PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937405

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937405

Thailand Telecom MNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

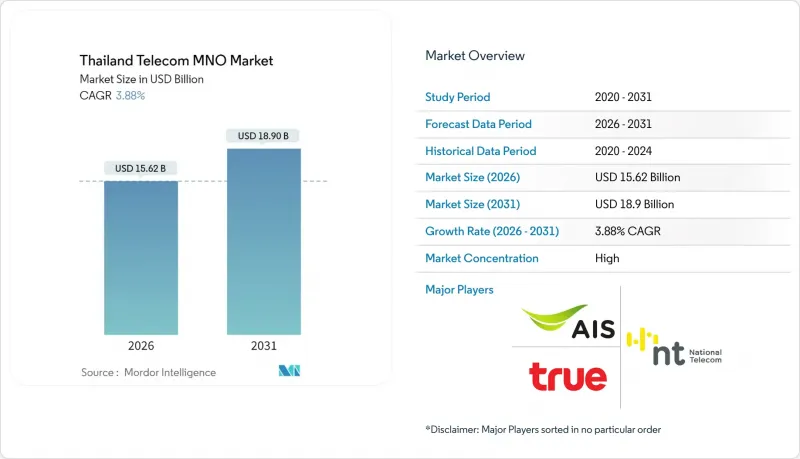

The Thailand Telecom MNO Market was valued at USD 15.04 billion in 2025 and estimated to grow from USD 15.62 billion in 2026 to reach USD 18.9 billion by 2031, at a CAGR of 3.88% during the forecast period (2026-2031).

That trajectory reflects measured topline expansion even as the sector undergoes deep structural change driven by the AIS-True-dtac duopoly, accelerated 5G rollouts, and an enterprise-led push toward private networks. Data and Internet services already account for almost two-thirds of revenue, while IoT connections scale quickly on nationwide NB-IoT infrastructure. At the same time, the Eastern Economic Corridor's smart-industry projects anchor large investments in ultra-low-latency connectivity, and rising rural smartphone adoption broadens the addressable subscriber base. On the regulatory front, high spectrum prices weigh on operator finances, yet supportive digital-economy targets and the Universal Service Obligation Fund open further network-expansion avenues. Competitive differentiation, therefore, shifts from pure price plays to technology leadership, quality of service, and enterprise solution depth.

Thailand Telecom MNO Market Trends and Insights

Nationwide 5G rollout accelerating mobile data monetization

5G networks covered 95% of Thailand's population in 2024, giving operators a platform for speed improvements 24 times faster than 4G and enabling premium pricing tiers . AIS holds more than 1,460 MHz across low-, mid-, and high-bands, translating into the country's highest Speed Score of 118.84 . Beyond consumer eMBB services, the same infrastructure supports edge-computing architectures that unlock new enterprise revenue streams. True Corporation improves spectral efficiency through Dynamic Spectrum Sharing on the 2.6 GHz band, a method that concurrently sustains 4G and 5G traffic. Private 5G deployments at factories like Midea Thailand delivered 15-20% efficiency gains and 30% opex savings, validating enterprise willingness to pay for guaranteed throughput. Government projections show 5G could inject USD 9.3 billion into national GDP by 2035, further anchoring the Thailand Telecom MNO market to data-driven growth .

Explosion in OTT video and gaming traffic driving ARPU uplift

Mobile data consumption surged as over-the-top video and cloud-gaming platforms gained traction, prompting a migration to higher-tier plans across urban millennials. Operators that bundle premium content, quality-of-service guarantees, and unlimited data observe ARPU premiums of 10-15% among 5G users versus 4G cohorts. Cloud gaming's sensitivity to latency favors 5G standalone slices, enabling differentiated offers that reduce churn in the highly contested Bangkok post-paid segment. Nationally, 55% of Asia-Pacific operators posted ARPU growth in 2024, and Thai carriers mirror this trend by leveraging data-usage-based pricing ladders. Video streaming in full-HD and 4K constitutes the single largest traffic category, compelling continued radio-access-network densification across populous corridors.

World-leading spectrum license fees straining operator balance sheets

Thailand's 2023 auctions raised USD 3.2 billion, positioning its spectrum fees among the costliest worldwide on a per-capita basis. Economic simulations show that license costs above THB 200 billion reduce five-year 5G adoption to 50%, versus 70% under lower-cost scenarios . True Corporation reported quarterly losses attributable in part to elevated interest expenses on spectrum-related debt. National Telecom's THB 34.3 billion outlay for 700 MHz blocks similarly eroded cash flow, highlighting systemic pressure on future network-investment budgets. High carrying costs risk delaying rural 5G rollouts and curtailing R&D for advanced standalone capabilities.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise digital-transformation boosting private-LTE and 5G SA demand

- Soaring smartphone penetration in rural provinces

- Intensifying price wars following True-dtac merger remedies

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Data and Internet revenue represented 63.78% of Thailand Telecom MNO market share in 2025 and is projected to retain primacy through 2031 as video streaming, cloud gaming, and remote work applications multiply. Voice traffic continues its secular decline, falling below 10.00% of Thailand Telecom's MNO market size as messaging apps displace traditional SMS. IoT and M2M contribute a modest top-line share today but register the fastest 4.00% CAGR, driven by nationwide NB-IoT availability and industrial-grade 5G SA slices that enable predictive maintenance, logistics tracking, and smart-meter rollouts. Operators bundle connectivity with device-management platforms and analytics dashboards, broadening average revenue per connection well beyond basic data charges. OTT and Pay-TV services present cross-sell upside: True leverages its content library while AIS partners with global streaming brands, using zero-rating to spur data-plan upgrades.

Thailand's differentiated spectrum holdings shape service-type economics. AIS's additional 700 MHz blocks improve in-building coverage for data services, while True's 2.6 GHz DSS boosts peak capacity. Both carriers pilot network-slicing proofs-of-concept that sell guaranteed latency to factories, hospitals, and AGV fleets. Global forecasts place 6.4 billion cellular-IoT connections by 2029, and Thai operators seek an outsized slice of that volume through vertical-specific solutions. VAS and roaming lines remain niche but gain relevance as Thailand reopens tourism flows; seamless 5G roaming agreements with regional partners position carriers to capture high-spending visitors.

The Thailand Telecom MNO Market is Segmented by Service Type (Voice Services, Data and Internet Services, Messaging Services, Iot and M2M Services, OTT and PayTV Services, and Other Services), and End User (Enterprises, Consumer). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Advanced Info Service (AIS)

- True Corporation Public Company Limited

- National Telecom (NT)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Regulatory and Policy Framework

- 4.3 Spectrum Landscape and Competitive Holdings

- 4.4 Telecom Industry Ecosystem

- 4.5 Macroeconomic and External Drivers

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Competitive Rivalry

- 4.6.2 Threat of New Entrants

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Bargaining Power of Buyers

- 4.6.5 Threat of Substitutes

- 4.7 Key MNO KPIs (2020-2025)

- 4.7.1 Unique Mobile Subscribers and Penetration Rate

- 4.7.2 Mobile Internet Users and Penetration Rate

- 4.7.3 SIM Connections by Access Technology and Penetration

- 4.7.4 Cellular IoT / M2M Connections

- 4.7.5 Broadband Connections (Mobile and Fixed)

- 4.7.6 ARPU (Average Revenue Per User)

- 4.7.7 Average Data Usage per Subscription (GB/month)

- 4.8 Market Drivers

- 4.8.1 Nationwide 5G rollout accelerating mobile data monetisation

- 4.8.2 Explosion in OTT video and gaming traffic driving ARPU uplift

- 4.8.3 Enterprise digital-transformation boosting private-LTE and 5G SA demand

- 4.8.4 Soaring smartphone penetration in rural provinces

- 4.8.5 Eastern Economic Corridor (EEC) smart-industry projects requiring ultra-low-latency connectivity

- 4.8.6 Universal Service Obligation (USO) Fund subsidies for remote-area base-stations

- 4.9 Market Restraints

- 4.9.1 World-leading spectrum licence fees straining operator balance sheets

- 4.9.2 Intensifying price wars following True-dtac merger remedies

- 4.9.3 Delay in National Digital-ID rollout limiting advanced fintech-telco bundles

- 4.9.4 Rising electricity costs for dense 5G site grids

- 4.10 Technological Outlook

- 4.11 Analysis of key business models in Telecom Sector

- 4.12 Analysis of Pricing Models and Pricing

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Overall Telecom Revenue and ARPU

- 5.2 Service Type

- 5.2.1 Voice Services

- 5.2.2 Data and Internet Services

- 5.2.3 Messaging Services

- 5.2.4 IoT and M2M Services

- 5.2.5 OTT and PayTV Services

- 5.2.6 Other Services (VAS, Roaming and International Services, Enterprise and Wholesale Services, etc.)

- 5.3 End-user

- 5.3.1 Enterprises

- 5.3.2 Consumer

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Investments by key vendors, 2023-2025

- 6.3 Market share analysis for MNOs, 2024

- 6.4 Product Benchmarking Analysis for mobile network services

- 6.5 MNO snapshot (subscribers, churn rate, ARPU, etc.)

- 6.6 Company Profiles* of MNOs (Includes Business Overview | Service Portfolio | Financials | Business Strategy and Recent Developments | SWOT Analysis)

- 6.6.1 Advanced Info Service (AIS)

- 6.6.2 True Corporation Public Company Limited

- 6.6.3 National Telecom (NT)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment