PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911784

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911784

Malaysia Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

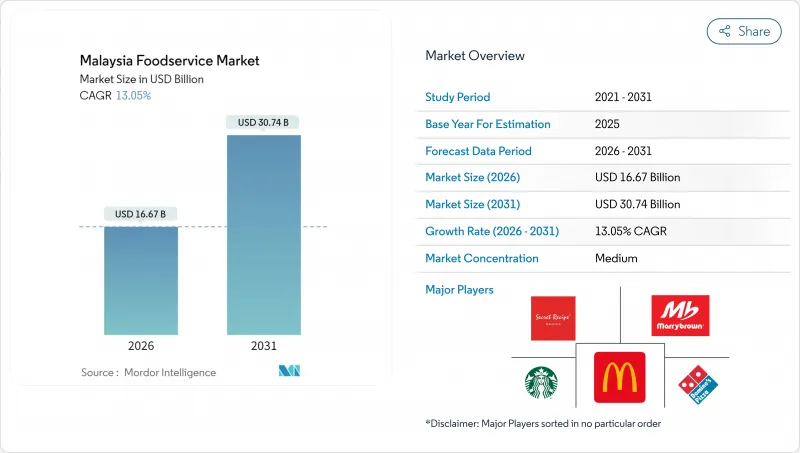

The Malaysia foodservice market was valued at USD 14.75 billion in 2025 and estimated to grow from USD 16.67 billion in 2026 to reach USD 30.74 billion by 2031, at a CAGR of 13.05% during the forecast period (2026-2031).

The market expansion is primarily attributed to the rising purchasing power of Malaysian consumers, consistent economic growth reflected in the country's GDP performance in 2025, and the population's increasing adoption of digital technologies. The foodservice industry's growth trajectory is supported by the widespread integration of mobile ordering applications, continuous improvements in restaurant infrastructure, and favorable government policies that benefit both established restaurant chains and small independent food businesses. Traditional full-service restaurants continue to hold significant cultural importance in the Malaysian dining landscape. However, the market is experiencing a transformation with the introduction of cloud kitchens, virtual restaurant brands, and delivery-optimized business models. The industry's potential is further validated by substantial investment commitments exceeding USD 1 billion from international quick-service restaurant chains and prominent local operators, demonstrating strong market confidence despite existing regulatory challenges.

Malaysia Foodservice Market Trends and Insights

Expansion and Modernization of Urban Infrastructure

Malaysia's extensive infrastructure modernization initiatives are creating significant opportunities for foodservice market expansion through the development of commercial real estate properties and improved transportation networks. The ongoing Pan Borneo Highway project and substantial data center developments in Johor have resulted in a notable 14.6% increase in construction employment during H1 2024, which has directly benefited local foodservice establishments operating near these project sites . The development of modern shopping malls and integrated commercial projects such as PMINT Square continues to provide premium locations for foodservice operators, while enhanced transportation infrastructure has significantly reduced delivery times and enabled businesses to serve broader geographical areas. The expansion of airport terminals at KLIA, Penang International Airport, and various regional facilities presents valuable concession opportunities for foodservice businesses, supported by Malaysia Airports Holdings' substantial investment of RM10 billion allocated over a five-year period for infrastructure improvements. This continuous cycle of infrastructure investment generates sustained foodservice demand through two key phases: initial consumption during the construction period and subsequent long-term commercial activities within the newly developed spaces.

Rapid Digitization and Mobile App Adoption for Ordering

Digital ordering platforms have fundamentally transformed Malaysia's foodservice consumption patterns, demonstrating significant impact on business operations and consumer behavior. QSR Brands exemplifies this transformation, recording a substantial 25% revenue growth in 2024, driven by strategic digital initiatives including customer-friendly self-ordering kiosks and mobile applications. Multi-sided platforms create valuable network effects that deliver mutual benefits to restaurants and consumers, resulting in reduced transaction costs and enhanced order accuracy. These platforms also leverage sophisticated data analytics to deliver personalized marketing campaigns and optimize inventory management systems. The Malaysian government's implementation of the e-invoicing mandate in August 2024 has accelerated digital payment adoption throughout the foodservice sector, with notable uptake among small and medium enterprises . Modern cloud-based point-of-sale systems and integrated delivery management platforms have leveled the playing field, enabling independent operators to effectively compete with established restaurant chains. Recent consumer research reveals a strong preference for digital ordering methods among urban populations, with bubble tea and fried chicken consistently ranking as the most frequently ordered items through online delivery services.

Supply Chain Fragility and Ingredient Sourcing Challenges

The Malaysian foodservice sector continues to grapple with significant supply chain challenges that affect daily operations and business sustainability. Restaurant operators, cafes, and food establishments face persistent difficulties in maintaining reliable access to imported ingredients and specialized products essential for their menus. The Malaysia Competition Commission's 2024 market review revealed concerning concentration risks within food supply networks, where any disruption at major distribution centers creates a ripple effect across numerous food businesses. The heavy dependence on imported premium ingredients makes these businesses particularly vulnerable to currency market movements, as fluctuations in the ringgit's value against major currencies directly impact their operational costs and pricing strategies. The mandatory halal certification process adds another layer of complexity to procurement decisions, requiring operators to conduct thorough compliance checks throughout their supply networks, which ultimately narrows their supplier options and increases overall procurement expenses . Small restaurants and independent food operators find themselves at a particular disadvantage, lacking the necessary scale to negotiate effectively with suppliers, which results in them paying premium prices for ingredients and facing more stringent payment conditions compared to larger restaurant chains. The situation is further complicated by unpredictable climate-related disruptions and ongoing geopolitical tensions, forcing food businesses to either maintain costly higher inventory levels or accept reduced profit margins when seeking alternative supply sources.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Cloud Kitchens and Virtual-Only Brands

- Increasing Consumer Preference for Convenience and Ready-to-Eat Food

- Pressure from Multinational and Domestic Chains on Smaller Operators

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The Malaysian foodservice market is experiencing a significant transformation, with cloud kitchens emerging as a key growth driver at a CAGR of 15.88% through 2031. These delivery-focused operations are changing how food businesses operate by implementing optimized processes and virtual brand strategies, while benefiting from lower costs and faster scaling abilities. Full-service restaurants continue to lead the market with a 34.02% share in 2025, building on Malaysia's rich dining culture, even as they adapt to new consumer behaviors.

Quick-service restaurants are strengthening their presence through franchise models and shopping mall locations, while cafes and bars are flourishing due to Malaysia's growing appreciation for coffee culture, particularly in specialty coffee shops and bubble tea establishments. The industry's digital evolution enables operators to launch virtual-only brands and test new concepts without traditional restaurant investments. This transformation is exemplified by TamJai International's market entry through Hextar Retail partnership, showing how international brands can successfully navigate Malaysia's market by working with local partners to meet regulatory requirements and consumer preferences.

The Malaysian foodservice landscape continues to be dominated by independent outlets, which currently command a substantial 73.52% market share in 2025. These establishments embody the entrepreneurial spirit of local food businesses and cater to Malaysia's diverse culinary preferences. However, they are experiencing heightened pressure from chain operations, which are making significant inroads with a robust 12.98% CAGR. This growth is fueled by their strong financial backing, well-established operational systems, and the ability to leverage economies of scale for competitive pricing and service consistency.

While independent operators maintain their stronghold through authentic local cuisine and deep community connections, particularly in residential areas and traditional markets, they face mounting challenges. The market is witnessing a notable shift as consumers increasingly gravitate toward standardized experiences and digital integration capabilities. This trend favors larger operators who possess the resources for technological investments. Additionally, independent operators must navigate the complexities of regulatory compliance, including halal certification and food safety standards, often with limited resources compared to their chain counterparts.

The Malaysia Foodservice Market Report Segments the Industry Into Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), and Service Type (Dine-In, Takeaway, and Delivery). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Gerbang Alaf Restaurants Sdn Bhd

- Berjaya Starbucks Coffee Company Sdn Bhd

- Domino's Pizza Enterprises Ltd

- Marrybrown Sdn Bhd

- Secret Recipe Cakes & Cafe Sdn Bhd

- A&W (Malaysia) Sdn Bhd

- Revenue Valley Sdn Bhd

- Nando's Chickenland Malaysia Sdn Bhd

- OldTown Bhd

- San Francisco Coffee Sdn Bhd

- Texchem Resources Bhd

- Craveat International Sdn Bhd

- Loob Holding Sdn Bhd (Tealive)

- KyoChon Sdn Bhd

- Big Apple Donuts & Coffee

- Sushi King Sdn Bhd

- The Chicken Rice Shop Sdn Bhd

- Papparich Group International Sdn Bhd

- Kenny Rogers Roasters

- Baskin Robbins Malaysia Sdn Bhd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 KEY INDUSTRY TRENDS

- 4.1 Number of Outlets

- 4.2 Average Order Value

- 4.3 Regulatory Framework

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Expansion and modernization of urban infrastructure

- 5.2.2 Rapid digitization and mobile app adoption for ordering

- 5.2.3 Rise of cloud kitchens and virtual-only brands

- 5.2.4 Increasing consumer preference for convenience and ready-to-eat food

- 5.2.5 Strong coffee and cafe culture

- 5.2.6 Expansion of quick-service and fast-casual restaurant chains

- 5.3 Market Restraints

- 5.3.1 Supply chain fragility and ingredient sourcing challenges

- 5.3.2 Pressure from multinational and domestic chains on smaller operators

- 5.3.3 Quality consistency issues and lack of standardized operating procedures among independents

- 5.3.4 Frequent policy/tax changes on food and beverage products

- 5.4 Regulatory Outlook

- 5.5 Porter's Five Forces

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Foodservice Type

- 6.1.1 Cafe and Bars

- 6.1.1.1 By Cuisine

- 6.1.1.1.1 Bars & Pubs

- 6.1.1.1.2 Cafe

- 6.1.1.1.3 Juice/Smoothie/Desserts Bars

- 6.1.1.1.4 Specialist Coffee and Tea Shops

- 6.1.1.1 By Cuisine

- 6.1.2 Cloud Kitchen

- 6.1.3 Full Service Restaurants

- 6.1.3.1 By Cuisine

- 6.1.3.1.1 Asian

- 6.1.3.1.2 European

- 6.1.3.1.3 Latin American

- 6.1.3.1.4 Middle Eastern

- 6.1.3.1.5 North American

- 6.1.3.1.6 Other FSR Cuisines

- 6.1.3.1 By Cuisine

- 6.1.4 Quick Service Restaurants

- 6.1.4.1 By Cuisine

- 6.1.4.1.1 Bakeries

- 6.1.4.1.2 Burger

- 6.1.4.1.3 Ice Cream

- 6.1.4.1.4 Meat-based Cuisines

- 6.1.4.1.5 Pizza

- 6.1.4.1.6 Other QSR Cuisines

- 6.1.4.1 By Cuisine

- 6.1.1 Cafe and Bars

- 6.2 By Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 By Locations

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Sandalone

- 6.3.5 Travel

- 6.4 By Service Type

- 6.4.1 Dine-in

- 6.4.2 Takeaway

- 6.4.3 Delivery

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Ranking Analysis

- 7.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 7.4.1 Gerbang Alaf Restaurants Sdn Bhd

- 7.4.2 Berjaya Starbucks Coffee Company Sdn Bhd

- 7.4.3 Domino's Pizza Enterprises Ltd

- 7.4.4 Marrybrown Sdn Bhd

- 7.4.5 Secret Recipe Cakes & Cafe Sdn Bhd

- 7.4.6 A&W (Malaysia) Sdn Bhd

- 7.4.7 Revenue Valley Sdn Bhd

- 7.4.8 Nando's Chickenland Malaysia Sdn Bhd

- 7.4.9 OldTown Bhd

- 7.4.10 San Francisco Coffee Sdn Bhd

- 7.4.11 Texchem Resources Bhd

- 7.4.12 Craveat International Sdn Bhd

- 7.4.13 Loob Holding Sdn Bhd (Tealive)

- 7.4.14 KyoChon Sdn Bhd

- 7.4.15 Big Apple Donuts & Coffee

- 7.4.16 Sushi King Sdn Bhd

- 7.4.17 The Chicken Rice Shop Sdn Bhd

- 7.4.18 Papparich Group International Sdn Bhd

- 7.4.19 Kenny Rogers Roasters

- 7.4.20 Baskin Robbins Malaysia Sdn Bhd

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK