PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910490

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910490

Italy Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

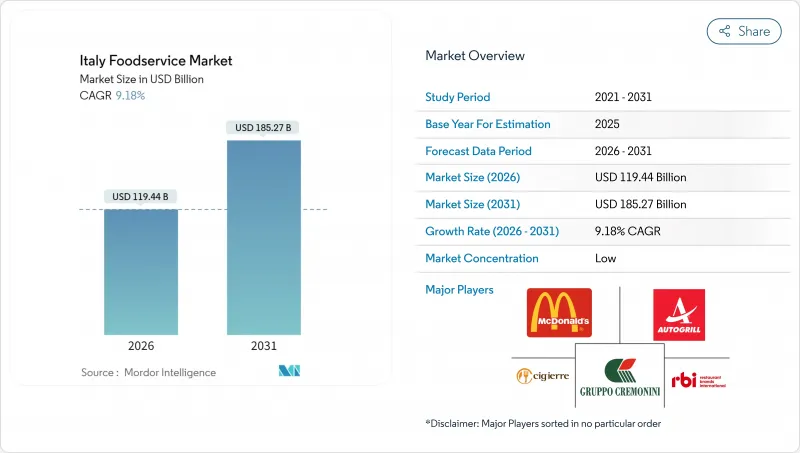

The italy foodservice market was valued at USD 109.4 billion in 2025 and estimated to grow from USD 119.44 billion in 2026 to reach USD 185.27 billion by 2031, at a CAGR of 9.18% during the forecast period (2026-2031).

Strong tourism inflows, a fast-maturing digital ordering ecosystem, and rising chain penetration have together moved the italy foodservice market well beyond pre-pandemic benchmarks. International visitor spending rebounded sharply, on-premise footfall surpassed 2019 levels, and delivery platforms booked record e-commerce receipts, providing operators with multiple high-growth revenue streams. Large chains are injecting capital into new store roll-outs, while independent restaurants are experimenting with AI-enabled demand forecasting to trim waste and protect margins. At the same time, sustainability initiatives-from zero-waste kitchens to provenance labeling-have augmented consumer trust and attracted premium price points. These intertwined dynamics underpin the optimistic growth trajectory anticipated for the italy foodservice market through 2030.

Italy Foodservice Market Trends and Insights

Health-centric Menus & Functional Snacking

Consumer health consciousness is reshaping Italy's foodservice landscape, with Bain & Company research revealing 73% of Italian consumers now consider health factors when making food choices. The organic food market expanded 5.7% in 2024, while dealcoholized wine sales reached EUR 55 million, representing a 39% year-over-year increase. Functional snacking has evolved beyond traditional offerings, with establishments incorporating superfoods, plant-based proteins, and probiotic ingredients into menu innovations. The vegetarian and vegan population has reached 9.5% of Italian consumers, driving restaurants to develop specialized menu sections and dedicated preparation areas. This trend is particularly pronounced in Northern urban centers where health-conscious millennials and Gen Z consumers demonstrate higher willingness to pay premium prices for functional food options.

Rapid Chain/QSR Penetration in Historically Fragmented Market

Italy's traditionally fragmented foodservice sector is experiencing unprecedented chain consolidation, with international QSR brands accelerating expansion strategies throughout 2024 and 2025. Wendy's announced plans to establish 170 restaurants by 2035 through its partnership with Your Food, while Popeyes officially entered the Italian market in 2024. McDonald's has committed EUR 800 million to reach 900 restaurants by 2027, representing a significant scaling from its current footprint. KFC operates 132 restaurants across 16 regions, demonstrating the viability of American fast-food concepts in Italian markets. This chain penetration is disrupting traditional independent operators while introducing standardized operational efficiency, digital ordering capabilities, and supply chain optimization that independent outlets struggle to match.

Structural Labour Shortages & Rising Wage Floor

Italy's foodservice sector faces a critical labor shortage of 258,000 positions, with particularly acute shortages in specialized roles including pizzaioli, camerieri, and cuochi. The shortage stems from demographic shifts, with younger generations increasingly pursuing higher education and avoiding hospitality careers traditionally viewed as temporary employment. Wage pressures have intensified as operators compete for available talent, with entry-level positions now commanding 15-20% higher compensation than pre-pandemic levels. The situation is most severe in Northern industrial regions where alternative employment opportunities in manufacturing and technology sectors offer more attractive career prospects. Regional governments have initiated training programs and immigration policy adjustments to address shortages, but structural solutions require multi-year implementation timelines that constrain near-term expansion capabilities.

Other drivers and restraints analyzed in the detailed report include:

- Tourism Rebound Fuelling Leisure & Travel Locations

- Digital Ordering & 3-Party Delivery Sophistication

- High Energy & Raw-Material Cost Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Full Service Restaurants maintain commanding market leadership with 45.92% share in 2025, reflecting Italy's deep-rooted dining culture that prioritizes experiential consumption and social interaction. Traditional trattorias, osterias, and ristorantes continue attracting both domestic diners and international tourists seeking authentic Italian culinary experiences. The segment benefits from Italy's UNESCO-recognized culinary heritage and the country's position as a premier gastronomic destination. FSR operators are adapting to contemporary demands through menu digitization, contactless payment systems, and hybrid service models that combine traditional table service with takeaway options.

Cloud Kitchens emerge as the fastest-growing segment with 10.55% CAGR through 2031, driven by delivery platform expansion and changing consumer behavior patterns. Milan leads cloud kitchen adoption with over 200 operational facilities, while Rome and Naples are experiencing rapid growth in delivery-only concepts. However, regulatory challenges persist, with municipalities implementing strict zoning requirements and SCIA (Segnalazione Certificata di Inizio Attivita) compliance mandates that complicate expansion efforts. The segment attracts both established restaurant brands seeking delivery optimization and new entrants focused exclusively on digital-native food concepts targeting younger demographics.

Independent Outlets dominate with 81.12% market share in 2025, reflecting Italy's cultural preference for family-owned establishments and artisanal food preparation. These outlets benefit from deep local relationships, customized menu offerings, and authentic regional specialties that resonate with both residents and tourists seeking genuine Italian experiences. Independent operators often occupy prime locations in historic city centers and leverage generations of culinary expertise to differentiate from standardized chain offerings. However, they face increasing pressure from rising operational costs, labor shortages, and digital transformation requirements that strain limited resources.

Chained Outlets represent the fastest-growing segment at 9.22% CAGR, driven by operational efficiency, standardized quality control, and sophisticated supply chain management. International brands like McDonald's, KFC, and Burger King are expanding aggressively, while domestic chains including La Piadineria and Alice Pizza demonstrate successful scaling strategies. Chain operators benefit from economies of scale in purchasing, marketing, and technology implementation, enabling competitive pricing and consistent service delivery. The segment's growth is particularly pronounced in shopping centers, transportation hubs, and suburban locations where convenience and speed take precedence over traditional dining experiences.

The Italy Foodservice Market Report is Segmented by Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, Delivery), and Geography (Italy). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Autogrill SpA

- Mc Donalds Corporation

- Cremonini SpA (Chef Express)

- CIGIERRE SpA

- Elior Ristorazione SpA

- Alice Pizza SpA

- Lagardore Travel Retail Italia

- La Piadineria Group

- Yum! Brands Inc. (KFC, Pizza Hut)

- Camst Group

- CIRFOOD SC

- Pellegrini SpA

- Sodexo Italia SpA

- Deliveroo Italy

- Just Eat Italia

- QSR Platform Holding

- Starhotels SpA

- Gruppo Sebeto

- Chef Express SpA

- Alicart Restaurant Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market landscape

- 4.1 Market Overview

- 4.2 Key Industry Trends

- 4.2.1 Number Of Outlets

- 4.2.2 Average Order Value

- 4.2.3 Menu Analysis

- 4.3 Market Drivers

- 4.3.1 Health-centric menus & functional snacking

- 4.3.2 Rapid chain/QSR penetration in historically fragmented market

- 4.3.3 Tourism rebound fuelling leisure & travel locations

- 4.3.4 Digital ordering & 3-party delivery sophistication

- 4.3.5 Sustainability-driven provenance & zero-waste practices

- 4.3.6 AI-enabled demand prediction for micro-formats

- 4.4 Market Restraints

- 4.4.1 Structural labour shortages & rising wage floor

- 4.4.2 Ageing population dampening domestic dine-in frequency

- 4.4.3 High energy & raw-material cost volatility

- 4.4.4 Tight urban licensing & NIMBY push-back on dark kitchens

- 4.5 Regulatory lanscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Segmentation

- 5.1 Foodservice Type

- 5.1.1 Cafes & Bars

- 5.1.1.1 By Cuisine

- 5.1.1.1.1 Bars & Pubs

- 5.1.1.1.2 Cafes

- 5.1.1.1.3 Juice/Smoothie/Desserts Bars

- 5.1.1.1.4 Specialist Coffee & Tea Shops

- 5.1.1.1 By Cuisine

- 5.1.2 Cloud Kitchen

- 5.1.3 Full Service Restaurants

- 5.1.3.1 By Cuisine

- 5.1.3.1.1 Asian

- 5.1.3.1.2 European

- 5.1.3.1.3 Latin American

- 5.1.3.1.4 Middle Eastern

- 5.1.3.1.5 North American

- 5.1.3.1.6 Other FSR Cuisines

- 5.1.3.1 By Cuisine

- 5.1.4 Quick Service Restaurants

- 5.1.4.1 By Cuisine

- 5.1.4.1.1 Bakeries

- 5.1.4.1.2 Burger

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Meat-based Cuisines

- 5.1.4.1.5 Pizza

- 5.1.4.1.6 Other QSR Cuisines

- 5.1.4.1 By Cuisine

- 5.1.1 Cafes & Bars

- 5.2 Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

- 5.4 Service Type

- 5.4.1 Dine-in

- 5.4.2 Takeaway

- 5.4.3 Delivery

6 Competitive Landscape

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Autogrill SpA

- 6.4.2 Mc Donalds Corporation

- 6.4.3 Cremonini SpA (Chef Express)

- 6.4.4 CIGIERRE SpA

- 6.4.5 Elior Ristorazione SpA

- 6.4.6 Alice Pizza SpA

- 6.4.7 Lagardore Travel Retail Italia

- 6.4.8 La Piadineria Group

- 6.4.9 Yum! Brands Inc. (KFC, Pizza Hut)

- 6.4.10 Camst Group

- 6.4.11 CIRFOOD SC

- 6.4.12 Pellegrini SpA

- 6.4.13 Sodexo Italia SpA

- 6.4.14 Deliveroo Italy

- 6.4.15 Just Eat Italia

- 6.4.16 QSR Platform Holding

- 6.4.17 Starhotels SpA

- 6.4.18 Gruppo Sebeto

- 6.4.19 Chef Express SpA

- 6.4.20 Alicart Restaurant Group

7 Market Opportunities and Future Outlook