PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940848

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940848

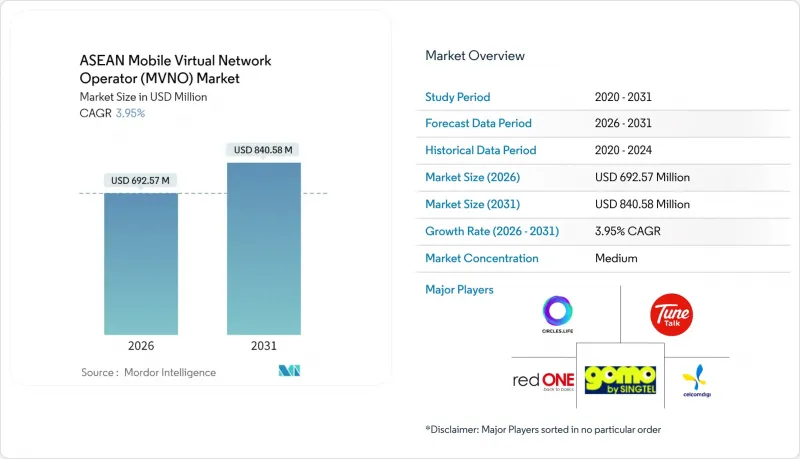

ASEAN Mobile Virtual Network Operator (MVNO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The ASEAN Mobile Virtual Network Operator Market is expected to grow from USD 666.25 million in 2025 to USD 692.57 million in 2026 and is forecast to reach USD 840.58 million by 2031 at 3.95% CAGR over 2026-2031.

In terms of subscriber volume, the market is expected to grow from 8.14 million subscribers in 2025 to 9.45 million subscribers by 2030, at a CAGR of 3.03% during the forecast period (2025-2030). Behind this headline growth, satellite and other non-terrestrial networks (NTN) expand as virtual operators adopt hybrid architectures that bypass traditional mobile-network-operator (MNO) infrastructure constraints. Cloud-native cores, cross-border eSIM packages, and regulatory liberalization collectively reshape competitive dynamics, allowing nimble entrants to scale without heavy capex. Demand for youth-centric data plans and enterprise IoT connectivity amplifies traffic volumes, while MNO digital sub-brands intensify price competition and force differentiation through value-added services. The interplay of sovereign data rules and regional roaming requirements makes compliance expertise a strategic asset for every participant in the ASEAN MVNO market.

ASEAN Mobile Virtual Network Operator (MVNO) Market Trends and Insights

Rising Mobile-Internet and Smartphone Penetration

Smartphone ownership surpassed 67% of the ASEAN population in 2025, translating into more than 440 million mobile internet users who expect high-data allowances and seamless app experiences. Vietnam's new telecom framework classifies machine-to-machine (M2M) traffic as a basic service, enabling MVNOs to sell IoT connectivity without value-added service permits . The clarification accelerates industrial adoption, especially in electronics and garment clusters that diversify beyond mainland China. Virtual operators capitalize by offering data-only plans free from legacy voice costs, yet the surge in data usage compresses unit prices and demands sophisticated traffic-management tools to sustain margins within the ASEAN MVNO market.

Regulatory Reforms on Wholesale Access

Vietnam's Decree 163/2024 mandates nondiscriminatory wholesale terms and codifies clear procedures for offshore cloud services, reducing approval cycles for MVNO cores hosted outside the country . Malaysia's single-wholesale-network model offers discounted 5G rates until 80% population coverage, but its centralized structure limits MNO product differentiation and widens opportunities for full MVNOs targeting enterprise verticals. Thailand continues to auction spectrum in regional blocks, compelling MVNOs to negotiate roaming in multiple provinces. Collectively, these policy shifts open the ASEAN MVNO market to new entrants that can juggle divergent regimes while maintaining uniform quality of service.

Limited Wholesale Pricing Flexibility

Despite pro-competition mandates, negotiating genuinely cost-based wholesale rates remains difficult, particularly where incumbent operators wield spectrum advantages. Thailand's provincial spectrum fragmentation forces MVNOs into multiple roaming contracts that dilute bargaining power. Elevated 5G infrastructure costs prompt MNOs to impose premium access surcharges, limiting the ability of virtual players to craft entry-level plans that preserve margin. This restraint compels many brands in the ASEAN MVNO market to offset higher network charges with value-added services or to explore satellite offload strategies.

Other drivers and restraints analyzed in the detailed report include:

- Demand for Affordable Youth-Centric Data Plans

- MNO Digital-Sub-Brand Convergence Strategies

- Multi-Country Licensing Complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud-based cores generated 65.32% of the ASEAN MVNO market size in 2025 and will rise at an 8.83% CAGR to 2031 as virtual operators favor opex over capex and pursue rapid cross-border launches. Regulatory clarity under Vietnam's Decree 163/2024, which treats offshore clouds as registrable rather than licensable, further accelerates adoption. Cloud elasticity lowers onboarding costs for niche brands and empowers real-time analytics that optimize pricing, marketing, and fraud controls across the ASEAN MVNO market.

On-premise deployments persist in sectors where latency, redundancy, or data-residency rules override cost considerations. Financial institutions and public-safety agencies often demand private cores within domestic data centers. Hybrid variants blend cloud control with edge processing, leveraging 5G non-terrestrial-network gateways to extend coverage. Operators adopting this mix report smoother service continuity during fiber outages and a stronger appeal among industrial clients that value deterministic performance.

Reseller/light models still represent 60.85% of ASEAN MVNO market share because they require minimal infrastructure and yield fast commercialization. Yet their dependence on host operators curbs service customization. Full MVNOs, while capital-intensive, grow at 18.12% CAGR as firms seek routing autonomy, network-slicing capabilities, and direct interconnects that enable differentiated IoT and enterprise offerings. These players directly manage IMS cores, issuer provisioning servers, and wholesale procurement, culminating in higher average revenue per user.

Service-operator MVNOs occupy a midpoint, owning elements such as HLR/HSS but leaving radio-access control to MNOs. They appeal to e-commerce majors that value loyalty integration but shun deep telecom investment. The operational spectrum within the ASEAN MVNO market thus ranges from pure-branding ventures to vertically integrated challengers, each aligning architecture with target segment economics.

The ASEAN Mobile Virtual Network Operator (MVNO) Market Report is Segmented by Deployment Model (Cloud, On-Premise), Operational Mode (Service Operator, and More), Subscriber Type (Consumer, and More), Application (Discount, and More), Network Technology (2G/3G, and More), Distribution Channel (Online/Digital-only, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Circles.Life (Liberty Wireless Pte Ltd.)

- GOMO (Singtel Mobile Singapore Pte Ltd.)

- redONE Network Sdn Bhd

- Tune Talk Sdn Bhd

- Celcom Berhad

- XOX Mobile Sdn Bhd

- MyRepublic Limited

- Cherry Prepaid (Cosmic Technologies Inc.)

- Itel Mobile (Transsion Holdings)

- Wintel (Masan Group Corporation)

- Penguin Telecom (Advanced Wireless Network Co., Ltd.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile-internet and smartphone penetration

- 4.2.2 Regulatory reforms on wholesale access

- 4.2.3 Demand for affordable youth-centric data plans

- 4.2.4 MNO digital-sub-brand convergence strategies

- 4.2.5 Cross-border eSIM tourism packs boom

- 4.2.6 IoT-focused enterprise MVNO uptake

- 4.3 Market Restraints

- 4.3.1 Limited wholesale pricing flexibility

- 4.3.2 Multi-country licensing complexity

- 4.3.3 Data-sovereignty concerns with cloud cores

- 4.3.4 5G-SA resource constraints on MVNO QoS

- 4.4 Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Model

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Operational Mode

- 5.2.1 Reseller / Light / Brand MVNO

- 5.2.2 Service Operator

- 5.2.3 Full MVNO

- 5.3 By Subscriber Type

- 5.3.1 Consumer

- 5.3.2 Enterprise

- 5.3.3 IoT-specific

- 5.4 By Application

- 5.4.1 Discount

- 5.4.2 Business

- 5.4.3 Cellular M2M

- 5.4.4 Others

- 5.5 By Network Technology

- 5.5.1 2G/3G

- 5.5.2 4G/LTE

- 5.5.3 5G

- 5.5.4 Satellite/NTN

- 5.6 By Distribution Channel

- 5.6.1 Online/Digital-only

- 5.6.2 Traditional Retail Stores

- 5.6.3 Carrier Sub-brand Stores

- 5.6.4 Third-Party/Wholesale

- 5.7 By Country

- 5.7.1 Brunei

- 5.7.2 Cambodia

- 5.7.3 Indonesia

- 5.7.4 Laos

- 5.7.5 Malaysia

- 5.7.6 Myanmar

- 5.7.7 Philippines

- 5.7.8 Singapore

- 5.7.9 Thailand

- 5.7.10 Vietnam

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Circles.Life (Liberty Wireless Pte Ltd.)

- 6.4.2 GOMO (Singtel Mobile Singapore Pte Ltd.)

- 6.4.3 redONE Network Sdn Bhd

- 6.4.4 Tune Talk Sdn Bhd

- 6.4.5 Celcom Berhad

- 6.4.6 XOX Mobile Sdn Bhd

- 6.4.7 MyRepublic Limited

- 6.4.8 Cherry Prepaid (Cosmic Technologies Inc.)

- 6.4.9 Itel Mobile (Transsion Holdings)

- 6.4.10 Wintel (Masan Group Corporation)

- 6.4.11 Penguin Telecom (Advanced Wireless Network Co., Ltd.)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment