PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939149

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939149

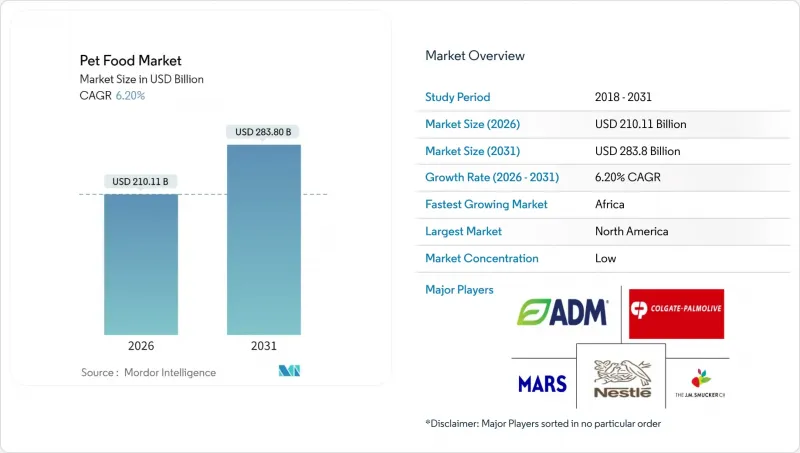

Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The pet food market is expected to grow from USD 197.85 billion in 2025 to USD 210.11 billion in 2026 and is forecast to reach USD 283.8 billion by 2031 at 6.2% CAGR over 2026-2031.

Surging pet humanization, premium diet adoption, and sustained spending resilience underpin this trajectory. Owners in mature economies increasingly select organic, grain-free, and functional recipes, even during economic slowdowns, while veterinarians steer demand toward therapeutic offerings. Digital subscription models are expanding margins by matching individualized nutrition plans with data-driven replenishment cycles. Meanwhile, alternative proteins such as algae-derived omega-3s and fermented chicken lessen raw-material volatility and create new value pools.

Global Pet Food Market Trends and Insights

Rise in Pet Humanization and Premiumization of Diets

Pet humanization represents the most significant driver reshaping the industry, as owners increasingly view their companions as family members deserving human-grade nutrition and specialized care. The Association for Pet Obesity Prevention reports that 59% of cats and 56% of dogs in the United States are overweight or obese, driving demand for weight management and therapeutic diets. Functional additives such as probiotics and algae-sourced omega-3s are now standard, shifting marketing narratives from indulgence to preventive health. Brands differentiate by disclosing sourcing and leveraging customization portals that integrate veterinary diagnostics. Long shelf-life wet foods with high moisture content are gaining traction for digestive and renal benefits, bolstering value per kilogram.

E-commerce Penetration is Expanding Access in Emerging Countries

Online channels are growing by dismantling geographic barriers by shipping directly to secondary and tertiary cities in Brazil, Mexico, and Indonesia. Mobile payments and social-commerce tie-ups accelerate first-time purchases, while subscription discounts lock in repeat orders. Direct-to-consumer start-ups segment audiences through AI-driven taste quizzes, upselling supplements alongside core kibble. Digital storefronts translate product claims into local languages, easing trust issues in cross-border trade. Logistics firms employ cold-chain micro-fulfillment to safeguard wet, fresh, or raw diets during last-mile delivery.

Volatile Meat and Grain Prices Compress Manufacturer Margins

Beef and chicken spot prices fluctuated through 2024 after droughts and disease outbreaks curtailed supply. Corn and soybean spikes forced three consumer price hikes within 12 months, risking down-trading to value brands in price-sensitive economies. Smaller producers lacking futures hedges face cash-flow strain, prompting mergers or exits. Manufacturers pivot to multi-protein recipes, tapioca, legumes, and insect meal to cushion swings. Retailers deploy agile shelf-pricing synchronized with commodity dashboards to maintain basket predictability.

Other drivers and restraints analyzed in the detailed report include:

- Innovation in Functional Ingredients and Nutraceutical Blends

- Younger Demographics' Higher Pet Ownership Rates

- Tightening Sustainability Regulations on Pet Food Packaging

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Pet food product, traditional food held 67.45% of the pet food market share in 2025, whereas veterinary diets are projected to post a 7.1% CAGR through 2031. Dry kibble remains the volume anchor due to cost efficiency and ease of storage, yet wet foods gain incremental share for palatability and moisture advantages. Functional chews and powders bundle joint and digestive benefits, lifting average order value in specialty clinics. Manufacturers introduce breed-specific SKUs that integrate glucosamine levels tailored to hip-dysplasia-prone lineages.

Across the mid-term, omnichannel availability of prescription lines blurs clinic and retail boundaries, though Rx verification safeguards remain. Ingredient diversification into insect and plant isolates hedges meat-price swings, while algae-derived DHA enhances cognitive-care portfolios. Reformulation toward low-glycemic carbohydrates responds to metabolic disease prevalence. Packaging shifts to recyclable aluminum trays satisfy regulatory timelines without compromising barrier performance. As personalized pet genomics emerge, micro-batch production platforms could further fragment offerings, reinforcing premium margins within the pet food industry.

The Pet Food Market Report is Segmented by Pet Food Product (Food, Nutraceuticals/Supplements, Treats, and Veterinary Diets), Pets (Cats, Dogs, and Other Pets), Distribution Channel (Convenience Stores, Online, Specialty Stores, Supermarkets/Hypermarkets, and Other Channels), and Geography (Africa, Asia-Pacific, Europe, North America, and South America). Market Forecasts are in Value (USD) and Volume (Metric Tons).

Geography Analysis

North America generated 44.10% of global revenue in 2025, translating to a pet food market share advantage anchored by high adoption rates, insurance penetration, and clinician influence on diet choices. United States households favor data-enriched subscription bundles, while Canadian shoppers gravitate toward organic and raw options. Mexico's rising middle class boosts mid-tier kibble volume, and domestic producers expand poultry-based formulas to align with local palatability preferences. The region benefits from mature cold-chain logistics that enable fresh-frozen delivery within 48 hours.

Africa edges ahead on growth velocity at a 8.95% CAGR, led by South Africa's urban clusters and expanding veterinarian networks. Multinationals partner with local mills to mitigate currency volatility and import duties. Value-focused 2 kg packs dominate entry pricing, while premium wet pouches begin appearing in upscale Johannesburg neighborhoods. Asia-Pacific rounds out the global landscape with heterogeneous dynamics. Chinese millennials drive premium uptake, Indian pet spending accelerates across Tier-2 cities, and Japan matures toward senior-pet health solutions. Localization of protein sources and culturally resonant flavors remains paramount to sustain momentum across the pet food market.

Europe follows as the second-largest bloc, where stringent labeling and sustainability mandates spur ingredient transparency and recyclable packaging. Germany and the United Kingdom lead therapeutic diet adoption, whereas France's gourmet wet ranges outpace dry sales. Eastern Europe shows double-digit growth on the back of urbanization and retail-chain expansion, supported by EU cohesion funds improving logistics corridors. Nordic nations' emphasis on traceable wild protein channels innovation in salmon and reindeer inclusions. The evolving regulatory scene positions environmental stewardship as a competitive lever in the pet food market.

- ADM (Archer Daniels Midland Company)

- Agroindustrias Baires

- Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- Simmons Foods Inc.

- General Mills Inc.

- Mars, Incorporated

- Nestle S.A.(Purina)

- The J. M. Smucker Company

- Central Garden and Pet Company

- Sunshine Mills, Inc.

- heristo aktiengesellschaft

- PLB International

- Diamond Pet Foods (Schell and Kampeter, Inc.)

- Unicharm Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY & KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY & PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain & Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Rise in pet humanization and premiumization of diets

- 5.5.2 E-commerce penetration expanding access in emerging countries

- 5.5.3 Innovation in functional ingredients and nutraceutical blends

- 5.5.4 Younger demographic's higher pet ownership rates

- 5.5.5 Venture-backed DTC (Direct to Consumer) fresh-frozen subscription services

- 5.5.6 Cell-based/fermented protein cost break-throughs

- 5.6 Market Restraints

- 5.6.1 Volatile meat and grain prices compress manufacturer margins

- 5.6.2 Tightening sustainability regulations on pet-food packaging

- 5.6.3 Growing scrutiny of ultra-processed formulations by veterinarians

- 5.6.4 Supply-chain exposure to mycotoxin contamination events

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 By Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft & Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Derma Diets

- 6.1.4.1.2 Diabetes

- 6.1.4.1.3 Digestive Sensitivity

- 6.1.4.1.4 Obesity Diets

- 6.1.4.1.5 Oral Care Diets

- 6.1.4.1.6 Renal

- 6.1.4.1.7 Urinary tract disease

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 By Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 By Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

- 6.4 By Region

- 6.4.1 Africa

- 6.4.1.1 By Country

- 6.4.1.1.1 South Africa

- 6.4.1.1.2 Rest of Africa

- 6.4.1.1 By Country

- 6.4.2 Asia-Pacific

- 6.4.2.1 By Country

- 6.4.2.1.1 Australia

- 6.4.2.1.2 China

- 6.4.2.1.3 India

- 6.4.2.1.4 Indonesia

- 6.4.2.1.5 Japan

- 6.4.2.1.6 Malaysia

- 6.4.2.1.7 Philippines

- 6.4.2.1.8 Taiwan

- 6.4.2.1.9 Thailand

- 6.4.2.1.10 Vietnam

- 6.4.2.1.11 Rest of Asia-Pacific

- 6.4.2.1 By Country

- 6.4.3 Europe

- 6.4.3.1 By Country

- 6.4.3.1.1 France

- 6.4.3.1.2 Germany

- 6.4.3.1.3 Italy

- 6.4.3.1.4 Netherlands

- 6.4.3.1.5 Poland

- 6.4.3.1.6 Russia

- 6.4.3.1.7 Spain

- 6.4.3.1.8 United Kingdom

- 6.4.3.1.9 Rest of Europe

- 6.4.3.1 By Country

- 6.4.4 North America

- 6.4.4.1 By Country

- 6.4.4.1.1 Canada

- 6.4.4.1.2 Mexico

- 6.4.4.1.3 United States

- 6.4.4.1.4 Rest of North America

- 6.4.4.1 By Country

- 6.4.5 South America

- 6.4.5.1 By Country

- 6.4.5.1.1 Argentina

- 6.4.5.1.2 Brazil

- 6.4.5.1.3 Rest of South America

- 6.4.5.1 By Country

- 6.4.1 Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 ADM (Archer Daniels Midland Company)

- 7.6.2 Agroindustrias Baires

- 7.6.3 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 7.6.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 7.6.5 Simmons Foods Inc.

- 7.6.6 General Mills Inc.

- 7.6.7 Mars, Incorporated

- 7.6.8 Nestle S.A.(Purina)

- 7.6.9 The J. M. Smucker Company

- 7.6.10 Central Garden and Pet Company

- 7.6.11 Sunshine Mills, Inc.

- 7.6.12 heristo aktiengesellschaft

- 7.6.13 PLB International

- 7.6.14 Diamond Pet Foods (Schell and Kampeter, Inc.)

- 7.6.15 Unicharm Corporation

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS