PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940736

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940736

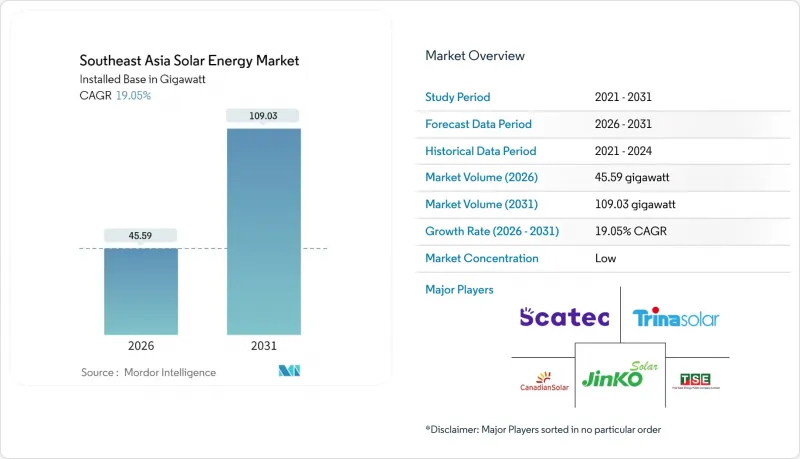

Southeast Asia Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Southeast Asia Solar Energy Market is expected to grow from 38.29 gigawatt in 2025 to 45.59 gigawatt in 2026 and is forecast to reach 109.03 gigawatt by 2031 at 19.05% CAGR over 2026-2031.

Falling module prices, rising carbon-neutral pledges, and widening retail-grid parity are reinforcing investment momentum across Vietnam, Indonesia, Thailand, the Philippines, Malaysia, Singapore, and Brunei. National auction programs priced between USD 0.04 and 0.05 per kWh have displaced new coal builds, while corporate renewable power purchase agreements (PPAs) are pulling commercial and industrial (C&I) demand forward. Grid integration remains a significant challenge, yet hybrid solar-plus-storage plants are mitigating curtailment risk, unlocking new ancillary service revenues, and enhancing project bankability. Heightened supply-chain bifurcation, triggered by anti-dumping duties on Chinese modules, and rising land-use conflicts in high-irradiance provinces are tempering near-term margins but are also spawning opportunities in floating solar and agrivoltaics.

Southeast Asia Solar Energy Market Trends and Insights

Accelerated National Renewable-Energy Targets and Carbon-Neutral Pledges

Revised power plans elevated regional solar targets in 2024 and are now anchored in energy-security economics rather than climate diplomacy. Vietnam's updated PDP VIII calls for 30 GW of utility-scale capacity. Indonesia has doubled its 2030 goal to 9.2 GW, and Thailand has lifted its renewable electricity commitment to 30% by 2030. Higher import costs for liquefied natural gas, averaging USD 14-16 per MMBtu in 2024, pushed solar to the top of least-cost supply stacks. The Philippines awarded 3.5 GW of contracts at record-low tariffs under its Green Energy Auction Program, signalling that transparent auctions can outcompete feed-in tariffs in capital attraction. Singapore's pledge to import 4 GW of renewables by 2035 has mobilized more than SGD 2 billion of cross-border transmission investment.

Rapid Cost Decline of Mono-PERC and TOPCon PV Modules

TOPCon module prices fell to USD 0.12-0.15 per W in 2024 as polysilicon costs slipped below USD 6 per kg, widening the performance gap with legacy PERC. Superior temperature coefficients deliver 4-6% higher annual yields in tropical heat, driving Vietnamese levelized costs down to USD 0.038-0.042 per kWh, well below new coal plants once environmental compliance is priced in. Indonesia's 145 MW Cirata floating project used bifacial TOPCon panels to capture 12-15% extra generation from water-surface albedo. Secondary markets for retired PERC modules are emerging across Myanmar and Cambodia, lowering entry barriers for off-grid electrification.

Land-Availability Conflicts in High-Irradiance Zones

Competition for farmland is elevating lease prices above USD 2,000 per hectare annually in Vietnam's Ninh Thuan and Binh Thuan provinces, eroding internal rates of return by up to 1.2 percentage points. Thailand withdrew 18,000 hectares of military land from solar allocation in 2024 to prioritize food security. Indonesia's environmental checks add almost one year to permitting for arrays larger than 10 hectares. Floating solar on reservoirs and agrivoltaic crop-sharing schemes are emerging workarounds, albeit at 18-22% capital-cost premiums.

Other drivers and restraints analyzed in the detailed report include:

- Grid-Parity Rooftop PV for Commercial and Industrial Users

- ASEAN Cross-Border Power-Trade Pilot

- Weak Distribution-Grid Infrastructure in Secondary Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Photovoltaic installations captured the entire Southeast Asia solar energy market in 2025, making concentrated solar power commercially unviable due to direct normal irradiance seldom exceeding 1,500 kWh per m2. TOPCon and heterojunction lines are pushing conversion efficiency to 24-25%, decreasing balance-of-system costs by USD 0.08-0.12 per W and sustaining a 19.12% CAGR forecast through 2031. The Southeast Asia solar energy market benefits from the scale of the Chinese supply chain: LONGi, Trina Solar, and JinkoSolar delivered landed costs 15-20% below global averages, enabling utility projects in Vietnam to clear auctions at USD 0.042-0.048 per kWh. Heterojunction modules carved out an 8% slice of premium rooftop demand in Singapore and Malaysia despite 25-30% price premiums, underscoring the willingness to pay for kW-density in space-constrained zones.

Thin-film cadmium-telluride technology gained only 2% share but posted better high-temperature yield in the Philippines' 150 MW Calatagan project. Perovskite-silicon tandem cells are transitioning from lab to field trials at Singapore's Solar Energy Research Institute and could enter commercial pilots by 2027, pending breakthroughs in humidity stability. Until then, crystalline silicon will continue to dominate the Southeast Asia solar energy market, with premium bifacial TOPCon projected to command more than 70% of shipments by 2031 as legacy PERC technologies retire.

The Southeast Asia Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), End-User (Utility-Scale, Commercial and Industrial, and Residential), and Geography (Vietnam, Indonesia, Philippines, Thailand, Malaysia, Singapore, and Rest of Southeast Asia). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW)

List of Companies Covered in this Report:

- Canadian Solar Inc.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Co. Ltd.

- LONGi Green Energy Technology Co. Ltd.

- Vena Energy Pte Ltd.

- Scatec ASA

- Thai Solar Energy PCL

- Blue Solar Co. Ltd.

- Sunseap Group Pte Ltd.

- AC Energy Corp.

- Sembcorp Industries Ltd.

- Cleantech Solar Energy Pte Ltd.

- First Solar Inc.

- Hanwha Q CELLS GmbH

- TotalEnergies Renewables Asia

- ENGIE South-East Asia

- Neoen SA

- Adaro Power

- PT Platinum Energy

- Solarie Energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated national RE targets & carbon-neutral pledges

- 4.2.2 Rapid cost decline of mono-PERC and TOPCon PV modules

- 4.2.3 Grid-parity rooftop PV for C&I users

- 4.2.4 ASEAN cross-border power-trade pilot (Lao-Thai-Malaysian-Singapore corridor)

- 4.2.5 Green-hydrogen export ambitions driving utility-scale solar pipelines

- 4.3 Market Restraints

- 4.3.1 Land-availability conflicts in high-irradiance zones

- 4.3.2 Weak distribution-grid infrastructure in secondary cities

- 4.3.3 Rising module-level import tariffs in Vietnam & Malaysia (trade-remedy risk)

- 4.3.4 Heightened cyclone-related asset-risk premiums in Philippines & Vietnam

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products & Services

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

- 5.5 By Geography

- 5.5.1 Vietnam

- 5.5.2 Indonesia

- 5.5.3 Philippines

- 5.5.4 Thailand

- 5.5.5 Malaysia

- 5.5.6 Singapore

- 5.5.7 Rest of South East Asia

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Canadian Solar Inc.

- 6.4.2 JinkoSolar Holding Co. Ltd.

- 6.4.3 Trina Solar Co. Ltd.

- 6.4.4 LONGi Green Energy Technology Co. Ltd.

- 6.4.5 Vena Energy Pte Ltd.

- 6.4.6 Scatec ASA

- 6.4.7 Thai Solar Energy PCL

- 6.4.8 Blue Solar Co. Ltd.

- 6.4.9 Sunseap Group Pte Ltd.

- 6.4.10 AC Energy Corp.

- 6.4.11 Sembcorp Industries Ltd.

- 6.4.12 Cleantech Solar Energy Pte Ltd.

- 6.4.13 First Solar Inc.

- 6.4.14 Hanwha Q CELLS GmbH

- 6.4.15 TotalEnergies Renewables Asia

- 6.4.16 ENGIE South-East Asia

- 6.4.17 Neoen SA

- 6.4.18 Adaro Power

- 6.4.19 PT Platinum Energy

- 6.4.20 Solarie Energy

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment