets

- 7.4 Sports & performance nutrition

- 7.4.1 Pre-workout & post-workout blends

- 7.4.2 Protein recovery drinks & bars

- 7.4.3 Weight management supplements

- 7.5 Functional foods & beverages

- 7.5.1 Bakery & confectionery fortification

- 7.5.2 Dairy alternatives (RTD, yogurt, smoothies)

- 7.5.3 Nutrient-dense snacks

- 7.6 Dietary supplements & nutraceuticals

- 7.6.1 Powdered mixes

- 7.6.2 Tablets / capsules

- 7.6.3 RDT supplement drinks

- 7.7 Animal nutrition & pet food

- 7.7.1 Companion animal feed

- 7.7.2 Aquafeed (fish/shrimp feed)

- 7.7.3 Livestock performance boosters

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 CRESCENT BIOTECH

- 9.2 Aumgene Biosciences

- 9.3 Eklavya Biotech Private Limited.

- 9.4 Fonterra (NZMP)

- 9.5 Uelzena Ingredients

- 9.6 Buchi

- 9.7 Kemin Industries

- 9.8 DSM-Firmenich

- 9.9 FrieslandCampina Ingredients