PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939747

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939747

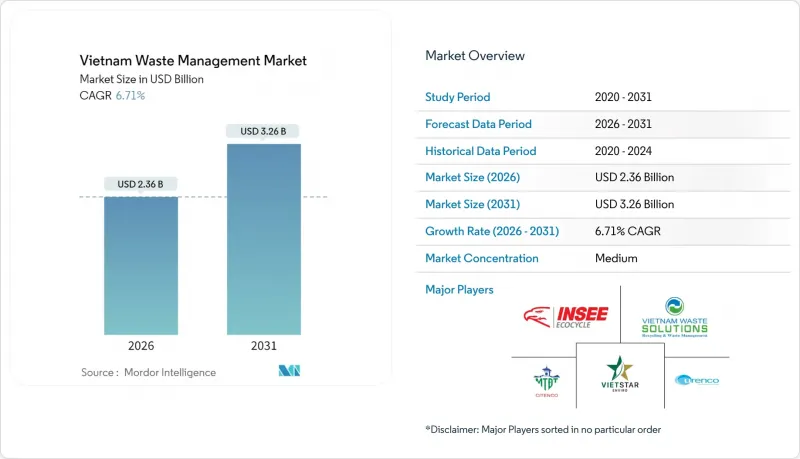

Vietnam Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Vietnam Waste Management Market size in 2026 is estimated at USD 2.36 billion, growing from 2025 value of USD 2.21 billion with 2031 projections showing USD 3.26 billion, growing at 6.71% CAGR over 2026-2031.

Accelerating urbanization, tighter environmental laws, and a national circular-economy roadmap continue to reshape demand, while extended-producer-responsibility (EPR) rules nudge manufacturers toward formal recycling channels. Public-health campaigns and digital route-optimization tools are raising source-separation rates in Ho Chi Minh City and Hanoi, creating new volumes for advanced treatment. Rising foreign direct investment is bringing waste-to-energy, polyester-to-polyester recycling, and high-purity composting technologies to provincial markets. At the same time, project developers must work around land-acquisition hurdles, rural collection gaps, and constrained provincial budgets, all of which slow down infrastructure roll-outs.

Vietnam Waste Management Market Trends and Insights

National Circular-Economy Roadmap Targeting 85% Waste Collection by 2030

Under the 2030 circular-economy action plan, Vietnam aims for 95% urban and 80% rural waste collection, while cutting landfill use below 50%. The strategy also links biomass and municipal waste to renewable-energy targets, giving waste-to-energy developers a government-endorsed revenue story. Agriculture generates 93.61 million tons of waste annually, yet just 52% is reused; regulations now call for a 25% jump in organic-fertilizer output by 2025 and a 30% organic share of all registered fertilizers by 2030. These targets integrate rural income growth with emissions goals, opening farmland markets for biochar and compost initiatives. As collection targets rise, the Vietnam waste management market gains visibility on feedstock volumes, improving bankability for regional treatment hubs.

Tightening Environmental Legislation & Enforcement

Vietnam's legal framework now revolves around Decree 05/2025/ND-CP, Decision 611/QD-TTg, and Decision 11/2025/QD-TTg, each introducing stricter EPR obligations, regional treatment-zone targets, and polluter-pays recovery rules. The new regime lifts revenue-exemption thresholds, formalizes 24 certified recyclers, and assigns full restoration costs to parties causing waste incidents. These rules accelerate market consolidation because smaller operators struggle to finance compliance upgrades, while integrated players monetize economies of scale. Predictable enforcement also reduces regulatory risk, unlocking long-tenor funding for large treatment plants. The net effect is a clearer, more investable backdrop that underpins the Vietnam waste management market's medium-term expansion.

Limited Landfill Capacity & Land-Acquisition Hurdles

Sites such as Dak R'lap in Dak Nong are operating beyond design limits because replacement projects like Dao Nghia remain stalled over land clearance, pushing completion to late 2025. In Ho Chi Minh City, four treatment complexes already span 1,670 ha, yet buffers mandated in earlier agreements are missing, constraining expansion. Waste-to-energy developers need larger footprints and special zoning, adding another layer of approvals that extends timelines. Scarcity of peri-urban land raises acquisition costs, forcing operators to pivot toward high-density or vertical technologies that demand larger upfront capital and more technical skill.

Other drivers and restraints analyzed in the detailed report include:

- Foreign-Investor-Led Technology Transfer in Waste-to-Energy Projects

- Rising Public-Health Awareness & Urban Cleanliness Campaigns

- Capital Constraints for Provincial Waste-Infrastructure Upgrades

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential streams held 55.12% of the Vietnam waste management market share in 2025, underpinned by an expanding urban population that generated predictable, route-dense tonnage. As a result, municipal operators have optimized pick-up times and standardized bins, bringing down per-household costs and freeing capital for treatment upgrades. The Vietnam waste management market size for commercial waste is much smaller today, yet it is forecast to rise at an 7.92% CAGR through 2031 as shopping centers, logistics hubs, and hospitality venues multiply across Tier-2 cities. Commercial clients also accept premium service packages, such as weekend pick-up and secure shredding, that carry higher margins.

Industrial, medical, and construction waste together account for the remaining share, yet each niche opens specialized revenue streams. Hazardous-waste contractors earn certification premiums to handle solvents and sludge, while hospitals in Bac Giang must conform to Decision 33/2025/QD-UBND's strict segregation rules. Rubber producers have begun converting wastewater sludge into organic fertilizer, signaling agricultural up-cycling potential. With policy pressure mounting, these sub-segments will scale, but residential tonnage will continue to anchor fleet utilization across the Vietnam waste management market.

The Vietnam Waste Management Market Report is Segmented by Source (Residential, Commercial, Industrial, and More), by Service Type (Collection/Transportation/Sorting, and More), by Waste Type (Municipal Solid Waste, Industrial Hazardous Waste, E-Waste, Plastic Waste, Biomedical Waste, and More), and by Geography (Ho Chi Minh City, Hanoi, Da Nang, Rest of Vietnam). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- CITENCO

- URENCO (Urban Environment Company Hanoi)

- INSEE Ecocycle

- Vietnam Waste Solutions

- Vietstar Environment

- Tetra Tech Coffey Vietnam

- Thuan Thanh Environment JSC

- Sonadezi Services JSC

- DUYTAN Plastic Recycling

- Green Environment Production Services Trade Co. Ltd

- Vietnam Australia Environment JSC

- SGS Vietnam

- Tan Phat Tai Co. Ltd

- An Phat Holdings (AnEco)

- Ha Noi Urban Environment Co. Ltd

- Bac Ninh Clean & Environment JSC

- TKV Waste Treatment Centre

- Holcim Vietnam Geocycle

- Indovin Power (Waste-to-Energy)

- Green Growth Asia Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening environmental legislation & enforcement

- 4.2.2 Rising public health awareness & urban cleanliness campaigns

- 4.2.3 National circular-economy roadmap targeting 85 % waste collection by 2030

- 4.2.4 Foreign-investor led technology transfer in waste-to-energy projects

- 4.2.5 Extended Producer Responsibility (EPR) expansion to packaging & electronics

- 4.3 Market Restraints

- 4.3.1 Limited landfill capacity & land-acquisition hurdles

- 4.3.2 Capital constraints for provincial waste-infrastructure upgrades

- 4.3.3 Fragmented collection system in rural communes

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Source

- 5.1.1 Residential

- 5.1.2 Commercial (retail, office, etc.)

- 5.1.3 Industrial

- 5.1.4 Medical (Health and Pharmaceutical)

- 5.1.5 Construction & Demolition

- 5.1.6 Others (institutional, agricultural, etc)

- 5.2 By Service Type

- 5.2.1 Collection, Transportation, Sorting & Segregation

- 5.2.2 Disposal / Treatment

- 5.2.2.1 Landfill

- 5.2.2.2 Recycling & Resource Recovery

- 5.2.2.3 Incineration & Waste-to-Energy

- 5.2.2.4 Others (Chemical Treatment, Composting, etc.)

- 5.2.3 Others (Consulting, Audit & Training, etc.)

- 5.3 By Waste Type

- 5.3.1 Municipal Solid Waste

- 5.3.2 Industrial Hazardous Waste

- 5.3.3 E-waste

- 5.3.4 Plastic Waste

- 5.3.5 Biomedical Waste

- 5.3.6 Construction & Demolition Waste

- 5.3.7 Agricultural Waste

- 5.3.8 Other Specialized Waste (radio active, etc)

- 5.4 By Geography

- 5.4.1 Ho Chi Minh City

- 5.4.2 Hanoi

- 5.4.3 Da Nang

- 5.4.4 Rest of Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 CITENCO

- 6.4.2 URENCO (Urban Environment Company Hanoi)

- 6.4.3 INSEE Ecocycle

- 6.4.4 Vietnam Waste Solutions

- 6.4.5 Vietstar Environment

- 6.4.6 Tetra Tech Coffey Vietnam

- 6.4.7 Thuan Thanh Environment JSC

- 6.4.8 Sonadezi Services JSC

- 6.4.9 DUYTAN Plastic Recycling

- 6.4.10 Green Environment Production Services Trade Co. Ltd

- 6.4.11 Vietnam Australia Environment JSC

- 6.4.12 SGS Vietnam

- 6.4.13 Tan Phat Tai Co. Ltd

- 6.4.14 An Phat Holdings (AnEco)

- 6.4.15 Ha Noi Urban Environment Co. Ltd

- 6.4.16 Bac Ninh Clean & Environment JSC

- 6.4.17 TKV Waste Treatment Centre

- 6.4.18 Holcim Vietnam Geocycle

- 6.4.19 Indovin Power (Waste-to-Energy)

- 6.4.20 Green Growth Asia Corp.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment