PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689928

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1689928

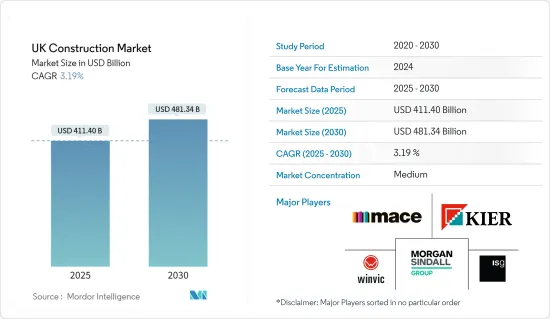

UK Construction - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The UK Construction Market size is estimated at USD 411.40 billion in 2025, and is expected to reach USD 481.34 billion by 2030, at a CAGR of 3.19% during the forecast period (2025-2030).

The increasing building activities across the United Kingdom are driving the market. Furthermore, the market is being propelled by growing commercial activities. Even though the general trends point to significant expansion, the UK construction industry has recently faced numerous difficulties. Inflation and Russia's invasion of Ukraine have disrupted the supply chain and pushed up the price of building materials.

There has been a significant recovery, with favorable growth rates in the United Kingdom's construction output. According to the Office for National Statistics UK, the value of new construction works in current prices in Great Britain reached a record high of GBP 132,989 million (USD 168,027 million) in 2022, which was mainly due to an increase in both domestic and public sector work amounting to GBP 14,093 million and GBP 4,068 million (USD 5,138 million), respectively.

In addition, new construction orders increased by 11.4% to GBP 80,837 million (USD 102,116 million) in 2022, driven by private infrastructure, private businesses, and other public non-housing, with industrial being the only sector that registered a decline.

In Great Britain, construction-related employees (excluding self-employment) totaled 1.4 million in 2022, an increase of 3.3% compared to 2021. England had the most significant increase in construction-related employees, amounting to 3.5%, followed by Wales and Scotland registering a 2.0% increase each.

UK Construction Market Trends

Increase in GVA of Construction Industry Driving the Market

The United Kingdom has a solid competitive edge in the construction market. The United Kingdom has world-class expertise in architecture, design, and engineering, and British companies lead the way in sustainability solutions for buildings.

The changes in the global economy create new opportunities for Britain. The government supports the growth of British companies and their aspirations, trust, and drive to compete on a global scale to promote recovery. This agenda includes reforming the planning system, ensuring that vital infrastructure projects are financed, and supporting the housing market through critical initiatives like the Funding for Lending Scheme and the Help-to-Buy Equity Loan Scheme.

The gross value added (GVA) by the construction sector in the United Kingdom in the first quarter of 2023 was GBP 37.63 billion (USD 47.55 billion), according to its Office for National Statistics. The GVA of this sector dropped to GBP 20 billion (USD 25.6 billion) in Q2 of 2020 due to the COVID-19 pandemic, marking the sector's lowest point in a decade. Out of all the industries in the UK construction sector, private housing was the one that made the most money.

Private Housing Holds the Largest Share in the UK Construction Market

Private housing was the segment that held the most significant share of the UK construction market. Nevertheless, housing and non-housing repair and maintenance together amounted to almost 39% of the construction output in 2022, according to data from the UK Office for National Statistics. The output volume of infrastructure grew during the past years, surpassing the construction of commercial buildings.

There has been a gradual increase in the number of households occupied by private renters in England. According to industry experts, the share of households occupied by private renters in 2023 was estimated to be 18.8%, with around 4.6 million households being privately rented. There has also been a marked increase in the average price of homes in the United Kingdom.

In the United Kingdom, private rental prices increased in the 12 months to January 2023 by 4.4%, up from 4.2% in the 12 months to December 2022, according to the Office of National Statistics. From 12 months to January 2023, the annual private rental price increased by 3.9% in Wales, 4.3% in England, and 4.5% in Scotland. In England, the East Midlands had the highest annual percentage change over 12 months to January 2023 in private rental prices of 5.0%, while the West Midlands recorded the lowest change at 3.9%. Also, in the 12 months until January 2023, London's yearly percentage change in private renting prices was 4.3%.

UK Construction Industry Overview

The UK construction market is partially fragmented, with the presence of many regional and local players and a few global companies. In addition, there is a vast potential for growth in the residential and transport construction segments during the forecast period, stimulating opportunities for market players. Key players are Kier Group PLC, Morgan Sindall Group PLC, Mace Limited, Winvic Ltd, and ISG PLC. In addition, due to the increasing investments in construction and future large projects in the United Kingdom, the market is projected to grow during the forecast period.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Drivers

- 4.2.1 Investments in Transport Infrastructure

- 4.3 Restraints

- 4.3.1 Shortage of Skilled Labor

- 4.4 Opportunities

- 4.4.1 The Birmingham Big City Plan

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET INSIGHTS

- 5.1 Current Economic and Construction Market Scenario

- 5.2 Technological Innovations in the Construction Sector

- 5.3 Impact of Government Regulations and Initiatives on the Industry

- 5.4 Insights into Upcoming and Ongoing Infrastructure Projects in the United Kingdom

- 5.5 Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Residential

- 6.1.2 Commercial

- 6.1.3 Industrial

- 6.1.4 Infrastructure

- 6.1.5 Energy and Utilities

- 6.2 By Key Regions

- 6.2.1 England

- 6.2.2 Northern Ireland

- 6.2.3 Scotland

- 6.2.4 Wales

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Kier Group PLC

- 7.1.2 Morgan Sindall Group PLC

- 7.1.3 Mace Ltd

- 7.1.4 Winvic Group

- 7.1.5 ISG PLC

- 7.1.6 Bouygues UK

- 7.1.7 Balfour Beatty PLC

- 7.1.8 Galliford Try PLC

- 7.1.9 Keller Group PLC

- 7.1.10 Laing O'Rourke PLC*

- 7.2 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX