PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939129

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939129

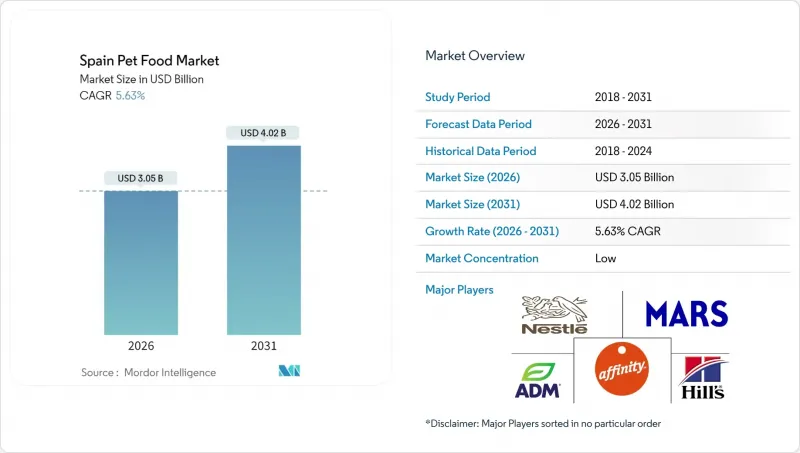

Spain Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Spain pet food market size in 2026 is estimated at USD 3.05 billion, growing from 2025 value of USD 2.89 billion with 2031 projections showing USD 4.02 billion, growing at 5.63% CAGR over 2026-2031.

The Spanish pet food market is gaining momentum from the rapid adoption of premiumization, functional formulation, and increasing e-commerce penetration, particularly among urban millennials who view pets as family members. Regulatory clarity regarding novel proteins supports innovation even as it imposes rigorous compliance costs. Supply chain vulnerabilities present headline risks, particularly omega-3 sourcing disruptions and ingredient price volatility affecting premium product margins. Low competitive concentration allows local challengers to secure share through sustainable ingredients and direct-to-consumer models while the top three global players continue to defend scale advantages.

Spain Pet Food Market Trends and Insights

Accelerating Humanization of Pets

Spanish owners increasingly view animals as family, with 85% embracing the human-grade nutrition ethos. Organic and natural lines captured 23% share in 2024, up from 18% in 2022, reflecting readiness to pay for ingredient transparency. Millennials drive this shift by favoring premium SKUs priced above EUR 8 (USD 8.5) per kilogram, which logged 40% sales growth at specialty retailers. Brands emphasize lifestyle narratives and emotive packaging to align with this mindset. As urban households rise, Spain pet food market benefits from higher per-capita expenditure, lifting revenue resilience even during economic uncertainty.

Premiumization and Functional Formulation Push

Digestive-health recipes climbed 35% in 2024 as veterinarians recommended targeted diets for chronic conditions. Affinity Petcare's postbiotic-enriched range recorded clinically validated gut benefits in 78% of pets, underscoring scientific proof points. Consumers also display willingness to pay for responsibly sourced proteins, with 42% favoring environmentally certified products. Insect-based formulations meet that demand while reducing carbon footprints. Spain pet food market therefore sees R&D investments in clinically backed, planet-friendly ingredients that sustain premium pricing.

Price Volatility of Key Ingredients

Raw material cost fluctuations create margin pressure across the pet food value chain, with protein sources experiencing price variations during 2024 due to global supply constraints and climate-related disruptions. Spanish manufacturers face particular challenges in omega-3 sourcing, where fish oil prices increased following reduced anchovy catches in Peruvian waters. The volatility affects premium product positioning, as manufacturers struggle to maintain consistent pricing while preserving profit margins. Smaller companies lack hedging capabilities enjoyed by multinational competitors, creating competitive disadvantages during periods of extreme price volatility. Consumer price sensitivity increases during economic uncertainty, potentially limiting premium product adoption and forcing manufacturers to reformulate products or accept reduced margins.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Penetration in Emerging Markets

- Veterinary Endorsements and Prescription Diet Growth

- Regulatory Scrutiny on Novel Proteins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The food segment commanded 69.35% of Spain pet food market share in 2025, retaining primacy due to habitual purchasing and broad distribution. Treats will post the strongest 6.79% CAGR through 2031 as owners reward pets more frequently and seek dental or joint-support benefits. Dry food delivers volume efficiency, whereas wet formulas for cats focus on palatability and hydration appeal. Spain pet food market size for veterinary diets captures disproportionately high revenue because disease-specific formulas trade at price premiums, supported by clinical research.

Functional snacks fortified with glucosamine or probiotics promise incremental growth, aligning with the premiumization arc. Sustainability claims now appear across mainstream kibble, reflecting owners appetite for ethically sourced proteins. Regulatory oversight ensures transparent labeling so consumers can confidently pay extra for perceived value. Larger players bundle treat innovations with core food portfolios to deepen brand stickiness, an approach that smaller challengers mimic through limited-edition SKUs and seasonal flavors.

The Spain Pet Food Market Report Segments the Industry Into Pet Food Product (Food, Pet Nutraceuticals/Supplements, and More), Pets (Cats, Dogs, and Other Pets), and Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Alltech Inc.

- Dechra Pharmaceuticals PLC

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Vafo Praha s.r.o.

- General Mills Inc.

- Mars, Incorporated

- Nestle S.A.(Purina)

- Virbac

- ADM

- Spectrum Brands Holdings Inc.

- Pets at Home Group plc

- Affinity Petcare S.A

- Diamond Pet Foods (Schell and Kampeter, Inc.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Accelerating Humanization of Pets

- 5.5.2 Premiumization and Functional Formulation Push

- 5.5.3 E-commerce Penetration in Emerging Markets

- 5.5.4 Veterinary Endorsements and Prescription Diet Growth

- 5.5.5 Microbiome-targeted Nutrition R&D Breakthroughs

- 5.5.6 Sustainable Protein Inclusions

- 5.6 Market Restraints

- 5.6.1 Price Volatility of Key Ingredients

- 5.6.2 Regulatory Scrutiny on Novel Proteins

- 5.6.3 Supply-chain Disruptions in Omega-3 Sourcing

- 5.6.4 Rising Incidence of Pet Food Recalls

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Alltech Inc.

- 7.6.2 Dechra Pharmaceuticals PLC

- 7.6.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.5 Vafo Praha s.r.o.

- 7.6.6 General Mills Inc.

- 7.6.7 Mars, Incorporated

- 7.6.8 Nestle S.A.(Purina)

- 7.6.9 Virbac

- 7.6.10 ADM

- 7.6.11 Spectrum Brands Holdings Inc.

- 7.6.12 Pets at Home Group plc

- 7.6.13 Affinity Petcare S.A

- 7.6.14 Diamond Pet Foods (Schell and Kampeter, Inc.)

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS