PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939753

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939753

South American Waste Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

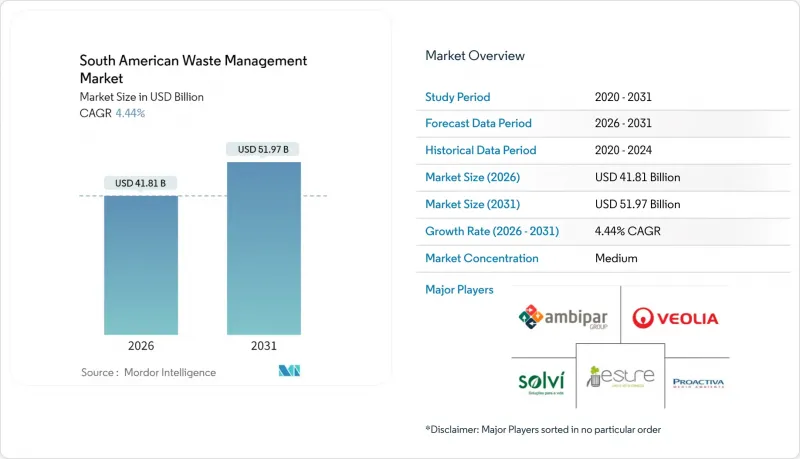

The South American Waste Management Market is expected to grow from USD 40.03 billion in 2025 to USD 41.81 billion in 2026 and is forecast to reach USD 51.97 billion by 2031 at 4.44% CAGR over 2026-2031.

Population growth, rapid urbanization, and tightening regulations, especially Brazil's National Circular Economy Strategy of June 2024, anchor the demand outlook, while green-bond inflows are accelerating the deployment of waste-to-energy (WtE) and advanced recycling assets. Regional governments are raising landfill taxes, and producers face mandatory collection targets, driving a measured pivot from linear disposal models to resource-recovery platforms.

South American Waste Management Market Trends and Insights

Rapid Urbanization Boosting MSW Volumes

South America's cities are expanding at their fastest pace in decades, with Brazil's urban centers generating more than 83 million tons of municipal solid waste annually. Only 4-5% of this material presently undergoes formal recovery, which underscores the sizable capacity gap and opens attractive niches for integrated collection-to-treatment platforms. Colombian hubs such as Medellin are piloting models that fold informal picker cooperatives into municipal service contracts, proving that social inclusion and scale efficiencies can coexist. The concentration of population in secondary cities compounds the logistical complexity, yet also yields route-density advantages that can lower per-ton collection costs. Municipal leaders increasingly accept that new landfills alone cannot absorb climbing waste volumes, reinforcing the case for multi-stream systems anchored by recycling and energy recovery assets.

Circular-Economy Legislation in Brazil & Chile

Regulatory reform is driving structural change. Brazil's National Circular Economy Strategy obliges producers to redesign products and prioritize reuse, compelling operators to invest in high-throughput sorting lines and advanced material-recycling facilities. Chile's Law 20.920 extends producer responsibility to packaging, electronics, and batteries, with enforceable collection targets that began phasing in during 2023. These rules tilt the competitive field toward players that can back up compliance claims with auditable resource-recovery metrics. Equipment suppliers of optical sorters, biodigesters, and refuse-derived-fuel (RDF) systems report increasing tenders tied to these mandates. Over the long haul, the legislation is expected to curb raw-material imports, channeling industrial demand toward locally recovered feedstock.

Dominance of Informal Waste Pickers

Informal recyclers recover nearly 90% of Brazil's recycled materials, yet operate outside tax and safety frameworks. Attempts to formalize cooperatives in Sao Paulo captured fewer than 1% of street pickers by 2017, revealing the scale of social, economic, and logistical hurdles. While their efficiency in collecting high-value recyclables relieves landfill demand, uncoordinated sorting can degrade material quality and complicate route planning for formal contractors. Integration programs in 25 Brazilian municipalities show that with training and equipment, picker-led sorting centers can cut collection costs to USD 35 per ton versus USD 195.3 for conventional curbside models. Success, however, hinges on steady municipal funding and transparent revenue-sharing.

Other drivers and restraints analyzed in the detailed report include:

- Rising Landfill-Tax Regimes Across Andean Nations

- Surge in Green-Bond Financing for WtE Plants

- Municipal Budget Shortfalls

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Residential waste streams captured 56.02% of the South American waste management market share in 2025, anchoring route planning and capital-allocation decisions for collectors. Household refuse is not only voluminous but also compositionally diverse, ranging from organics to flexible plastics, which demands sophisticated sorting and transfer capacity. Collection coverage in large cities tops 90%, yet material recovery remains below 10%, signaling room for advanced curbside segregation and pay-as-you-throw pilots. The residential stream's sheer scale is a magnet for technology vendors offering IoT-enabled collection bins and analytics platforms that optimize truck dispatch. Operators that automate weigh-ticket data improve billing accuracy and unlock feedstock assurances sought by WtE financiers.

Commercial waste is advancing at a 6.22% CAGR, emerging as the fastest-growing source through 2031 on the back of retail and hospitality expansion across Bogota, Santiago, and Lima. Stricter occupational health rules push malls and hotels to contract licensed handlers, while brand-owner ESG targets stimulate demand for closed-loop packaging programs. Industrial waste streams face rising scrutiny as Brazil's import-control decree prioritizes domestic reprocessing of strategic materials, nudging factories to secure local recovery partners. A forward integration trend is observable where beverage brands install on-site balers and sell compacted PET directly to recyclers, squeezing out intermediaries. Construction debris remains the least served, yet rising disposal taxes in Colombia and Peru present incentives for crushing and reuse businesses.

The South American Waste Management Market Report is Segmented by Source (Residential, Commercial, Industrial, and More), by Service Type (Collection, Transportation, Sorting & Segregation, and More), by Waste Type (Municipal Solid, Industrial Hazardous Waste, E-Waste, and More), and Geography (Brazil, Argentina, Chile, Colombia, Peru, and the Rest of South America). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Veolia Latin America

- Estre Ambiental

- Grupo Solvi

- Ambipar

- Proactiva Medio Ambiente

- Waste Management Inc.

- Republic Services Inc.

- Casella Waste Systems

- Covanta Holding Corporation

- Inciner8 Ltd

- SWM Colombia

- Capitao Ambiental

- Entorno Sustentable

- Syngas do Brasil

- Usina Verde

- Bioelektra

- Estaciones Ecologicas

- Solvi Essencis

- Reciclar S.A.

- TRASHCo Peru

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urbanisation boosting MSW volumes

- 4.2.2 Circular-economy legislation in Brazil & Chile

- 4.2.3 Rising landfill-tax regimes across Andean nations

- 4.2.4 Surge in green-bond financing for WtE plants

- 4.2.5 Mining-sector zero-waste mandates

- 4.3 Market Restraints

- 4.3.1 Dominance of informal waste pickers

- 4.3.2 Municipal budget shortfalls

- 4.3.3 Cross-border hazardous-waste trafficking

- 4.3.4 Limited grid interconnection hurting WtE economics

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Force Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Logistics Infrastructure Insights

- 4.9 Startup Strategies & Venture Funding

5 Market Size & Growth Forecasts (Values, In USD Billion)

- 5.1 By Source

- 5.1.1 Residential

- 5.1.2 Commercial (retail, office, etc.)

- 5.1.3 Industrial

- 5.1.4 Medical (Health and Pharmaceutical)

- 5.1.5 Construction & Demolition

- 5.1.6 Others (institutional, agricultural, etc)

- 5.2 By Service Type

- 5.2.1 Collection, Transportation, Sorting & Segregation

- 5.2.2 Disposal / Treatment

- 5.2.2.1 Landfill

- 5.2.2.2 Recycling & Resource Recovery

- 5.2.2.3 Incineration & Waste-to-Energy

- 5.2.2.4 Others (Chemical Treatment, Composting, etc.)

- 5.2.3 Others (Consulting, Audit & Training, etc.)

- 5.3 By Waste Type

- 5.3.1 Municipal Solid Waste

- 5.3.2 Industrial Hazardous Waste

- 5.3.3 E-waste

- 5.3.4 Plastic Waste

- 5.3.5 Biomedical Waste

- 5.3.6 Construction & Demolition Waste

- 5.3.7 Agricultural Waste

- 5.3.8 Other Specialized Waste (radio active, etc)

- 5.4 By Geography

- 5.4.1 Brazil

- 5.4.2 Argentina

- 5.4.3 Chile

- 5.4.4 Colombia

- 5.4.5 Peru

- 5.4.6 Rest of South America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, Recent Developments)

- 6.4.1 Veolia Latin America

- 6.4.2 Estre Ambiental

- 6.4.3 Grupo Solvi

- 6.4.4 Ambipar

- 6.4.5 Proactiva Medio Ambiente

- 6.4.6 Waste Management Inc.

- 6.4.7 Republic Services Inc.

- 6.4.8 Casella Waste Systems

- 6.4.9 Covanta Holding Corporation

- 6.4.10 Inciner8 Ltd

- 6.4.11 SWM Colombia

- 6.4.12 Capitao Ambiental

- 6.4.13 Entorno Sustentable

- 6.4.14 Syngas do Brasil

- 6.4.15 Usina Verde

- 6.4.16 Bioelektra

- 6.4.17 Estaciones Ecologicas

- 6.4.18 Solvi Essencis

- 6.4.19 Reciclar S.A.

- 6.4.20 TRASHCo Peru

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment