PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910517

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910517

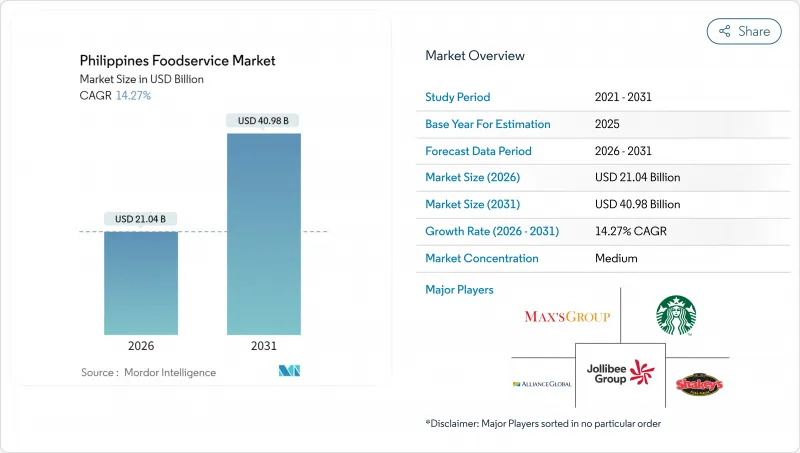

Philippines Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Philippines foodservice market is expected to grow from USD 18.41 billion in 2025 to USD 21.04 billion in 2026 and is forecast to reach USD 40.98 billion by 2031 at 14.27% CAGR over 2026-2031.

This growth translates to a robust CAGR of 14.52%, outpacing many of its Southeast Asian counterparts. Factors such as sustained urban migration, a burgeoning middle class with increased purchasing power, and heightened smartphone penetration are driving traffic in both physical and digital realms. This dynamic environment is ripe for innovative formats and expansive franchising. Operators adept at omnichannel fulfillment, stringent supply-chain management, and menu localization are reaping significant rewards, particularly in the densely populated areas of Metro Manila. As landlords reassess retail spaces, cloud kitchens are transitioning from niche players to mainstream contenders. Meanwhile, dine-in spaces, designed for social media appeal, are capitalizing on consumers' desire for Instagram-worthy experiences. In this competitive landscape, technology adoption, spanning from kitchen automation to AI-driven promotions, is proving to be the key differentiator for securing repeat business.

Philippines Foodservice Market Trends and Insights

Expansion of Cloud and Virtual Kitchens in Major Cities

Cloud kitchens are transforming the foodservice industry in the Philippines by eliminating the need for front-of-house operations and enabling multiple brands to operate from a single production facility. This model significantly reduces capital investment by 40-50% compared to traditional restaurants, allowing businesses to test new ideas with lower financial risk. The growing preference for online-to-offline (O2O) models, with the majority of consumers favoring this approach, has driven GrabFood to focus on integrated omnichannel experiences. This shift has created a strong demand for cloud kitchens, particularly in the densely populated urban areas of Metro Manila. Additionally, the Department of Trade and Industry, in partnership with Jollibee Foods Corporation, is supporting the growth of micro, small, and medium enterprises (MSMEs) by introducing cloud kitchen frameworks. These frameworks provide smaller operators with access to delivery platforms, which is especially important in a market where independent outlets account for 75% of the market share but often lack the resources to establish traditional storefronts in high-traffic areas.

Experiential, Social-Media-Friendly Dine-in Formats

Restaurants are transforming into spaces designed for content creation, driven by the fact that most consumers rely on in-app reviews before choosing where to dine, and younger audiences are heavily influenced by user-generated content. A notable example is Jollibee's September 2024 launch of its JolliBrews coffee concept, which combines high-quality beverages with visually appealing, Instagram-friendly interiors to encourage social media sharing. According to operators, locations optimized for social media attract 25-30% more foot traffic and can charge higher prices for unique experiences that traditional QSR formats cannot offer. This shift goes beyond just aesthetics, incorporating interactive dining, personalized food presentations, and theatrical meal preparation, all of which turn dining into shareable experiences. In Metro Manila's highly competitive market, this approach has proven effective, as creating memorable and engaging experiences now plays a more critical role in attracting customers than simply competing on price or convenience.

Perishable Supply Chain Gaps and Cold-Chain Limitations

The Philippines' archipelagic geography creates significant logistics challenges, with temperature-controlled shipping costs rising 15-25% compared to ambient transportation across its 7,641 islands. This cost disparity complicates the movement of perishable goods, particularly for businesses reliant on cold-chain logistics. The World Food Programme's analysis of climate vulnerabilities and food security risks highlights the fragile nature of the supply chain, which directly impacts the availability of ingredients and the stability of pricing. Although the Department of Agriculture introduced Administrative Order No. 20 in April 2024 to simplify agricultural import procedures, it does not address the lack of adequate cold storage infrastructure in provincial areas. This shortfall disrupts menu consistency for operators managing multiple locations. Smaller operators are disproportionately affected, as they lack the resources to invest in dedicated cold-chain systems or negotiate better rates with logistics providers.

Other drivers and restraints analyzed in the detailed report include:

- Strong Cafe Culture and Modern Tea Concepts Boosting Dayparts

- Sustainability Focus: Food-Waste Reduction and Responsible Sourcing

- Labor Shortages and High Staff Turnover

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Quick Service Restaurants (QSRs) hold a commanding 57.28% market share, driven by local players who effectively combine affordability with cultural relevance to appeal to Filipino consumers. Jollibee Foods Corporation exemplifies this approach by offering localized menu options and expanding its presence through approximately 200,000 franchise outlets nationwide. This strategy highlights how QSR operators achieve operational efficiency while catering to regional taste preferences. The segment benefits from well-established supply chain networks, standardized employee training programs, and strong brand loyalty, which collectively lower customer acquisition costs compared to newer competitors. The QSR model remains resilient by meeting the needs of busy urban consumers who value speed and consistency over elaborate dining experiences, ensuring stable revenue even during economic challenges.

Cloud Kitchens are emerging as the fastest-growing segment, with a projected CAGR of 24.85% through 2031. This model is transforming foodservice economics by eliminating front-of-house expenses, which typically account for 30-40% of a traditional restaurant's budget. By focusing on delivery, operators can test multiple brand concepts from a single kitchen, reducing capital investment by 40-50% compared to conventional restaurants, while still offering diverse menu options to meet varied consumer preferences. The Department of Trade and Industry, in partnership with Jollibee Foods Corporation, is supporting MSME growth by introducing cloud kitchen frameworks. These frameworks provide smaller operators with access to delivery platforms, bypassing the high costs associated with traditional storefronts. In densely populated areas like Metro Manila, where high real estate costs make traditional restaurant spaces unaffordable for new brands, cloud kitchens offer a practical solution. The segment's rapid growth reflects shifting consumer habits, with majority of consumers now preferring omnichannel options that prioritize convenience over the social aspects of dining out.

In 2025, independent outlets dominate the Philippine foodservice market with a 74.42% share, reflecting the country's strong entrepreneurial dining culture. These family-owned establishments act as community hubs, preserving regional culinary traditions that chains struggle to replicate. Their flexibility allows quick menu adjustments based on seasonal ingredients, local festivals, and neighborhood preferences, avoiding the delays of corporate processes. Low entry barriers and Filipinos' preference for supporting local businesses give independents a lasting competitive edge. They offer authentic regional dishes like Bicol Express and Lechon, maintaining cultural authenticity and sourcing practices that chains find hard to standardize.

Chained outlets are growing at a 14.18% CAGR through 2031, driven by demand for consistent quality, standardized service, and reliable brands. Fruitas Holdings' USD 12.8 million investment in August 2024, including a 60% stake in Mang Bok's roasted chicken chain, highlights strong investor confidence in scalable models. Chains benefit from 10-15% cost savings on ingredients through supply chain efficiencies and use technology for inventory, customer management, and menu optimization. Consolidation is accelerating as chains leverage brand recognition to secure prime locations in malls and commercial districts. Kuya J Food Group's PHP 100 million (USD 1.8 million) expansion plan in June 2024, along with openness to investor partnerships, underscores the importance of scaling to compete with market leaders.

The Philippines Foodservice Market Report is Segmented by Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, Delivery), and Geography (Philippines). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Berjaya Corporation Bhd.

- Bounty Agro Ventures, Inc.

- Three Bears Group (Domino's Pizza)

- Alliance Global Group, Inc. (McDonald's Philippines)

- Inspire Brands, Inc.

- Jollibee Foods Corporation

- Mary Grace Foods Inc.

- Max's Group, Inc.

- Restaurant Brands International Inc.

- Seven & I Holdings Co., Ltd.

- Shakey's Pizza Asia Ventures, Inc.

- Rustan Group of Companies (Starbucks Corporation)

- Figaro Culinary Group, Inc

- Udenna Group

- Yum! Brands, Inc.

- Fruitas Holdings Inc.

- Philippine Pizza, Inc.

- One Food Group

- Red Ribbon Bakeshop Inc.

- ArmyNavy Burger Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Key Industry Trends

- 4.2.1 Number of Outlets

- 4.2.2 Average Order Value

- 4.2.3 Menu Analysis

- 4.3 Market Drivers

- 4.3.1 Expansion of Cloud and Virtual Kitchens in Major Cities

- 4.3.2 Experiential, Social-Media-Friendly Dine-in Formats

- 4.3.3 Strong Cafe Culture and Modern Tea Concepts Boosting Dayparts

- 4.3.4 Omnichannel Formats and Curbside/Pick-Up Infrastructure

- 4.3.5 Sustainability Focus: Food-Waste Reduction and Responsible Sourcing

- 4.3.6 Personalization and Build-Your-Own Formats Driving Loyalty

- 4.4 Market Restraints

- 4.4.1 Perishable Supply Chain Gaps and Cold-Chain Limitations

- 4.4.2 Food Safety, Traceability, and Sustainability Compliance Overhead

- 4.4.3 Consumer Pushback on Ultra-Processed Items

- 4.4.4 Labor Shortages and High Staff Turnover

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Foodservice Type

- 5.1.1 Cafes & Bars

- 5.1.1.1 By Cuisine

- 5.1.1.1.1 Bars & Pubs

- 5.1.1.1.2 Cafes

- 5.1.1.1.3 Juice/Smoothie/Desserts Bars

- 5.1.1.1.4 Specialist Coffee & Tea Shops

- 5.1.1.1 By Cuisine

- 5.1.2 Cloud Kitchen

- 5.1.3 Full Service Restaurants

- 5.1.3.1 By Cuisine

- 5.1.3.1.1 Asian

- 5.1.3.1.2 European

- 5.1.3.1.3 Latin American

- 5.1.3.1.4 Middle Eastern

- 5.1.3.1.5 North American

- 5.1.3.1.6 Other FSR Cuisines

- 5.1.3.1 By Cuisine

- 5.1.4 Quick Service Restaurants

- 5.1.4.1 By Cuisine

- 5.1.4.1.1 Bakeries

- 5.1.4.1.2 Burger

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Meat-based Cuisines

- 5.1.4.1.5 Pizza

- 5.1.4.1.6 Other QSR Cuisines

- 5.1.4.1 By Cuisine

- 5.1.1 Cafes & Bars

- 5.2 Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

- 5.4 Service Type

- 5.4.1 Dine-in

- 5.4.2 Takeaway

- 5.4.3 Delivery

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Berjaya Corporation Bhd.

- 6.4.2 Bounty Agro Ventures, Inc.

- 6.4.3 Three Bears Group (Domino's Pizza)

- 6.4.4 Alliance Global Group, Inc. (McDonald's Philippines)

- 6.4.5 Inspire Brands, Inc.

- 6.4.6 Jollibee Foods Corporation

- 6.4.7 Mary Grace Foods Inc.

- 6.4.8 Max's Group, Inc.

- 6.4.9 Restaurant Brands International Inc.

- 6.4.10 Seven & I Holdings Co., Ltd.

- 6.4.11 Shakey's Pizza Asia Ventures, Inc.

- 6.4.12 Rustan Group of Companies (Starbucks Corporation)

- 6.4.13 Figaro Culinary Group, Inc

- 6.4.14 Udenna Group

- 6.4.15 Yum! Brands, Inc.

- 6.4.16 Fruitas Holdings Inc.

- 6.4.17 Philippine Pizza, Inc.

- 6.4.18 One Food Group

- 6.4.19 Red Ribbon Bakeshop Inc.

- 6.4.20 ArmyNavy Burger Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK