PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939001

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939001

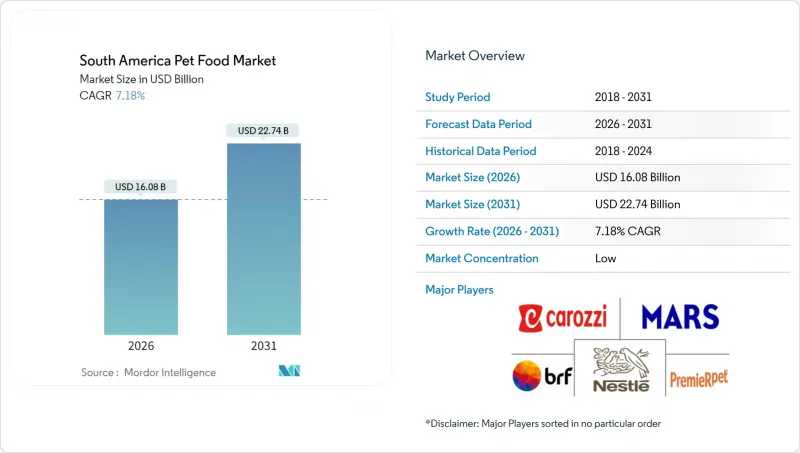

South America Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The South America pet food market is expected to grow from USD 15 billion in 2025 to USD 16.08 billion in 2026 and is forecast to reach USD 22.74 billion by 2031 at 7.18% CAGR over 2026-2031.

After years of sustained investment, the region now boasts more than USD 1 billion in recently installed capacity, which underpins competitive exports, especially from Brazil and Argentina. Consumption patterns continue to migrate toward premium and therapeutic recipes as rising urban incomes, humanization of companion animals, and e-commerce accessibility reshape purchase priorities across all income brackets. Competitive rivalry remains low because multinationals, such as Mars and Nestle Purina, share shelf space with agile regional champions that know how to leverage local crop availability for a cost advantage.

South America Pet Food Market Trends and Insights

Rising Humanization of Pets Fueling Premiumization

Three of four Argentine owners consider their companion animals family members, so they willingly pay for premium snacks, organic formulations, and veterinary diets that emulate human wellness trends. Brazilian and Argentine factories have installed advanced twin-screw extruders and automated packaging to deliver scientifically validated recipes at scale, allowing brands to justify higher price points and differentiate through functional claims. Start-ups such as Mascote Fit use human-grade meats and transparent labeling to capture younger consumers who distrust artificial additives. Premium share already sits at 12% in Mexico and is predicted to approach 20% once disposable incomes converge with regional averages. Parallel growth in pet hospitality and insurance services reinforces willingness to invest in nutrition, confirming a virtuous cycle between humanization and premium feed demand.

Expansion of E-commerce Pet-Specialty Platforms

Digital platforms lowered the cost of reaching fragmented pet households, as e-commerce gained 100 basis points of expenditure share in Argentina within one year. Mercado Libre ranked pet food the sixth best-selling category during Mexico's "El Buen Fin" campaign, posting 90% year-over-year sales growth that validated the omnichannel shift. Consumers appreciate subscription convenience, a larger selection, and price transparency, which is eroding the dominance of independent pet shops, which still number 42,000 in Brazil. Nestle Purina piloted zero-waste bulk delivery in Santiago using Algramo's electric tricycles, reducing packaging weight by 10 grams per kilogram sold and demonstrating how digital tools can align sustainability goals with direct-to-consumer economics. Rapid fulfillment networks now enable same-day delivery in capital cities, further closing convenience gaps that once discouraged online orders.

Volatility in Raw Meat and Grain Prices Squeezing Manufacturer Margins

Corn production in Brazil is affected, following drought-reduced harvests, which added 1.07 percentage points to national inflation and led to cost pass-through to retail shelves. Argentine yellow maize climbed year on year in March 2024 due to drought and peso devaluation, while wheat rose over the same period. Protein inputs tell a similar story, with Brazilian beef briefly reaching USD 2.32 per kilogram at wholesale before easing due to larger slaughter volumes, as reported by. Companies hedge through ingredient substitution and futures contracts, but smaller firms without vertical integration face solvency pressure.

Other drivers and restraints analyzed in the detailed report include:

- Growth in Functional Nutrition and Nutraceutical Adoption for Preventive Pet Healthcare

- Increasing Cat Ownership in Densely Populated Urban Centers

- Limited Cold-Chain Infrastructure Restricting Wet Food Distribution

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Veterinary diets were the fastest-growing segment, with a 8.85% CAGR, despite food still accounting for 70.30% of the 2025 revenue in the South America pet food market. The South America pet food market size for veterinary diets is projected to grow by 2031 as clinics recommend condition-specific formulas for renal or metabolic support. Manufacturer margins reach double those of conventional adult maintenance kibble because functional ingredients raise perceived value and price elasticity.

Treats now account for a significant share of consumer spending, with options including dental sticks, freeze-dried bits, and jerky. Regulatory shifts, such as Mexico's NOM-012-SAG/ZOO-2020, enforce stability tests for high-moisture treats, prompting investments in inline moisture analyzers and metal detection to avoid product recalls. Pet nutraceuticals, omega-3 oils, yeast-derived beta-glucans, and milk bioactives are climbing a 10% runway, albeit from a low base, propelled by cross-selling in veterinary offices. Wet food is gaining share too, but logistics bottlenecks limit distribution beyond tier-one cities.

The South America Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, and More), Pets (Cats, Dogs, and Other Pets), Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, and More), and Geography (Argentina, Brazil, and Rest of South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Alltech Inc.

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Dechra Pharmaceuticals PLC

- Farmina Pet Foods

- General Mills Inc.

- Mars Incorporated

- Nestle S.A. (Purina)

- Schell & Kampeter Inc. (Diamond Pet Foods)

- Virbac S.A.

- Empresas Carozzi S.A

- PremieRpet

- BRF Global

- The J.M. Smucker Company

- ADM

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Rising humanization of pets fueling premiumization

- 5.5.2 Expansion of e-commerce pet-specialty platforms

- 5.5.3 Growth in functional nutrition and nutraceutical adoption for preventive pet healthcare

- 5.5.4 Increasing cat ownership in densely populated urban centers

- 5.5.5 Localization of production by multinationals mitigating import tariffs

- 5.5.6 Innovation in insect-based proteins improving sustainability profile

- 5.6 Market Restraints

- 5.6.1 Volatility in raw meat and grain prices squeezing manufacturer margins

- 5.6.2 Limited cold-chain infrastructure restricting wet food distribution

- 5.6.3 High informality of retail limiting premium brand penetration

- 5.6.4 Stringent labeling regulations on nutraceutical claims slowing new launches

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

- 6.4 Geography

- 6.4.1 Brazil

- 6.4.2 Argentina

- 6.4.3 Rest of South America

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Alltech Inc.

- 7.6.2 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.4 Dechra Pharmaceuticals PLC

- 7.6.5 Farmina Pet Foods

- 7.6.6 General Mills Inc.

- 7.6.7 Mars Incorporated

- 7.6.8 Nestle S.A. (Purina)

- 7.6.9 Schell & Kampeter Inc. (Diamond Pet Foods)

- 7.6.10 Virbac S.A.

- 7.6.11 Empresas Carozzi S.A

- 7.6.12 PremieRpet

- 7.6.13 BRF Global

- 7.6.14 The J.M. Smucker Company

- 7.6.15 ADM

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS