PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939613

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939613

United Kingdom Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

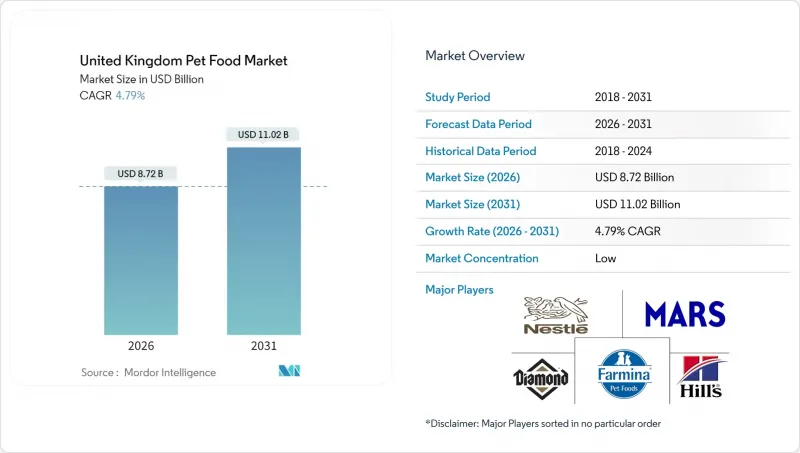

The United Kingdom pet food market was valued at USD 8.32 billion in 2025 and estimated to grow from USD 8.72 billion in 2026 to reach USD 11.02 billion by 2031, at a CAGR of 4.79% during the forecast period (2026-2031).

Rising premiumization, digital commerce adoption, and demographic shifts that favor single-person and senior households reinforce the market's resilience. Companies continue to widen functional portfolios, integrate supply chains, and invest in domestic capacity to offset post-Brexit frictions and currency swings. Sustainability scrutiny accelerates interest in alternative proteins, recycled inputs, and recyclable packaging, encouraging innovation and brand differentiation. Cost-of-living pressures do temper trading-up, yet premium categories hold ground as owners prioritize perceived health benefits for companion animals.

United Kingdom Pet Food Market Trends and Insights

Humanization of pets elevating demand for premium food

Pet owners increasingly insist on human-grade recipes, transparent sourcing, and functional benefits, lifting average unit prices across the United Kingdom pet food market. Organic, grain-free, single-protein, and locally produced lines resonate with health-minded consumers. Premium brands leverage small-batch narratives and science-backed claims to justify price premiums. Subscription models bolster retention by automating replenishment and offering tailored diet plans. Manufacturers that sustain ingredient integrity while communicating clear welfare credentials build lasting competitive moats.

Growth in single-person and senior households adopting companion animals

Single residents and retirees adopt pets for companionship, which sustains volume growth even when birth rates stagnate. These demographics embrace portion-controlled packs and auto-replenishment to minimize store trips. Seniors gravitate toward diets that support joint, weight, and cognitive health for aging pets, fueling demand for veterinarian-endorsed products. Urban single owners value convenience, prompting brands to launch easy-open cans and lightweight pouches that fit compact living spaces. The spending stability of retirees cushions premium categories during economic stress.

Cost-of-living pressure shifting buyers to economy brands

Inflation compresses disposable income, prompting households to trade down within the United Kingdom pet food market. Private-label lines gain share because supermarkets negotiate volume discounts and pass savings through. Premium players introduce value extensions or smaller packs to retain price-sensitive users. While substitution from premium to mid-tier slows revenue per kilogram, consistent pet ownership levels buffer overall volume. Treat purchases become more occasional, creating uneven demand swings across subcategories.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce expansion enabling direct-to-consumer brands

- Functional ingredients focus

- Post-Brexit regulatory divergence raising import costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food retained the largest 71.62% share of the United Kingdom pet food market size in 2025 and continues to anchor household purchasing cycles. Dry kibble dominates for convenience, price, and dental benefits, yet wet formulations gain traction among owners seeking higher palatability and moisture. Manufacturers diversify protein sources within both formats to hedge raw-material risk and respond to allergen concerns. Pet treats, while accounting for a smaller base, posts the swiftest 5.55% CAGR, fueled by training, bonding rituals, and functional snacking that blur the line between feed and supplement. Formulators embed joint, digestive, and skin support ingredients to command price premiums.

Growing demand for therapeutic and fortified solutions elevates pet nutraceuticals and supplements. Owners frequently supplement base diets with omega oils, multivitamins, and probiotic chews on veterinary advice, lifting average spending per pet. Pet veterinary diets occupy a specialized niche with high margins because prescriptions must follow clinical diagnosis. Although volume remains limited, rising incidences of obesity and chronic disease among the aging pet population underpin steady growth. The United Kingdom pet food market share for therapeutic diets is projected to widen as clinic recommendations increase and e-commerce platforms simplify refill ordering.

The United Kingdom Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), Pets (Cats, Dogs, Other Pets), Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Alltech Inc.

- Dechra Pharmaceuticals PLC

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Farmina Pet Foods

- General Mills Inc.

- Mars, Incorporated

- Nestle S.A.(Purina)

- Virbac

- Vafo Praha s.r.o.

- Spectrum Brands Holdings Inc.

- Pets at Home Group plc

- IPN Holdings Ltd.

- Diamond Pet Foods (Schell and Kampeter, Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY & PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Humanization of pets elevating demand for premium food

- 5.5.2 Growth in single-person and senior households adopting companion animals

- 5.5.3 E-commerce expansion enabling direct-to-consumer brands

- 5.5.4 Functional ingredients focus

- 5.5.5 Circular-economy sourcing of insect and up-cycled proteins

- 5.5.6 Veterinary endorsement programs boosting therapeutic diets

- 5.6 Market Restraints

- 5.6.1 Cost-of-living pressure shifting buyers to economy brands

- 5.6.2 Post-Brexit regulatory divergence raising import costs

- 5.6.3 Sustainability scrutiny on meat-based carbon footprint

- 5.6.4 Retail consolidation squeezing smaller brand shelf space

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft & Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Alltech Inc.

- 7.6.2 Dechra Pharmaceuticals PLC

- 7.6.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.5 Farmina Pet Foods

- 7.6.6 General Mills Inc.

- 7.6.7 Mars, Incorporated

- 7.6.8 Nestle S.A.(Purina)

- 7.6.9 Virbac

- 7.6.10 Vafo Praha s.r.o.

- 7.6.11 Spectrum Brands Holdings Inc.

- 7.6.12 Pets at Home Group plc

- 7.6.13 IPN Holdings Ltd.

- 7.6.14 Diamond Pet Foods (Schell and Kampeter, Inc.)

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS