PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850150

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850150

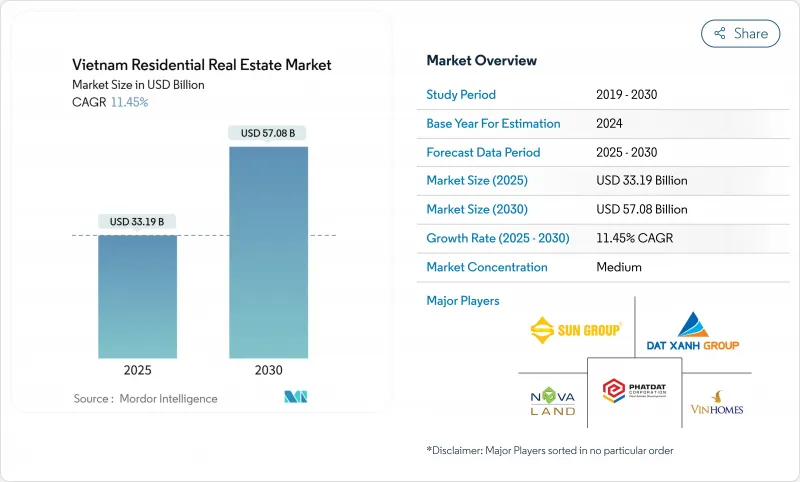

Vietnam Residential Real Estate - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

Vietnam residential real estate market size stands at USD 33.19 billion in 2025 and is forecast to reach USD 57.08 billion by 2030, translating into an 11.45% CAGR and signaling one of the most dynamic growth outlooks in Southeast Asia.

Demographic momentum, a steady flow of foreign direct investment into industrial corridors, and streamlined housing regulations together keep residential demand robust across price bands. Large-scale transport projects such as Ho Chi Minh City's Metro Line 2 and the planned Ring Road 4 are progressively pushing demand into peri-urban districts, broadening the geographic footprint of new supply. Villas and landed houses are beginning to close the growth gap with high-rise apartments as household wealth expands, while digital mortgage platforms that cut loan approval times below five days are lifting transaction velocity. Despite moderate fragmentation, the market benefits from professionalized developers whose integrated township models permit cross-subsidization of infrastructure and residential assets, limiting project-level risk exposure.

Vietnam Residential Real Estate Market Trends and Insights

Rising Urban Middle Class & Household Formation in Tier-1 and Tier-2 Cities

Vietnam's Q1 2025 GDP expansion was the strongest first-quarter performance since 2020, directly lifting disposable incomes and urban household formation. Young professionals in tier-2 cities such as Hai Phong are gaining purchasing power faster than their tier-1 peers because living costs remain lower, amplifying affordability. Developers have broadened project pipelines in these locations, confident that infrastructure investments will keep migration inflows steady. Construction activity registered a noticeable uptick in early 2025, mirroring the demand pipeline. The demographic dividend, therefore, delivers both immediate absorption and a durable buyer base, anchoring the Vietnam residential real estate market to long-term consumption fundamentals.

Surging FDI-Led Industrial Corridors Creating Housing Demand Near IZs

Foreign direct investment reached USD 2.4 billion in Q1 2025, a 46% year-over-year jump that is closely correlated with residential launches adjacent to industrial zones. Korean conglomerates are pioneering integrated industrial-residential ecosystems in northern provinces where expatriate engineers and local skilled workers prefer proximity housing. These clusters enjoy predictable take-up rates because factory start-ups trigger phased housing demand. As worker incomes rise, an upgrade cycle forms, stimulating mid-market and eventually high-end demand in the same micro-catchments. The industrial-housing nexus, therefore, embeds a self-reinforcing growth loop into the Vietnam residential real estate market.

Fragmented Land-Title System & Prolonged Red-Tape for Land-Use-Right Certificates

Developers frequently confront multi-step approvals to secure land-use-right certificates, delaying launches and adding holding costs. Novaland's legal clearance for nearly 7,000 units in Ho Chi Minh City highlights the administrative burden on even well-resourced firms. Although the 2024 Land Law introduces annual land-price lists to replace five-year cycles, the learning curve may lengthen processing times in the near term. The drag on project timelines can mute supply response, elevating prices and curbing affordability in the Vietnam residential real estate market.

Other drivers and restraints analyzed in the detailed report include:

- Relaxed Foreign Ownership Caps in 2023 Housing Law Amendments

- Rapid Expansion of MRT and Ring-Road Projects Unlocking Peripheral Land Banks

- Periodic Credit Caps on Real-Estate Lending by SBV

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Apartments and condominiums controlled 68% Vietnam residential real estate market share in 2024, primarily because high-rise formats optimize scarce urban land and match the lifestyle expectations of younger households. The Vietnam residential real estate market size for apartments is projected to stay dominant but expand at a slightly slower pace than landed products as demographic cohorts age. Villas and landed houses are on track for a 12.05% CAGR through 2030, underpinned by wealth accumulation and returning diaspora buyers seeking land ownership.

Hanoi registered a 9% quarter-over-quarter increase in primary apartment supply during Q1 2024, whereas Ho Chi Minh City saw a 35% quarterly drop because of delayed approvals, signaling regional imbalances. Rising secondary prices stimulate upgrade moves into larger units or suburban villas, narrowing the price gap. For developers, the landed segment offers premium margins per square meter and allows phased construction that aligns with demand absorption, a strategic hedge against approval volatility in the vertical segment.

Mid-market properties captured 45% of the Vietnam residential real estate market size in 2024 as they deliver an optimal mix of price and amenity for a widening middle class. Even so, the affordable category is forecast to expand at 13.11% CAGR up to 2030 as government social-housing quotas and reduced-interest mortgages lift eligibility for buyers under 35 years.

State Bank credit guidance steers capital toward affordable schemes, insulating the segment from macro-prudential tightening that weighs on luxury launches. Resolution 77, adopted in April 2025, further reduced clinker taxes to tame construction input costs, enabling developers to sustain unit prices without sacrificing margins. As the policy-driven supply ramp unfolds, developers equipped with standardized designs and modular construction methods will capture volume while meeting environmental and ESG targets.

The Vietnam Residential Real Estate Market is Segmented by Property Type (Apartments and Condominiums, and Villas and Landed Houses), by Price Band (Affordable, Mid-Market and Luxury), by Business Model (Sales and Rental), by Mode of Sale (Primary and Secondary), and by Key Cities and Provinces (Ho Chi Minh City, Hanoi, Danang, Hai Phong and More). The Market Forecasts are Provided in Terms of Value (USD)

List of Companies Covered in this Report:

- Vinhomes

- Novaland Group

- Dat Xanh Group

- Sun Group

- Phat Dat Corporation

- Hung Thinh Corporation

- Nam Long Investment Corporation

- Khang Dien House Trading and Investment

- Keppel Land Vietnam

- CapitaLand Development (Vietnam)

- Gamuda Land Vietnam

- FLC Group

- SonKim Land

- Phu My Hung Development

- An Gia Investment

- Ecopark Corporation

- BCG Land

- Masterise Homes

- VSIP / Becamex

- Rever (PropTech)

- CenLand

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Overview of the Economy and Market

- 4.2 Real Estate Buying Trends - Socioeconomic and Demographic Insights

- 4.3 Government Initiatives and Regulatory Aspects for the Residential Real Estate Sector

- 4.4 Focus on Technology Innovation, Startups, and PropTech in Real Estate

- 4.5 Insights into Rental Yields in Real Estate Segment

- 4.6 Real Estate Lending Dynamics

- 4.7 Insights Into Affordable Housing Support Provided by Government and Public-private Partnerships

- 4.8 Market Dynamics

- 4.8.1 Drivers

- 4.8.1.1 Rising Urban Middle Class and Household Formation in Tier-1 and Emerging Tier-2 Cities

- 4.8.1.2 Surging FDI-led Industrial Corridors Creating Housing Demand Near IZs

- 4.8.1.3 Relaxed Foreign Ownership Caps in 2023 Amendments to Housing Law

- 4.8.1.4 Rapid Expansion of MRT and Ring-Road Projects Unlocking Peripheral Land Banks

- 4.8.1.5 Growing Remittances (USD 14 Bn+) Channelled into Residential Assets

- 4.8.1.6 Digital Mortgage Platforms Reducing Time-to-Loan below 5 Days

- 4.8.2 Restraints

- 4.8.2.1 Fragmented Land-Title System and Prolonged Red-Tape for Land-Use-Right Certificates

- 4.8.2.2 Periodic Credit-Caps on Real-Estate Lending by SBV

- 4.8.2.3 High Construction-Input Inflation (Steel, Cement) vs. Flat Selling Prices

- 4.8.2.4 Vulnerability to Overseas Interest-Rate Cycles Impacting USD-Denominated Debt

- 4.8.1 Drivers

- 4.9 Value / Supply-Chain Analysis

- 4.9.1 Overview

- 4.9.2 Real estate developers and Contractors - Key Quantitative and Qualitative insights

- 4.9.3 Real estate brokers and agents - Key Quantitative and Qualitative insights

- 4.9.4 Property management companies --Key Quantitative and Qualitative insights

- 4.9.5 Insights on Valuation Advisory and Other Real Estate Services

- 4.9.6 State of the building materials industry and partnerships with key developers

- 4.9.7 Insights on key strategic real estate investors/buyers in the market

- 4.10 Porter's Five Forces

- 4.10.1 Bargaining Power of Suppliers

- 4.10.2 Bargaining Power of Buyers

- 4.10.3 Threat of New Entrants

- 4.10.4 Threat of Substitutes

- 4.10.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Property Type

- 5.1.1 Apartments and Condominiums

- 5.1.2 Villas and Landed Houses

- 5.2 By Price Band

- 5.2.1 Affordable

- 5.2.2 Mid-Market

- 5.2.3 Luxury

- 5.3 By Mode of Sale

- 5.3.1 Primary (New-Build)

- 5.3.2 Secondary (Existing Home Resale)

- 5.4 By Key Cities and Provinces

- 5.4.1 Ho Chi Minh City

- 5.4.2 Hanoi

- 5.4.3 Danang

- 5.4.4 Hai Phong

- 5.4.5 Rest of Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (MandA, JV, Land-Bank Acquisitions, IPOs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Vinhomes

- 6.4.2 Novaland Group

- 6.4.3 Dat Xanh Group

- 6.4.4 Sun Group

- 6.4.5 Phat Dat Corporation

- 6.4.6 Hung Thinh Corporation

- 6.4.7 Nam Long Investment Corporation

- 6.4.8 Khang Dien House Trading and Investment

- 6.4.9 Keppel Land Vietnam

- 6.4.10 CapitaLand Development (Vietnam)

- 6.4.11 Gamuda Land Vietnam

- 6.4.12 FLC Group

- 6.4.13 SonKim Land

- 6.4.14 Phu My Hung Development

- 6.4.15 An Gia Investment

- 6.4.16 Ecopark Corporation

- 6.4.17 BCG Land

- 6.4.18 Masterise Homes

- 6.4.19 VSIP / Becamex

- 6.4.20 Rever (PropTech)

- 6.4.21 CenLand

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment (Senior-Living, Green-Certified Homes, Co-Living)