PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940638

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940638

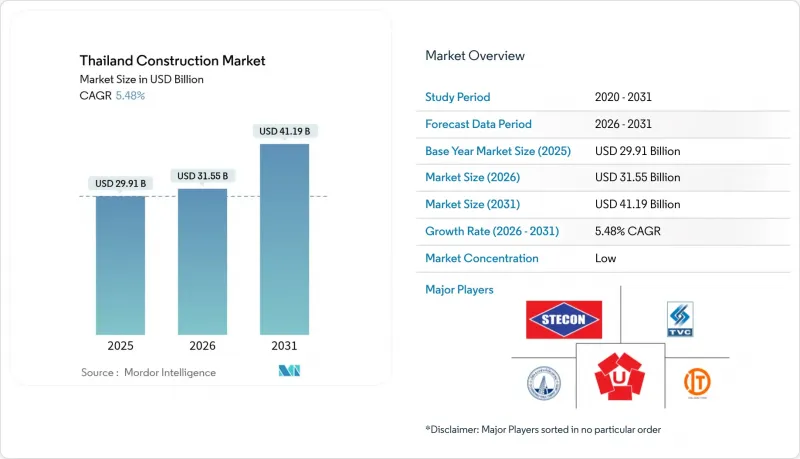

Thailand Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Thailand Construction Market size in 2026 is estimated at USD 31.55 billion, growing from 2025 value of USD 29.91 billion with 2031 projections showing USD 41.19 billion, growing at 5.48% CAGR over 2026-2031.

Underpinning this expansion is the government's USD 75.7 billion nationwide transport upgrade, the USD 14.1 billion Land Bridge corridor, and a wave of private mixed-use schemes that anchor Bangkok and secondary cities as regional logistics and tourism hubs. Large projects such as the USD 9.6 billion Thai-China high-speed rail second phase, the USD 430 million U-Tapao second runway, and the USD 3.9 billion 2025 infrastructure package keep orderbooks full for established contractors while signalling reliable cashflow visibility to suppliers. At the same time, renovation, digital design tools, and low-carbon materials reshape project economics, giving investors fresh opportunities to extract value from Thailand's ageing building stock. Supply-side obstacles-tight skilled labour, condo oversupply and cost inflation-temper near-term momentum but also accelerate adoption of prefabrication and sustainable construction solutions, setting the Thailand construction market on a structurally stronger footing through 2030.

Thailand Construction Market Trends and Insights

Major infrastructure rollouts drive nationwide construction surge

A record USD 3.9 billion budget covering 223 projects in 2025 anchors public spending, with rail, road and aviation schemes dominating award pipelines. The USD 9.6 billion Thai-China high-speed rail link and the USD 430 million U-Tapao runway illustrate the revenue visibility such mega-projects create for tier-one contractors while cementing Thailand's role as an ASEAN logistics node. Long delivery schedules stretching beyond 2030 assure multi-year demand for civil works, signalling permanence in the Thailand construction market.

Public-private partnerships accelerate project delivery

A maturing PPP law has unlocked USD 30.8 billion in planned investment and already approved USD 13.3 billion of priority schemes. Laem Chabang Port Phase 3 combines 47% public and 53% private capital to lift annual container handling to 18 million TEU, showcasing risk-sharing structures that attract technology-rich foreign operators and ensure timetable discipline. This framework injects predictable cash flows into the Thailand construction market while sparing the public balance sheet.

Skilled labour shortages constrain project execution

Tight domestic talent pools and rising wages have pushed contractors to source foreign workers, yet permit approvals still lag demand, stretching schedules and eroding margins. Larger firms mitigate the crunch through in-house training and mechanisation, while smaller builders struggle to meet timetable guarantees, dampening the Thailand construction market's near-term pace.

Other drivers and restraints analyzed in the detailed report include:

- Mixed-use developments transform urban landscapes

- Renewable energy construction expands grid infrastructure

- Bangkok apartment oversupply dampens residential construction

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The residential segment captured 35.25% of Thailand's construction market share in 2025, fuelled by urban population gains and lifestyle shifts. Yet infrastructure is the outright growth engine, forecast at 5.86% CAGR through 2031 as Thailand chases regional logistics leadership. Passenger rail corridors, airport runways, and expressways dominate award lists, reflecting a clear policy pivot toward connectivity. Illustrative is the Thai-China high-speed rail second phase, budgeted at USD 9.6 billion, and the three-airport high-speed link that ties Don Mueang, Suvarnabhumi, and U-Tapao for tourism flows. These corridors promise long-term revenue to civil contractors and unlock new catchment areas for property developers.

Commercial construction rebounds on tourism and mixed-use initiatives. Central Pattana's USD 424 million multi-city programme underlines retail-hospitality resurgence, while emerging co-working and life-science labs diversify demand. Industrial facilities tied to the Eastern Economic Corridor benefit from electronics, automotive, and advanced biotech tenants, reinforcing infrastructure-induced spill-overs inside the Thailand construction market.

Infrastructure's momentum rests on guaranteed public funding and the PPP pipeline that has already approved USD 13.3 billion of port, highway and rail packages. Renewable power plants and grid upgrades complement transport schemes, broadening contractor scopes and smoothing cyclicality. Consequently, infrastructure's rising slice of Thailand construction market size is poised to outstrip residential by the decade's close.

New construction accounted for 73.50% of Thailand's construction market size in 2025, mirroring the country's continuing build-out of transport links and greenfield real estate. Landmark examples include the USD 14.1 billion first phase of the Land Bridge and the USD 429 million second runway at U-Tapao International Airport. Greenfield projects create immediate bulk demand for structural steel, cement, and heavy equipment, locking in volume for material suppliers.

Renovation, although smaller, is the fastest-growing slice at a 6.01% CAGR to 2031. Bangkok's ageing office towers, 1990s-era condominiums, and provincial hotels are moving into their first major refurbishment cycle. Corporate ESG targets and higher utility tariffs spur energy-efficiency retrofits that rely on insulated facades, LED upgrades, and smart-building controls. SCG's 63% share of low-carbon cement output positions the company to capitalise on this wave, giving renovation a strategic environmental overlay within the Thailand construction market.

Property owners value renovation for speed to market and lower regulatory hurdles, especially in dense central locations where land is scarce. As renovation share rises, design consultants and specialised contractors stand to benefit from steady workflow, while material makers pivot portfolios toward green certifications to defend pricing power.

The Thailand Construction Market Report is Segmented by Sector (Residential, Commercial And, Infrastructure), by Construction Type (New Construction and Renovation), by Construction Method (Conventional On-Site Construction and More), by Investment Source (Private and Public), and by City (Bangkok, Chiang Mai, Phuket, and More). The Report Offers Market Size and Forecasts in Value (USD) for all the Above Segments.

List of Companies Covered in this Report:

- Italian-Thai Development PCL

- Sino-Thai Engineering & Construction PCL

- Ch. Karnchang PCL

- Unique Engineering & Construction PCL

- TTCL Public Company Limited

- SCG International Corporation Co. Ltd

- Siam Global House PCL

- Land & Houses PCL

- Dohome PCL

- CRC Thai Watsadu Ltd

- Drainage & Sewerage Department (Bangkok)

- Bangkok Komatsu Ltd

- SPCC Joint Venture

- Caterpillar (Thailand) Ltd

- Bouygues-Thai Co. Ltd

- Thai Obayashi Corp. Ltd

- Ritta Co. Ltd

- Power Line Engineering PCL

- Sinohydro-Thailand JV

- CK Power PCL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Insights and Dynamics

- 4.1 Market Overview (incl. Current Economic & Construction Scenario)

- 4.2 Market Drivers

- 4.2.1 Major infrastructure rollouts-including high-speed rail, airport upgrades, and mass transit expansions-are fueling nationwide construction demands.

- 4.2.2 Public-private partnership push in highways, bridges, and port facilities is accelerating project delivery.

- 4.2.3 Surge in mixed-use and transit-oriented developments, such as integrated urban townships, is boosting construction volumes.

- 4.2.4 Renewables and energy grid expansion, especially solar and hydro, are adding to utility-sector construction.

- 4.2.5 Residential growth in Bangkok and secondary cities is driven by improving household incomes and migration.

- 4.2.6 Adoption of digital construction tools (e.g., BIM, prefabrication) is streamlining project efficiency.

- 4.3 Market Restraints

- 4.3.1 Skilled labor shortages and rising wages are driving up costs and extending schedules.

- 4.3.2 Weak apartment sales in Bangkok are causing cancellations and slower launches.

- 4.3.3 Land acquisition and environmental reviews are delaying permission processes.

- 4.3.4 Rising global material prices and logistics challenges are squeezing contractor margins

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porter's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of Thailand with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Major Cities

- 5.5.1 Bangkok

- 5.5.2 Phuket

- 5.5.3 Pattaya

- 5.5.4 Chiang Mai

- 5.5.5 Rest of Thailand

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, PPPs, Digitalisation)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Italian-Thai Development PCL

- 6.4.2 Sino-Thai Engineering & Construction PCL

- 6.4.3 Ch. Karnchang PCL

- 6.4.4 Unique Engineering & Construction PCL

- 6.4.5 TTCL Public Company Limited

- 6.4.6 SCG International Corporation Co. Ltd

- 6.4.7 Siam Global House PCL

- 6.4.8 Land & Houses PCL

- 6.4.9 Dohome PCL

- 6.4.10 CRC Thai Watsadu Ltd

- 6.4.11 Drainage & Sewerage Department (Bangkok)

- 6.4.12 Bangkok Komatsu Ltd

- 6.4.13 SPCC Joint Venture

- 6.4.14 Caterpillar (Thailand) Ltd

- 6.4.15 Bouygues-Thai Co. Ltd

- 6.4.16 Thai Obayashi Corp. Ltd

- 6.4.17 Ritta Co. Ltd

- 6.4.18 Power Line Engineering PCL

- 6.4.19 Sinohydro-Thailand JV

- 6.4.20 CK Power PCL

7 Market Opportunities & Future Outlook