PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939040

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939040

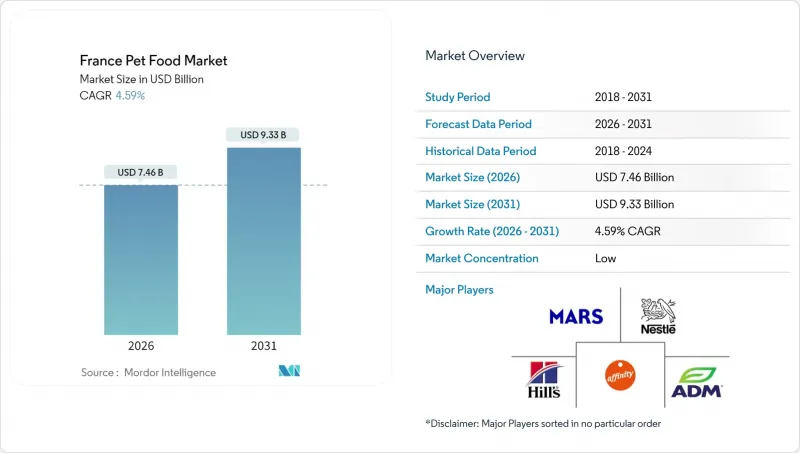

France Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

France pet food market size in 2026 is estimated at USD 7.46 billion, growing from 2025 value of USD 7.13 billion with 2031 projections showing USD 9.33 billion, growing at 4.59% CAGR over 2026-2031.

Continuous premiumization, the shift toward human-grade ingredient sourcing, and the spread of functional diets collectively sustain value growth even though total tonnage rises at a slower pace. Structural advantages such as dense veterinary networks, strong local agriculture, and stable disposable income levels enable manufacturers to pass through selective price hikes while maintaining brand loyalty. E-commerce subscription models reinforce predictable demand and data-driven personalization, while regulatory openings for insect and other novel proteins unlock incremental formulation opportunities. At the same time, prolonged cost-of-living pressures temper mid-tier spending, prompting retailers to push private-label lines that compete directly with legacy brands.

France Pet Food Market Trends and Insights

Premiumization of Cat Food Drives Value Growth Beyond Volume Expansion

French cat owners increasingly treat feline nutrition as a health investment rather than a commodity purchase, driving segment value expansion beyond volume metrics. This shift reflects deeper behavioral changes where pet humanization intersects with France's culinary culture, creating demand for artisanal and restaurant-quality pet food formulations. The European Pet Food Industry Federation reported that cat treats represent only 3% of volume but capture 10% of category value in 2023, demonstrating the premium pricing power of specialized feline products. The trend gains momentum as French retailers expand premium shelf space allocation, with specialty stores capturing higher margins on functional and therapeutic cat food formulations.

Human-Grade Ingredient Demand Reshapes Supply Chain and Pricing Strategies

Consumer expectations for transparency and ingredient quality mirror trends in human food markets, compelling manufacturers to source ingredients that meet human consumption standards. This demand creates supply chain complexity as pet food producers compete with human food manufacturers for premium protein sources and organic certifications. French manufacturers benefit from domestic agricultural infrastructure, with Purina spending approximately EUR 530 million (USD 577.7 million) annually on French suppliers, thereby creating integrated value chains that support ingredient traceability. The Origin'Info transparency charter demonstrates industry commitment to ingredient disclosure, addressing consumer demands for supply chain visibility.

Inflation-Driven Price Sensitivity Forces Trading Down Across Middle-Market Segments

Economic pressures force pet owners to reconsider premium purchases as household budgets tighten, creating downward pressure on average selling prices across categories. Pet food prices increased 7% in France during 2024, outpacing general inflation and triggering consumer resistance, particularly in middle-market segments . This sensitivity manifests in trading down behaviors where consumers shift from super-premium to premium categories or increase purchase frequency of promotional offerings. The constraint disproportionately affects smaller brands lacking economies of scale to absorb input cost inflation, while large manufacturers like Mars and Nestle leverage procurement advantages to maintain margin stability.

Other drivers and restraints analyzed in the detailed report include:

- E-commerce Channel Growth Disrupts Traditional Retail Distribution Models

- Veterinary Endorsement Legitimizes Premium Pricing for Functional Diets

- Supermarket Private-Label Expansion Pressures Branded Manufacturers' Margins and Shelf Space

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Food products maintain a 66.20% France pet food market size in 2025. This substantial market share is primarily driven by the segment's role in providing essential daily nutrition to pets through both dry and wet food options. This divergence reflects consumer willingness to experiment with indulgent and functional treat categories while maintaining conservative approaches to primary nutrition. Functional treats represent a particularly dynamic subsegment, with ADM's European launch of seven turnkey formulas targeting specific health benefits like calming, dental care, and mobility support.

Pet treats capture the fastest growth momentum at 6.98% CAGR through 2031. This remarkable growth is driven by several factors, including the increasing use of treats for training purposes, particularly among young pets, and the growing trend of pet owners using treats to strengthen their bonds with their pets. The segment's expansion is further supported by innovations in treat formulations, including dental treats, functional treats with added health benefits, and premium treats made from natural ingredients. The rising demand for freeze-dried and natural treats, particularly in the premium and super-premium categories, is also contributing to this segment's rapid growth. Additionally, the increasing focus on pet mental stimulation and enrichment activities has led to higher consumption of treats as rewards and engagement tools.

The France Pet Food Market Report is Segmented by Pet Food Product (Food, Pet Nutraceuticals/Supplements, Pet Treats, Pet Veterinary Diets), by Pets (Cats, Dogs, Other Pets), and by Distribution Channel (Convenience Stores, Online Channel, Specialty Stores, Supermarkets/Hypermarkets, Other Channels). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons)

List of Companies Covered in this Report:

- Mars, Incorporated

- Nestle (Purina)

- Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- General Mills Inc.

- Affinity Petcare S.A

- ADM

- Diamond Pet Foods (Schell & Kampeter, Inc.)

- Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- Alltech

- Virbac

- Yora Pet Foods

- Zooplus SE

- GA Pet Food Partners

- Farmina Pet Foods

- Laroy Group (Flamingo)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Consumer Trends

5 SUPPLY AND PRODUCTION DYNAMICS

- 5.1 Trade Analysis

- 5.2 Ingredient Trends

- 5.3 Value Chain and Distribution Channel Analysis

- 5.4 Regulatory Framework

- 5.5 Market Drivers

- 5.5.1 Premiumization of cat food drives value growth beyond volume expansion

- 5.5.2 Human-grade ingredient demand reshapes supply chain and pricing strategies

- 5.5.3 Growth of e-commerce groceries disrupts traditional retail distribution models

- 5.5.4 Veterinary endorsement legitimizes premium pricing for functional diets

- 5.5.5 Upcycling of French agro-by-products supports the circular economy and cost efficiency

- 5.5.6 Expansion of insect-protein approvals opens alternative ingredient pathways

- 5.6 Market Restraints

- 5.6.1 Inflation-driven price sensitivity forces trading down across middle-market segments

- 5.6.2 Supermarket private-label expansion pressures branded manufacturers' margins and shelf space

- 5.6.3 Tightening Europe's additive regulations increases reformulation costs and time-to-market

- 5.6.4 Supply risk of novel proteins creates sourcing uncertainty for premium formulations

6 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 6.1 Pet Food Product

- 6.1.1 Food

- 6.1.1.1 By Sub Product

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.1.1.1 Kibbles

- 6.1.1.1.1.1.2 Other Dry Pet Food

- 6.1.1.1.1.1 By Sub Dry Pet Food

- 6.1.1.1.2 Wet Pet Food

- 6.1.1.1.1 Dry Pet Food

- 6.1.1.1 By Sub Product

- 6.1.2 Pet Nutraceuticals/Supplements

- 6.1.2.1 By Sub Product

- 6.1.2.1.1 Milk Bioactives

- 6.1.2.1.2 Omega-3 Fatty Acids

- 6.1.2.1.3 Probiotics

- 6.1.2.1.4 Proteins and Peptides

- 6.1.2.1.5 Vitamins and Minerals

- 6.1.2.1.6 Other Nutraceuticals

- 6.1.2.1 By Sub Product

- 6.1.3 Pet Treats

- 6.1.3.1 By Sub Product

- 6.1.3.1.1 Crunchy Treats

- 6.1.3.1.2 Dental Treats

- 6.1.3.1.3 Freeze-dried and Jerky Treats

- 6.1.3.1.4 Soft and Chewy Treats

- 6.1.3.1.5 Other Treats

- 6.1.3.1 By Sub Product

- 6.1.4 Pet Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.4.1.1 Diabetes

- 6.1.4.1.2 Digestive Sensitivity

- 6.1.4.1.3 Oral Care Diets

- 6.1.4.1.4 Renal

- 6.1.4.1.5 Urinary tract disease

- 6.1.4.1.6 Obesity Diets

- 6.1.4.1.7 Derma Diets

- 6.1.4.1.8 Other Veterinary Diets

- 6.1.4.1 By Sub Product

- 6.1.1 Food

- 6.2 Pets

- 6.2.1 Cats

- 6.2.2 Dogs

- 6.2.3 Other Pets

- 6.3 Distribution Channel

- 6.3.1 Convenience Stores

- 6.3.2 Online Channel

- 6.3.3 Specialty Stores

- 6.3.4 Supermarkets/Hypermarkets

- 6.3.5 Other Channels

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Brand Positioning Matrix

- 7.4 Market Claim Analysis

- 7.5 Company Landscape

- 7.6 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 7.6.1 Mars, Incorporated

- 7.6.2 Nestle (Purina)

- 7.6.3 Colgate-Palmolive Company (Hill's Pet Nutrition, Inc.)

- 7.6.4 General Mills Inc.

- 7.6.5 Affinity Petcare S.A

- 7.6.6 ADM

- 7.6.7 Diamond Pet Foods (Schell & Kampeter, Inc.)

- 7.6.8 Clearlake Capital Group, L.P. (Wellness Pet Company, Inc.)

- 7.6.9 Alltech

- 7.6.10 Virbac

- 7.6.11 Yora Pet Foods

- 7.6.12 Zooplus SE

- 7.6.13 GA Pet Food Partners

- 7.6.14 Farmina Pet Foods

- 7.6.15 Laroy Group (Flamingo)

8 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS