PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910489

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910489

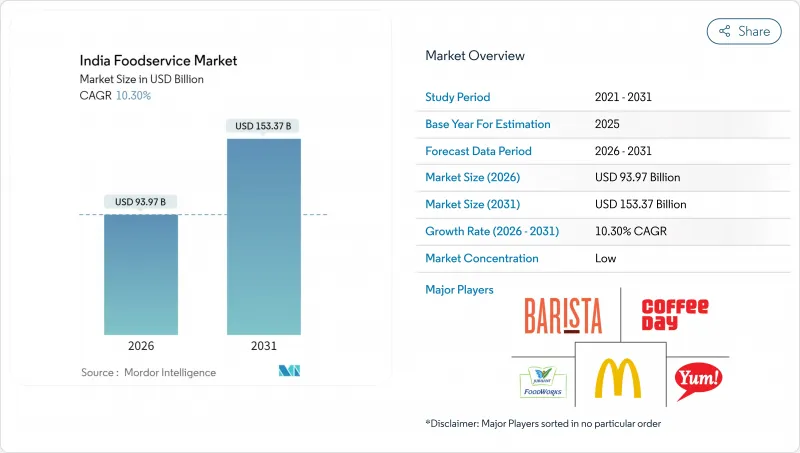

India Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The India foodservice market is expected to grow from USD 85.19 billion in 2025 to USD 93.97 billion in 2026 and is forecast to reach USD 153.37 billion by 2031 at 10.3% CAGR over 2026-2031.

The expansion of digital payments, urban migration, and the steady rise of working women are reshaping household consumption, steering demand toward prepared meals and technology-enabled ordering. The India foodservice market continues to split between experience-oriented full-service outlets and convenience-led delivery models, while cloud kitchens win share through lower overheads and data-driven menu optimization. Growing domestic tourism, improved highway infrastructure, and airport upgrades broaden the India foodservice market footprint beyond metropolitan cores. Meanwhile, aggregator platforms deepen penetration in tier-2 and tier-3 cities, catalyzing franchise investments and widening the market's geographic base. Heightened FSSAI (Food Safety and Standards Authority of India) scrutiny pushes operators to formalize hygiene protocols, raising barriers for unorganized vendors and nudging them toward licensing compliance

India Foodservice Market Trends and Insights

Increasing dining out and convenience food consumption

Rising dining-out frequency and growing consumption of convenience foods are key structural drivers of India's foodservice market, as urban consumers balance longer working hours, commuting time and nuclear family living with higher disposable incomes and aspirational lifestyles. Eating out has shifted from an occasional treat to a routine social and lifestyle activity, especially among millennials and Gen Z, boosting demand for quick-service restaurants, cafes, casual dining and food courts in malls and transit hubs. In parallel, strong growth in convenience formats ready-to-eat and ready-to-cook meals, frozen snacks and delivery-friendly items supports foodservice operators by enabling faster turnarounds, standardized quality and efficient delivery and takeaway models, including cloud kitchens and aggregator-led online ordering. Together, these shifts expand average transaction frequency, increase per-capita spend on out-of-home food, and encourage rapid chain expansion into tier 2 and tier 3 cities, underpinning robust double-digit growth expectations for India's foodservice industry over the medium term.

Growing tourism and business travel boosting demand for hotels and restaurants

Growing tourism and business travel have significantly boosted demand for hotels and restaurants in India, with the country recording approximately 56 lakh Foreign Tourist Arrivals (FTAs) till August 2025 according to the Press Information Bureau, Ministry of Tourism. This influx of international visitors has fueled the expansion of the foodservice market as hotels, resorts, and standalone restaurants experience increased patronage. Culinary tourism, where travelers seek authentic local food experiences, has become a key attraction, encouraging establishments to offer region-specific cuisines and immersive dining. The surge in travel not only raises demand for quality food and beverage services but also stimulates economic growth by creating jobs and supporting local food ecosystems. India's strategic focus on combining culinary experiences with tourism continues to enhance the overall appeal of the foodservice industry through vibrant gastronomic offerings and hospitality excellence.

Stringent food safety and hygiene regulations

Stringent food safety and hygiene regulations pose a significant restraint to the growth of India's foodservice market, as compliance demands can be complex and costly for operators. The Food Safety and Standards Authority of India (FSSAI) enforces rigorous standards covering hygiene, sanitation, food handling, labeling, and packaging to protect public health and ensure quality. All food businesses, from street vendors to large restaurant chains, must obtain an FSSAI license, prominently display their license details, and adhere to detailed requirements such as temperature controls, allergen management, and regular inspections. While these regulations build consumer trust and safeguard health, the evolving and stringent compliance landscape also increases operational challenges and entry barriers for many foodservice providers, particularly smaller players.

Other drivers and restraints analyzed in the detailed report include:

- Investments in infrastructure and government support for the hospitality sector

- Increasing penetration of smartphones facilitating online ordering and delivery

- Intense competition among unorganized and organized players

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full-service restaurants (FSRs) dominated the India foodservice market, holding the largest market share of 43.33% in 2025. This segment's leading position is driven by its ability to offer a comprehensive dining experience that combines a comfortable ambiance, personalized waiter service, and an extensive variety of cuisines. FSRs appeal to a broad customer base, including families, business professionals, and social groups who seek leisurely and upscale dining occasions. The growth of this segment is also fueled by rising disposable incomes and increasing urbanization across India, encouraging consumers to dine out more frequently. Furthermore, FSRs generate higher revenues per customer due to multi-course meals and significant beverage sales, positioning them as a premium segment within the market. Their adaptability in providing both traditional regional dishes and international cuisines allows them to cater to India's culturally diverse population, ensuring sustained demand and growth.

The cloud kitchen segment represents the fastest-growing foodservice format in India, advancing at an impressive compound annual growth rate (CAGR) of 18.29% through 2031. This rapid expansion is primarily driven by the surge in demand for convenient, on-demand food delivery enabled by the widespread adoption of digital ordering platforms and mobile apps. Cloud kitchens benefit from lower operational costs compared to traditional dine-in restaurants since they operate without storefronts, focusing exclusively on food preparation and delivery. Investors and food tech companies are actively fueling growth in this sector, especially in metropolitan areas with tech-savvy consumers. Additionally, cloud kitchens allow foodservice operators to experiment with diverse menus and niche cuisines without the heavy investment usually required for physical outlets. This agility combined with the increasing preference for home delivery among younger demographics positions cloud kitchens as a transformational force reshaping the Indian foodservice landscape.

Independent players dominated the India foodservice market by outlet type, controlling a substantial 64.76% share in 2025. This segment's dominance is largely attributed to its deep roots in local communities and its ability to offer personalized dining experiences that resonate with regional tastes and preferences. Independent outlets typically showcase a diverse range of cuisines, often experimenting with fusion and innovative dishes tailored to local palates. These establishments benefit from their flexibility in menu design, pricing strategies, and rapid responsiveness to consumer trends and feedback. Being often owner-managed, independent outlets provide attentive customer service and cultivate strong customer loyalty. Additionally, their relatively lower overhead costs compared to chained counterparts allow them to operate competitively across both urban and rural areas, supporting their strong market presence.

On the other hand, chained concepts represent the fastest-growing segment within the Indian foodservice market, forecasted to expand at a CAGR of approximately 10.78% through 2031. This growth surge is fueled by increasing brand awareness, standardization of food quality, and efficient operational models that resonate with the evolving urban consumer's preference for consistent and convenient dining options. Chain outlets, including quick-service restaurants (QSRs) and limited-service formats, are rapidly expanding their footprint beyond metropolitan areas into tier-2 and tier-3 cities, tapping into new consumer bases driven by rising disposable incomes and changing lifestyles. The scalability and marketing prowess of chained players enable them to leverage technology platforms effectively, enhancing customer engagement through loyalty programs and digital ordering. The ongoing urbanization, lifestyle shifts, and preference for branded, hygienic food options further accelerate the adoption and growth of the chained segment.

The India Foodservice Market Report is Segmented by Foodservice Type (Cafes and Bars, Cloud Kitchens, Full-Service Restaurants, Quick-Service Restaurants), Outlet (Chained Outlets and Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, Delivery), and Geography (India). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Jubilant FoodWorks Ltd

- Yum! Brands Inc

- McDonald's Corporation

- Barista Coffee Company Limited

- Coffee Day Enterprises Ltd

- Barbeque Nation Hospitality Ltd

- Doctor's Associates Inc (Subway)

- Graviss Foods Pvt Ltd (Baskin Robbins)

- Gujarat Cooperative Milk Marketing Federation

- Haldiram Foods Pvt Ltd

- Hotel Saravana Bhavan

- Impresario Entertainment & Hospitality Pvt Ltd

- Mountain Trail Foods Pvt Ltd (Chai Point)

- Rebel Foods

- Restaurant Brands Asia Ltd

- Tata Starbucks Pvt Ltd

- Wow! Momo Foods Pvt Ltd

- Paradise Food Court

- Keventers

- Burger Singh

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 INDUSTRT TREND ANALYSIS

- 4.1 Number of Outlets

- 4.2 Average Order Value

- 4.3 Menu Analysis

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Increasing dining out and convenience food consumption

- 5.2.2 Increasing westernization and food variety preferences

- 5.2.3 Growing tourism and business travel boosting demand for hotels and restaurants

- 5.2.4 Investments in infrastructure and government support for the hospitality sector

- 5.2.5 Rising number of working women and dual-income households

- 5.2.6 Increasing penetration of smartphones facilitating online ordering and delivery

- 5.3 Market Restraints

- 5.3.1 Stringent food safety and hygiene regulations

- 5.3.2 Inconsistent quality and supply chain issues

- 5.3.3 Intense competition among unorganized and organized players

- 5.3.4 Cultural and regional food preferences limiting standardization

- 5.4 Consumer Behavior Analysis

- 5.5 Regulatory Landscape

- 5.6 Porter's Five Forces

- 5.6.1 Threat of New Entrants

- 5.6.2 Bargaining Power of Buyers/Consumers

- 5.6.3 Bargaining Power of Suppliers

- 5.6.4 Threat of Substitute Products

- 5.6.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Foodservice Type

- 6.1.1 Cafes and Bars

- 6.1.1.1 Bars and Pubs

- 6.1.1.2 Cafes

- 6.1.1.3 Juice/Smoothie/Dessert Bars

- 6.1.1.4 Specialist Coffee and Tea Shops

- 6.1.2 Cloud Kitchens

- 6.1.3 Full-Service Restaurants

- 6.1.3.1 Asian

- 6.1.3.2 European

- 6.1.3.3 Latin American

- 6.1.3.4 Middle Eastern

- 6.1.3.5 North American

- 6.1.3.6 Other FSR Cuisines

- 6.1.4 Quick-Service Restaurants

- 6.1.4.1 Bakeries

- 6.1.4.2 Burger

- 6.1.4.3 Ice-cream

- 6.1.4.4 Meat-based Cuisines

- 6.1.4.5 Pizza

- 6.1.4.6 Other QSR Cuisines

- 6.1.1 Cafes and Bars

- 6.2 Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 Location

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Standalone

- 6.3.5 Travel

- 6.4 Service Type

- 6.4.1 Dine-in

- 6.4.2 Takeaway

- 6.4.3 Delivery

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Ranking Analysis

- 7.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 7.4.1 Jubilant FoodWorks Ltd

- 7.4.2 Yum! Brands Inc

- 7.4.3 McDonald's Corporation

- 7.4.4 Barista Coffee Company Limited

- 7.4.5 Coffee Day Enterprises Ltd

- 7.4.6 Barbeque Nation Hospitality Ltd

- 7.4.7 Doctor's Associates Inc (Subway)

- 7.4.8 Graviss Foods Pvt Ltd (Baskin Robbins)

- 7.4.9 Gujarat Cooperative Milk Marketing Federation

- 7.4.10 Haldiram Foods Pvt Ltd

- 7.4.11 Hotel Saravana Bhavan

- 7.4.12 Impresario Entertainment & Hospitality Pvt Ltd

- 7.4.13 Mountain Trail Foods Pvt Ltd (Chai Point)

- 7.4.14 Rebel Foods

- 7.4.15 Restaurant Brands Asia Ltd

- 7.4.16 Tata Starbucks Pvt Ltd

- 7.4.17 Wow! Momo Foods Pvt Ltd

- 7.4.18 Paradise Food Court

- 7.4.19 Keventers

- 7.4.20 Burger Singh

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK