PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939044

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939044

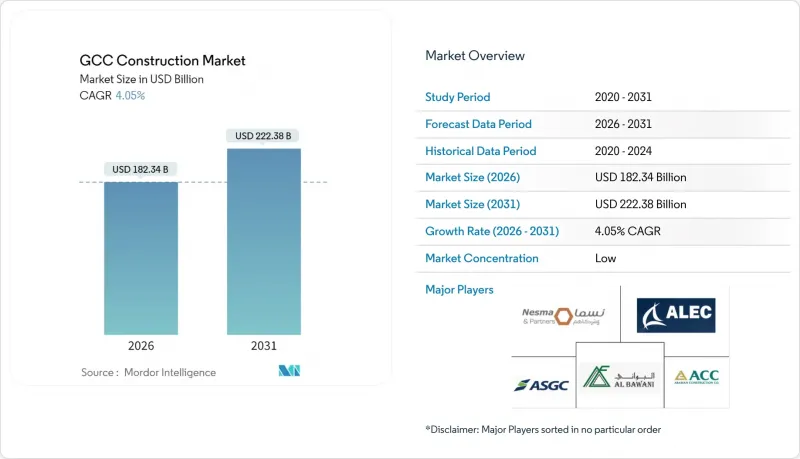

GCC Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The GCC Construction Market was valued at USD 175.24 billion in 2025 and estimated to grow from USD 182.34 billion in 2026 to reach USD 222.38 billion by 2031, at a CAGR of 4.05% during the forecast period (2026-2031).

This solid trajectory mirrors policymakers' resolve to diversify economies away from hydrocarbons by fast-tracking infrastructure programs under Saudi Vision 2030 and Dubai's 2040 Urban Master Plan. Robust public spending insulates the GCC construction market from oil-price swings, while international contractors help transfer advanced technology and finance to regional mega-projects. Across the GCC construction market, modular building systems, 3D concrete printing, and other industrialized methods are speeding project timelines and shrinking labor needs. Private capital is rising through public-private partnership (PPP) structures, and green-building codes now shape bidding criteria, materials choices, and life-cycle cost calculations.

GCC Construction Market Trends and Insights

Giga-Project Pipeline Drives Sustained Construction Demand

Saudi Vision 2030, Dubai's 2040 Urban Master Plan, and linked mega-initiatives together underpin more than USD 1.8 trillion of schemes that anchor the GCC construction market. The USD 1.554 billion railway contract inside NEOM and USD 810 million financing for Sindalah Island underscore global investor confidence in the region's execution capacity. Dubai's 64-kilometer green spine, a USD 8.1 billion renewal of Sheikh Mohammed Bin Zayed Road, blends transit, solar-power generation, and public realm upgrades. Such schemes fuse smart-city digital layers into concrete and steel, creating procurement niches for specialist contractors and driving the GCC construction market toward higher-margin technology-led workstreams.

Modular Construction Methods Transform Project Delivery

Prefabrication is moving from niche pilot to mainstream in the GCC construction market. The SAR 177.7 million (USD 177.7 million) contract for modular worker camps at Trojena proves factory-built units can meet stringent quality and schedule targets. Modular guest-room pods for religious-tourism hotels offer scale benefits while easing urban congestion around holy sites. Regional governments support off-site manufacturing because it seeds new industrial clusters and absorbs local labor, thereby reinforcing economic-diversification targets.

Oil-Revenue Volatility Constrains Government Infrastructure Spending

The International Monetary Fund warns that combined GCC budget deficits could reach USD 54.2 billion in 2025 if oil averages USD 60 per barrel. Fiscal tightening forces ministries to sequence projects more selectively, stretching payment schedules for contractors. Governments hedge by packaging projects into PPP concessions so that private lenders share cash-flow risk. Firms with strong balance sheets, diversified order books, and robust working-capital lines weather delays better than narrowly focused peers, resulting in gradual industry consolidation within the GCC construction market.

Other drivers and restraints analyzed in the detailed report include:

- Green-Building Codes Accelerate Sustainable Construction Adoption

- 3D Concrete Printing Scales Beyond Pilot Projects

- Labor-Market Reforms Increase Construction Operating Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure held 28.31% of the GCC construction market size in 2025, just behind residential's leading 33.76%. Yet infrastructure is advancing at a 5.63% CAGR to 2031, the fastest among sectors. Dubai's USD 1.431 billion Al Khaleej Street Tunnel and Abu Dhabi's USD 8.1 billion Tasreef drainage upgrade illustrate how transport and utilities spending now eclipses private real estate cycles. Contractors capable of heavy civil works, traffic modeling, and micro-tunneling capture larger work packages.

The residential segment remains volume king, propelled by young demographics and mortgage reforms, but growth moderates at 3.31% CAGR. Developers increasingly bundle smart-home systems and district-cooling links to meet green-code thresholds and reduce life-cycle costs. Infrastructure's momentum is therefore set to dilute residential's share, reinforcing a shift in the GCC construction market toward public-service assets over pure housing stock.

New-build projects represented 73.84% of GCC construction market share in 2025 and still dominate pipelines. However, renovation and retrofit activities are growing at a 5.18% CAGR as asset owners chase energy savings and code compliance in existing towers. The Gulf construction industry now values certified energy-use intensity metrics, prompting widespread facade re-cladding and HVAC replacement drives.

Renovation also draws on heritage-preservation budgets in Saudi Arabia's Diriyah and Jeddah Historic Districts. Specialists in laser scanning, BIM-to-field workflows, and lime-based mortars secure premium margins. Investors perceive renovation as less cyclical than ground-up work, thereby smoothing revenue streams across the GCC construction market.

The GCC Construction Market Report is Segmented by Sector (Residential, Commercial, and Infrastructure), by Construction Type (New Construction and Renovation), by Construction Method (Conventional On-Site, and More), by Investment Source (Public and Private), and by Geography (United Arab Emirates, Saudi Arabia, Oman, Qatar, Kuwait and Bahrain). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nesma & Partners Contracting

- Albawani Group

- ALEC Engineering & Contracting

- Arabian Construction Company

- ASGC Construction

- Al Naboodah Construction Group

- Almabani General Contractors

- Airolink Building Contracting

- UCC Holding

- Khansaheb Civil Engineering

- Saudi Binladin Group

- China State Construction Eng. ME

- Consolidated Contractors Company

- BESIX Middle East

- Samsung C&T ME

- Shapoorji Pallonji ME

- Orascom Construction

- Bechtel Corp. (GCC)

- Larsen & Toubro ME

- ACC (Arabtec Construction Co.)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 GCC giga-projects pipeline (Vision 2030, Dubai 2040 Urban Master Plan, etc.)

- 4.2.2 Mandatory green-building codes (e.g., Estidama, SBC 801)

- 4.2.3 Shift to modular/off-site construction

- 4.2.4 Revival of religious tourism infrastructure

- 4.2.5 Adoption of project-finance PPP models

- 4.2.6 3-D-printed concrete pilots scaling to mid-rise assets

- 4.3 Market Restraints

- 4.3.1 Volatile crude-oil fiscal revenues

- 4.3.2 Tightened migrant-labour quotas & wage-protection reforms

- 4.3.3 Building-materials price spikes (cement, rebar)

- 4.3.4 Slow permitting cycles for foreign contractors in GCC region

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Industry Attractiveness - Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of the GCC region with Other Major Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 United Arab Emirates

- 5.5.2 Saudi Arabia

- 5.5.3 Oman

- 5.5.4 Qatar

- 5.5.5 Kuwait

- 5.5.6 Bahrain

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Nesma & Partners Contracting

- 6.4.2 Albawani Group

- 6.4.3 ALEC Engineering & Contracting

- 6.4.4 Arabian Construction Company

- 6.4.5 ASGC Construction

- 6.4.6 Al Naboodah Construction Group

- 6.4.7 Almabani General Contractors

- 6.4.8 Airolink Building Contracting

- 6.4.9 UCC Holding

- 6.4.10 Khansaheb Civil Engineering

- 6.4.11 Saudi Binladin Group

- 6.4.12 China State Construction Eng. ME

- 6.4.13 Consolidated Contractors Company

- 6.4.14 BESIX Middle East

- 6.4.15 Samsung C&T ME

- 6.4.16 Shapoorji Pallonji ME

- 6.4.17 Orascom Construction

- 6.4.18 Bechtel Corp. (GCC)

- 6.4.19 Larsen & Toubro ME

- 6.4.20 ACC (Arabtec Construction Co.)

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment