PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937436

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937436

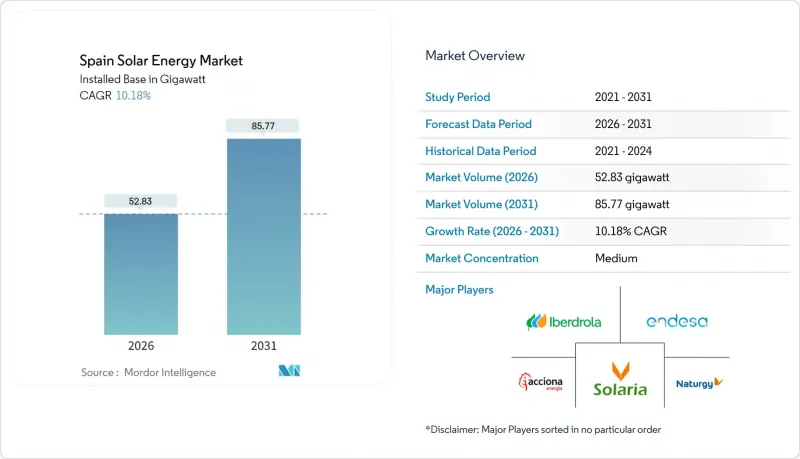

Spain Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Spain Solar Energy Market was valued at 47.95 gigawatt in 2025 and estimated to grow from 52.83 gigawatt in 2026 to reach 85.77 gigawatt by 2031, at a CAGR of 10.18% during the forecast period (2026-2031).

Rapid capacity growth already lifts solar to 21% of national electricity generation, well ahead of the European Union average, and places the country on a clear trajectory to meet its 76 GW solar PV target under the revised National Energy and Climate Plan. Declining module prices, accelerated permitting aligned with EU Fit-for-55 mandates, and strong corporate PPA appetite underpin momentum across the Spain solar energy market. Hybrid solar-and-storage configurations, especially in high-irradiance provinces, are emerging as a hedge against curtailment and price cannibalization. International developers are deepening commitments, as illustrated by TotalEnergies' 263 MW Sevilla cluster and Plenitude's 330 MW Renopool project, while grid congestion and Natura-2000 land constraints temper short-term volumes.

Spain Solar Energy Market Trends and Insights

Declining cost of utility-scale PV modules

Module prices continue to fall due to global oversupply, allowing projects in Castilla-La Mancha and Extremadura to reach competitive levelized costs even on lower-grade land. Bifacial panels paired with single-axis trackers now achieve capacity factors above 25%, widening the economic envelope for large ground-mounted plants. International utilities such as TotalEnergies cite capex savings of up to 15% compared with 2023 figures. Cost parity encourages hybridization with battery storage because freed capital can be reallocated to balance-of-system upgrades and energy management software. Local engineering firms report a notable shift toward 1,500 VDC system designs that cut cable losses and labor inputs. The net effect is an enlarged Spain solar energy market pipeline in regions previously on the economic margin.

EU Fit-for-55 & REPowerEU Compliance Deadlines

Binding 2030 decarbonization targets give developers regulatory certainty, accelerating auction participation and bankability. Spain authorized 22,326 MW of PV construction in 2024 and cleared an additional 3,019 MW in Q1 2025. Regulatory alignment extends to storage: behind-the-meter batteries now qualify for capacity revenues, improving cash flows for distributed assets. Regional authorities echo the national stance; the Junta de Andalucia fast-tracked grid interconnection for 1.4 GW of projects in 2025. Clear policy timelines minimize merchant-price risk, drawing foreign direct investment into the Spain solar energy market.

Land-Use Conflicts with Natura-2000 Conservation Areas

Protected zones cover about 30% of Spain and trigger full environmental impact studies for any project footprint larger than 5 hectares. Murcia alone plans 30,000 ha of PV by 2030, yet 60% lies on former cropland that faces organized opposition from farm cooperatives. Developers increasingly target brownfield sites such as disused mines, adding EUR 50,000-100,000/MW in remediation costs. Concentration in low-conflict land funnels capacity into regions already constrained by weak transmission, thereby amplifying curtailment risk.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPA Boom Among IBEX-35 Firms

- Grid-Connected Battery Hybrids Enhancing Project IRR

- Curtailment Risk from Inverter Saturation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic commanded 94.45% of the Spain solar energy market in 2025 and is expanding at a 10.45% CAGR to 2031, whereas CSP's PNIEC target has fallen to 4.8 GW. Lithium-ion batteries cost below USD 140/kWh in 2024 and enable two-to-four-hour storage at half the cost of molten-salt systems, so developers prioritise PV-plus-battery hybrids. Spain's solar energy market size for photovoltaic additions will therefore increase by more than 31 GW between 2025 and 2030.

CSP still offers industrial process heat at EUR 20-50/MWh, cheaper than volatile natural gas prices, and Spain hosts 2.3 GW of operating plants. Yet no new utility-scale CSP projects reached financial close in 2024. As utilities redeploy capital into bifacial PV with n-type cells that lift yield by 10-15%, CSP's share will shrink further.

The Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Iberdrola SA

- Acciona Energia

- Endesa (Enel Group)

- Solaria Energia y Medio Ambiente SA

- Repsol SA

- Engie Espana

- Naturgy Renovables

- Gransolar Group

- Soltec Power Holdings

- Cobra IS (ACS Group)

- RIC Energy

- Forestalia Renovables

- Prodiel

- Powertis (SPIC)

- Q-Energy

- X-Elio

- Opdenergy

- TotalEnergies Renewables Espana

- Sonnedix

- Fit Energy

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining cost of utility-scale PV modules

- 4.2.2 EU Fit-for-55 & REPowerEU compliance deadlines

- 4.2.3 Corporate PPA boom among IBEX-35 firms

- 4.2.4 Grid-connected battery hybrids enhancing project IRR

- 4.2.5 Agri-PV incentives in drought-stricken regions (Andalucia, Castilla-La Mancha)

- 4.2.6 Surge in self-consumption cooperatives (autoconsumo colectivo)

- 4.2.7 AI-optimised dispatch lifting merchant revenue capture

- 4.3 Market Restraints

- 4.3.1 Land-use conflicts with Natura-2000 conservation areas

- 4.3.2 Curtailment risk from inverter saturation in high-irradiance provinces

- 4.3.3 Volatile cannibalisation discounts in day-ahead pool

- 4.3.4 Lengthy municipal permitting for 2-axis trackers

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Iberdrola SA

- 6.4.2 Acciona Energia

- 6.4.3 Endesa (Enel Group)

- 6.4.4 Solaria Energia y Medio Ambiente SA

- 6.4.5 Repsol SA

- 6.4.6 Engie Espana

- 6.4.7 Naturgy Renovables

- 6.4.8 Gransolar Group

- 6.4.9 Soltec Power Holdings

- 6.4.10 Cobra IS (ACS Group)

- 6.4.11 RIC Energy

- 6.4.12 Forestalia Renovables

- 6.4.13 Prodiel

- 6.4.14 Powertis (SPIC)

- 6.4.15 Q-Energy

- 6.4.16 X-Elio

- 6.4.17 Opdenergy

- 6.4.18 TotalEnergies Renewables Espana

- 6.4.19 Sonnedix

- 6.4.20 Fit Energy

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment