PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940758

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940758

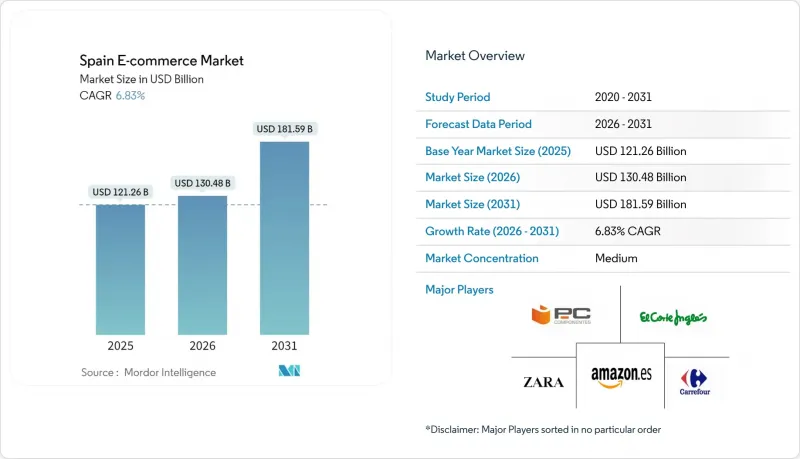

Spain E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Spain e-commerce market is expected to grow from USD 63.26 billion in 2025 to USD 82.18 billion in 2026 and is forecast to reach USD 304.59 billion by 2031 at 29.95% CAGR over 2026-2031.

This growth surpasses the wider European average and is propelled by the Digital Spain 2025 agenda, 5G coverage reaching 92.3% of the population, and e-shopper participation of 70%. High adoption of Bizum, mobile-first shopping habits, and government grants that accelerate SME digitalisation further reinforce momentum. International players are intensifying competition, and cross-border commerce with Latin America provides incremental demand. Same-day delivery networks built by Correos, SEUR, and DHL reduce fulfillment friction, while rising sustainability expectations encourage investment in eco-friendly logistics. Over the forecast horizon, stakeholder focus shifts to mobile optimisation, BNPL usability, and last-mile innovation that can mitigate rural delivery cost pressures.

Spain E-commerce Market Trends and Insights

High penetration of Bizum instant-payment system

Bizum reaches 27 million users, equal to 57% of Spain's population, and processes 90% of instant transfers. Integration inside mobile banking apps eliminates external sign-ups, cutting checkout friction and lowering cart abandonment. Retailers that embed Bizum record conversion uplifts that outpace card-only peers. Widespread adoption also reduces reliance on cash-on-delivery, vital for rural profitability. Continuous feature rollouts, such as in-app BNPL, are expected to deepen consumer stickiness.

Government KIT Digital grants accelerating SME digitalisation

EUR 1.9 billion (USD 2.05 billion) in grants to 460,000 SMEs subsidise website creation, cybersecurity, e-invoicing, and AI add-ons. The subsidy pool raises SME participation in online sales from under 10% in 2023 to an anticipated 25% by 2025. Rural merchants gain priority access, narrowing the urban-rural digital gap and unlocking fresh supply for the Spain e-commerce market. Platform providers targeting the SME cohort secure new revenue streams via implementation support and managed services.

Fragmented last-mile logistics in rural provinces raising fulfilment costs

Delivery costs in isolated areas run 30% higher than urban benchmarks. Courier route deviations and low drop density undermine productivity, pushing merchants to set order thresholds or exclude certain postcodes. Micro-depot pilots and shared locker networks have begun, yet scale remains limited. Until density improves, retailers absorb higher surcharges or pass them on, both of which can slow rural penetration.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of same-day delivery networks by Correos & SEUR in urban corridors

- Cross-border demand from Latin-American Spanish-speaking shoppers

- Strict LOPDGDD / GDPR enforcement elevating SME compliance costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The B2C segment controlled 85.42% of 2025 revenue within the Spain e-commerce market. B2C dominance reflects mature consumer demand, but B2B transactions now register a 34.2% CAGR that is faster than overall growth. The Spain e-commerce market size for B2B transactions is expected to surpass USD 53.87 billion by 2031, propelled by procurement portals and integrated payment workflows.

SME uptake of the Digital Kit expands supplier catalogues and digitises invoicing protocols. Resulting transparency shortens payment cycles and lowers working-capital strain. Large corporates deploy private marketplaces to consolidate purchasing, which creates data streams that analytics vendors monetise. Cross-border trade with European peers provides incremental scale benefits, especially for industrial spare parts and packaging supplies.

Smartphones accounted for 63.78% of transactions in 2025 and sustain a 32.1% CAGR through 2031. Spain e-commerce market share for mobile is likely to reach 74.8% by 2027 as 5G strengthens video-rich product displays. Retailers allocate budget to progressive web apps supported by push-notification marketing that drives frequency. Spain e-commerce market size attributable to desktop stabilises due to multitab research behaviour in high-value purchases.

Voice assistants and smart TV checkouts remain niche but carry strategic relevance for grocery and media bundles. Omnichannel use cases such as click-and-collect blur device boundaries, prompting retailers to synchronise basket data across sessions. In this environment, experience consistency surpasses mere channel presence as the key differentiator.

The Spain E-Commerce Market Report is Segmented by Business Model (B2C, B2B), Device Type (Smartphone / Mobile, Desktop and Laptop, Other Device Types), Payment Method (Credit / Debit Cards, Digital Wallets, BNPL, Other Payment Method), B2C Product Category (Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Amazon EU S.a r.l.

- El Corte Ingles S.A.

- Alibaba Group Holding Ltd.

- Centros Comerciales Carrefour S.A.

- Inditex S.A.

- Adevinta Spain S.L.U.

- eBay Inc.

- Zara Spain

- MediaMarkt Iberia S.A.U.

- PC Componentes y Multimedia S.L.

- Decathlon Espana S.A.U.

- Leroy Merlin Espana S.L.U.

- Zalando SE

- Mercadona S.A.

- Distribuidora Internacional de Alimentacion S.A. (DIA)

- Perfumerias Primor S.L.

- Glovoapp23 S.L.

- Promofarma by DocMorris

- Alcampo S.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High penetration of Bizum instant-payment system

- 4.2.2 Government KIT Digital grants accelerating SME digitalisation

- 4.2.3 Expansion of same-day delivery networks by Correos and SEUR in urban corridors

- 4.2.4 Cross-border demand from Latin-American Spanish-speaking shoppers

- 4.2.5 5G-driven surge in mobile-first shopping across autonomous communities

- 4.2.6 Rising adoption of sustainable delivery and reverse-logistics solutions

- 4.3 Market Restraints

- 4.3.1 Fragmented last-mile logistics in rural provinces raising fulfilment costs

- 4.3.2 Persistent cash-on-delivery culture limiting online payment conversion

- 4.3.3 Strict LOPDGDD / GDPR enforcement elevating SME compliance costs

- 4.3.4 High product-return rates in fashion segment eroding margins

- 4.4 Value Chain Analysis

- 4.5 Regulatory or Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers / Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Key Market Trends and E-commerce Share of Total Retail

- 4.8 Assessment of Macro Economic Trends on the Market

- 4.9 Investment Analysis

- 4.10 Demographic Trends and Patterns

- 4.11 Cross-Border E-commerce Trends

- 4.12 Spain's Position within European E-commerce

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Business Model

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Device Type

- 5.2.1 Smartphone / Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Device Types

- 5.3 By Payment Method

- 5.3.1 Credit / Debit Cards

- 5.3.2 Digital Wallets

- 5.3.3 BNPL

- 5.3.4 Other Payment Method

- 5.4 By B2C Product Category

- 5.4.1 Beauty and Personal Care

- 5.4.2 Consumer Electronics

- 5.4.3 Fashion and Apparel

- 5.4.4 Food and Beverages

- 5.4.5 Furniture and Home

- 5.4.6 Toys, DIY and Media

- 5.4.7 Other Product Categories

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Amazon EU S.a r.l.

- 6.4.2 El Corte Ingles S.A.

- 6.4.3 Alibaba Group Holding Ltd.

- 6.4.4 Centros Comerciales Carrefour S.A.

- 6.4.5 Inditex S.A.

- 6.4.6 Adevinta Spain S.L.U.

- 6.4.7 eBay Inc.

- 6.4.8 Zara Spain

- 6.4.9 MediaMarkt Iberia S.A.U.

- 6.4.10 PC Componentes y Multimedia S.L.

- 6.4.11 Decathlon Espana S.A.U.

- 6.4.12 Leroy Merlin Espana S.L.U.

- 6.4.13 Zalando SE

- 6.4.14 Mercadona S.A.

- 6.4.15 Distribuidora Internacional de Alimentacion S.A. (DIA)

- 6.4.16 Perfumerias Primor S.L.

- 6.4.17 Glovoapp23 S.L.

- 6.4.18 Promofarma by DocMorris

- 6.4.19 Alcampo S.A.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment