PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940762

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940762

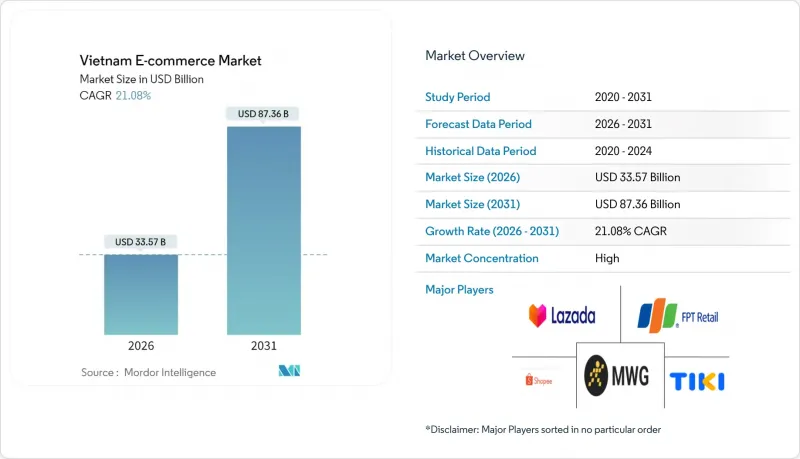

Vietnam E-commerce - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam e-commerce market is expected to grow from USD 27.73 billion in 2025 to USD 33.57 billion in 2026 and is forecast to reach USD 87.36 billion by 2031 at 21.08% CAGR over 2026-2031.

Digital commerce now commands about 9% of total retail sales, underscoring how swiftly online channels are displacing traditional store formats. Ongoing expansion springs from rapid mobile adoption, rising consumer trust in cash-free payments, and an ecosystem where social-commerce and short-video content have turned product discovery into entertainment. Government policies-most notably the National Cashless Payment Development Project-are accelerating non-cash transactions, while free-trade pacts such as the CPTPP and RCEP are drawing in a wave of cross-border sellers. Competitive intensity is sharpening as content-driven commerce narrows the field to a handful of dominant platforms, forcing smaller merchants to refine niche strategies or exit. On the infrastructure side, last-mile investments in tier-2 cities are shrinking delivery windows, further broadening the addressable base for the Vietnam e-commerce market.

Vietnam E-commerce Market Trends and Insights

Nationwide adoption of cashless payments via the National Cashless Payment Development Project 2021-2025

Card-less transactions soared 63.3% in volume and 41.45% in value in early 2024, while QR code usage leapt nearly ten-fold. Retail acceptance is now commonplace, with 79% of food-service outlets and 74% of stores offering digital options. Linking the National Population Database to payment rails streamlines checkout, lifting conversion rates and widening the Vietnam e-commerce market. By 2025, authorities expect e-commerce to account for half of all cashless payments, embedding a structural trust factor that reduces cart abandonment.

Expansion of last-mile delivery infrastructure into tier-2 cities

Logistics providers are rolling out urban consolidation centres that trim delivery times by up to 40% and support same-day service outside major hubs. Trucks remain the backbone for inter-city hauls, while motorbikes excel in dense streets. Local authorities prioritise eco-friendly vehicles and digital route planning to relieve congestion. As delivery reliability improves, consumer confidence in the Vietnam e-commerce market strengthens, unlocking new cohorts in Da Nang and Can Tho that previously relied on cash-on-delivery.

Escalating digital-ad costs squeezing SME margins

Capturing just 1% of the Vietnam e-commerce market demands annual media spend near USD 6 million, a figure well beyond most local sellers. Active storefronts fell 6.2% between early 2023 and late 2024 as marketing bids spiralled on dominant marketplaces, lowering product variety and throttling innovation. SMEs are pivoting to micro-influencers, first-party data and community-led channels to stretch budgets, yet the near-term drag on growth remains.

Other drivers and restraints analyzed in the detailed report include:

- Surge in social-commerce transactions via short-video platforms

- Entry of cross-border sellers leveraging CPTPP & RCEP free-trade agreements

- Fragmented cold-chain logistics limiting fresh-food penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

B2C retained 73.25% of Vietnam e-commerce market share in 2025, yet the B2B segment is compounding at 21.75%-well above headline growth. Digital financing, ASEAN supply-chain integration and omnichannel procurement tools are persuading manufacturers and wholesalers to migrate spend online. The Vietnam E-commerce and Digital Economy Agency notes that MRO buyers in industrial zones are doubling their online order values each year, a trend that augments the Vietnam e-commerce market size for enterprise transactions.

Rising demand from tier-2 industrial parks is reshaping fulfilment. Sellers bundle financing and inventory-led models that guarantee delivery within two days, a timeline once reserved for B2C orders. Cross-border sourcing through CPTPP channels gives Vietnamese SMEs direct access to components at competitive terms, sharpening cost structures across export value chains. As adoption matures, the Vietnam e-commerce industry is poised to see B2B's share climb toward 30% by decade-end.

Smartphones accounted for 71.10% of all orders in 2025 and are scaling at an 18.1% CAGR, ensuring mobile retains primacy in the Vietnam e-commerce market. Average data use per handset topped 12 GB a month, and 84% of residents held 4G connectivity. App-first strategies-lighter code, one-tap payments and embedded loyalty-translate directly into basket expansion.

Desktop traffic still matters for complex goods such as high-value electronics, but its relative weight is waning. Meanwhile, wearables and smart-TV commerce sit below 3% share yet exhibit promising double-digit growth as 5G rolls out. This multi-device environment pushes platforms to unify session data, creating cohesive experiences that nurture retention across the Vietnam e-commerce market.

The Vietnam E-Commerce Market Report is Segmented by Business Model (B2C, B2B), Device Type (Smartphone / Mobile, Desktop and Laptop, Other Device Types), Payment Method (Credit / Debit Cards, Digital Wallets, BNPL, Other Payment Method), B2C Product Category (Beauty and Personal Care, Consumer Electronics, Fashion and Apparel, Food and Beverages, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Shopee Pte. Ltd. (Sea Ltd)

- Lazada South East Asia Pte. Ltd.

- Tiki Corporation

- Sendo Technology JSC

- Mobile World Investment Corp. (The Gioi Di Dong)

- Bach Hoa Xanh JSC

- Dien May Xanh JSC

- FPT Retail JSC (FPT Shop)

- Viettel Retail JSC

- CellphoneS Digital Retail JSC

- Nguyen Kim Trading JSC

- Hoang Ha Mobile Co. Ltd.

- MediaMart Vietnam JSC

- Dien May Cho Lon JSC

- Cho Tot Co. Ltd.

- Meta Platforms, Inc.

- TikTok Pte. Ltd.

- Amazon Services LLC

- Alibaba Group Holding Ltd.

- JD.com Inc.

- Grab Holdings Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Nationwide Adoption of Cashless Payments via National Cashless Payment Development Project 2021-2025

- 4.2.2 Expansion of Last-mile Delivery Infrastructure into Tier-2 Cities

- 4.2.3 Surge in Social-Commerce Transactions via Short-Video Platforms

- 4.2.4 Entry of Cross-border Sellers Leveraging CPTPP and RCEP FTAs

- 4.2.5 Government-backed E-Invoicing Mandate (Circular 78) Boosting Trust

- 4.2.6 Rapid Growth in Quick-commerce Online Grocery

- 4.3 Market Restraints

- 4.3.1 High Return Rates Elevating Fulfilment Costs

- 4.3.2 Fragmented Cold-chain Logistics Limiting Fresh-Food Penetration

- 4.3.3 Escalating Digital-ad Costs Squeezing SME Margins

- 4.3.4 Rural Broadband Reliability Causing Checkout Drop-offs

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Demographic and Socio-economic Analysis

- 4.8 Payment Ecosystem Analysis

- 4.9 Cross-Border E-commerce Snapshot

- 4.10 Current positioning of Vietnam in the E-Commerce Industry in Asia-Pacific

- 4.11 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Business Model

- 5.1.1 B2C

- 5.1.2 B2B

- 5.2 By Device Type

- 5.2.1 Smartphone / Mobile

- 5.2.2 Desktop and Laptop

- 5.2.3 Other Device Types

- 5.3 By Payment Method

- 5.3.1 Credit / Debit Cards

- 5.3.2 Digital Wallets

- 5.3.3 BNPL

- 5.3.4 Other Payment Method

- 5.4 By B2C Product Category

- 5.4.1 Beauty and Personal Care

- 5.4.2 Consumer Electronics

- 5.4.3 Fashion and Apparel

- 5.4.4 Food and Beverages

- 5.4.5 Furniture and Home

- 5.4.6 Toys, DIY and Media

- 5.4.7 Other Product Categories

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Initiatives

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Shopee Pte. Ltd. (Sea Ltd)

- 6.4.2 Lazada South East Asia Pte. Ltd.

- 6.4.3 Tiki Corporation

- 6.4.4 Sendo Technology JSC

- 6.4.5 Mobile World Investment Corp. (The Gioi Di Dong)

- 6.4.6 Bach Hoa Xanh JSC

- 6.4.7 Dien May Xanh JSC

- 6.4.8 FPT Retail JSC (FPT Shop)

- 6.4.9 Viettel Retail JSC

- 6.4.10 CellphoneS Digital Retail JSC

- 6.4.11 Nguyen Kim Trading JSC

- 6.4.12 Hoang Ha Mobile Co. Ltd.

- 6.4.13 MediaMart Vietnam JSC

- 6.4.14 Dien May Cho Lon JSC

- 6.4.15 Cho Tot Co. Ltd.

- 6.4.16 Meta Platforms, Inc.

- 6.4.17 TikTok Pte. Ltd.

- 6.4.18 Amazon Services LLC

- 6.4.19 Alibaba Group Holding Ltd.

- 6.4.20 JD.com Inc.

- 6.4.21 Grab Holdings Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment