PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939057

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939057

Vietnam Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

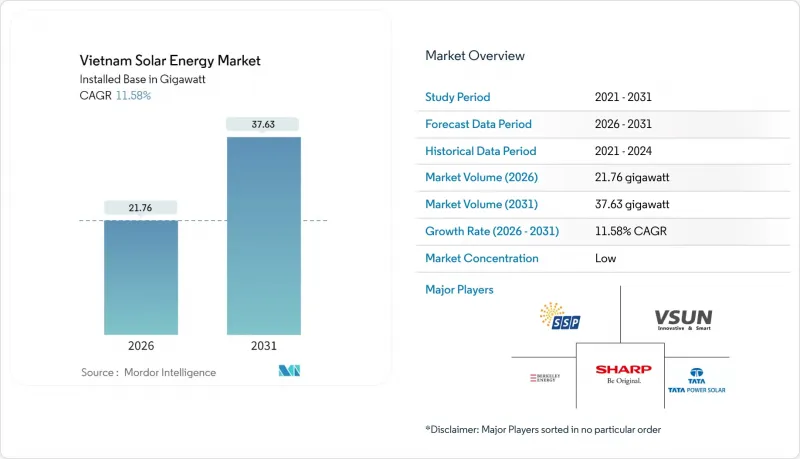

The Vietnam Solar Energy Market was valued at 19.5 gigawatt in 2025 and estimated to grow from 21.76 gigawatt in 2026 to reach 37.63 gigawatt by 2031, at a CAGR of 11.58% during the forecast period (2026-2031).

The upward curve reflects policy recalibration following the 2020 feed-in tariff (FIT) sunset, the expansion of Power Development Plan VIII (PDP8), and ongoing module-cost deflation. Competitive land auctions for floating arrays, the rollout of direct power-purchase agreements (DPPAs), and data-center procurement for 24X7 clean power underpin demand momentum, while transmission build-outs and FIT uncertainty temper near-term commissioning risk. Module capex fell 36% between 2020 and 2024, compressing utility-scale levelized costs below USD 0.04 per kWh in high-insolation provinces, and concessional climate-finance pipelines are amplifying the private sector's appetite. Despite grid congestion in the south and execution bottlenecks for large projects, hybrid solar-plus-storage mandates and corporate offtake commitments position the Vietnam solar energy market for double-digit growth through 2030.

Vietnam Solar Energy Market Trends and Insights

Power Development Plan VIII Upsizing Solar Target to 34 GW by 2030

Decision 768, issued in April 2025, reset the PDP8, raising the 2030 solar ceiling to 46.5-73.4 GW and mandating battery energy storage equal to at least 10% of the nameplate capacity with a 2-hour duration. Developers now finance lithium-ion arrays costing USD 200-250 per kWh, adding USD 40-50 million to a 100 MW plant, yet unlocking evening-peak tariffs 30-40% above midday rates. Ninh Thuan and Binh Thuan have streamlined permits for projects exceeding the storage threshold, whereas northern provinces lag due to weaker grid infrastructure. Electricity Vietnam estimates that USD 15 billion in new transmission is required to absorb PDP8 volumes, but the annual spend averages only USD 1.2 billion, implying that deployment will likely track the plan's lower bound. The policy nonetheless anchors long-term visibility for the Vietnam solar energy market, guiding provincial land auctions and private-sector financing structures.

Corporate PPAs & Green-Loan Pipelines Accelerating C&I Demand

Decree 80/2024 unlocked DPPAs for consumers topping 200,000 kWh per month, and within six months, 24 projects totaling 1.77 GW entered the approval queue. Textile, electronics, and food processors are chasing tariff hedges and ESG credentials, favoring virtual PPAs that avoid private-line build costs of USD 0.5-2 million per kilometer. The World Bank committed USD 500 million in 2024 for renewable integration, while the Asian Development Bank disbursed USD 1.7 billion during 2023-24 for rooftop solar and microgrids. Hyperscalers such as Google and Microsoft expect to contract close to 300 MW of dedicated solar by 2027 to meet 24X7 carbon-free goals. Although the 200,000 kWh threshold limits SME participation, the decree accelerates the commercial pivot within the Vietnam solar energy market.

Grid Congestion & Curtailment in Southern Vietnam

Solar output in Ninh Thuan and Binh Thuan already exceeds local demand, and the 500 kV backbone operates near thermal limits, forcing Electricity Vietnam to curtail up to 60% of excess generation in 2020. Curtailment averages 15-25% during dry-season peaks, undermining project returns. The planned HVDC reinforcement, worth USD 15 billion, will not be fully online until 2027, leaving new capacity exposed to dispatch risk. Lenders now insist on curtailment insurance, adding 50-75 basis-point spreads to debt. Mandatory 10% battery storage helps time-shift energy but cannot offset multi-day oversupply events, keeping this restraint a prominent drag on the Vietnam solar energy market.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Data-Center Build-Outs with 24X7 Renewables Procurement

- Declining Capex of Tier-1 PV Modules (-36% 2020-24)

- Uncertain FIT Step-Down & Price-Cap Regime

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic systems controlled the entire 19.5 GW base in 2025, and continued capex declines support an 11.58% CAGR to 2031. Concentrated solar power remains commercially unviable in Vietnam because the country lacks the direct-normal irradiance required for thermodynamic efficiency. Utility-scale ground mounts in Ninh Thuan utilize single-axis trackers to achieve 12-18% yield gains, whereas urban rooftops rely on module-level power electronics to minimize shading losses. Floating PV on hydropower reservoirs broadens the siting palette and leverages existing transmission. The rapid uptake of TOPCon and heterojunction modules, already accounting for 35% of 2024 shipments, reduces balance-of-system costs. CSP's higher capital intensity of USD 3,000-4,000 per kW, compared to USD 550-650 for PV, together with humidity-driven optical losses, negates its prospects through 2031, cementing photovoltaic primacy in the Vietnam solar energy market.

Innovation accelerates as developers deploy bifacial modules and DC-coupled batteries via hybrid inverters that yield round-trip efficiencies of 92-94%. String-inverter architectures are replacing central units in plants exceeding 50 MW, enhancing fault tolerance and facilitating incremental capacity additions. Battery mandates reshape procurement: 45 MW/90 MWh stacks paired with 450 MW solar farms now clear investment hurdles under peak-tariff spreads, signaling a hybridized roadmap for Vietnam's solar energy market.

The Vietnam Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Song Giang Solar Power JSC

- Vietnam Sunergy JSC

- Sharp Energy Solutions Corp.

- Tata Power Solar Systems Ltd

- Shire Oak International Ltd

- B.Grimm Power PCL

- VU Phong Energy Group JSC

- Longi Green Energy Technology Co. Ltd

- Trina Solar Co. Ltd

- Berkeley Energy C&I Solutions

- Trung Nam Group

- BIM Group (AC Renewables)

- Bamboo Capital - CME Solar

- Xuan Cau Holdings

- T&T Group

- SkyX Solar

- First Solar Inc.

- JA Solar Technology Co. Ltd

- Canadian Solar Inc.

- Sunseap (EDP Renewables)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Subsidised feed-in-tariffs (FiTs) & rooftop net-metering schemes

- 4.2.2 Power Development Plan VIII (PDP8) upsizing solar target to 34 GW by 2030

- 4.2.3 Corporate PPAs & Green-loan pipelines accelerating C&I demand

- 4.2.4 Declining capex of Tier-1 PV modules (-36 % 2020-24)

- 4.2.5 Surge in data-centre build-outs with 24 X 7 renewables procurement

- 4.2.6 Provincial land-use auctions favouring floating PV on irrigation reservoirs

- 4.3 Market Restraints

- 4.3.1 Grid congestion & curtailment in Southern Vietnam

- 4.3.2 Uncertain FIT step-down & price-cap regime

- 4.3.3 Shortage of local tier-1 EPC capacity post-2026

- 4.3.4 Investor scepticism over roof structural integrity for large C&I systems

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Song Giang Solar Power JSC

- 6.4.2 Vietnam Sunergy JSC

- 6.4.3 Sharp Energy Solutions Corp.

- 6.4.4 Tata Power Solar Systems Ltd

- 6.4.5 Shire Oak International Ltd

- 6.4.6 B.Grimm Power PCL

- 6.4.7 VU Phong Energy Group JSC

- 6.4.8 Longi Green Energy Technology Co. Ltd

- 6.4.9 Trina Solar Co. Ltd

- 6.4.10 Berkeley Energy C&I Solutions

- 6.4.11 Trung Nam Group

- 6.4.12 BIM Group (AC Renewables)

- 6.4.13 Bamboo Capital - CME Solar

- 6.4.14 Xuan Cau Holdings

- 6.4.15 T&T Group

- 6.4.16 SkyX Solar

- 6.4.17 First Solar Inc.

- 6.4.18 JA Solar Technology Co. Ltd

- 6.4.19 Canadian Solar Inc.

- 6.4.20 Sunseap (EDP Renewables)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment