PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939053

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939053

China Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

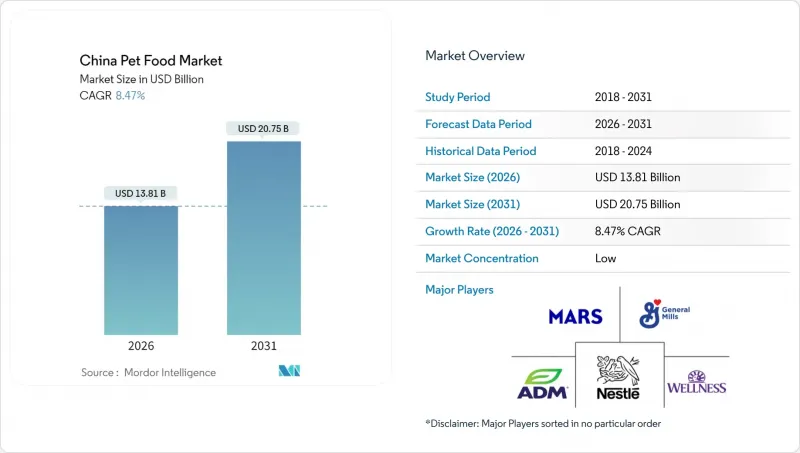

The China pet food market was valued at USD 12.73 billion in 2025 and estimated to grow from USD 13.81 billion in 2026 to reach USD 20.75 billion by 2031, at a CAGR of 8.47% during the forecast period (2026-2031).

Premium formulations, direct-to-consumer innovation, and functional positioning elevate average selling prices while urbanization and rising disposable income expand the pet-owning population. Domestic manufacturers scale freeze-dried capacity to capture value in high-margin treat formats, and livestreaming commerce compresses the path from product discovery to purchase, allowing niche brands to compete head-on with multinational incumbents. Regulatory tightening around labeling and ingredient traceability reinforces consumer trust, helping premium and therapeutic diets gain share even in price-sensitive Tier-3 markets. Raw material cost volatility and carbon-neutral compliance outlays temper margins but simultaneously spur technology upgrades and supply-chain diversification.

China Pet Food Market Trends and Insights

Accelerated Premiumization of Cat and Dog Diets

Premium formats expanded 18-22% in 2024 as pet owners traded up to limited-ingredient, organic, and veterinary-endorsed formulas that command price premiums of 40-60% over standard kibble . Tier-1 consumers tie product choice to food-safety credentials and novel proteins, such as insect- or plant-based sources, that support digestive and allergy management. Clearer feed-safety standards issued by the Ministry of Agriculture and Rural Affairs specify protein quality and traceability norms, giving retailers confidence to merchandise high-end lines. The premium wave lifts the China pet food market by raising average spend per pet and encourages manufacturers to invest in research and packaging upgrades that justify higher price points. Spillover into Tier-2 markets is already visible as household income growth narrows the affordability gap and social media accelerates trend diffusion. The premiumization narrative, therefore, underpins both volume stability and margin expansion for branded producers.

Rise of DTC (Direct-to-Customer) Digital-Native Pet-Food Brands

Digital-native players secured a roughly 12-15% share in 2024 by selling exclusively through Tmall, JD, and Xiaohongshu storefronts, where same-day delivery and data-driven personalization foster repeat purchases. Subscription bundles reduce inventory risk and deliver predictable cash flow, while interactive livestreams strengthen community engagement that traditional mass-media advertising cannot match. Consumer review ecosystems reward transparency and rapid product iteration, enabling start-ups to roll out new SKUs in as little as six weeks. Logistics partnerships with JD Logistics and Cainiao reduce last-mile costs and extend cold-chain coverage for fresh and raw food products. The China pet food market, therefore, experiences a structural shift as brand equity migrates from above-the-line campaigns to digital intimacy and customer lifetime value analytics. Established multinationals respond with joint ventures and minority investments to capture DTC (Direct-to-Consumer) know-how without diluting existing retail channels.

Raw-Material Price Volatility for Poultry and Fish Meals

Protein inputs fluctuated by 15-25% in 2024 due to disruptions from avian flu and uncertainty over fishing quotas, leading to selective retail price hikes that risk compromising demand elasticity. Poultry meal peaked at RMB 8,500 (USD 1,200) per metric ton before sliding to RMB 7,200 (USD 1,015), yet forward contracts remain scarce, compelling spot purchases. Fish meal reached RMB 16,000 (USD 2,255) at seasonal highs, squeezing manufacturers already investing in packaging upgrades. Brands diversify into insect protein and pea concentrate to hedge volatility, but reformulation cycles absorb R&D bandwidth. Although the Chinese pet food market retains its volume momentum, profit pools are compressing for value brands that cannot fully pass through their costs.

Other drivers and restraints analyzed in the detailed report include:

- Growth of Functional/Therapeutic Nutrition Positioning

- Human-Grade Ingredient Sourcing Mandates from Tier-1 Retailers

- Rising Regulatory Scrutiny on Labeling Claims

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products maintain commanding market leadership with a 60.02% China pet food market size in 2025, reflecting their essential role in daily pet nutrition and broad consumer accessibility across price points. This significant market position is primarily driven by the fact that the segment is a staple purchase for most pet owners, regardless of their pet's breed, size, or age.

The segment's 9.21% CAGR through 2031, benefits from premiumization trends as consumers upgrade from basic kibble to specialized formulations featuring novel proteins, functional ingredients, and life-stage targeting. Dry pet food, particularly kibble formats, represents the largest subsegment due to convenience, shelf stability, and cost-effectiveness for multi-pet households. Wet pet food experiences accelerating growth as urbanization increases demand for portion-controlled, palatability-enhanced options that appeal to finicky eaters and senior pets requiring softer textures.

The China Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, and Pet Veterinary Diets), by Pets (Cats, Dogs, and Other Pets), and by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons)

List of Companies Covered in this Report:

- Mars, Incorporated

- General Mills Inc.

- ADM

- Nestle (Purina)

- Affinity Petcare S.A

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- PLB International Inc.

- Virbac

- Alltech

- Schell & Kampeter, Inc. (Diamond Pet Foods Inc.)

- Shanghai Enova Pet Products Co. Ltd

- Shanghai Navarch Pet Products Co. Ltd

- Tianjin Ringpu Bio-Pharmacy Co. Ltd

- Tongwei Pet Food

- Wellpet China

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Accelerated premiumization of cat and dog diets

- 5.5.2 Rise of DTC (Direct-to-Customer) digital-native pet-food brands

- 5.5.3 Growth of functional/therapeutic nutrition positioning

- 5.5.4 Human-grade ingredient sourcing mandates from Tier-1 retailers

- 5.5.5 Expansion of domestic freeze-dried capacity in Tier-3 cities

- 5.5.6 Cross-border live-stream commerce for exotic pet diets

- 5.6 Market Restraints

- 5.6.1 Raw-material price volatility for poultry and fish meals

- 5.6.2 Rising regulatory scrutiny on labeling claims

- 5.6.3 Intensifying competition from home-made fresh diets

- 5.6.4 Carbon-neutral factory compliance costs

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Diabetes

- 6.1.4.1.2 Digestive Sensitivity

- 6.1.4.1.3 Oral Care Diets

- 6.1.4.1.4 Renal

- 6.1.4.1.5 Urinary tract disease

- 6.1.4.1.6 Obesity Diets

- 6.1.4.1.7 Derma Diets

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 General Mills Inc.

- 7.6.3 ADM

- 7.6.4 Nestle (Purina)

- 7.6.5 Affinity Petcare S.A

- 7.6.6 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.7 PLB International Inc.

- 7.6.8 Virbac

- 7.6.9 Alltech

- 7.6.10 Schell & Kampeter, Inc. (Diamond Pet Foods Inc.)

- 7.6.11 Shanghai Enova Pet Products Co. Ltd

- 7.6.12 Shanghai Navarch Pet Products Co. Ltd

- 7.6.13 Tianjin Ringpu Bio-Pharmacy Co. Ltd

- 7.6.14 Tongwei Pet Food

- 7.6.15 Wellpet China

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS