PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911776

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911776

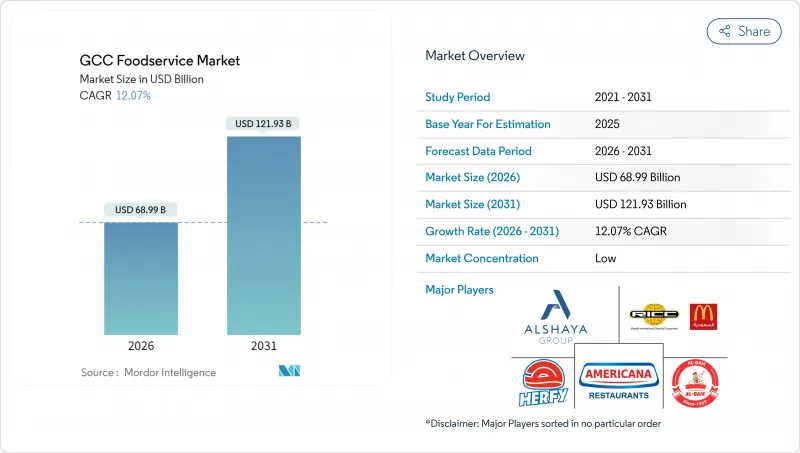

GCC Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC foodservice market was valued at USD 61.55 billion in 2025 and estimated to grow from USD 68.99 billion in 2026 to reach USD 121.93 billion by 2031, at a CAGR of 12.07% during the forecast period (2026-2031).

Robust expansion reflects Vision 2030-led economic diversification, sovereign-backed manufacturing localization, tourism build-outs, and technology adoption that improves operating efficiency. Quick service restaurants (QSRs) keep momentum by pairing standardized menus with rapid roll-outs, while cloud kitchens scale profitably on low real-estate footprints and data-driven production. Chain operators consolidate purchasing power and technology budgets, yet independents retain niches through hyper-local flavors and experiential formats. Geographic growth pivots on Saudi Arabia's mega-projects and the UAE's logistics advantages, while smaller Gulf states capture spillover demand and specialty tourism. Capital flows from regional sovereign funds into processing plants and international franchise rights strengthen upstream resilience and reduce import exposure.

GCC Foodservice Market Trends and Insights

Rapid expansion of quick-service chains

The acceleration of QSR expansion across the GCC reflects strategic positioning ahead of Vision 2030 tourism targets, with Saudi Arabia aiming for 150 million visitors annually. ALBAIK's expansion into Pakistan through Gas & Oil Pakistan Limited demonstrates how regional chains leverage established operational frameworks to capture growth beyond traditional markets. Pickl's MENA expansion with Sky Restaurants and BonBird's Oman entry illustrate how emerging brands capitalize on franchise models to achieve rapid geographic coverage while maintaining quality standards. The trend accelerates as mega-projects like NEOM create concentrated demand nodes, with Sindalah alone generating 38 culinary outlets and 3,500 hospitality jobs. This expansion pattern suggests QSR growth will outpace traditional dining formats as operators prioritize scalable, standardized concepts that can serve both local populations and international visitors. Regulatory compliance with Dubai Municipality's FoodWatch platform and similar systems across the GCC ensures operational consistency while enabling rapid deployment across multiple jurisdictions.

Rising tourism linked to mega-events (Expo City, Vision 2030)

Tourism-driven foodservice demand intensifies as the UAE welcomed 17.15 million international visitors in 2023, while Saudi Arabia's Vision 2030 targets create unprecedented hospitality infrastructure requirements. The Red Sea Project's 50 resorts and 8,000 hotel rooms by 2030, combined with NEOM's multiple hospitality developments, establish new consumption centers that require diverse F&B offerings from quick-service to ultra-luxury dining. Dubai Exhibition Centre's USD 10 billion expansion doubles events capacity, creating sustained demand for catering and hospitality services that extends beyond traditional seasonal patterns. The strategic positioning of these developments along key transportation corridors ensures accessibility for international visitors while creating employment opportunities that support local economic diversification. Gulfood 2026's expansion to two venues with new F&B sectors demonstrates how trade events themselves become demand drivers, requiring specialized catering capabilities and creating networking opportunities that generate additional business relationships. The regulatory framework supporting these developments includes streamlined licensing processes and international compliance standards that facilitate foreign investment and operational partnerships.

High real-estate rents in premium retail zones

Commercial real estate costs create operational pressures as Dubai F&B retail rents increased 10.5% in 2024, with Abu Dhabi experiencing 14.7% growth, forcing operators to reconsider location strategies and operational models. Strong demand from F&B tenants encounters limited quality stock in core locations, creating bidding wars that favor established chains with stronger balance sheets over independent operators. Industrial and logistics rents also surge, with Dubai recording 14.3% increases that affect supply chain costs and cloud kitchen operations seeking cost-effective locations. The trend drives innovation in space utilization, with restaurants adopting smaller footprints, shared kitchen concepts, and technology-enabled service models that reduce labor requirements. This constraint particularly impacts mid-market operators who lack the scale advantages of major chains or the flexibility of cloud-only concepts, potentially accelerating market consolidation. Regulatory frameworks in Dubai and Abu Dhabi provide some relief through streamlined licensing processes and zoning flexibility, but fundamental supply-demand imbalances persist in premium locations.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce integrations driving cloud-kitchen demand

- Growth of healthy/functional menus

- Growing "eat-at-home" preference post-inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quick Service Restaurants command 45.93% market share in 2025, reflecting consumer preferences for convenience, standardized quality, and value pricing that align with the region's diverse expatriate population and growing tourism sector. Major QSR expansions demonstrate this segment's resilience, with ALBAIK extending operations to Pakistan and Pickl partnering with Sky Restaurants for MENA-wide growth, leveraging proven operational frameworks to capture market share across multiple jurisdictions. The segment benefits from streamlined regulatory compliance through platforms like Dubai Municipality's FoodWatch system, enabling rapid deployment while maintaining food safety standards. Franchise models accelerate expansion by reducing capital requirements while ensuring operational consistency, particularly valuable in markets where local partnerships facilitate regulatory navigation and cultural adaptation.

Cloud Kitchens emerge as the fastest-growing segment at 12.28% CAGR through 2031, driven by high real estate costs and evolving consumer preferences for delivery-optimized dining experiences. The Cloud's USD 12 million Series B funding demonstrates investor confidence in delivery-only formats that address operational efficiency challenges while serving the UAE's AED 5 billion online food delivery market. These operations benefit from Dubai's new guidelines for online food delivery platforms, which mandate transparency in commission structures and prevent anti-competitive practices that previously disadvantaged smaller operators. Cloud kitchens achieve 35% lower overhead costs compared to traditional restaurants while serving consumers who order online at least weekly, creating sustainable demand for technology-enabled food production and delivery models.

Chained outlets dominate with 57.76% market share in 2025 while maintaining 12.45% growth momentum through 2031, demonstrating the competitive advantages of scale, standardization, and brand recognition in fragmented markets. Major acquisitions like Lavoya Restaurant Group's Em Sherif Deli franchise and Americana's USD 100 million investment with Farm Frites illustrate how established chains leverage operational expertise and financial resources to expand geographic coverage and menu offerings. Chain operators benefit from economies of scale in procurement, marketing, and technology implementation that enable competitive pricing while maintaining quality standards across multiple locations. The regulatory environment favors chains through streamlined licensing processes and compliance frameworks that reward systematic operational approaches.

Independent outlets face increasing pressure from rising real estate costs and operational complexity, yet maintain relevance through specialized offerings and local market knowledge that chains struggle to replicate. Dubai's commercial real estate transactions grew 23% year-over-year in Q1 2024, creating bidding wars that favor financially stronger chain operators over independent restaurants with limited capital resources. Independent operators increasingly adopt franchise models or seek acquisition by larger chains to access operational support and financial resources necessary for growth. Technology adoption becomes critical for independent survival, with cloud-based POS systems and delivery platform integration enabling competitive service levels while managing operational costs.

The GCC Foodservice Market Report is Segmented by Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, Delivery), and Geography (GCC Countries). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Al Tazaj Fakeih

- Alamar Foods Co.

- ALBAIK Food Systems Co. SA

- Americana Restaurants International PLC

- Galadari Ice Cream Co. Ltd LLC

- Herfy Food Service Co.

- Kudu Co. for Food & Catering

- LuLu Group International

- MH Alshaya Co. WLL

- Nando's Group Holdings Ltd

- Riyadh International Catering Corp.

- Shahia Food Ltd Co. (Tim Hortons GCC)

- The Sultan Center

- McDonald's GCC

- Subway Arabia

- Starbucks MENA (Alshaya)

- Krispy Kreme GCC

- Five Guys Middle East

- Papa John's GCC

- Caribou Coffee GCC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 EXECUTIVE SUMMARY

4 Market landscape

- 4.1 Market Overview

- 4.2 KEY INDUSTRY TRENDS

- 4.2.1 Number Of Outlets

- 4.2.2 Average Order Value

- 4.2.3 Menu Analysis

- 4.3 Market Drivers

- 4.3.1 Rapid expansion of quick-service chains

- 4.3.2 Rising tourism linked to mega-events (Expo City, Vision 2030)

- 4.3.3 E-commerce integrations driving cloud-kitchen demand

- 4.3.4 Growth of healthy/functional menus

- 4.3.5 AI-optimised demand forecasting for inventory cuts

- 4.3.6 Sovereign-fund investment in domestic F&B manufacturing

- 4.4 Market Restraints

- 4.4.1 High real-estate rents in premium retail zones

- 4.4.2 Growing -eat-at-home- preference post-inflation

- 4.4.3 Tightening labour-nationalisation quotas

- 4.4.4 Import-dependent supply-chain volatility

- 4.5 Regulatory lanscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Foodservice Type

- 5.1.1 Cafes & Bars

- 5.1.1.1 By Cuisine

- 5.1.1.1.1 Bars & Pubs

- 5.1.1.1.2 Cafes

- 5.1.1.1.3 Juice/Smoothie/Desserts Bars

- 5.1.1.1.4 Specialist Coffee & Tea Shops

- 5.1.1.1 By Cuisine

- 5.1.2 Cloud Kitchen

- 5.1.3 Full Service Restaurants

- 5.1.3.1 By Cuisine

- 5.1.3.1.1 Asian

- 5.1.3.1.2 European

- 5.1.3.1.3 Latin American

- 5.1.3.1.4 Middle Eastern

- 5.1.3.1.5 North American

- 5.1.3.1.6 Other FSR Cuisines

- 5.1.3.1 By Cuisine

- 5.1.4 Quick Service Restaurants

- 5.1.4.1 By Cuisine

- 5.1.4.1.1 Bakeries

- 5.1.4.1.2 Burger

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Meat-based Cuisines

- 5.1.4.1.5 Pizza

- 5.1.4.1.6 Other QSR Cuisines

- 5.1.4.1 By Cuisine

- 5.1.1 Cafes & Bars

- 5.2 Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

- 5.4 Service Type

- 5.4.1 Dine-in

- 5.4.2 Takeaway

- 5.4.3 Delivery

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Al Tazaj Fakeih

- 6.4.2 Alamar Foods Co.

- 6.4.3 ALBAIK Food Systems Co. SA

- 6.4.4 Americana Restaurants International PLC

- 6.4.5 Galadari Ice Cream Co. Ltd LLC

- 6.4.6 Herfy Food Service Co.

- 6.4.7 Kudu Co. for Food & Catering

- 6.4.8 LuLu Group International

- 6.4.9 MH Alshaya Co. WLL

- 6.4.10 Nando's Group Holdings Ltd

- 6.4.11 Riyadh International Catering Corp.

- 6.4.12 Shahia Food Ltd Co. (Tim Hortons GCC)

- 6.4.13 The Sultan Center

- 6.4.14 McDonald's GCC

- 6.4.15 Subway Arabia

- 6.4.16 Starbucks MENA (Alshaya)

- 6.4.17 Krispy Kreme GCC

- 6.4.18 Five Guys Middle East

- 6.4.19 Papa John's GCC

- 6.4.20 Caribou Coffee GCC

7 Market Opportunities and Future Outlook