PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939744

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939744

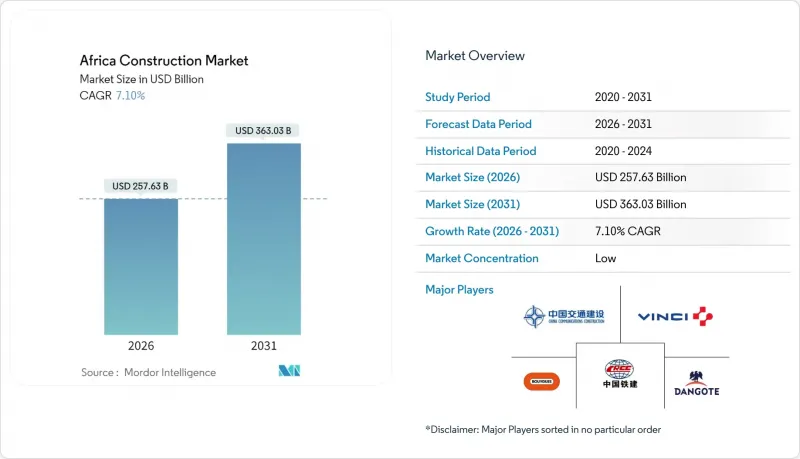

Africa Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Africa Construction Market was valued at USD 240.55 billion in 2025 and estimated to grow from USD 257.63 billion in 2026 to reach USD 363.03 billion by 2031, at a CAGR of 7.1% during the forecast period (2026-2031).

Rapid urban migration, the African Continental Free Trade Area (AfCFTA) rollout, and heightened government focus on connectivity projects are combining to lift contract backlogs across all major markets. Multilateral lenders continue to anchor funding for transnational logistics corridors, while climate-related finance mechanisms are unlocking capital for water security, renewable power, and green-building initiatives. Rising private-sector participation, particularly through public-private partnerships (PPPs), is beginning to rebalance a historically public-led ecosystem, enhancing project delivery discipline and technology uptake. Construction methods are also modernizing as modular and prefabricated solutions gain traction, addressing skilled labor bottlenecks and accelerating build times in densely populated cities.

Africa Construction Market Trends and Insights

Rapid Urbanization & Housing Backlog

Africa's urban population is forecast to double to 1.4 billion by 2050, creating an immediate housing imperative that stretches across major capitals and secondary cities. The current deficit of 51 million affordable units puts sustained pressure on public budgets and spurs innovative financing, including mortgage-backed securities and diaspora bonds. Kenya's two-million-unit shortfall has pushed authorities to mandate 250,000 new affordable homes annually, injecting steady volume into the Africa construction market. Nigeria's demographic surge toward 401.31 million people by 2050 further amplifies demand for formal housing and supporting utilities. Smaller economies such as Zimbabwe are also scaling initiatives-for example, a 220,000-unit program slated for completion by 2025-highlighting region-wide momentum.

Economic Diversification & GDP Rebound

Post-pandemic fiscal strategies are channeling recovery funds into infrastructure that underpins manufacturing, services, and renewable energy goals. Morocco targets 52% renewable power in its generation mix by 2030, driving utility-scale construction and grid upgrades. Egypt's New Administrative Capital and South Africa's USD 54 billion infrastructure plan illustrate how megaproject pipelines can catalyze private investment and job creation. Ghana's macro-stabilization under international support has revived flagship transport schemes, restoring contractor order books and reducing financing spreads. These diversification agendas sustain multipliers that reinforce long-run demand for civil works, commercial premises, and industrial zones across the Africa construction market.

Political-Regulatory Volatility & Contract Risk

Security incidents in the Sahel and sudden policy reversals elsewhere have raised political-risk premiums, pressuring contractor margins and insurance costs. Project suspensions by several global firms underscore the sensitivity of the Africa construction industry to governance instability. Retroactive rule changes, such as new localization quotas, can distort project economics and delay execution timetables. Currency volatility adds a second-order impact by inflating imported material costs and undermining debt-service capacity for foreign-currency loans. These uncertainties prompt risk-sharing mechanisms and demand contractual safeguards that lengthen negotiation cycles.

Other drivers and restraints analyzed in the detailed report include:

- Government-Backed Infrastructure Programs & PPP Pipelines

- Expansion of Pan-African Logistics Corridors

- Skilled-Labor Deficits & Productivity Gaps

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Infrastructure commands the fastest 9.05% CAGR within the Africa construction market, energized by flagship transport, energy, and water projects that enhance regional integration and climate resilience. Residential retained a 38.02% share of the Africa construction market size in 2025, buoyed by housing backlog programs and mortgage market reforms. Commercial schemes trail but remain significant, tracking the expansion of retail chains and multinational head-office relocations.

Mass-transit rail in Egypt, the USD 7.8 billion Bishoftu Airport in Ethiopia, and Morocco's USD 40 billion water-security master plan anchor multiyear capital commitments, providing visibility to contractors and suppliers. Meanwhile, AfCFTA-enabled industrial estates stimulate warehousing and light-manufacturing structures, bridging infrastructure and commercial sub-sectors. As governments mainstream climate adaptation, infrastructure outlays increasingly cover levee upgrades, desalination plants, and smart-grid deployments, thereby diversifying contractor scope within the Africa construction market.

New builds ruled with a hefty 71.05% Africa construction market share in 2025, mirroring the continent's infrastructure gap and swelling city footprints. Renovation, however, is projected to outpace at a 9.2% CAGR, propelled by asset-life extension and energy-retrofit mandates, particularly in middle-income economies.

South Africa's refurbishment of apartheid-era commercial towers and Ghana's school-rehabilitation programs illustrate how aging assets pivot capital toward retrofits. Climate-resilience spending further accelerates facade upgrades, waterproofing, and insulation improvements. Contractors with diagnostic-survey and BIM reverse-engineering capabilities are positioned to capture this climbing renovation slice of the Africa construction market.

The Africa Construction Market Report is Segmented by Sector (Residential, Commercial, Infrastructure), by Construction Type (New Construction, Renovation), by Construction Method (Conventional On-Site, Modern Methods), by Investment Source (Public, Private), and by Geography (Nigeria, South Africa, Egypt, Kenya, Ethiopia, Rest of Africa). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- China Communications Construction Group Ltd

- China Railway Construction Corp. Ltd

- Vinci SA

- Dangote Group

- Bouygues SA

- Aveng Ltd

- WBHO (Wilson Bayly Holmes-Ovcon)

- Orascom Construction

- Bam International

- Shapoorji Pallonji Group

- Julius Berger Nigeria PLC

- Sonatrach (Infrastructure arm)

- Consolidated Contractors Company (CCC)

- China National Machinery Industry Corp. (Sinomach)

- Power Construction Corp. of China (PowerChina)

- Shapoorji Pallonji Africa

- Group Five Construction

- Arab Contractors

- Dumez Nigeria PLC

- General Nile Company for Roads & Bridges

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanisation & housing backlog

- 4.2.2 Economic diversification & GDP rebound

- 4.2.3 Government-backed infrastructure programmes & PPP pipelines

- 4.2.4 Expansion of pan-African logistics corridors

- 4.2.5 Green-building finance inflows (e.g., SDG, climate bonds)

- 4.2.6 AfCFTA-linked industrial park developments

- 4.3 Market Restraints

- 4.3.1 Political-regulatory volatility & contract risk

- 4.3.2 Skilled-labour deficits & productivity gaps

- 4.3.3 Hard-currency shortage & capital-controls risk

- 4.3.4 Climatic shocks driving insurance & re-build costs

- 4.4 Value / Supply-Chain Analysis

- 4.4.1 Overview

- 4.4.2 Real Estate Developers and Contractors - Key Quantitative and Qualitative Insights

- 4.4.3 Architectural and Engineering Companies - Key Quantitative and Qualitative Insights

- 4.4.4 Building Material and Equipment Companies - Key Quantitative and Qualitative Insights

- 4.5 Government Initiatives & Vision

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook

- 4.8 Industry Attractiveness - Porter's Five Force Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Pricing (Construction Materials) and Construction Cost (Materials, Labour, Equipment) Analysis

- 4.10 Comparison of Key Industry Metrics of Africa with Other Countries

- 4.11 Key Upcoming/Ongoing Projects (with a focus on Mega Projects)

5 Market Size & Growth Forecasts (Value, In USD Billion)

- 5.1 By Sector

- 5.1.1 Residential

- 5.1.1.1 Apartments/Condominiums

- 5.1.1.2 Villas/Landed Houses

- 5.1.2 Commercial

- 5.1.2.1 Office

- 5.1.2.2 Retail

- 5.1.2.3 Industrial and Logistics

- 5.1.2.4 Others

- 5.1.3 Infrastructure

- 5.1.3.1 Transportation Infrastructure (Roadways, Railways, Airways, others)

- 5.1.3.2 Energy & Utilities

- 5.1.3.3 Others

- 5.1.1 Residential

- 5.2 By Construction Type

- 5.2.1 New Construction

- 5.2.2 Renovation

- 5.3 By Construction Method

- 5.3.1 Conventional On-Site

- 5.3.2 Modern Methods of Construction (Prefabricated, Modular, etc)

- 5.4 By Investment Source

- 5.4.1 Public

- 5.4.2 Private

- 5.5 By Geography

- 5.5.1 Nigeria

- 5.5.2 South Africa

- 5.5.3 Egypt

- 5.5.4 Kenya

- 5.5.5 Ethiopia

- 5.5.6 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 China Communications Construction Group Ltd

- 6.4.2 China Railway Construction Corp. Ltd

- 6.4.3 Vinci SA

- 6.4.4 Dangote Group

- 6.4.5 Bouygues SA

- 6.4.6 Aveng Ltd

- 6.4.7 WBHO (Wilson Bayly Holmes-Ovcon)

- 6.4.8 Orascom Construction

- 6.4.9 Bam International

- 6.4.10 Shapoorji Pallonji Group

- 6.4.11 Julius Berger Nigeria PLC

- 6.4.12 Sonatrach (Infrastructure arm)

- 6.4.13 Consolidated Contractors Company (CCC)

- 6.4.14 China National Machinery Industry Corp. (Sinomach)

- 6.4.15 Power Construction Corp. of China (PowerChina)

- 6.4.16 Shapoorji Pallonji Africa

- 6.4.17 Group Five Construction

- 6.4.18 Arab Contractors

- 6.4.19 Dumez Nigeria PLC

- 6.4.20 General Nile Company for Roads & Bridges

7 Market Opportunities & Future Outlook