PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938987

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1938987

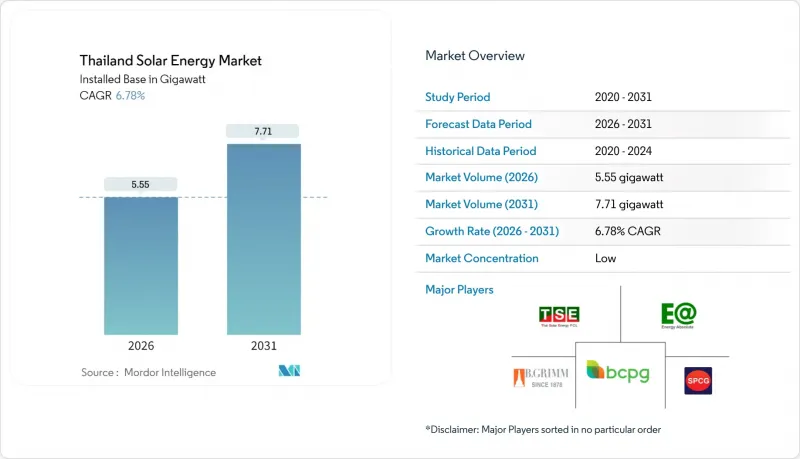

Thailand Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand Solar Energy Market is expected to grow from 5.20 gigawatt in 2025 to 5.55 gigawatt in 2026 and is forecast to reach 7.71 gigawatt by 2031 at 6.78% CAGR over 2026-2031.

Continued tariff pressure, renewable energy policy targets, and declining photovoltaic costs position the Thai solar energy market for steady growth, despite grid infrastructure bottlenecks. A 2,000 MW direct power purchase pilot, approved in 2024, is opening an alternative procurement pathway for data centers and large manufacturers, which shortens sales cycles for independent power producers. Module prices that fell to USD 0.10-0.12 per watt in 2024 trimmed commercial payback periods to five to seven years, enhancing bankability across all customer classes. Floating-solar hybrid projects planned for nine hydroelectric reservoirs will add 2.7 GW of incremental capacity, circumventing land-acquisition hurdles that limit the use of ground-mounted sites. Solar leasing models and simplified licensing for systems below 1 MW are driving a residential installation boom in Bangkok and peri-urban provinces, signaling broader democratization of solar access.

Thailand Solar Energy Market Trends and Insights

Rising Retail-Grid Tariffs and Electricity-Price Volatility

Retail tariffs remained at THB 4.15-4.18 per kWh in 2024; however, the Electricity Generating Authority of Thailand reported cumulative losses of nearly THB 98 billion, suggesting an 8-12% tariff hike by late 2025 is likely. Manufacturers in the Eastern Economic Corridor now view rooftop solar as a hedge against gas price swings, as a typical 1 MW installation pays for itself within seven years. Data from the Energy Policy and Planning Office show that gas-fired units still supply about 60% of the grid's electricity, linking tariffs to spot LNG imports. Commercial buyers facing European Union carbon-border fees have accelerated solar procurement to protect export margins. The resulting demand is giving the Thai solar energy market fresh momentum across both on-site and third-party financed systems.

Rapid Cost Decline of Bifacial and TOPCon PV Modules

Average bifacial module prices declined to USD 0.10-0.12 per watt in 2024, while TOPCon cells achieved 24-25% efficiencies at only marginally higher costs. Developers now negotiate multi-year supply contracts, locking in component prices to 2027 and stabilizing levelized energy costs. Lower capital intensity has enabled smaller rooftops to achieve five-year paybacks even under net-billing. Oversupply in Chinese factories diverted products to Southeast Asia, further pushing down local prices. Although United States antidumping tariffs on Thai-assembled panels reshuffled export channels in 2024, domestic oversupply created broader price relief for local projects.

Long-Cycle Grid-Connection Approvals and Curtailment Risks

Developers report approval times of six to eighteen months because utilities must conduct voltage-stability studies and substation-capacity reviews before granting interconnection. Projects larger than 10 MW also require environmental impact assessments and National Energy Policy Council sign-offs, which extend pre-construction periods and increase holding costs. In 2024, curtailment events totaled up to fifty hours in feeders where solar penetration exceeded 18% of daytime demand. Absent real-time pricing or mandatory storage, over-generation causes forced shutdowns that undermine project revenue. These obstacles shave nearly one percentage point off forecast growth.

Other drivers and restraints analyzed in the detailed report include:

- Direct PPA Pilot Opening Commercial and Industrial Demand

- Government Push for 2.7 GW Floating-Solar Hybrids

- Saturated Feeders in Bangkok and Eastern Economic Corridor

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Photovoltaic systems accounted for 100.00% of the installed capacity in 2025 and are expected to expand at a 6.72% growth rate through 2031. The Thailand solar energy market size for photovoltaic technology reached 5.20 GW in 2025 and is expected to reach 7.71 GW by 2031, maintaining a significant share, as concentrated solar power remains economically impractical under Thailand's humid climate. Bifacial modules that capture reflected irradiance are quickly becoming standard in floating-solar tenders, with the Ubolratana project registering 5-8% higher output than monofacial arrays. TOPCon cells, which offer 24-25% conversion efficiency, are overtaking PERC modules in utility-scale bids where land constraints justify premium pricing.

Continuous cost declines widen the economic gap between photovoltaic and concentrated solar power, which needs direct-normal-irradiance levels rarely achieved in the monsoon season. The Ministry of Energy's 2024 feed-in-tariff schedule excludes concentrated solar power, effectively cementing photovoltaics' monopoly. Looking forward, International Energy Agency data project module prices dropping another 15-20% by 2027, ensuring photovoltaic technologies remain the only commercially viable solar option in Thailand.

The Thailand Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- SPCG PLC

- BCPG PLC

- Thai Solar Energy PLC

- B.Grimm Power PLC

- Energy Absolute PLC

- Solartron PLC

- Delta Electronics (Thailand) PLC

- Huawei Technologies Co. Ltd.

- Sungrow Power Supply Co. Ltd.

- JinkoSolar Holding Co. Ltd.

- Trina Solar Co. Ltd.

- LONGi Green Energy Co. Ltd.

- Canadian Solar Inc.

- First Solar Inc.

- Risen Energy Co. Ltd.

- Seraphim Solar Group

- Sharp Energy Solutions Corp.

- Hitachi Energy Thailand

- Black & Veatch Holding Co.

- Marubeni Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising retail-grid tariffs & electricity-price volatility

- 4.2.2 Rapid cost decline of bifacial & TOPCon PV modules

- 4.2.3 Direct-PPA pilot opening C&I demand flood-gates

- 4.2.4 Government push for 2.7 GW floating-solar hybrids

- 4.2.5 Agro-PV programs easing land-acquisition risks

- 4.2.6 Growing demand for green RECs from export-oriented firms

- 4.3 Market Restraints

- 4.3.1 Long-cycle grid-connection approvals & curtailment risks

- 4.3.2 Saturated feeders in Bangkok & Eastern Economic Corridor

- 4.3.3 Rising import tariffs on Thai modules in US/EU markets

- 4.3.4 Limited domestic Li-ion cell production for BESS

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 SPCG PLC

- 6.4.2 BCPG PLC

- 6.4.3 Thai Solar Energy PLC

- 6.4.4 B.Grimm Power PLC

- 6.4.5 Energy Absolute PLC

- 6.4.6 Solartron PLC

- 6.4.7 Delta Electronics (Thailand) PLC

- 6.4.8 Huawei Technologies Co. Ltd.

- 6.4.9 Sungrow Power Supply Co. Ltd.

- 6.4.10 JinkoSolar Holding Co. Ltd.

- 6.4.11 Trina Solar Co. Ltd.

- 6.4.12 LONGi Green Energy Co. Ltd.

- 6.4.13 Canadian Solar Inc.

- 6.4.14 First Solar Inc.

- 6.4.15 Risen Energy Co. Ltd.

- 6.4.16 Seraphim Solar Group

- 6.4.17 Sharp Energy Solutions Corp.

- 6.4.18 Hitachi Energy Thailand

- 6.4.19 Black & Veatch Holding Co.

- 6.4.20 Marubeni Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment