PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849983

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849983

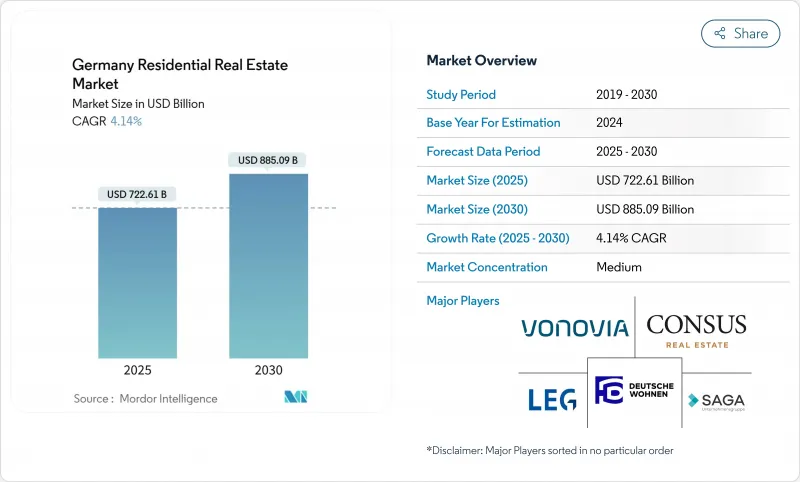

Germany Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The German residential real estate market reached USD 722.61 billion in 2025 and is projected to expand to USD 885.09 billion by 2030, reflecting a 4.14% CAGR and confirming the sector's steady rebound from the 2023-2024 downturn.

Rising urban migration, persistent housing shortages and supportive green-building incentives continue to outweigh lingering construction-cost pressures, positioning the German real estate market for durable, policy-backed growth. Institutional capital inflows into build-to-rent schemes, senior-living facilities and energy-efficient developments reinforce overall resilience, while demographic diversity-especially international migration-keeps demand broad-based. Developer margins remain squeezed by cost inflation, yet KfW's enlarged low-interest funding channels are cushioning balance sheets and accelerating ESG-compliant projects.

Germany Residential Real Estate Market Trends and Insights

Rising Urbanization and Single-Person Households Driving Apartment Demand

Germany's city populations continue to swell as single-person households touch new highs, pushing sustained demand for compact centrally located units. Berlin's population edged up to 3.897 million in 2024, with 25,509 new foreign registrations adding immediate strain to already tight apartment inventories. Similar patterns in Munich and Hamburg drive developers toward high-density designs and modular construction that shorten build cycles. Southern tech hubs exhibit the steepest medium-term growth, whereas certain eastern rural districts experience population loss that reallocates construction focus. Micro-apartments and co-living schemes in Frankfurt and Berlin underscore emerging preferences for access over space, reinforcing the momentum behind the German real estate market.

ESG Regulation & KfW Subsidies Accelerating Energy-Efficient New Builds

Germany's climate-neutral-by-2045 target is tightening building codes and making ESG compliance a prerequisite for financing. KfW now offers up to EUR 150,000 per unit in low-interest loans for certified climate-friendly projects, sharply lowering capital costs for compliant developers. Heating-system grants covering as much as 70% of installation expense further sweeten project economics and are steering many builders toward net-zero ready specifications. Large landlords such as Vonovia have earmarked EUR 2 billion for green modernization, betting that sustainable assets will secure superior occupancy and regulatory approval. Over time, green standards are expected to evolve from a premium feature to a baseline requirement in the German real estate market.

Construction Cost Inflation Compressing Developer Margins

Construction prices rose 3.2% year-on-year in February 2025, extending a decade-long surge that has inflated costs by 64% since 2010. Higher steel, concrete and wage bills threaten project viability, especially in land-scarce metros where plots already command hefty premiums. Nearly half of contractors anticipate revenue declines in 2025, prompting greater adoption of prefabrication, longer supplier contracts and design simplification. The German real estate market therefore faces an immediate profitability squeeze until cost curves stabilize or innovations deliver material savings.

Other drivers and restraints analyzed in the detailed report include:

- Demographic Aging Boosting Senior-Living Demand

- Influx of High-Skill Migrants Raising Rental Housing Needs in Tech Hubs

- Urban Rent Caps Limiting Income Growth for Landlords

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums held 65.12% of German real estate market share in 2024, underscoring how demographic change and urban job clustering sustain compact-unit demand. Average Berlin rents climbed 10.6% in 2024, validating the pricing power of well-located apartments amid limited new supply. Villas and landed houses, while a smaller slice, are projected to post a 4.31% CAGR as hybrid work lets households trade commute times for larger suburban lots. Modular construction and offsite prefabrication shorten delivery timelines for multifamily projects, enabling faster turnover of capital in the German real estate market.

Growing institutional appetite for build-to-rent apartments supports ongoing capital formation, and strong absorption rates justify premium amenities such as co-working spaces and fitness centers. Suburban single-family growth is most notable around Hamburg and Cologne, where pro-family policies and improved rail links encourage outbound migration. However, even these edge developments stay tied to urban cores through transit, keeping them integral to the broader German real estate market.

Mid-market assets retained 47.12% of German real estate market size in 2024, yet the affordable tranche is the fastest-moving at 4.34% CAGR, helped by subsidies for 100,000 new social units every year and favorable depreciation rules. Developers able to balance cost controls with ESG targets stand to capture meaningful public funding and tax offsets. Although luxury homes trade on brand and scarcity, tightened mortgage affordability following ECB hikes has shifted volume toward subsidized products.

In eastern metros like Leipzig, natural affordability and rapid wage growth combine to draw value-seeking migrants, further boosting the affordable pipeline. Conversely, constrained prime-city plots leave the luxury segment more dependent on international buyers and cash-rich locals. Balanced portfolios that blend mid-market stability with subsidized affordable developments appear best positioned within the German real estate industry.

The Germany Residential Real Estate Market is Segmented by Property Type (Apartments & Condominiums and Villas & Landed Houses), Price Band (Affordable, Mid-Market and Luxury), Business Model (Sales and Rental), Mode of Sale (Primary and Secondary), and Key Cities (Berlin, Hamburg, Munich, Cologne, Frankfurt, Dusseldorf, Leipzig and Rest of Germany). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Vonovia SE

- Deutsche Wohnen SE

- LEG Immobilien SE

- TAG Immobilien AG

- Grand City Properties S.A.

- Covivio Immobilien GmbH

- Adler Group S.A.

- Patrizia SE

- Vivawest GmbH

- SAGA Unternehmensgruppe Hamburg

- Degewo AG

- ABG Frankfurt Holding

- GAG Immobilien AG

- BUWOG GmbH

- Heimstaden Germany GmbH

- Consus Real Estate AG

- Residia Care Holding GmbH & Co. KG

- Wohnungsbaugenossenschaft Musikwinkel eG

- Wertgrund Immobilien AG

- Bayerische Versorgungskammer - Immobilien

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Regulatory Outlook

- 4.4 Technological Outlook

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Drivers

- 4.8.1 Rising Urbanization and Single-Person Households Driving Apartment Demand

- 4.8.2 ESG Regulation & KfW Subsidies Accelerating Energy-Efficient New Builds

- 4.8.3 Demographic Aging Boosting Senior-Living Demand

- 4.8.4 Influx of High-Skill Migrants Raising Rental Housing Needs in Tech Hubs

- 4.8.5 Build-to-Rent Institutional Investment Unlocking Mid-Range Supply

- 4.8.6 Adoption of Prefabrication Shortening Construction Cycles

- 4.9 Market Restraints

- 4.9.1 Construction Cost Inflation Compressing Developer Margins

- 4.9.2 Urban Rent Caps Limiting Income Growth for Landlords

- 4.9.3 Skilled-Labour Shortages Causing Project Delays

- 4.9.4 Rising ECB Rates Tightening Mortgage Affordability

- 4.10 Value / Supply-Chain Analysis

- 4.10.1 Overview

- 4.10.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.10.3 Real Estate Brokers and Agents - Key Quantitative and Qualitative Insights

- 4.10.4 Property Management Companies - Key Quantitative and Qualitative Insights

- 4.10.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.10.6 State of the Building Materials Industry and Partnerships with Key Developers

- 4.10.7 Insights on Key Strategic Real Estate Investors/Buyers in the Market

- 4.11 Porter's Five Forces

- 4.11.1 Bargaining Power of Suppliers

- 4.11.2 Bargaining Power of Buyers/Consumers

- 4.11.3 Threat of New Entrants

- 4.11.4 Threat of Substitute Products

- 4.11.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments & Condominiums

- 5.1.2 Villas & Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Business Model

- 5.3.1 Sales

- 5.3.2 Rental

- 5.4 By Mode of Sale

- 5.4.1 Primary (New-Build)

- 5.4.2 Secondary (Existing Home Resale)

- 5.5 By Key Cities

- 5.5.1 Berlin

- 5.5.2 Hamburg

- 5.5.3 Munich

- 5.5.4 Cologne

- 5.5.5 Frankfurt

- 5.5.6 Dusseldorf

- 5.5.7 Leipzig

- 5.5.8 Rest of Germany

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Vonovia SE

- 6.4.2 Deutsche Wohnen SE

- 6.4.3 LEG Immobilien SE

- 6.4.4 TAG Immobilien AG

- 6.4.5 Grand City Properties S.A.

- 6.4.6 Covivio Immobilien GmbH

- 6.4.7 Adler Group S.A.

- 6.4.8 Patrizia SE

- 6.4.9 Vivawest GmbH

- 6.4.10 SAGA Unternehmensgruppe Hamburg

- 6.4.11 Degewo AG

- 6.4.12 ABG Frankfurt Holding

- 6.4.13 GAG Immobilien AG

- 6.4.14 BUWOG GmbH

- 6.4.15 Heimstaden Germany GmbH

- 6.4.16 Consus Real Estate AG

- 6.4.17 Residia Care Holding GmbH & Co. KG

- 6.4.18 Wohnungsbaugenossenschaft Musikwinkel eG

- 6.4.19 Wertgrund Immobilien AG

- 6.4.20 Bayerische Versorgungskammer - Immobilien

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment