PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940705

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940705

US MVNO - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

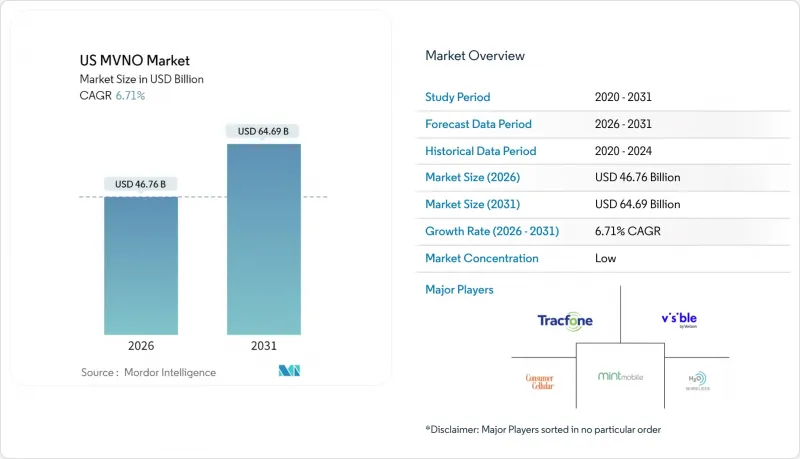

The US MVNO Market was valued at USD 43.82 billion in 2025 and estimated to grow from USD 46.76 billion in 2026 to reach USD 64.69 billion by 2031, at a CAGR of 6.71% during the forecast period (2026-2031).

Robust growth comes from sustained consumer appetite for lower-cost plans, enterprise outsourcing of IoT connectivity, and rapid cloud adoption that cuts time-to-market. Cable operators translate broadband strength into wireless cross-sell gains, while retailers launch eSIM-only brands that deepen digital engagement. Large carriers, worried about revenue dilution, counter with network slicing and strategic acquisitions that keep wholesale traffic-and profit streams-inside their own ecosystems. The steady influx of API-first wholesale platforms further flattens entry barriers and stimulates service innovation, ensuring that competitive pressure remains intense across every segment of the US MVNO market.

US MVNO Market Trends and Insights

Growing demand for budget-friendly wireless plans

Inflation keeps household budgets tight, pushing more consumers toward low-cost offerings in the US MVNO market. Operators answer with transparent, fee-free pricing that undercuts major carrier plans by 30-40%. Visible's five-year USD 15 rate guarantee directly counters Mint Mobile's headline promotions and illustrates how price competition now shapes brand perception. Bulk wholesale agreements, lean back-end operations, and digital onboarding let MVNOs preserve margins even while rates fall. Word-of-mouth referrals and flexible prepaid terms push churn down, reinforcing the cost advantage loop that sustains subscriber expansion.

5G coverage expansion supporting MVNO feature parity

Nationwide standalone 5G deployments erase the performance gap that once separated discount brands from network owners. Access to network slicing allows MVNOs to offer differentiated security, latency, and throughput tiers once reserved for direct carrier contracts. Feature parity reshapes competitive positioning: brands now lead with service innovation-gaming passes, AR perks, or bundled cloud storage-rather than apologizing for slower data. As device upgrade cycles accelerate, new 5G-only handsets default to eSIM provisioning, further smoothing customer migration to the US MVNO market.

Network deprioritization impacting perceived QoS

Most wholesale contracts allocate QCI 9 during peak congestion, leaving subscribers with slower speeds than postpaid carrier users. Complaints of unusable data during city-center rush hours dent brand credibility, forcing US MVNO market players to double down on price or negotiate costly premium QCI 8 access. Visible downtime in early 2025 and Mint Mobile's intermittent throttling issues highlight how quickly social media amplifies negative user experiences. Unless MVNOs secure higher priority lanes or lean on satellite fallback, the gap between promise and reality could flare into churn spikes.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise and IoT connectivity outsourcing to MVNOs

- FCC pro-competition policies and wholesale mandates

- Price wars compressing already thin MVNO margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployments held a 57.25% share of the US MVNO market in 2025 and are growing at a 12.89% CAGR. These architectures strip away capex-heavy hardware and let operators scale subscribers in line with demand surges. Platform-as-a-Service offerings-such as ATandT's MVNX stack-bundle billing, policy, and analytics into modular APIs that speed launch cycles from months to weeks. The shift lowers operating costs by up to 40%, freeing resources for marketing and feature development. On-premise solutions remain the pick for heavily regulated verticals, but their share erodes as cloud certifications expand. The flexibility of containerized microservices also future-proofs integrations with satellite gateways and IoT device clouds, positioning cloud MVNOs to capture the next wave of US MVNO market growth.

The cloud mindset fosters a fail-fast culture: brands A/B test plan mixes in real time, push over-the-air updates to companion apps, and surface churn-risk signals that prompt targeted retention offers. Data residency concerns, once a stumbling block, now find remedies in sovereign cloud zones that meet state privacy statutes. Early adopters report subscriber NPS gains after migrating to fully automated support chatbots anchored on cloud AI. Together, these factors make cloud operation the engine room of experimentation that keeps the US MVNO market vibrant and fiercely competitive.

Full MVNOs represented 45.30% of US MVNO market share in 2025 and are expanding at a 10.73% CAGR. Ownership of core network elements lets these players customize rate plans, embed fintech add-ons, and harvest granular usage data that refines upsell algorithms. CompaxDigital's BSS/OSS link-up with T-Mobile demonstrates the strategic tooling now available to brands that want deeper integration without building infrastructure from scratch. Light MVNOs still appeal when speed to launch outweighs differentiation needs, but price compression forces many to graduate toward full control as soon as subscriber bases hit breakeven scale.

Operational autonomy shields full MVNOs from abrupt wholesale policy changes, such as new throttling rules or SIM swap fees. It also simplifies multi-carrier negotiations, a critical advantage when bundling terrestrial and satellite links into single SKUs. As consumer acquisition costs rise, the value of owning cross-sell touchpoints-from device insurance to streaming bundles-climbs sharply, reinforcing the strategic migration toward full MVNO status in the US MVNO market.

The US MVNO Market Report is Segmented by Deployment Model (Cloud, On-Premises), Operational Mode (Reseller, and More), Subscriber Type (Consumer, Enterprise, and More), Application (Discount, Business and More), Network Technology (2G/3G, and More), Distribution Channel (Online/Digital-only, Traditional Retail Stores, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Subscribers).

List of Companies Covered in this Report:

- Tracfone Wireless

- H2O Wireless

- Visible

- Mint Mobile

- Consumer Cellular

- Cricket Wireless

- Straight Talk Wireless

- Boost Mobile

- Metro by T-Mobile

- Google Fi Wireless

- TruConnect

- Ting Mobile

- Red Pocket Mobile

- US Mobile

- Simple Mobile

- Total by Verizon

- Xfinity Mobile

- Spectrum Mobile

- TextNow

- Optimum Mobile

- Lycamobile USA

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for budget-friendly wireless plans

- 4.2.2 5G coverage expansion supporting MVNO feature parity

- 4.2.3 Enterprise & IoT connectivity outsourcing to MVNOs

- 4.2.4 FCC pro-competition policies and wholesale mandates

- 4.2.5 Rise of eSIM-only digital brands launched by retailers

- 4.2.6 API-driven wholesale marketplaces lowering entry barriers

- 4.3 Market Restraints

- 4.3.1 Network deprioritization impacting perceived QoS

- 4.3.2 Price wars compressing already thin MVNO margins

- 4.3.3 Rising digital-ad CAC for niche MVNO customer acquisition

- 4.3.4 MNO 5G-SA slice-access lockouts limiting service innovation

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Assessment of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Deployment Model

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.2 By Operational Mode

- 5.2.1 Reseller

- 5.2.2 Service Operator

- 5.2.3 Full MVNO

- 5.2.4 Light / Brand MVNO

- 5.3 By Subscriber Type

- 5.3.1 Consumer

- 5.3.2 Enterprise

- 5.3.3 IoT-specific

- 5.4 By Application

- 5.4.1 Discount

- 5.4.2 Business

- 5.4.3 Cellular M2M

- 5.4.4 Others

- 5.5 By Network Technology

- 5.5.1 2G/3G

- 5.5.2 4G/LTE

- 5.5.3 5G

- 5.5.4 Satellite/NTN

- 5.6 By Distribution Channel

- 5.6.1 Online/Digital-only

- 5.6.2 Traditional Retail Stores

- 5.6.3 Carrier Sub-brand Stores

- 5.6.4 Third-Party/Wholesale

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Tracfone Wireless

- 6.4.2 H2O Wireless

- 6.4.3 Visible

- 6.4.4 Mint Mobile

- 6.4.5 Consumer Cellular

- 6.4.6 Cricket Wireless

- 6.4.7 Straight Talk Wireless

- 6.4.8 Boost Mobile

- 6.4.9 Metro by T-Mobile

- 6.4.10 Google Fi Wireless

- 6.4.11 TruConnect

- 6.4.12 Ting Mobile

- 6.4.13 Red Pocket Mobile

- 6.4.14 US Mobile

- 6.4.15 Simple Mobile

- 6.4.16 Total by Verizon

- 6.4.17 Xfinity Mobile

- 6.4.18 Spectrum Mobile

- 6.4.19 TextNow

- 6.4.20 Optimum Mobile

- 6.4.21 Lycamobile USA

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment