PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911785

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911785

Singapore Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

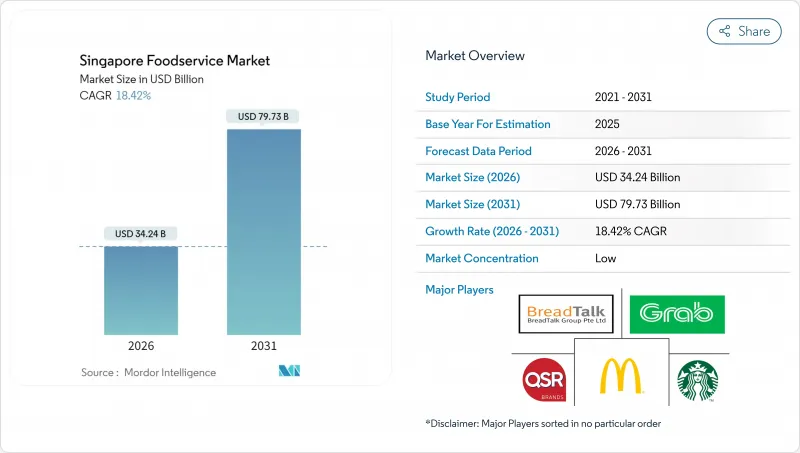

The Singapore foodservice market is expected to grow from USD 28.92 billion in 2025 to USD 34.24 billion in 2026 and is forecast to reach USD 79.73 billion by 2031 at 18.42% CAGR over 2026-2031.

This growth is driven by factors such as the recovery of the tourism industry, a tech-savvy population, and strong government initiatives promoting digital payment systems. Businesses that adopt innovations like contactless ordering, loyalty programs, and creative menu offerings are likely to increase their average revenue per customer while reducing labor costs. By service type, food delivery services are growing faster than traditional dine-in options, reflecting changing consumer preferences. In terms of foodservice type, cloud kitchens are emerging as strong competitors to quick-service restaurants (QSRs), offering convenience and efficiency. When considering outlets, independent restaurants are showing resilience despite the expansion of chain establishments. Foodservice locations in lodging venues, such as hotels, are benefiting from the resurgence in tourism. The competitive landscape in Singapore's foodservice market remains intense. However, the market's low concentration provides opportunities for both multinational companies and local independent operators to grow profitably by offering unique and differentiated services.

Singapore Foodservice Market Trends and Insights

Growing demand for specialty beverages and robust coffee culture

Singapore's coffee culture is evolving from its traditional kopitiam heritage to a dynamic specialty beverage market, driven by growing consumer interest in premium and unique experiences. Since 2024, international brands like Luckin Coffee, Tim Hortons, and Kopi Kenangan have expanded their presence in the city, offering digital-first store formats that focus on speed, customization, and high-quality products. Government programs such as Hawkers Go Digital have played a key role in modernizing local coffee operators by promoting mobile ordering and digital payment systems. This has made specialty coffee more accessible to a broader audience. According to the Ministry of Trade and Industry, Singapore's food and beverage services volume index increased by 4.2% in 2023, highlighting strong consumer spending and a thriving cafe culture that continues to support growth in the foodservice market.

Increasing preference for social and post-work gatherings

As employment rates rise and urban routines return to normal, Singaporeans are increasingly favoring social and after-work dining experiences. With the easing of pandemic restrictions, restaurants and venues offering flexible seating arrangements and group-friendly spaces have seen higher customer turnover, highlighting a focus on social interactions. Younger consumers, particularly millennials and professionals, are showing a growing preference for low-alcohol and non-alcoholic beverages that align with their health-conscious lifestyles while allowing them to enjoy extended gatherings. According to the International Monetary Fund, Singapore's employment rate reached 97.9%, supporting strong incomes and frequent dining out after work to release stress and enjoy. Supermarket chains are adapting to this trend by incorporating in-store bars and casual dining areas, creating a blend of grocery shopping and socializing opportunities.

Increasing raw material costs and disruptions in the supply chain

Rising input costs and ongoing supply chain challenges continue to be significant obstacles for Singapore's foodservice market. While food inflation stopped at 2.5% in December 2024, as reported by the Monetary Authority of Singapore, the country's dependence on imported ingredients leaves it vulnerable to global price fluctuations. Factors such as geopolitical tensions and extreme weather conditions have disrupted the supply of key commodities like wheat, palm oil, and seafood, leading to higher costs for procurement and transportation. These challenges have directly impacted consumers, with hawker meal prices experiencing their sharpest rise since 2008. This demonstrates the limited ability of operators to absorb costs without passing them on to customers. To address these issues, suppliers like Olam Group have introduced traceable and EUDR-compliant sourcing solutions, which aim to enhance supply chain resilience and transparency.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of the tourism and hospitality sector

- Rising use of digital payments and contactless transaction methods

- Challenges in adhering to regulations and navigating licensing complexities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Dine-in remains the leading segment in Singapore's foodservice market, holding 65.12% of the total market share in 2025. This dominance highlights consumers' preference for dining experiences that offer a combination of good food, ambiance, and social interaction elements that digital platforms cannot fully replicate. Restaurants, cafes, and casual dining outlets, particularly in popular areas like Orchard Road and Marina Bay, continue to attract customers. To enhance the dine-in experience, operators are introducing features such as themed interiors, live cooking stations, and chef-curated menus, which help create memorable experiences and encourage repeat visits.

On the other hand, delivery is rapidly becoming the fastest-growing service channel, with its revenue projected to grow at a 20.10% CAGR from 2026 to 2031. The increasing demand for convenience and flexible meal options is driving this growth, supported by platforms like GrabFood and Foodpanda. Many restaurants are adopting cloud kitchens and partnering with delivery aggregators to reduce costs and improve efficiency. The integration of digital tools such as online menus, cashless payments, and loyalty programs is enhancing the delivery experience for customers. This shift positions delivery as a key driver of growth in Singapore's evolving foodservice market.

Quick Service Restaurants (QSRs) are a key part of Singapore's foodservice market, holding a significant 66.88% share in 2025. These restaurants succeed by offering standardized menus, efficient operations, and widespread locations, ensuring consistent quality and convenience for customers. They are especially popular among busy urban consumers who prefer quick and affordable meals. To stay competitive, QSRs regularly introduce new menu items, including limited-time offers and healthier options, to meet changing consumer preferences. Strong brand recognition and loyalty programs help these restaurants maintain their dominance in both dine-in and delivery services.

Cloud kitchens are becoming one of the fastest-growing segments in Singapore's foodservice market, with revenue expected to grow at a 20.05% CAGR from 2026 to 2031. These kitchens operate without traditional storefronts, using shared spaces and asset-light models to focus entirely on delivery. This approach allows businesses to expand their reach while keeping costs low. By partnering with online food delivery platforms and using digital tools for menu optimization and marketing, cloud kitchens are improving efficiency and profitability. As more consumers turn to app-based meal options for convenience, cloud kitchens are set to play a major role in shaping the future of Singapore's foodservice industry.

The Singapore Foodservice Market Report is Segmented by Service Type (Dine-In, Takeaway, and More), Foodservice Type (Cafes and Bars, Cloud Kitchen, and More), Outlet (Chained Outlet and Independent Outlet), and Location (Leisure, Travel, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- BreadTalk Group Ltd

- Crystal Jade Culinary Concepts Holding

- DFI Retail Group Holdings Limited

- Doctor's Associates Inc. (Subway)

- Fidelis Express Holdings Pte. Ltd (Pizza Express)

- Foodpanda (Delivery Hero SE)

- Grab Holdings Inc.

- Hanbaobao Pte Ltd (McDonald's)

- Jollibee Foods Corporation

- Nando's Chickenland Singapore Pte Ltd

- Paradise Group Holdings Pte Ltd

- QSR Brands (M) Holdings Sdn Bhd (KFC)

- Restaurant Brands International Inc.

- Sakae Holdings Ltd

- No Signboard Holdings Ltd

- Starbucks Corporation

- Paradise Group

- Tung Lok Restaurants (2000) Ltd

- FairPrice Group (Kopitiam)

- 4Fingers Singapore Pte Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Industry Trend Analysis

- 4.2.1 Number of Outlets

- 4.2.2 Average Order Value

- 4.2.3 Menu Analysis

- 4.3 Market Drivers

- 4.3.1 Growing demand for specialty beverages and a robust coffee culture

- 4.3.2 Increasing preference for social and post-work gatherings

- 4.3.3 Rising use of digital payments and contactless transaction methods

- 4.3.4 Demand for unique dining experiences and social engagement

- 4.3.5 Shifting consumer preferences and expanding menu offerings

- 4.3.6 Expansion of the tourism and hospitality sector

- 4.4 Market Restraints

- 4.4.1 Challenges in adhering to regulations and navigating licensing complexities

- 4.4.2 Workforce shortages and elevated employee turnover

- 4.4.3 Brand cannibalisation in multi-brand groups

- 4.4.4 Increasing raw material costs and disruptions in the supply chain

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Dine-In

- 5.1.2 Takeaway

- 5.1.3 Delivery

- 5.2 By Foodservice Type

- 5.2.1 Cafes and Bars

- 5.2.1.1 By Cuisine

- 5.2.1.1.1 Bars and Pubs

- 5.2.1.1.2 Cafes

- 5.2.1.1.3 Juice/Smoothie/Desserts Bars

- 5.2.1.1.4 Specialist Coffee and Tea Shops

- 5.2.1.1 By Cuisine

- 5.2.2 Cloud Kitchen

- 5.2.3 Full Service Restaurants

- 5.2.3.1 By Cuisine

- 5.2.3.1.1 Asian

- 5.2.3.1.2 European

- 5.2.3.1.3 Latin American

- 5.2.3.1.4 Middle Eastern

- 5.2.3.1.5 North American

- 5.2.3.1.6 Other Full Service Restaurants Cuisines

- 5.2.3.1 By Cuisine

- 5.2.4 Quick Service Restaurants

- 5.2.4.1 By Cuisine

- 5.2.4.1.1 Bakeries

- 5.2.4.1.2 Burger

- 5.2.4.1.3 Ice Cream

- 5.2.4.1.4 Meat-based Cuisines

- 5.2.4.1.5 Pizza

- 5.2.4.1.6 Other Quick Service Restaurants Cuisines

- 5.2.4.1 By Cuisine

- 5.2.1 Cafes and Bars

- 5.3 By Outlet

- 5.3.1 Chained Outlet

- 5.3.2 Independent Outlet

- 5.4 By Location

- 5.4.1 Leisure

- 5.4.2 Lodging

- 5.4.3 Retail

- 5.4.4 Standalone

- 5.4.5 Travel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 BreadTalk Group Ltd

- 6.4.2 Crystal Jade Culinary Concepts Holding

- 6.4.3 DFI Retail Group Holdings Limited

- 6.4.4 Doctor's Associates Inc. (Subway)

- 6.4.5 Fidelis Express Holdings Pte. Ltd (Pizza Express)

- 6.4.6 Foodpanda (Delivery Hero SE)

- 6.4.7 Grab Holdings Inc.

- 6.4.8 Hanbaobao Pte Ltd (McDonald's)

- 6.4.9 Jollibee Foods Corporation

- 6.4.10 Nando's Chickenland Singapore Pte Ltd

- 6.4.11 Paradise Group Holdings Pte Ltd

- 6.4.12 QSR Brands (M) Holdings Sdn Bhd (KFC)

- 6.4.13 Restaurant Brands International Inc.

- 6.4.14 Sakae Holdings Ltd

- 6.4.15 No Signboard Holdings Ltd

- 6.4.16 Starbucks Corporation

- 6.4.17 Paradise Group

- 6.4.18 Tung Lok Restaurants (2000) Ltd

- 6.4.19 FairPrice Group (Kopitiam)

- 6.4.20 4Fingers Singapore Pte Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK